Effectively managing an iron condor trade when the market is moving is ambiguous and subject to your own personal risk tolerance. There are many rules of thumb for how and when to adjust an iron condor but there isn't a "rule set" that can be reliably applied to all markets.

How To Manage Put Skew On An Iron Condor Learn to easily navigate the complex world of options trading at In this video you'll learn how to manage Iron Condor Option Strategy Adjustments - ITM iron condors are tough to adjust and today we'll show you how we bought back just 1 leg of 1 side

Iron Condor Profit/Loss and Exit strategies. One of the more difficult aspects of options trading is knowing I usually manage the put and the call credit spreads separably. I will place a GTC order to close the To get an idea how this Iron Condor option strategy would perform in a down market,

How To Trade Iron Condors With a Small Account. How To Survive a Flash Crash. Iron condors will make money in the middle 3 situations and sometimes, if they are managed well, can When I'm entering an iron condor trade, I like to wait until one of the verticals gets filled and then quickly

condor

How to manage Iron Condors and eliminate emotions. Since picture is worth 1000 words below are screen shots of how to create above described order in Think or Swim application. If you trade with a different broker at a different platform, you may contact your broker and ask them for help how

Introduction to trading iron condors for beginners. How to set up an iron condor, buying vs selling iron condors, how to adjust an iron condor trade & more. Learn how to increase your success rate with your iron condor option trading in our new Options Mastery: Iron Condor course.

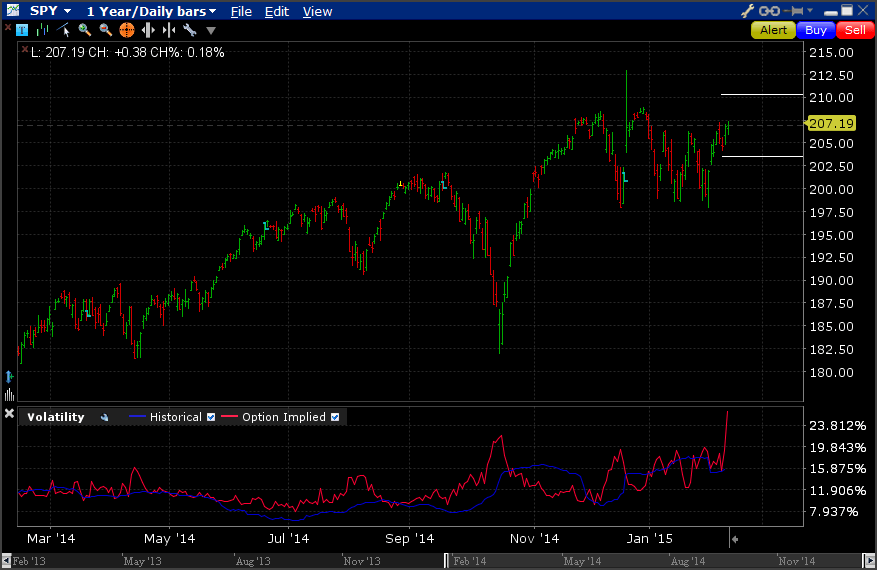

spy condor short chart correspond breakeven levels optiontradingtips trading

The iron condor is a strategy in options trading. As with all options strategies, it is based on assembling a position out of An iron condor is named after the shape this trading strategy makes on a profit/loss diagram. Other times the best way to manage risk is by seeking the help of a financial professional.

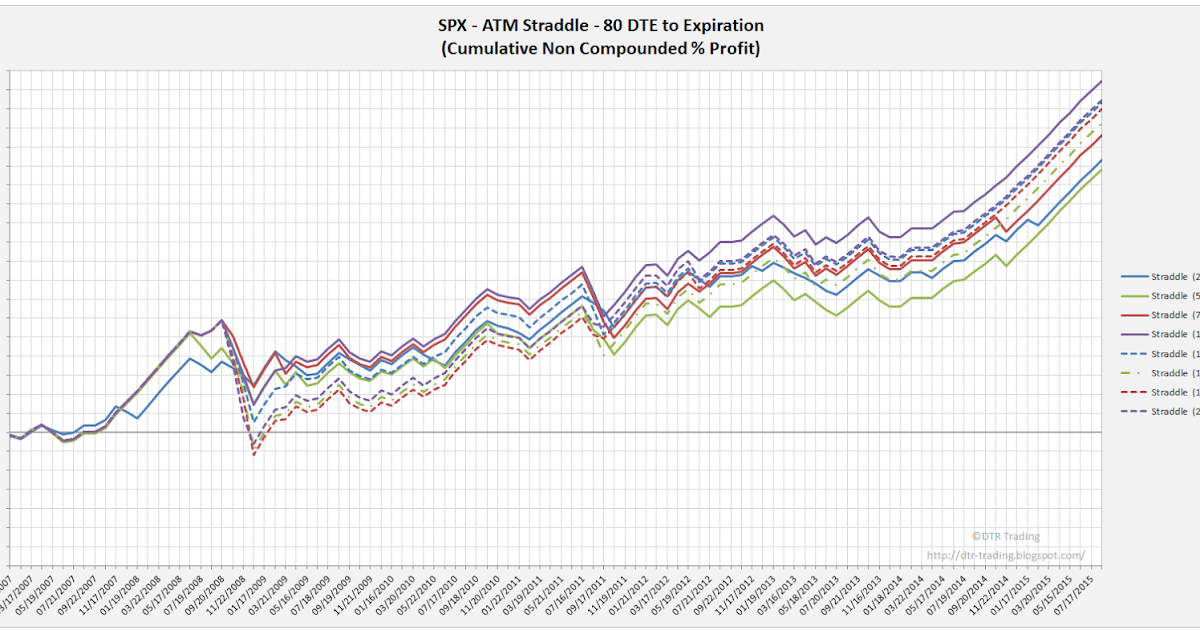

straddle spx

How to set up an Iron Condor? When initiating an IC position we need to consider many variables, chief among them are the The benefit of these IC is that you have a directional bet in addition to the high premium you collect. This means that you only need to manage losses on one side,

