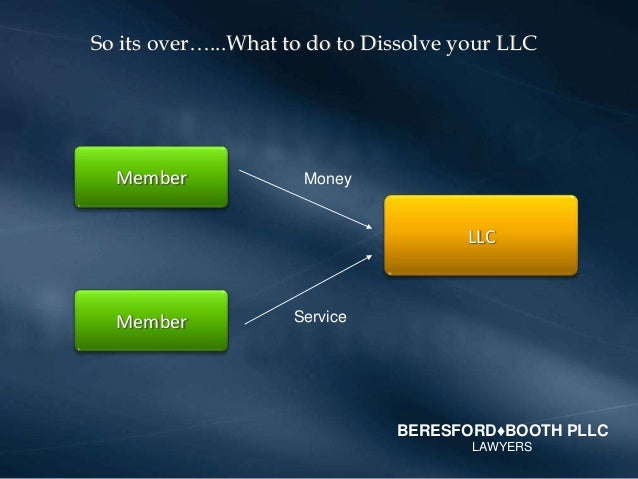

How Do I Dissolve (or Close) My LLC? Once you've decided it is time to dissolve (or close down) your LLC, there are several important steps to take. The first step is for the members (or owners) to officially agree to close the business.

Formally dissolving an LLC puts an end to these requirements. It also gives creditors notice that the LLC can no longer take on debts. The members of an LLC must vote to dissolve the company. If your LLC operating agreement has a procedure for voting on dissolution, you should follow it.

