How To Start Investing in Private Companies. Investing in private companies is very different from investing in public ones. For example, there are different regulations regarding the information public businesses have to share so it can be harder to evaluate private companies than public ones.

Investing in private companies is another way for wealth creation adding diversification to your investment portfolio. Where to Find Information About How to Invest in Private Companies. There are many sources on the internet you can visit to get informed about equity crowdfunding.

Learn how to start investing in the stock market. Build wealth using The Motley Fool's market-beating method. If you are ready to start investing in the stock market, but aren't sure of the first steps to take when investing in I like to read about the different companies I can invest in, but don't

Investing in a public company may seem far superior to investing in a private one, but there are a handful of benefits to not being public. A major criticism of many public firms is that they are overly focused on quarterly results and meeting Wall Street analysts' short-term expectations.

How does private equity work? To invest in a company, private equity investors raise pools of capital from limited partners to form the fund. PE investors may invest in a company that's stagnant, or potentially distressed, but still shows signs for growth potential. Although the structure

Investing in private companies is much different than investing in public stocks: Invest in at least 10-15 private companies in order to increase your chances of generating higher overall portfolios. Investors should never consider investing in solely one or two private companies. It is critical

1. How Private Equity Works. In the last tutorial, we looked at venture capital. Private equity works in a similar way: a private equity fund invests in companies and looks to sell its stake about five years later for a substantial Private equity firms are looking for particular types of companies to invest in.

Six experts weigh in on how to invest in a shifting financial landscape. By Suzanne Woolley. November 17, 2020 | Updated: August 13, 2021. Their ideas range from Chinese companies in the battery and solar power markets to private commercial real estate funds to healthcare stocks

Private equity is a company composed of funds and investors that directly invest in private companies, or that engage in buyouts of small businesses and companies that may or may not be making profits. PE firms buy companies that have significant potential for growth.

Why Invest In Private Companies? Qualifying As An Accredited Investor. Investing Using Equity Crowdsourcing. If you really want to invest in a private company but don't quite make the financial requirements of being an accredited investor, the good news is that it is still possible to do so.

Hey friends, in this video I'll give you a complete breakdown of how to get started with investing your hard earned cash, what various terms mean in

How Does the Average Investor Invest in Private Equity? Historically, private market investments have typically outperformed investments in public stocks. In addition, while private equity has grown from a $30 billion asset class in 1995 to more than $4 trillion today, the number of publicly

With Streitwise you can invest in private real estate deals with a minimum of $5,000, while Fundrise lets you invest in commercial real estate for just $500. Mandatory Distributions to Investors — REITs are companies whose assets consist mainly of real estate holdings.

Reddit can often be a difficult place to navigate, so it is always good to be pointed in the right direction every once in a while. This is particularly true when you are starting up a business or an entrepreneur.

These companies offer their compensation in terms of cryptos; this, therefore, means that the value of your earnings can more than double in value within BTC is the best cryptocurrency to make earnings due to the recent outbreak. Sometimes when we have that specific money that we want to invest in

Guide to Private Equity Investment Strategies. The boom in private equity shows no sign of abating. These private equity firms utilize debt instruments to comprise of a majority, if not all of the purchase price. They invest in private companies, help manage and improve them, and then

Smart investors put their money in reputable companies and investigate new companies thoroughly before committing their money. By carefully considering the qualities of the companies you invest in and incorporating your own knowledge Social login does not work in incognito and private browsers.

temasek bonds gurita equity ezion 38m bllnr tirto holdings azalea classes

Investing in private cannabis companies opens a whole new world of opportunity. These collectively represent the cannabis private equity opportunity. We continue to believe that cannabis will be the best performing asset class over the next decade, and that there will be no sector

Private Market Investment Risks. Investing in private companies can be considered riskier than publicly traded companies in some respects. Evaluating a private company is similar to researching a public company; however, the same tools and resources accessible for public companies may

These companies were ranked keeping in mind the hype around them on Reddit, the funds they raised at their initial public offering According to news agency Reuters, the merger will be supported by $250 million in private investment from firms such as BlackRock, Apollo Global Management and others.

Why invest in private equity? Investors turn to private equity to diversify their holdings and aim for higher returns than the public market might provide. The goal here is to invest in companies with high growth potential that can either be sold at a later date or taken public through an initial

Discover startups to invest in on a leading private investing platform. Republic uses cookies. Learn how we use cookies to improve your experience by reviewing our Terms of Service and Investments in private companies are particularly risky and may result in total loss of invested capital.

private singapore

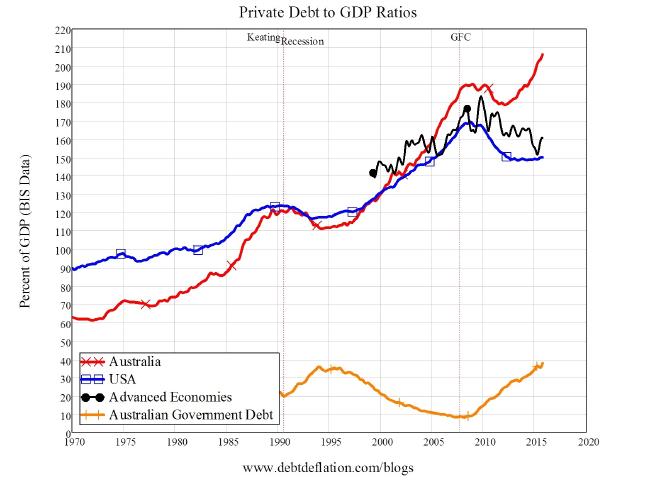

australia recession keen during brace macrobusiness parliament probably fall prolonged

Should you invest in private real estate syndications or funds? Here's how to know if you are the right investor for these high-risk investments. (You can thank the Investment Company Act of 1940.) They're generally in the business of gathering assets and charging an AUM fee on them.

When investing in private equity, retail and institutional investors provide money that can be used to fund the development of a new technology, to restructure business Restructuring capital. Investing in distressed companies, which are in the process of reorganization. How to invest in private equity.

Investing in private companies. This may be the wrong place for this, please let me know if it is. Another option is to invest on equity crowdfunding platforms like SeedInvest where you don't have to be an accredited investor and can invest in different startups that they've vetted on their platform.

Private-equity firm Anacacia Capital and Appen management invested in it in a 2009 capital raising at less than 10¢ a share. Appen listed on the ASX in 2015 at 50¢ and trades above $23. You have reached an article available exclusively to subscribers.

Investing in private equity ventures done through private funds, run by private equity firms with specific investment strategies and areas of expertise. Private equity offers the potential for substantial returns. Part of the general partner's art is identifying promising companies to invest

Some public investments do invest in private companies, but some of these investments - GSV Capital (GSVC), for example - really have not done very well (http Broker dealers are scrambling to understand how to gather, review and publish information on the companies whose bonds they trade.

Best Credit Repair Companies How To Fix Your Credit In 7 Easy Steps How Much Does Credit Repair Cost? Invest In Real Estate With REITs. Miranda Marquit, Benjamin Curry. Investing in private REITs can be a risky, expensive proposition. Minimum purchase amounts can run as high as $25,

How do folks invest in private companies ( SpaceX, or upcoming IPO by Discord)? Caveat is that these funds may not have access to the deals you're interested in. I've also had friends DM CEOs of private companies and get location that way.