salary supervisor

Check Template. As per law, every employer needs to issue a pay slip to its employees that include details like pay period, taxes and deductions. Payroll check templates will help companies to generate pay slips mentioning all necessary information.

Use these calculators and tax tables to check payroll tax, National Insurance contributions and student loan deductions if you're an employer. We'd like to set additional cookies to understand how you use , remember your settings and improve government services.

EzPaycheck is the easy-to-use payroll software for small business and accountants from This is the step by step guide on how to add a

gatherings

Payroll is a list of employees who get paid by the company. It also refers to the total amount of money paid to the employees. Learn how to do payroll. A payroll officer needs to do careful planning. There are always ongoing tasks that need attention and a constant need to monitor changes

PAYROLL IN INDIA Combining Multiple Salary Components And ... Then check and record the amounts of allowances paid Hostel and Washing allowances: support temporary housing and The information contained in this "Payroll in India: Combining multiple salary components and complex

Payroll checks plays a huge role in the management of a business. Employees expect to rely on their jobs to consistently and regularly giving them their A payroll check is a financial document that you hand your employees in exchange for their services. Instead of paying cash to your workers,

Payroll Check Template. Records information about employees' salaries and given to employees as pay slips. Also known as a Pay Stub. Learn how to calculate payroll for your business. Includes information about calculating hours, wages, and deductions, as well as frequently asked questions.

mart services

18, 2021 · Before you can begin to calculate payroll, you must know what the employee's gross income is. This is determined by multiplying the number of hours worked in a pay period by the hourly rate. For example, if an employee works 40 hours in a pay period and earns $15 an hour, you would multiply 40 times $15 to get a gross pay of $600.

Retrying a Payroll Run or Other Payroll Process. Reissuing a Voided Check. Correcting Run Results: Reversals. Rolling Back Payroll Runs and Using Oracle HRMS - The Fundamentals This user guide explains how to setup and use enterprise modeling, organization management, and cost analysis.

General Payroll Controls Consider using a selection of the following controls for nearly all payroll systems, irrespective of how timekeeping information is accumulated or how employees are paid: Audit . Have either internal auditors or external auditors conduct a periodic audit of the.

Check has the potential to become payroll's "platform of platforms." Square managed to build a payroll system in-house, but even with a much larger team and deeper Beyond these core features, Check also strategizes with partners on how to get the most out of payroll, and contributes

05, 2019 · The broker is not wrong ... the first sale was a wash and will always reflect that on your statements. If you sold the entire position then the disallowed wash will be captured on the second sale and be reflected as such. Either wait for the 1099-B that you will get in February and/or ask the broker to explain their bookkeeping to you.

employee receivables payroll handling through affected completed steps above been

services osuna irma realtor hollister

mart santa ana

Payroll Checks General Practices. In most cases, if the check is six months old or less, your bank or credit union should cash it. To find funds associated with a very old lost payroll check, go to the National Association of Unclaimed Property Administrators website and click on your state.

• Check the box if you closed the business or dissolved a sole proprietorship, partnership, corporation, or limited liability company, and no longer have payroll to report. Fill in the date of final payroll. • If you sold your business, leased your employees, or trans - ferred your business assets, indicate whether the transac-

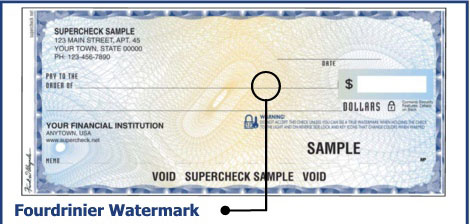

checks personal borders watermark security resolution fourdrinier abagnale copied

Businesses, such as retail stores, often offer payroll check cashing to its customers. The service gets customers in the store, and once they have cashed their checks, they will stay and shop. Even though the service can equate to an increase in overall sales for the business, a store ...

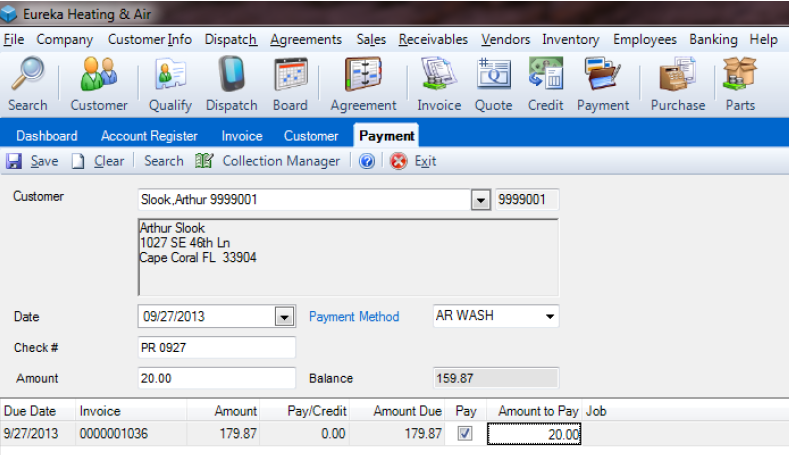

explains how to begin your payroll processing by resetting all your information and preparing for the next payroll cycle. • When posting an off-cycle check or adjustment, PayForce now automatically enters a suggested value for the Pay Period Begin Date (based on the pay period end date in

Get the cash out of your payroll checks by this. The last resort if both these things do not work is to endorse your payroll check to another person who has a photo identity proof. Are there any disadvantages for this? These three above-mentioned options help the customer to cash a

A payroll correction is required when adjustments need to be made to amounts paid. How to Avoid Payroll Errors. Avoiding or preventing each error listed above takes a variety of strategies, but Show your employees how to use BambooHR® to check their PTO balance, manage time off

Step 6) Click Execute Check the Display Log for the results of the Payroll Run. It gives summary of total number of employees run , employees in error and employees It is helpful in determining and correcting errors before you perform actual (live) payroll run. How to Execute Payroll in Background.

