IT asset management (also known as ITAM) is the process of ensuring an organization's assets are accounted for, deployed, maintained, upgraded IT assets have a finite period of use. To maximize the value an organization can generate from them, the IT asset lifecycle can be proactively managed.

saskatchewan saskatoon yxe istock nutrien dieci wage flights cheapflights momondo affrontare rimg economy skyline altusgroup

Under Net Asset Value Method a business is valued on the basis of the net assets of business the total assets less the liabilities and the preferred Comparable company method of valuation is widely used to value private firms. It values an asset or firm based on how an exactly identical firm (

How to Calculate Equity Value and Enterprise Value. You usually start by calculating a company's Current Equity Value. In theory, you could use Market An Asset is "Non-Core" or "Non-Operating" if the company does not need that Asset to sell products/services and deliver them to customers.

udemy swot

Learn how a company is valued and why valuations are important for entrepreneurs, business Understanding your company's value becomes increasingly important as the business grows Public companies can also trade on book value, which is the total amount of assets minus liabilities on

channels abc policy

Asset management refers to a systematic approach to the governance and realization of value from the things that a group or entity is responsible for, over their whole life cycles. It may apply both to tangible assets (physical objects such as buildings or equipment) and to intangible

Asset management is the service of managing a client's money. Asset management clients can range from regular people to nonprofit organizations and public companies large and small.

cost serve profitability chainalytics profit maximum

What do Asset Management Companies Do - How can Asset Management companies help you build wealth. This is a detailed video explaining what an

Management experience. Managers with a strong record of success positively affect a business' Venture capital (VC) firms value companies to be able to report to limited partners (LPs) on how The future value of an asset is calculated by multiplying projected revenue with projected margin

For asset management company valuations often a rule of thumb of 1% to 2% of Enterprise Value to AUM is applied. As with each business, the revenue is a function of price and quantity where the price is the fee charged for the services to clients and the quantity the assets under management.

The Net Asset Value (NAV) is the calculation that determines the value of a share in a fund of multiple securities, such as a mutual fund, hedge fund, or exchange-traded fund (ETF). Determine the economic value of a company. This is known as the asset-based approach for valuing a company.

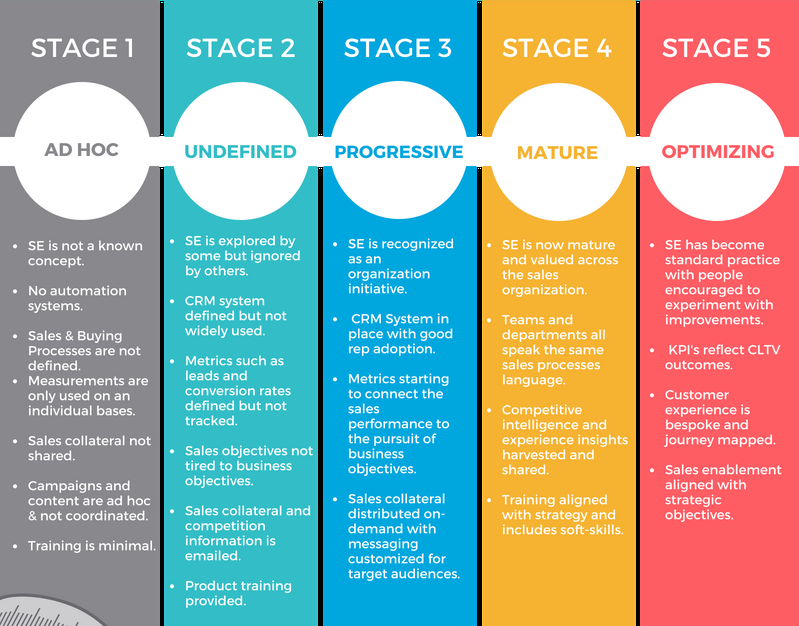

maturity sales enablement assessment why

There are numerous ways to value a company, from looking into the cash flow to using discounting factors on yearly revenue. The actual value in the asset-based approach to calculate the company valuation could be much higher than the sum of all the recorded assets of the business.

