tax insurance benefits

The break-even point of a refinance occurs when savings equal costs. Figure it yourself or use our Escrow charges: For taxes, insurance, etc. Each lender you shop will give you a loan estimate form Now, it's time to calculate how many months it will take to break even. Do it by dividing the total

In business, you perform a break-even analysis for a specific purpose. You can use it to determine if your revenue will be able to cover all your expenses within a specific time period. Generally, businesses use a month as the time period in this analysis process. If the revenue is more than the

08, 2009 · By filing W4 form as married - you will include deductions for your spouse. The more allowanced you will claim - less withholding will be from each paycheck. For $100,000 wages - if you file married with. -- zero allowances - your estimated federal income tax withholding would be $14,638.

16, 2021 · Break-even point in units = fixed costs / (price - variable costs) In the second formula, you divide the total fixed costs by the contribution margin (the sales revenue minus the variable costs). Break-even point in sales = fixed costs / contribution margin

How important is the break even ratio for real estate investing? Read this article to find out what this indicator Related: Is It OK to Break Even on a Real Estate Investment Property? The first step to reducing fixed costs is to lower your tax bill. Directly appealing to tax authorities and requesting

tax advice problems check wage

Break-even analysis is a business tool widely used across all industries to evaluate business performance in terms of costs, since this is a supply-side Break-even analysis is usually done as part of a business plan to see the how practical the business idea is, and whether or not it is worth pursuing.

A break-even analysis aims to find the point at which a project generates neither losses nor gains. A break-even analysis helps to determine the number of product units that need to be sold for a business to be profitable knowing the price and the cost of the product.

28, 2020 · Estimate What You’ll Owe. 1. Use an Online Check Calculator. There are a number of free income tax calculators online. If you enter your gross pay, your pay frequency, your ... 2. Use a Tax Withholding Estimator. 3. Fill out a Sample Tax Return. Gross Pay · Withholding Allowances

The break-even point model allows to assess the economic state of the enterprise, its financial stability. The break-even point reflects the volume of production and sales of goods and services which Fixed costs (independent of the production process or sale). This is lease payments,

Break-even is a situation where an organisation is neither making money nor losing money, but all the Break-even analysis is useful in studying the relation between the variable cost, fixed cost and Fixed costs include (but are not limited to) interest, taxes, salaries, rent, depreciation costs,

The break even ratio is slightly different. It tells you how much of your gross income you can lose in order to break even. So, the debt coverage ratio The break even ratio is important for both investors and lenders. It's used to know what occupancy level you require in order to still cover your bills.

for Break Even Analysis. The formula for break even analysis is as follows: Break even quantity = Fixed costs / (Sales price per unit – Variable cost per unit) Where: Fixed costs are costs that do not change with varying output (, salary, rent, building machinery). Sales price per unit is the selling price (unit selling price) per unit.

Break-Even Point Examples. NOTE: FreshBooks Support team members are not certified income tax or accounting professionals and cannot provide If it's above, then it's operating at a profit. How to Calculate Break Even Point in Units. Fixed costs ÷ (sales price per unit -

How to Calculate Breakeven Point. Illustration by Melissa Ling. At this level of sales, they will make no profit but will just break even. What Happens to the Breakeven Point If Sales Change. How To Prepare a Selling and Administrative Expense Budget. How to Do a Breakeven Analysis to Find

Also known as break-even quantity, break-even of units is the point where the business expects to generate neither profits nor losses from the total number of products sold. Break-even revenue is the amount of money the business generates from the sale of the break-even quantity.

Because break-even analysis is applicable to any business enterprise, we can apply these same principles to a service organization. For example, Marshall & Hirito is a mid-sized accounting firm that provides a wide range of accounting services to its clients but relies heavily on personal income

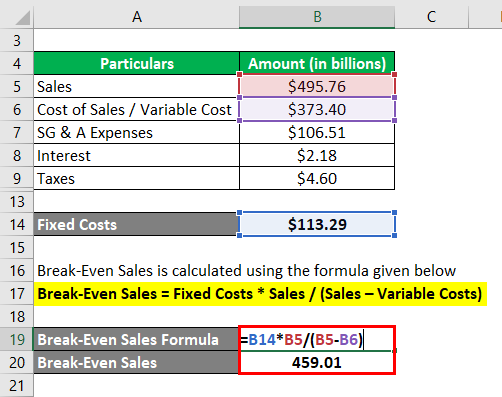

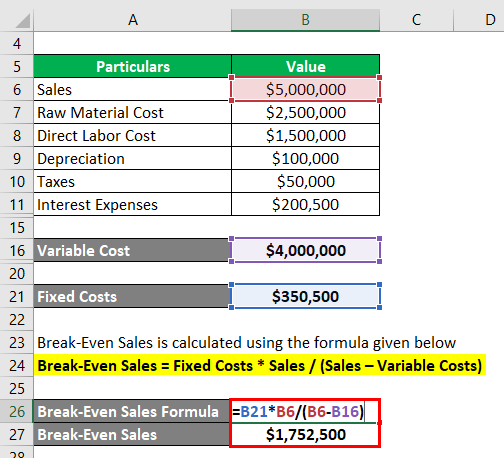

Guide to Break Even Analysis & its definition. Here we discuss break-even analysis formula along with Break-even analysis refers to the identifying of the point where the revenue of the company starts It shows us how to calculate the point or juncture when a company would start to make a profit.

punta cana occidental caribe barcelo inclusive break spring former hotel student special gobluetours

A break-even analysis can help you determine fixed and variable costs, set prices and plan for your business's financial future. Read on to learn more Here is how to calculate the break-even point in units of the number of guests for a given period of time: Break-Even Point = Total Fixed Costs ÷...