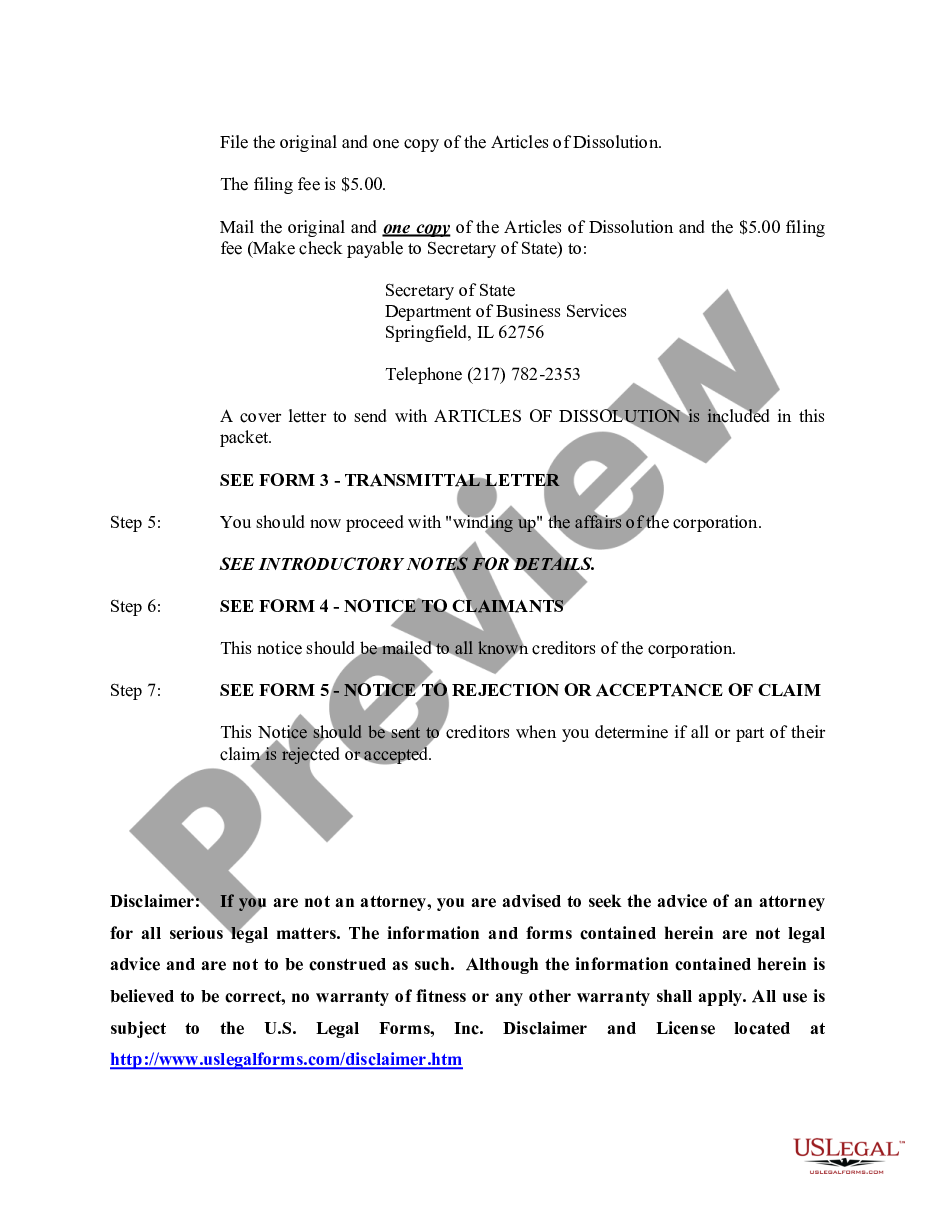

How to Close an LLC or Corporation. A company begins with Articles of Incorporation when it is formed, therefore it makes sense that Articles must be filed to dissolve a company that has been in operation. Without filing the proper paperwork, the business owner will continue to be liable for

How to Properly Dissolve a Minnesota Limited Liability Company. LLC Dissolved by Its Limited Period of Duration or Termination of a Member. There are various reasons to dissolve a limited liability company ("LLC") ranging from the sale of its assets to unprofitability or bankruptcy.

dissolve dissolution mycrafts liability

The process of Dissolving a Minnesota LLC is called Minnesota LLC Dissolution. The Minnesota Secretary of State will issue a Certificate of Termination to The time it takes to Dissolve a Minnesota LLC varies depending on how long it takes to complete the actions that are required in each

Dissolving a Limited Liability Corporation LLC - How To Dissolve Llc. This Package provides all the forms needed to dissolve an LLC in your state, saving you precious time and money. Includes a state-specific law summary, instructions and the appropriate forms, notices and resolutions

Vote to Dissolve: Your company's formation documents (articles of organization, articles of incorporation, your LLC's operating agreement, or your corporate bylaws) should indicate internal rules for dissolving the business. If there are multiple owners/shareholders

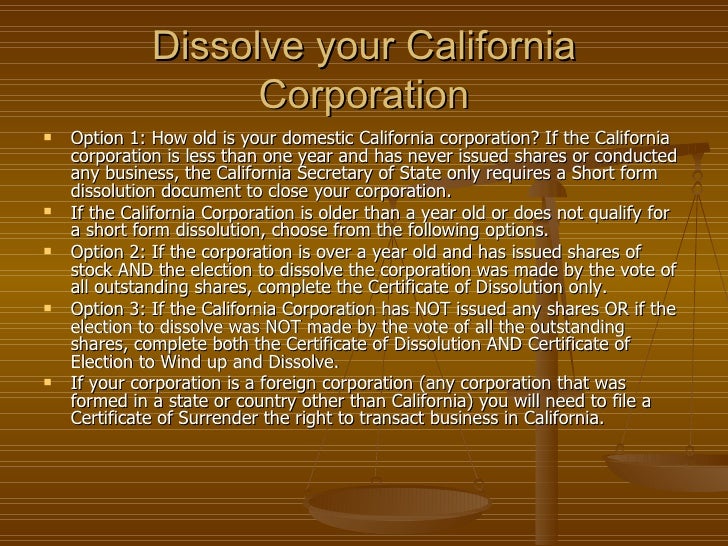

How do I file the California dissolution form? How much does it cost to dissolve a California business? If you don't properly dissolve your corporation or LLC, the California Secretary of State will likely forfeit your business. This means that you'll lose the right to do business in California and

behance

dissolve example gis geoprocessing vector ppt powerpoint presentation introduction counties codes zip slideserve

08, 2021 · How to Dissolve an LLC in Minnesota Step 1: Follow Your Minnesota LLC Operating Agreement For most LLCs, the steps for dissolution will be outlined in Step 2: Close Your Business Tax Accounts Every active Minnesota LLC has various tax accounts that are maintained Step 3: File Articles ...Estimated Reading Time: 2 mins

Closing your Minnesota limited liability company (LLC) will involve a variety of tasks. These are the rules that must be followed to voluntarily dissolve an LLC in Minnesota. Under these rules, dissolution will require a vote on a resolution to dissolve by your LLC members.

