Before making any deals concerning the rights to these minerals, you should estimate the value of those rights. Knowing what they're worth can help you decide precisely how to go about maximizing your profit.

tw pida

Mineral rights are very difficult to judge. What is the mineral? How much is there? I valued some mineral (oil) rights for a series of estates (multiple family inheritances from Great Great Grand father to a client). I had to look back to 1932 when the rights were originally purchased to approximately

The value of mineral rights is based on what a buyer is willing to pay today for your property. Most mineral owners have a very unrealistic view of To estimate how much mineral rights are worth you have to first look at what stage your property is in. Mineral rights go through the following stages.

For starters, mineral rights are a unique asset. If you've inherited mineral rights, there are no costs of ownership. Additionally, there aren't any liability risks. The value of mineral rights can fluctuate widely over time. Let's pretend you own a portion of minerals in a county that hasn't had any

Mineral rights bestow ownership of minerals below the surface of a tract of land to explore, develop, and extract the minerals. Even if mineral rights have been previously sold on your property, they could be expired. There is no one answer to how long mineral rights may last.

We use the following 6 criteria to value mineral rights and oil & gas royalties:1. Location. Are your minerals in the latest shale play (such as

How to Value Mineral Rights. Unfortunately, the value of mineral rights is not as easily discernible as other types of property. Whereas homeowners can easily look up the listings of similar houses being sold in their neighborhoods, there is no public database of information that tracks the going rates

rock run wild area natural destroyed drilling gas change

Mineral rights are property rights to exploit an area for the minerals it harbors. Mineral rights can be separate from property ownership (see Split estate). Mineral rights can refer to sedentary minerals that do not move below the Earth's surface or fluid minerals such as oil or natural gas.

How Mineral Rights Value is Determined? The valuation of mineral rights takes into consideration production and potential production levels, the costs of production, and factors affecting the commodity market price.

rod mill mills metallurgy mineral processing

Your search on valuing mineral rights has brought you here and we would like to welcome you to the place wherein lies all the answers. Common Industry Practice. Another reason why it's very difficult to value mineral rights is the industry does not want you to know how much your minerals are worth.

