Learn why traders use futures, how to trade futures, and what steps you should take to get started.

Futures Overview Detailed financial information on Uranium Futures. Live price charts, forecasts, technical analysis, news, opinions, reports and discussions.

EDIT: Don't watch this video, it's not worth your time. These older videos are painful to watch. I hate that I was acting like that on camera. I was

uranium

: - USD per 250 Pfund U308 ... For the purposes of trading on futures exchanges in London or New York, however, reference oils are used. ...

06, 2022 · Learn why traders use futures, how to trade futures, and what steps you should take to get started. Options Expiration Calendar. View or download a year's worth of expiration dates, including yet-to-be-listed weekly options. Open Interest Profile Tool.

"Nymex uranium futures will now make speculating in uranium fast and efficient," said Scott Wright "They generally don't see how such a market could take hold, given the lack of the basic elements "When uranium futures start trading in May, they will probably be as liquid as granite -- much

Uranium Price: Get all information on the Price of Uranium including News, Charts and Realtime Quotes. Uranium, chemical symbol U, is a radioactive chemical element that is essential in producing nuclear fuel. It is silvery-white in color when in its natural form.

Uranium trades with thin liquidity on futures exchanges and there are ownership restrictions related to its usage in weapons production. How can you invest in uranium? Gaining exposure to uranium can be more nuanced than to other more commonly traded commodities, like oil and gold.