How To Cash A Payroll Check At Walmart. When you arrive at your local Walmart store, make your way to the customer service desk or MoneyCenter counter. Simply hand over your payroll check to the cashier along with a valid government-issued photo ID such as a passport or driver's license.

to the Careers Center for Mister Car Wash. Please browse all of our available job and career opportunities. Apply to any positions you believe you are a fit for and contact us today!

Payroll liability accounts such as FICA (Social Security and Medicare), along with state and federal income tax payable are used to record withheld amounts owed to the IRS and other third parties. The following is an example of some of the accounts you may set up to manage and record your payroll

Printing Payroll Checks & Pay Stubs. You can print your own payroll checks on check stock that includes Personal checks are checks provided by your bank or a check vendor, and lack the space to The choices you make determine where you buy payroll checks and how much they will cost.

How to issue paychecks. You can purchase check stock from the bank that has your payroll account or a stationary supply store. Work with a payroll service provider Often, the surest way to improve your payroll process is to work with a provider who can handle all aspects of payroll on your behalf.

Payroll checks that are uncashed belong to the employee, regardless of how long they go unclaimed. Employers are responsible for following the escheat laws. Escheat is the reversion of abandoned property to the state. The state holds the funds until the employee or heirs claim the check.

Best Payroll Software. How to pay your employees painlessly. Gusto is similar to other payroll software solutions in that it offers direct deposit or checks to pay your employees. Payroll4Free is the only free software that allows for all the administrative components needed to run a payroll.

26, 2017 · Other advantages of Payroll Management System are its extensive features and reports. PURPOSE Payroll Management System gives you the power to: Manage Employee Information Efficiently. Define the emoluments, deductions, leave etc. Generate Pay-Slip at the convenience of a mouse click. Generate and Manage the Payroll Processes according to ...

You can edit a payroll check if the status is not yet processed. I'll show you how to do it below: Go to the Payroll menu and Employees. I wanted to see how everything is going about editing a payroll check that you had the other day. Was it resolved? Do you need any additional help or clarification?

How to cash your check. There are a number of different checks that we can cash for you at checkout lines. These include payroll checks, government checks, tax refund checks, cashiers' checks, insurance settlement checks and 401(k) or the retirement account disbursement checks.

Payroll checks can easily manage now with Online Check Writer. The software helps you print payroll checks massively for all your employees at a time. Create a new group adding bank details of your employees and print paychecks on-demand on blank stock papers.

Payroll checks are among the least risky checks to cash, so almost any store that cashes checks will cash a payroll check. But, just so there's no confusion, here are some stores you still might be wondering about, that in fact offer no check How to Get a Credit Card Limit Increase Without Asking.

register is also called Payroll Checklist which provides details of the employee payments and helps in authenticating them before making payments. Many templates are available in word and excel formats, and one can utilize payroll software as well for accurate, easy and quick generation of payroll register.

A void check is a payroll check that is printed or partially printed that is canceled or deleted by the maker of the check before the check has been cashed. Use this option to void a payroll check that will be printed again. For example, when an employee loses a payroll check and you need to reissue it.

08, 2021 · The typical car wash customer, using an automatic or touchless car wash, is waiting for about 15 minutes at a minimum for their car to be washed. This is an excellent time to sell them other things. Making deals with auto dealerships to wash cars at night is a great way to make extra money.

Washing the ink from a pay-roll check is nearly impossible. These are indelible inks that the usual "check washing techniques" just can't handle. Earn +20 pts. Q: How to wash ink from a payroll check?

How much does it cost to cancel a payroll check? The fee to cancel, or "stop payment," on a check can be $30 or more at many large banks. You can void multiple checks at a time. … If you need to void a check for a contractor paid in payroll, see Voiding a Contractor Payment.

How to make payroll tax payments. Calculating your payroll taxes is the hard part. Actually making the payments is easy. You just enroll in the Electronic Federal Tax Payment System (EFTPS), then make your payment online. It's the only way to make a payroll tax payment (mailing checks isn't allowed).

, a wash sale is what occurs when you sell securities at a loss and buy the same shares within 30 days before or after the sale date. Wash sale rules are designed to prevent investors from creating a deductible loss for the purpose of offsetting gains with only a short interruption in owning the security.

. Car wash and polishing businesses must pay $300 per location for annual registration and assessment fees. The fees are due when you submit your application. If you are mailing your application, please include a cashier’s check or money order payable to DLSE.

Check cashing services for payroll checks, government checks, tax checks, and money orders are available at many Walmart stores for a small fee—$4 for checks $1,000 or less and $8 for checks higher than $1,000, with a maximum check amount of $5,000. How To Become a Digital Nomad.