Dissolving an LLC requires you to reach an agreement with all members of the LLC. You will also need to file your final tax return and fill out a great deal Some states also require dissolving LLCs to publish a notice in their local newspaper. Your notice to creditors should give creditors a deadline

dissolve dissolution

In administrative LLC dissolutions, the secretary of state orders the dissolution due to a failure of the business to comply with regulations. How Much Does It Cost to Dissolve an LLC? If you file the documents to dissolve your LLC on your own, you only have to pay a state filing fee to submit

filing the articles of dissolution and termination must certify that no company debts remain unpaid. The forms you need to dissolve your LLC in Minnesota are available in your online account when you sign up for registered agent service with Northwest. Keep the original and submit a legible copy to the SOS.

Voluntary LLC Dissolution — Voluntary dissolution occurs when the LLC members willingly decide to close the business. It can happen as the result of a Whatever category your dissolution falls in, you still need to follow the steps outlined in this guide for formal dissolution. How to Dissolve an LLC

dissolve

If you want to know how to dissolve an LLC in California, what it means to fill 2021 form 3522, and other essential facts As a business lawyer, I've assisted hundreds of clients just like you dissolve their LLC in California and I can help you find out how to close an LLC in California according to

dissolve

dissolves chemistry solutions properties

Here is a complete guide on how to dissolve an LLC in Minnesota. In Minnesota, if you and the members of the LLC want to discontinue business, then it is necessary to dissolve their business legally to avoid any administrative and legal consequences.

LLC is registered with the State of Minnesota. Officially ending its existence as a state-registered business entity and, by extension, putting it beyond the reach of creditors, begins with a formal process called dissolution. While an LLC may be involuntarily dissolved by a court order, this article covers voluntary dissolution b…Notice of DissolutionArticles of TerminationNote on Tax ClearanceAdditional InformationAfter you have voted to dissolve the LLC, you must file a notice of dissolution with the Secretary of State. The notice of dissolution will state where and when the meeting to dissolve took place. It must also include a statement that the requisite vote of the members was received …See more on Reading Time: 6 mins

Minnesota Business Corporation | Articles of Dissolution. Minnesota Statutes, Chapter or Read the instructions before completing this Articles of Dissolution filed under Minnesota Statutes, sections or is used to dissolve a corporation that has issued shares.

Knowing how to dissolve an LLC starts with knowing that a Limited Liability Company is easier to form than dissolve. 7 min read.

dissolve

will need to make arrangements to pay all LLC liabilities, debts and obligations. Minnesota requires that different articles be filed, based on whether the LLC accepted or did not accept contributions. If your LLC accepted contributions, you must first file a notice of dissolution with the Secretary of State by mail or in person.

Business owners choose to dissolve LLC entities via judicial dissolution for various reasons. Now that we know the three different types of dissolution, lets take a closer look at how to close an LLC and wind up the business affairs by settling debts and distributing any remaining assets to the owners.

How do you dissolve/terminate a Minnesota Limited Liability Company? LLCs which accepted contributions: After your LLC has approved dissolution it An administratively dissolved Minnesota LLC must pay a $25 fee and file an annual renewal in order to be reinstated. If you are

the Account Information tab. Select Close Account. Complete the remaining steps as directed. You can also email @, or call 651-282-5225 or 1-800-657-3605 (toll-free). Note: You should close tax accounts at the end of your filing cycles (annually, quarterly, or monthly).

All Minnesota LLCs must file an Annual Renewal each year. Minnesota LLC Annual Renewal Instructions. How to form an LLC in Minnesota This Quick Start Guide is a brief If your LLC has been administratively dissolved (shut down) for failing to file an Annual Renewal in the past, then

dissolution corporation dissolve

Learn how to dissolve your Minnesota LLC in just three simple steps. You can also access more useful articles, guides, tools, and legal forms.

Dissolving an LLC. Step 1: Follow the LLC's Internal Procedures. Step 2: Notify Any Creditors of the Dissolution. If you have an LLC that you would like to dissolve, there are some specific steps to take in the process. Follow these steps and you will have your dissolution completed in no time at all.