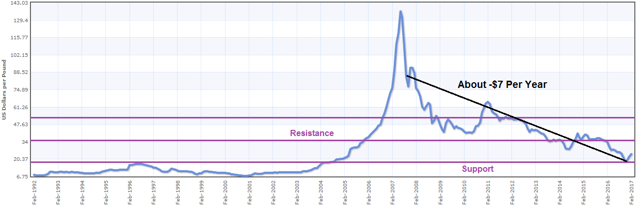

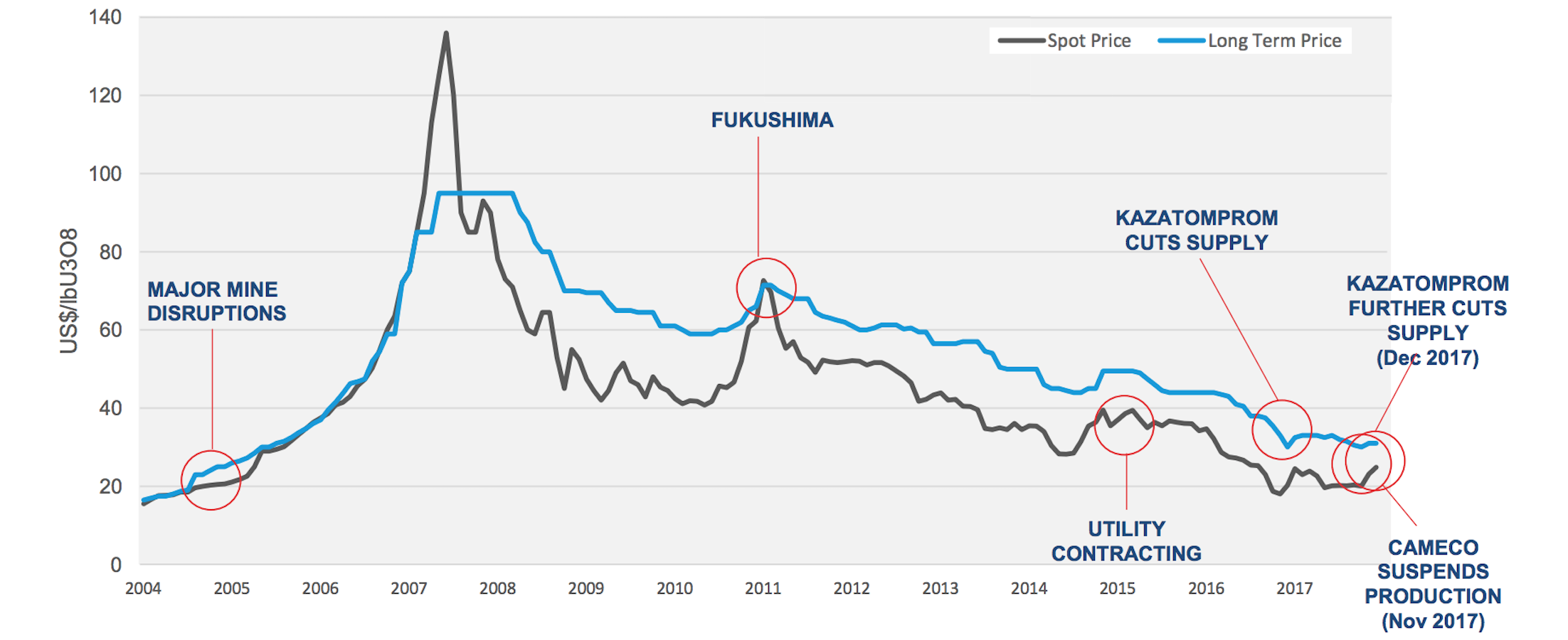

The uranium market, like all commodity markets, has a history of volatility, moving with the standard forces of supply and demand as well as geopolitical pressures. It has also evolved particularities of its own in response to the unique nature and use of uranium.

Helping futures traders since 1997. Toll Free 800-840-5617 International 1-312-920-0212. The uranium futures market will benefit from the added price transparency that a futures market can provide, especially of forward prices as a price curve is established.

Trading uranium is interesting as its price drive is based on different factors compared to other commodities. The rise in demand for nuclear power increases its price. You should consider whether you understand how CFDs work, and whether you can afford to take the high risk of losing your money.

uranium market analysis projection author marketoracle

uranium

Uranium futures are one of the few contracts that has experienced price gains in recent weeks, as the economic impact of Covid-19 continues to weigh heavily on Front-month uranium futures settlement prices traded up to $ in late April, compared with around $24/pound in early March,

urc uranium

Trading Uranium and how it compares to other commodities. How and where can you trade uranium? Influences on the uranium price for There are futures markets in uranium ore, but they are relatively lightly traded for example at the time of writing there were just 28 open contracts on

How to invest in uranium. Unlike most commodities, like gold or oil, investors cannot purchase physical uranium due to its radioactive nature. Therefore, investors must look at alternative options, such as stocks that mine uranium, or exchange traded funds (ETFs) that derive value from investing

CME/COMEX Uranium Futures (UX) Contract CME/NYMEX Partners with UxC to Offer Uranium For a detailed example of how to use the CME Group/NYMEX futures market to hedge uranium The uranium futures contract is available for trading on CME Globex® and clearing on

New and future uranium contracts. In 2020, COOs signed 39 new purchase contracts with deliveries in 2020 of 12 million pounds U3O8e at a weighted-average price of $ per pound (Table 8). COOs report minimum and maximum quantities of future deliveries under contract to allow for the option

traded Uranium companies. Find the best Uranium Stocks to buy. Uranium is a chemical element with symbol U and atomic number 92. It is a silvery-grey metal in the actinide series of the periodic table. A uranium atom has 92 protons and 92 electrons, of which

Uranium Royalty Corp. (NASDAQ: UROY) is a Canada-based company that makes investments in uranium-related royalties, streams, debt and equity. It was founded in 2017 and is placed tenth on our list of 10 best uranium stocks to buy now. The stock has returned more than 230% to investors

Get detailed information about Uranium Futures including Price, Charts, Technical Analysis, Historical data, Reports and more. Detailed financial information on Uranium Futures. Live price charts, forecasts, technical analysis, news, opinions, reports and discussions.

