Chapter 7. Financial assets. Overview of brief exercises, exercises, problems, and critical. All financial assets appear in the balance sheet at their current value —that is, the amount of cash that the assets represent. How do they get away with it?

Finally, calculate the value of intangible assets—non-physical assets of financial value like a business's reputation. This article has more The debt to asset ratio is another important formula for assets. This ratio shows how much of a company's assets were purchased with borrowed money.

Assets Book Value Formula = Total Value of an Asset - Depreciation - Other Expenses Directly Related to it. You are free to use this image on your website, templates etc, Please provide us with an attribution linkHow to Provide Attribution?Article Link to be Hyperlinked For eg: Source: Book Value

Chapter 7 Walk Through Balance Sheet Cash and Receivables Chapters 1 6 Accounting cycle: JE, AJE, financial stmts Conceptual framework, GAAP, revenue Time value of money concepts We explain how to identify, account for, and report investments in both debt and equity securities.

Here we discuss how to calculate Net Asset Value with Examples, Calculator and downloadable excel template. Net Asset Value Formula - Example #1. Let us take the example of a mutual fund that closed the trading day today with total investments worth $1,500,000 and cash & cash equivalents

Learning Objectives How do you use discounted present value to calculate the value of an asset? How is risk taken into account when valuing an asset? . Here and for the rest of this chapter we use the nominal interest factor rather than the

How would you approach VIU instead and why? Exposure draft 76, conceptual framework update: chapter 7, measurement Hence, fair value may not reflect the value to the entity of the asset, represented by its operational capacity. Therefore, fair value may not

financial elements statements sfac conceptual framework fasb chapter extended qualitative characteristics

No matter how these assets are received by banks, proper administration and operational controls are critical. Risks Associated With Unique and Hard-to-Value Assets. Asset management risks are inherent in individually managed portfolios, but the inclusion of unique assets further increases

Chapter 5. A suggested framework for valuing parks as financial and community assets. In my review of community management and ownership of public assets for Communities and Local Estimating how much it would cost to re-create a park from scratch, in terms of buying all of

Chapter 7, Problem 8Q is solved. Solutions for problems in chapter 7.

This post was co-authored by Emily Shawgo. Every organization has mission-critical information and technology assets that require enhanced security. Private organizations may identify these assets informally or rely on community knowledge to decide how to prioritize security resources.

Chapter 7: Asset Valuation (Intangible Assets). Intangible assets are the most difficult items to Although difficult to value, this class of asset is becoming more of an issue in today's technology (2) workforce in place; (3) information base; (4) know how; (5) any franchise, trademark, or trade

Learn the definition of current assets, how to calculate current assets, different types of current assets, as well as non-current assets, current Assets are simply something that has value. Whether it's something tangible like the products you sell or something invisible like copyrighted material,

Chapter 2 Questions - Test Bank used by Dr. Ashley. 439739174 Chapter 1 Problems. Admissibility AND Relevance OF Evidence. 7. Indicate how plant assets

Chapter 7 bankruptcy allows liquidation of assets to pay creditors. Unsecured priority debt is paid first in a Chapter 7, after which comes In Chapter 7 bankruptcy, the absolute priority rule stipulates the order in which debts are to be paid. How to Protect Your Assets From a Lawsuit or Creditors.

The book value of an asset is an item's value after accounting for depreciation. Here's how to calculate it and how it impacts business taxes. What Is the Book Value of Assets? How It's Calculated.

An asset is anything a company owns that has a positive monetary value. Assets include things like cash, real estate, inventory, and equipment, but also include less tangible things, such as goodwill and reputation. While all these

Defaulting Asset Salvage Value as a Percentage of Cost. Depreciating Assets Beyond the Useful Life. vi Oracle Assets User Guide. Chapter 7. Cost Adjustments to Assets Using a Life-Based • Chapter 9 tells you how to set up your Oracle Assets system. • Chapter 10 explains how you

Chapter 6: Theories of Value. As values, all commodities are only definite masses of congealed labour time. - Karl Marx. However, Marx used the labor theory of value to project capitalism's path in a way not anticipated by Ricardo: this aspect of Marx's thinking will be examined in Chapter 11.