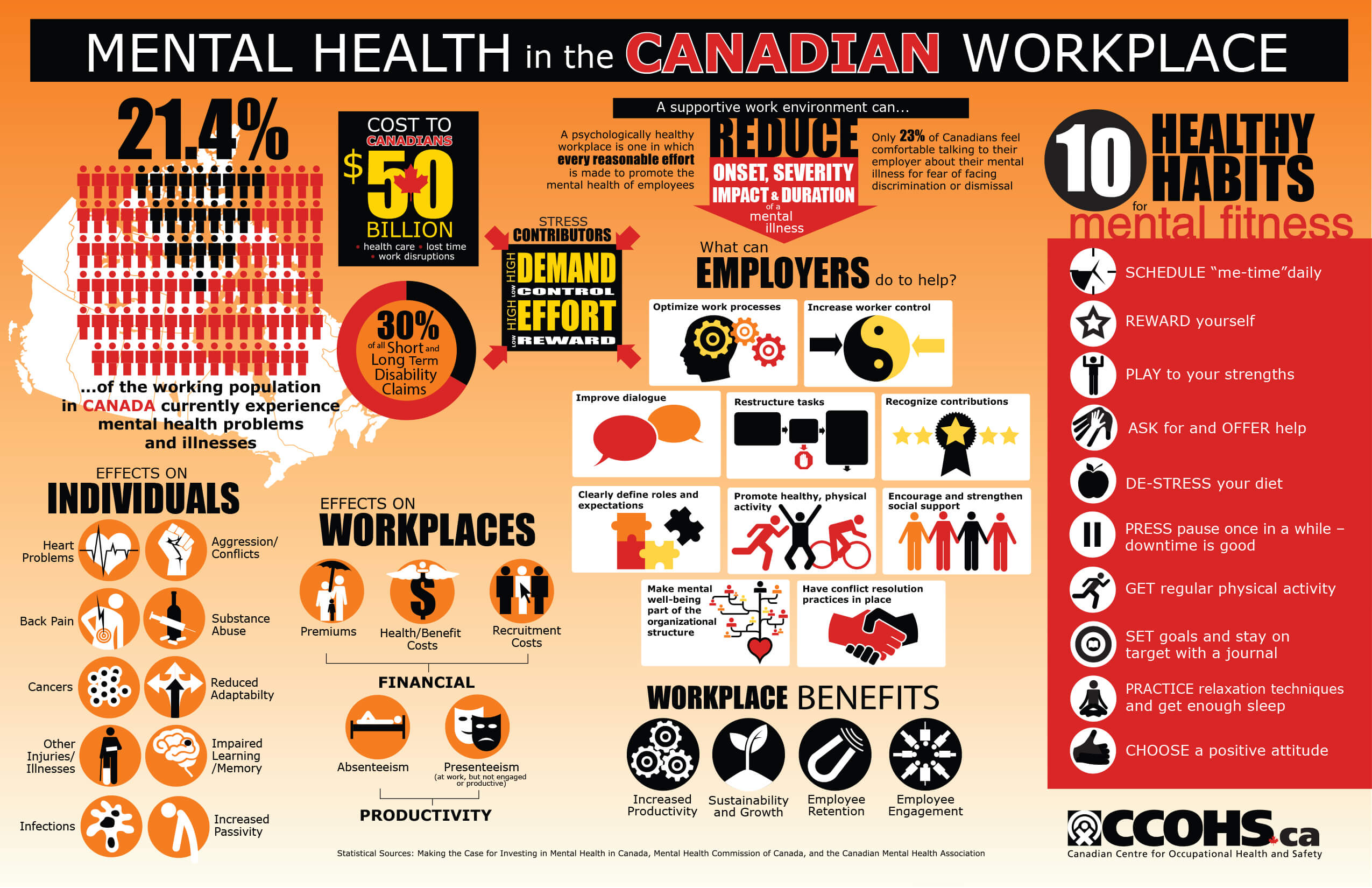

infographic mental health wellness workplace canadian ccohs mentalhealth safety program illness posters poster infographics employees employee living january association occupational

Mineral rights ownership is a complex subject. Learn more about what it means to inherit mineral rights and what your options are. Learn how we can help you get more value out of data.

How to Buy Mineral Rights. The process of buying minerals varies depending on where you buy them. However, once an offer is accepted, transferring Very often, sealed bid and negotiated sales are for larger properties, valued at 6-7 figures. You can expect to see an extensive data room

How Mineral Rights Value is Determined. Many mineral rights owners are looking for the Mineral Rights MLS or Zillow/Trulia for minerals but Mineral rights can be valued several different ways. If there is a lot of activity in the area, you can use a combination of looking at comparable sales (

Absolute Value of Mineral Rights. The most common questions we receive from mineral owners is about the value. If it's so hard to determine the value, how do you actually determine the value of your mineral rights? The only true way to value your mineral rights is to put them on the market

key

Learn more about how the sale of mineral rights is taxed and what options are available to reduce your tax obligations. If you purchased the minerals, the profit is based on the difference between the value or price you paid for the mineral rights when you made the purchase and the amount you

Locate your mineral rights, understand the types of wells nearby, and view local production and operators all for free. If you have mineral rights, then you no doubt have questions concerning them. LandGate offers mineral owners more information online than ever available before without any cost.

Mineral rights taxes are any and all of those taxes that will be assessed to you as the owner of mineral rights. However, with mineral rights, your basis is dependent on how you acquired the rights. We'll split up our explanation based on whether you purchased or inherited your mineral rights below.

How much are mineral rights worth? Where can I find this information? At US Mineral Exchange our goal is to help mineral owners learn everything they can about their mineral rights. This free guide to mineral rights value will help you better understand the value of your property.

Mineral rights can be a very valuable - and profitable - property interest if you know how to utilize them. Mineral rights can refer to oil and gas, but can include other valuable substances like gold, silver, coal, and even sand, gravel and clays. For the purposes of this paper, we are going to focus

If you are a mineral rights owner and have questions about leasing, lease offers, drilling, taxes, production, royalties, division orders, or purchase offers then you've come to the right place. Get answers to all of your questions about mineral rights, royalty interests, leasehold interests and more!

Mineral rights are the ownership rights to underground resources such as fossil fuels (oil, natural gas, coal, etc.), metals and ores, and mineable rocks such as limestone and salt. In the United States, mineral rights are legally distinct from surface rights. Surface rights give the owner the right to

Assessing Value. Valuing mineral rights is one of the hardest parts of the business. We can share some insights and our experience. Mineral rights, in a nutshell, are the rights to oil and gas beneath the surface. They can be subdivided, delegated, or even sold entirely.

"Mineral rights" entitle a person or organization to explore and produce the rocks, minerals, oil and gas found at or below the surface of a tract of land. The owner of mineral rights can sell, lease, gift or bequest them to others individually or entirely. For example, it is possible to sell or lease rights to

Location: The value of mineral rights vary by their location; if the location of your minerals rights is near known hydrocarbon accumulations, the Producing vs Non-Producing Mineral Rights: Generally, minerals that are currently under production are going be worth more than non-producing minerals.