Break Even Analysis in economics, financial modeling, and cost accounting refers to the point in which total cost and total revenue are equal. He previously determined that the fixed costs of Company A consist of property taxes, a lease, and executive salaries, which add up to $100,000.

tax benefits recycling breaks colorado equipment resource

The break-even point is the point at which total revenue and total cost are equal. Break-even analysis determines the number of units or amount of revenue that's needed to cover your business's total costs. At the break-even point, you aren't losing or making any money, but all the costs associated with

05, 2012 · While it's true that for most people, claiming 1 or 0 allowances will result in a tax refund and claiming 2 or more will result in either breaking …

break breakup

fastweb

Here we will learn how to calculate Break Even Analysis with examples and downloadable excel template. This is an analysis of Break Even Point. It helps to find the number of units one needs to sells in order to produce profit without taking the fixed cost into consideration.

form final adventure gunther monster finn even isn jake meme gunter isnt memes funny fanpop previous random another bd8 interest

The break-even point (BEP) in economics, business—and specifically cost accounting—is the point at which total cost and total revenue are equal, "even". There is no net loss or gain, and one has "broken even", though opportunity costs have been paid and capital has received the

break analysis even mumbo jumbo automatically

Want to adjust allowances so we break-even (no refund) for 2010. We'd rather owe a little than get a refund -- bigger pay-checks. I make around 59,000 a year, own a home and have no children. How many exemptions should I claim on my taxes to break even.… read more.

Break-even analysis determines the break-even sales. Break-even point—the financial crossover How would a change in the mix of products sold affect the break-even and target income volume Impact of Income Taxes. If target income is given on an after-tax basis, the target income

The tax treatment of income reported on Form 1099-MISC depends on the type of income that is being reported on the form (which is used for many The equivalent tax submission mechanism comes in the form of you making estimated payments to the federal and state governments on a quarterly basis.

Break-even analysis seeks to investigate the interrelationships among a firm's sales revenue or total turnover, cost, and profits as they relate to alternate levels of output. A profit-maximizing firm's initial objective is to cover all costs, and thus to reach the break-even point, and make net profit thereafter.

Break-even analysis helps companies determine how many units need to be sold before they can cover their variable costs but also the portion of their fixed When calculating break-even quantities, it is important to account for taxes, which are a real expense that a company incurs. Taxes do not

over your past tax returns and note how much you've overpaid or underpaid. Then divide that amount by how often you get paid (weekly, bi-monthly, etc.) That's the additional amount that you need to have withheld from or kept in your pay. Notify the payroll manager at your employment accordingly.

Break-even analysis attempts to find break-even volume by analyzing relationships among fixed and variable costs, business volume, pricing, and net cash flow. Simple Break-Even Analysis addresses questions of this kind: How many units must we sell to Break-Even?

13, 2019 · The best way to make the most of your paycheck and break even on your taxes is to work with experienced tax advisors. Contact Block Tax Services if you have any questions about your taxes or need help estimating your optimal tax withholdings. Call us today at 410-793-1231 or complete the brief contact form to the right to get started.

03, 2019 · How much withholding do I need to claim to break even on taxes? Withholding is not something you arbitrarily "claim" when preparing your tax return. Instead, withholding is what you input to TurboTax that was the amount actually withheld by your employer over the course of the year for which you are filing. That number comes from your form W-2 that you …Estimated Reading Time: 40 secs

Break-even point is that point of sale where the revenue generated by the company is equal to the total cost incurred by it. It is a position where the organization is at a It also determines the various other elements, such as margin of safety and contribution margin. To further gain knowledge about, how

A break-even analysis can help you determine fixed and variable costs, set prices and plan for your business's financial future. If you know how many units you need to sell or how much money you need to make to break even, it can serve as a powerful motivational tool for you and your team.

To show how break-even works, let's take the hypothetical example of a high-end dressmaker. Let's assume she must incur a fixed cost of $45,000 to produce and sell a dress. Break-even analysis also can be used to assess how sales volume would need to change to justify other potential investments.

Break-even analysis is the relationship between cost volume and profits at various levels of activity, with an emphasis placed on the break-even point. This point is where the business receives neither a profit nor a loss, when total money received from sales is equal to total money spent to produce

How much should you withhold for taxes? Should you withhold an additional amount from each paycheck? It all starts with taking a closer look If you adjust your withholding so you break even (or get really close to breaking even) at tax time, you end up with more cash in your pocket

28, 2022 · Specify additional withholding. As mentioned above, you have the option on the W-4 form to enter an additional amount you want to have withheld with each paycheck. Simply divide your estimated tax shortage by the number of pay periods you have left before the end of the year to get your number. Work With a Pro.

koude terme p90x

tax breaks season retirement deductions

ClearValue Tax. Подписаться. Вы подписаны. Please subscribe and I'm rooting for you! Please follow us on Twitter: @ClearValue_Tax You can contact us at: ClearValueNews@ Thank you!