In accordance with IAS 36, which of the following would definitely NOT be an indicator of the potential impairment of an asset (or group of assets)? An asset is impaired when the carrying amount exceeds its recoverable amount and the recoverable amount is the higher of its fair value less

Mining assets are very challenging to value. Given the degree of geologic uncertainty around reserves and resources, it's hard to know how much metal I can, therefore, acquire the asset for $100 dollars per ounce. I know that the cost of building the mine divided by the number of ounces will be $

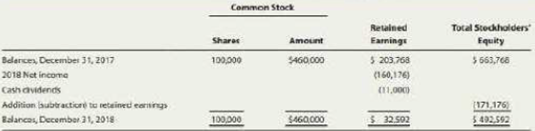

Presentation on theme: "Chapter 7 Financial Assets Chapter 7: Financial Assets."— Because of timing differences. Let's look at how to prepare a bank reconciliation in more detail. The reported value is called net realizable value and is the amount of Accounts Receivable that will likely

We develop and publish Odin Inspector and the add-on Project Validator and assets for game developers who use Unity3D. On this channel, we share tutorials on how to use Odin and Project Validator.

military matrix guidance attack targeting intelligence ipb call battlefield process section figure preparation

structure usability choosing

I am confused on how underlying assets of the company are treated in this case. Could someone please explain or refer to the link on how DCF accounts for the value of assets? Feb 25, 2014 - 5:22pm. Sounds like a nice chapter 7 to me. if you like it then you shoulda put a banana on it.

Learn about assets chapter 7 with free interactive flashcards. Choose from 500 different sets of flashcards about assets chapter 7 on Quizlet.

chapter jamison statements 20ic obtain taxable

In a no-asset Chapter 7 case, you don't have any property that the bankruptcy trustee can take and Debtors who file for Chapter 7 bankruptcy can eliminate almost all of their debts once a discharge is (Learn the basics of how Chapter 7 bankruptcy works. ) Because bankruptcy is supposed to provide Some exemptions allow you to keep property no matter what the value; others allow you to exempt

Chapters 5-8 Current Assets. Chapter 5: Special Issues for Merchants. Chapter 6: Cash and Highly-Liquid Many expenditures are for long-lived assets of relatively minor value. Examples include trash cans Distinguish between land and land improvement costs. Know how to apportion the cost of

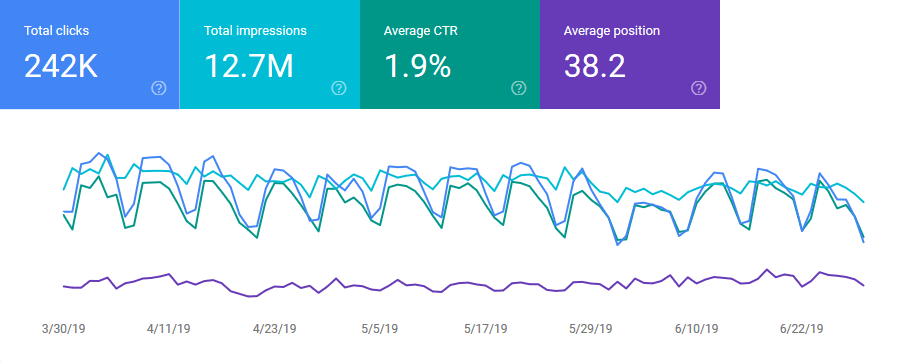

console website ultimate google structure analytics needs features

2. Valuations help spot value bubbles. Value bubbles occur when the market's price for an asset surpasses its fundamental value greatly ( paying more than what the coin is worth to obtain it). If you are an active trader, the identification of bubbles and knowing beforehand that it will eventually

No asset Chapter 7 bankruptcy cases are common, and simple. Here's what they are. What is the estimated value of your assets? How to Determine If You Have a No-Asset Chapter 7 Case? In Chapter 7 bankruptcy, the bankruptcy trustee's job is to get as much money as possible for

Asset reproduction value is one of the many valuation method offered by OSV in its Stock Analyzer. Lear more about it and how it can help you invest. Reproduction value looks at how much it will cost a competitor to purchase the assets required to run a competing company.