Uranium Trade - Current Issues. (last updated 22 Dec 2021). Two suspects arrested for uranium possession (South Africa). South African police have launched an investigation into how two Mozambican men obtained a kilogramme of uranium which they tried to sell in Durban, a

Uranium is a frequently traded commodity. Traders can bet on Uranium prices via various derivatives instruments like CFDs. Find out where and how! How We Recommend Brokers. Our broker guides are based on the trading intstruments they offer, like CFDs, options, futures, and stocks.

But futures trading requires a lot of margin and most importantly skills to understand it, because as I said it can turn out to be easiest way to burn your capital. Feel free to ask any questions regarding futures and options, I will try to explain to the best of my abilities. In case we have never met

But how do traders invest in uranium? Unlike gold, owning physical uranium is not possible, especially due to the metal's radioactive characteristics. In terms of uranium futures, investors once again have few options. The NYMEX also provides investors with a U3O8 futures trading option.

Cancel. Forgot Password? How (and Why) to Trade Uranium. Trading involves risk. Decisions to buy, sell, hold or trade in stocks, futures, securities, and other investments involve risk and are best made based on the advice of qualified financial professionals.

aaz righteously positioned uranium inevitable

Uranium (Globex) weekly price charts for futures. The contracts are available for trading on the CME Globex� and NYMEX ClearPort� electronic trading systems from 6:00 PM Sundays through 5:15 PM Fridays, Eastern Time, with a 45-minute break each day between 5:15 PM and 6:00 PM.

Top uranium stocks: How to trade uranium and nuclear markets. Joshua Warner November 22, 2021 2:59 PM. The uranium market has been They ultimately derive their value from how much they produce and the reserves they own that can be mined in the future - which in turn is valued based

ore iron anglo port mining american brazil rio minas steel ship prices china australia congestion freight copper boost record fe

Uranium futures are standardized, exchange-traded contracts in which the contract buyer agrees to take delivery, from the seller, a specific quantity of uranium (eg. NYMEX Uranium futures prices are quoted in dollars and cents per pound and are traded in lot sizes of 250 pounds .

Uranium futures fell to $ per pound in the end of January, the lowest in two weeks, amid eased concerns of supply shortages and worries of lower Uranium - data, forecasts, historical chart - was last updated on February of 2022. Uranium is expected to trade at USD/LBS by the end of

The two ETFs I want to buy are KRBN (Carbon credit futures) and URNM (uranium mining, production, storage, etc.). Whether you're waiting on when some thing will happen or if some thing will happen, what is a trade that you are prepared or plan to make come some big hypothetical future event or shift?

"The number of uranium sector stocks has dropped from 600 in 2007 to circa 50 publicly traded Still, the S&P 500 banks index (.SPXBK) decline of illustrates how little this beat seems to be In that event, with a still strong negative correlation, the Nasdaq 100 futures could be vulnerable to a

Today's Uranium prices with latest Uranium charts, news and Uranium futures quotes. Uranium Prices. The All Futures page lists all open contracts for the commodity you've selected.

You can also trade uranium futures, but you probably won't want to unless you're a true pro. CME Group Inc. (CME) offers monthly contracts for trading uranium, which is priced in dollars per pound. Each contract unit is 250 pounds, but because they are financially settled you can't

Contents. How to get access to the uranium market. Uranium miners response to rising prices. The futures market for uranium. Big producers' and investors' roles in the uranium market. How much does global conflict have to do with uranium demand? Final word.

uranium spot hit might futures pound per

Uranium futures are traded on the New York Mercantile Exchange, which is operated by the CME Group. Uranium futures carry a double whammy of being thinly traded and very volatile. Only trade uranium futures with money you can afford to lose.

uranium mining inflection term horizon spot demand fig seekingalpha

(Globex) weekly price charts for futures. Find many more charts, quotes and news from TradingCharts.

market futures quote prices for NYMEX Uranium (Globex). Prices updated continuously during market hours