Every limited liability company should include internal procedures for dissolving the company in its operating agreement. Another option is to hire an online business services company to dissolve your LLC. With these companies (which are best known for forming LLCs) you can save a

howtostartanllc dissolution

Name of Limited Liability Company: (Required) List the company name on file with the Office of the Secretary of State. 2. Check and Complete One of the Following Options: (Required) Select one of the following options for filing the Notice of Dissolution and complete any fields associated with this option. 3.

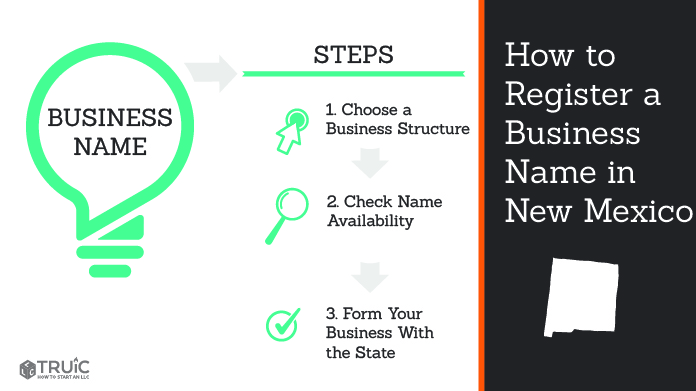

How to Incorporate & Form an LLC Online. The state of Minnesota requires corporations to file documentation of a dissolution, which can differ depending on a couple of key factors. In this guide to dissolving a Minnesota corporation, we'll break down all the relevant details.

Dissolving a limited liability company: how to wind up your business. If your reason for dissolving the LLC is to form a corporation, make sure to check the state rules to transfer. Some states allow LLCs to be converted to corporations without having to go through the long dissolution

An LLC (limited liability company) combines aspects of corporations and partnerships to create a unique business model. In an LLC, members don't hold personal responsibility for business debts and lawsuits. But, just like any other type of business, LLCs must sometimes come to an end.

LLC that has accepted contributions must first internally approve the dissolution pursuant to Minn. Stat. § Where the LLC has members, the proposed dissolution must be approved by a majority vote of the members. Where the LLC no longer has any members, the governors may authorize and commence the Reading Time: 6 mins

Dissolving an LLC might seem daunting. It doesn't have to be. By following a few simple steps, your LLC can close up shop and This agreement sets out the rules for LLCs when they dissolve or when an LLC member chooses to move on. Your Buy-Sell might have pertinent information for this process.

26, 2022 · The process of dissolving an LLC in Minnesota is simple. You file all necessary documents with the Secretary of State online or by mail. If you have a corporate bylaws, LLC operating agreement, or partnership agreement, you can use these to dissolve the LLC. In Minnesota, you will be required to submit a reinstatement form and pay a fee.

To dissolve your Minnesota business, you must officially file for dissolution with the Minnesota Secretary of State. The exact document you use will How long does it take to dissolve an LLC in Minnesota? It usually takes 7-10 business days to process your dissolution document filing with

: minnesotaMust include: minnesota Voting on Dissolution. If you are the sole member of your LLC, then you skip this altogether. …Filing for Dissolution. This step could either come second or last, depending on your state’s …Filing for a Final Tax Return. Wondering how to dissolve an LLC with the IRS? Closing your …Notify Your Creditors. Some guides on how to dissolve an LLC suggest this as the first step, …Dividing the Assets. The last step on our list does not apply to all LLCs, but it’s crucial when …See full list on

Statement of Dissolution does not dissolve a Limited Liability Company. In order to file this form, the organization must have already been dissolved by an event listed in Minnesota Statutes A separate Statement of Termination form under Minnesota Chapter Statutes is then required. Statement of Dissolution (322C LLC).pdf

dba howtostartanllc fictitious assumed establecer

Want more All Up In Yo' Business? Become a member for special access to members-only videos, live streams, live chats, behind the scenes, and MORE!

Home Services Dissolution. How To Properly Dissolve A Company. Various reasons could lead to the dissolution of the business, such as bankruptcy A Corporation or an LLC is an entity created under authority granted by the state. Hence, its existence may only be terminated by the state.

dissolve company

dissolve arcgis geoanalytics pro desktop features tool portal boundaries field buffers create enterprise applied dissolved created based four specified fields

Learn how to end a business, LLC or corporation including state and federal requirements as well as notification of creditors. A common misconception about EIN is that you can simply cancel or close it when dissolving a business. The IRS cannot cancel your EIN.