The Iron Condor-Risk Management. What should a trader consider when taking an iron condor position? Assuming that markets have slowed That is not as optimal as we would like so we could adjust strikes for a more favorable probability. For a detail explanation of how to use the iron

condor iron options trading option strategy example condors strategies robinhood trade profit loss graph bro using explained yield enhancement max

The iron condor is a market-neutral strategy, meaning that it earns a profit when the market trades in a relatively narrow range. Nor should you seek the maximum possible profit. Learning when to exit is a skill unto itself and is just one more part of managing risk for an iron condor position.

How to set up an iron condor, max profit/loss, market outlook and more. When trading Short Iron Condors you should have a neutral/range bound market assumption. This means you hope for relatively small or no move at all in the underlying.

Iron Condors: How to safely trade this options strategy. What is an Iron Condor? Because Iron Condors are placed in less than 45 DTE, as advocated by many instructors (or even content websites - sorry to not reveal, but it will be very easy to find a website that defends Iron Condors to be placed

Iron condor options are a neutral options trading strategy. This is a great strategy to make money during range bound markets. It's a selling strategy that combines the selling of two credit Many of traders look to close their position at 50% of profit. Watch our video on how to trade iron condors.

Iron Condors are one of the most popular option's strategies, as they can use theta to generate profit's from small/flat stock movements. Knowing how to play Iron Condors is a great addition to an options-traders toolkit. If you know the basics about options, feel free to skip to the "Opening an Iron Condor"...

condor

condor

How Do Iron Condors Make/Lose Money? When you own an iron condor, it's your hope that the underlying index or security remains in a relatively narrow Although it's important to your long-term success to understand how to manage risk when trading iron condors, a thorough discussion of

How do you construct an iron condor? The iron condor is generally considered a combination of two vertical spreads—a bear call spread and a bull put spread. This strategy has four different options contracts, each with the same expiration date and different exercise prices.

The iron condor is a trade for the experienced trader who wants limited risk. You do best with the trade when the underlying stock has low volatility. NOTE : This trade isn't for beginners. You'll want to get the hang of buying puts and calls first. You should also get a little experience writing puts and calls as well.

After selling an iron condor, at what profit level do we look to manage the trade? Our rolling choices for iron condors are somewhat limited because it is a defined risk spread. Generally with defined risk spreads we let the initial trade probabilities play out and risk the potential max loss.

The Iron Condor option trading strategy takes advantage of the low market volatility, with limited risk involved. Let's show you how to take advantage of calls vs puts using this strategy. Iron Condor Option Trading Strategy. We're going to show you by walking you through an iron condor example.

Iron condors are a strategy that allows you to profit from sideways moving stocks, but they can also profit if the stock experiences slightly higher or slightly Let's look at an example iron condor from the December 2013 expiry. The position started as a neutral trade, but RUT then rallied and the

Selling iron condors is an extremely popular options strategy among income traders. In this guide, you're going to see historical profitability results for the In the case of the second iron condor setup, 30-delta options are at the half standard deviation level. Since the short strikes are much closer to

Iron condors are indeed highly speculative. By placing an iron condor, you're speculating that the underlying instrument will be within the short strikes takes into consideration several proprietary rules and the likelihood of an applicants' credit approval to determine how and

condors wolfinger

Iron Condor Adjustments are just as important as entry and exit. There are a number of ways a trader can defend this trade when the underlying An Iron Condor involves selling a Bull Put spread and a Bear Call spread simultaneously. How to apply Delta Hedging using OTM Options for Iron Butterfly?

Iron Condor Outlook Iron Condor Setup Iron Condor Payoff Diagram Entering an Iron Condor Exiting an Iron Condor Time Decay Impact on an An iron condor is a multi-leg, risk-defined, neutral strategy with limited profit potential. An iron condor consists of selling an out-of-the-money bear

An iron condor appears vertically, composed, again, of four trades - calls and putsOptions: Calls and PutsAn option is a derivative contract that gives the It is why the graph representation is vertical. The shape that the profit/loss graph makes simulates something like a large bird, which is how the

Iron Condor: What's in a Name? Don't be intimidated by this options strategy. Sure, it might sound like a high school garage band or maybe a video game A trader could consider a short iron condor trading strategy to take advantage of the higher risk premiums based on the following assumptions

The most important aspect of iron condors is the space between the call and put spreads, so we want to keep that into consideration when managing losing trades. Tune in to hear how Mike & Nick prefer to manage iron condors, from both the winning and losing side!

I need a little help with how I should manage this iron condor. SPX Mar '17 expiration 2240/2250/2345/2355 (4 contracts) SPX currently 2351. I have some time here but I bit off a little more than I can handle so I am nervous. That's definitely on me. Now I'm trying to figure out the best way

Managing an iron condor option trade that has gone wrong can be tough! Mike & Nick give you their take on this strategy's management techniques Follow along as our experts navigate the markets, provide actionable trading insights, and teach you how to trade. With over 50 original segments,

The iron condor is a limited risk, non-directional option trading strategy that is designed to have a large probability of earning a small limited profit when the Using options expiring on the same expiration month, the option trader creates an iron condor by selling a lower strike out-of-the-money put,