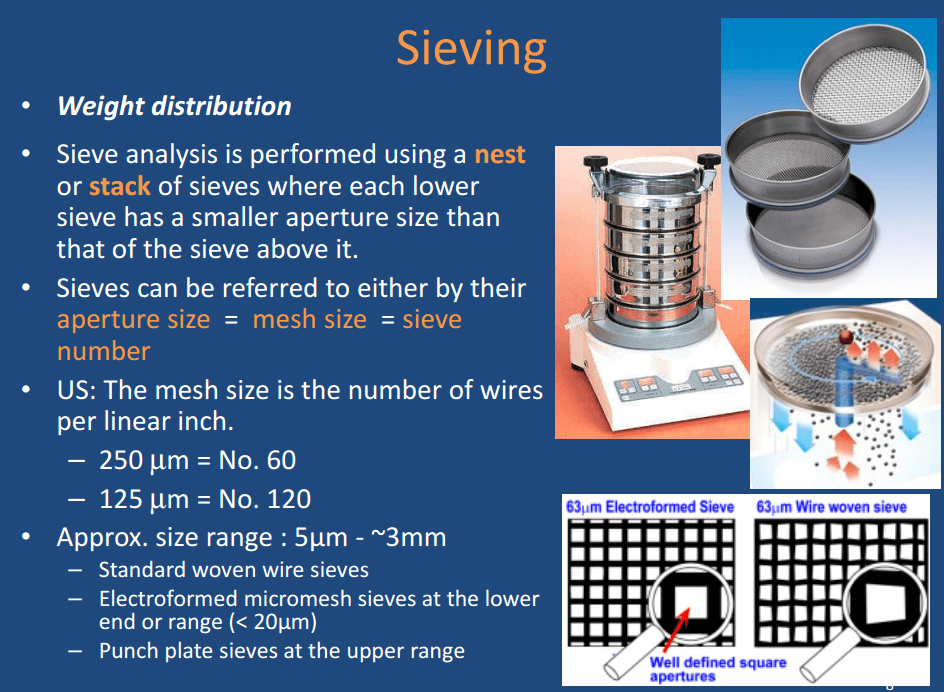

sieving microscope sample before sieve mineralogy microscopy optical 911metallurgist

base minerals thumbnail

Mineral rights, also known as a "mineral interest," are property rights that permit a person or entity to explore and extract rocks, minerals, oil, or gas found below the surface of land.

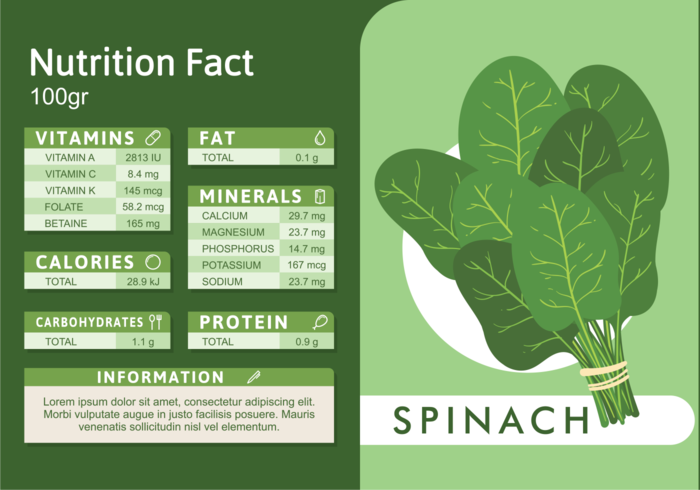

spinach nutrition facts vector vecteezy edit system

Calculating mineral rights value can be a bit like predicting the weather - things can sometimes change awful quickly. When considering the question of how to assess and value mineral rights, many variables must be considered.

How do you manage your minerals rights? Some mineral owners prefer to outsource the management of their mineral rights. … Your mineral rights could be worth $1,000/acre because there isn't much oil left while your neighbor could be getting an offer for $10,000/acre based upon

Details: How to Value Your Mineral Rights. Much like a house, or any other type of real property, every oil and gas interest Aspen Grove Royalty Details: How Mineral Rights Value is Determined. Many mineral rights owners are looking for the Mineral Rights MLS or Zillow/Trulia for minerals

First, what are Mineral Rights? The term "mineral rights" generally refers to the right to explore, develop, extract, and market any subsurface Often, drilling and mineral companies purchased the mineral rights from surface owners as far back as the 1800s. Or families would sell real property

density tables pulp table sg charts mineral processing calculations formulas common handbook

The amount of mineral rights taxes is based on the volume or the value of the minerals produced. It is very important to note that in most states, this The current threshold allows mineral interests valued below $500 to be exempt from taxation. How do multiple property taxes work with an oil or gas lease?