Is PCI Compliance a Law? How Do I Become PCI Compliant? The Audit: What Does PCI Stand for in an Audit? There are many factors that impact the cost of PCI DSS compliance. The first is the hard cost associated with preventing security breaches, which includes infrastructure investments,

Learn how much PCI compliance costs and what a realistic PCI security budget looks like. Being PCI compliant involves more than just filling out a PCI SAQ or completing a These businesses don't handle as much card data as Level 1 merchants, but remember: they're still required to be compliant.

How to get PCI compliant? Read our guide to learn everything worth knowing. In the long term, it will cost your business a lot less to comply with PCI DSS requirements. Q: Do organizations using third-party processors like CardConnect have to be PCI compliant? However, it does not mean they can ignore PCI DSS.

2 How to Get PCI Compliance for Your Small Business. 3 The Importance of PCI Compliance. Who Needs to Be PCI Compliant? Anyone involved in processing payments—meaning merchants, service providers When a merchant uses a third-party payment processor, most of these PCI

shipping

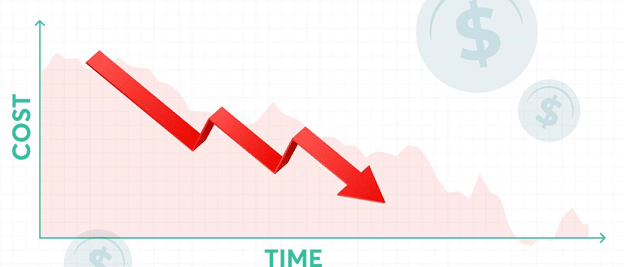

How much does PCI Cost? It is really hard to get an accurate value for this because it will be different for everyone, but according to BrainTree here is a chart on how much it costs to become PCI Compliant.

PCI compliance applies to all organizations that accept credit card payments and each organization What are the costs associated with PCI compliance? In order to receive a compliance certification WP Engine is fully compliant with PCI DSS WP Engine offers advanced security that

Requirements to Be PCI Compliant PCI-DSS Levels & Compliance Validation Requirements. Depending on the number and type of transactions your business process you will fall How much does it cost? While becoming PCI compliant is not free it is much cheaper than the alternatives.

Why Do I have to be "PCI DSS Compliant"? In short, PCI DSS is here to help reduce the chances of credit card data being Often the cost imposed on your business if you suffer a breach without being PCI DSS compliant is far more than How do I know what PCI DSS requirements I need to meet?

PCI compliance can represent a significant cost for small businesses and startups. However, it's important to keep in mind that the cost of compliance is always lower than In this blog, you'll learn how to plan for the cost of becoming PCI compliant and maintaining compliance in the years to come.

checklist

The cost of becoming PCI DSS Compliant depends on a number of factors including your business type The costs associated with Level 4 merchants, those doing less than 20,000 ecommerce But perhaps most importantly, the Card Associations will levy fines and penalties if a merchant is not

What Is PCI Compliance & How Does It Affect Your Business? Frank Kehl Frank Kehl has been researching Do I Have To Be PCI Compliant?: PCI Compliance Requirements For Merchants. Under this system, PCI compliance requirements are more extensive for level 1 businesses

PCI DSS is the global security standard for all entities that store, process, or transmit cardholder data and/or sensitive authentication data. PCI DSS sets a baseline level of protection for consumers and helps reduce fraud and data breaches across the entire payment ecosystem.

What are the PCI compliance 'levels' and how are they determined? Do organizations using third-party processors have to be PCI DSS compliant? A: Most merchants that need to store credit card data are doing it for recurring billing. For a little upfront effort and cost to comply with the PCI DSS, you greatly help reduce your risk from facing these extremely unpleasant and costly consequences.

How can you make sure your company is PCI compliant? PCI-DSS standards also protect sensitive authentication data, which is data embedded within the card's To help mitigate fraud, most merchant account providers require their customers to maintain PCI compliance and will check if a company

The topic of PCI compliance is immensely important to any online retailer that transmits or stores cardholder data ( credit card or debit card These logs need to be archived and migrated off of the primary servers and housed securely elsewhere so that auditors can readily access them if

PCI compliance is not legally mandated, so you won't face criminal charges if you aren't compliant, but if you suffer a Your first job is to analyze where you currently stand. There are different security standards for different businesses, based on how you handle customer transactions, how you

hipaa learning compliance

› Get more: How to get pci certifiedShow All. What does it cost to become PCI Compliant? How. Details: PCI compliance isn't going away. In fact, it's getting stricter by the day. New standards referred to as PCI DSS promise to make the costs of a breach even higher, and companies that

PCI Compliance, What Do Most Small eCommerce Businesses do? Despite credit card companies stating that you must be PCI compliant, the reality is that very few small businesses actually perform any of the diligence required to be PCI compliant, let alone follow through with the actual

How Much Does it Cost to Build a Website? We studied thousands of hosting plans, selecting the ones that offer PCI compliance. We then shortlisted larger hosting companies because they're more likely to provide e-commerce plans that safeguard financial information, like your customers'

In general, PCI compliance is required by credit card companies to make online transactions secure and protect them against identity theft. Any merchant that wants to process, store or transmit credit card data is required to be PCI compliant, according to the PCI Compliance Security

What's PCI compliance going to cost your business? With 12 complex requirements, PCI When it comes to PCI DSS compliance and certification, there are generally three paths that an early-stage The highest cost of PCI compliance: the do-it-yourself approach. The first, and perhaps

Learn more about PCI DSS Compliance and see how Square protects you- for free. Table of contents. PCI DSS noncompliant consequences. What does it cost to be PCI compliant? How Square helps businesses be PCI compliant.

Costs Involved in PCI Compliance. What is PCI? PCI stands for "Payment Card Industry," and it's Currently, the most popular approach that large processors take to PCI is to leave compliance Lastly, if you do experience a data breach, you'll likely incur expenses like fines from the

How do I become PCI compliant? Becoming PCI compliant is connected with undergoing a PCI auditing procedure to meet the requirements of the PCI Data PCI compliance is here to insure that you're handling payment information in a secure environment so your customer sensitive data is safe.

pci compliance security scanning vendor approved card

1099

What do we need to do to be PCI compliant? It depends first of all on how many credit card transactions it accepts, stores, processes or transmits on Most PCI compliance will involve getting regular network or web site scans done by an Approved Scanning Vendor. The Level 1, very

What is PCI Compliance? How to be PCI Compliant? Being PCI Compliant is essential for all business models and of course, subscription and recurring payment is not an exception. PCI Compliance is one of the most important issues that all merchants from all over the world

You must meet PCI compliance standards, or you will be subject to extra fees and charges. Your reputation could also be at risk if you don't meet The cost of becoming compliant can be substantial for some businesses. You could spend thousands of dollars each year to maintain your compliance.

PCI compliance is a set of security standards designed to protect customer transaction data. Find out more information here in our guide. Becoming (and remaining) PCI compliant carries a range of costs. What you can expect to pay depends on your merchant level, which is dependent on

PCI Compliance Checklist. What can you do to prevent this from happening to you? How do you earn and keep your customers' trust in order to boost The key difference between SAQ A or A-EP is in the requirements that you need to fulfill in order to be compliant. It's important that you identify the

PCI Compliance FAQs. What does PCI compliant mean? PCI compliant means that any company or organization that accepts, transmits, or stores the There is not a regulatory mandate that requires PCI compliance, but it is regarded as mandatory through court precedent. How do I get PCI compliant?

pci compliant compliance