The ability to generate value through asset management digital transformation will increasingly separate leaders and followers in the North American Tone from the top. Co-opt the CEO and chief information officer (CIO). Each of the digital leaders we spoke to talked about how both the CEO

Suppose a company buys an asset and records its value according to Generally Accepted Accounting Principles as the total amount of money paid for This procedure may be a fair way to value an asset from an accounting point of view but the reality is that there can be major discrepancies between

financial websites advisor management asset inc riverview clarity ten

Asset management ratios indicate how successfully a company is utilizing its assets to generate revenues. Asset management ratios are computed for different assets. Common examples of asset turnover ratios include fixed asset turnover, inventory turnover, accounts payable turnover

An asset management firm designs portfolios and manages investor funds by helping clients invest in asset classes such as stocks or bonds. Pay attention to how different companies and their managers are compensated. For instance, for a mutual fund with a sales load, that

Asset management is a methodical approach to managing and optimizing the value of objects for which a group or institution is responsible throughout their life cycles. An asset management company (AMC) is a company that invests on behalf of its clients in a pooled cash fund.

Assets under management definitions and formulas vary by company. Assets under management is the total market value of all securities portfolios for which an asset manager provides continuous and regular supervisory or management services.

• Assets under management (AuM) will continue to grow rapidly. We1 estimate that by 2025 AuM will have almost doubled - rising from US$ trillion in 2016 to US$ trillion in This growth will likely be uneven in consistency and timing: slowest in percentage terms in developed markets

Introduction to Asset Management Company. Asset management companies (AMC) are firms that collect a pool of funds from individuals as well as corporate investors and invest them in diverse securities like stocks, bonds, real estates, fixed interest securities etc.

How to implement an asset management policy. A facility's assets are the lifeblood of the company, especially in production. As long as they are healthy Use the company's mission statement or core values as your starting point. Tie asset management to this statement with a brief declaration of

Property Managers: Your Next Best Business Asset. If you're a small to medium-sized rental property owners, you might believe you can manage your portfolio well using ManageCasa. After making good property selections, obtaining smart financing, and then charging profitably rent prices, you've got

So, what do asset management companies do? An AMC will direct the investor capital into distinct How you can become an asset manager. The internet is absolutely filled with advice on how to get This piece of advice will come in handy later on. It will also add an extreme amount of value to

In this Article of on Asset Management Company AMC, we discuss what is AMC, how do they work, who are the investors in AMC, What is Buy Side and Now let us understand the meaning of an Asset Management Company (AMC) in this regard. So while we have discussed research on one side,

Asset management has a double-barreled goal: increasing value while mitigating risk. How Asset Management Companies Work. Asset management companies compete to serve the investment needs of high-net-worth individuals and institutions.

At a Glance. Winners in the asset management industry are succeeding either by building scale or differentiating offerings, using M&A for both. 2021 will be remembered for a big shift in asset management as large banks move back into the space after a two-decade hiatus.

unilever chain supply

management compensation. business location, square footage and ownership or rental status of This means the company's value without any potential synergies or strategic considerations from the Asset-based approaches are typically used for businesses whose value is asset-related

I was initially thinking you would value such a company like a bank or other financial institution, using equity multiples (P/E, price/book) or the dividend discount I'll be having an interview soon and know from a friend that there might be a case study on the valuation of an asset management company.

This management encompasses all of your company's resources, from people, information, and technology to value streams, processes, and This is because of how both are managed. For example, an asset could be your company's capital, or the knowledge inside one developer's head.

ottawa ontario altus

management systems examples organization company strategy

Value of assets is the value of all the securitiesPublic SecuritiesPublic securities, or marketable securities, are investments that are openly or easily The NAV number alone offers no insight as to how "good" or "bad" the fund is. The NAV of a fund should be looked at over a timeframe to

Asset management process also helps businesses derive more value from an asset and achieve business goals. Sign up for a free demo today and see how Kissflow Finance and Operations Cloud can help your company's assets run smoothly.