This article explains garnishment, which wages you can garnish, and how worker wages are protected. Federal wage garnishment law protects employees by placing restrictions on the garnishment process. This is done under Title III of the Consumer Credit Protection Act .

State Limits on Wage Garnishment. Laws vary from state to state as to the type and amount of There may be grounds to vacate that judgment, but you may have a limited time to do so, and it is To learn how to object to a wage garnishment, see Stopping a Wage Garnishment Without Bankruptcy .

A wage garnishment requires employers to withhold and transmit a portion of an employee's wages until the balance on the order is paid in full or the order is released by us. Use our collection hierarchy to find out how to handle multiple orders. Adjusting the garnishment amount on your employees pay.

3) How do I go about fighting or vacating this garnishment or bringing it back to court? 4) If I filing bankruptcy to avoid the garnishment will this get rid of the judgement (I believe chapter 7 will but not 13) 5) Is it too late for me to file a

Creditors can garnish both wages and bank accounts. The process for garnishing wages differs from the process for garnishing bank accounts. It is ultimately up to the judge to decide whether to vacate a default judgment. If you believe that a judgment has been wrongfully entered against

Do you have to garnish your employees wages? Did you get a wage garnishment letter? Q: Wage Garnishment: Everything You Need Know on How to Handle It.

Wage garnishment procedures. An eviction case is divided into two separate hearings if you choose to pursue both the eviction and the claim for damages. Posting the summons and complaint (the summons and complaint are different from the three day notice to vacate) upon the tenant's door

How to Avoid a Wage Garnishment. The best way to avoid having your wages garnished is to avoid being sued in the first place. So many consumers go into denial mode when they can't pay their debt and try to hide from and avoid their creditors by ignoring correspondence and phone calls.

Read an overview of wage garnishments and other garnishees, their rules in British Columbia, and how to stop a wage garnishment. Facing a wage garnishment can be incredibly stressful and overwhelming, and many people don't know what their rights and remedies are in the situation.

Unfortunately, getting a wage garnishment for tax debt is more common than you might think. In 2020, the IRS requested over 780,000 notices of levy on. This guide will explain what a wage garnishment is, how it works, how to stop it, and what you should do if you receive a notice of garnishment

Find out how much money can be taken from your paycheck through a wage garnishment and how to stop it. How Exactly Is Garnishment Paid? The legal resources website Nolo states: "Wage garnishments are usually continuous, being withdrawn from each paycheck until paid."

How Can a Creditor Garnish My Wages? Most creditors will not be permitted to seek a wage garnishment until they have first obtained a judgment (court order) allowing Alternatively, the debtor may be able to file a lawsuit to vacate the judgment. If the judgment is vacated, the previous

How to Stop Wage Garnishment. Avoiding a situation in which a wage garnishment may be issued is always the best course of action, but in the event an individual is facing garnishment, he should respond to the notification and the court hearing if one is held.

A wage garnishment is any legal or equitable procedure where some portion of a person's earnings is withheld by an employer for the payment of a debt. When notified of an order to garnish wages, an employer is legally obligated to make the appropriate deductions from an employee's salary and

How to stop wage garnishment before it is applied. First of all, you need to understand how much of your wage can be garnished. The creditor can't garnish more than either 25% of your net pay or the amount by which your net pay exceeds 30 times the federal minimum wage.

Wage garnishment is now a fact of modern American life for many people, and like every other fact of American life, its implications can ripple through society and the economy with equal power. The home and workplace stress of wage garnishment, and of debt in general, can be devastating to

How much of my wages can be garnished for a private debt? What if I can't vacate the judgment, but I can't afford a wage garnishment? Even if you choose not to try to vacate the judgment, you always have the right to go to court and ask the court to modify the amount of your garnishment.

Who's affected by wage garnishments? Answer: more people than you'd think… Almost million people in America have their wages garnished. A wage garnishment is a court order to have part of your pay or earnings be withheld in order to pay a debt. How did the debt get here?

garnishment wage irs wages stop levy tax help bankruptcy

How Wages Are Garnished. When it comes to garnishing wages, the amount due will come from an employee's disposable earnings. When it comes to how much money can be garnished, it varies depending on the type of garnishment. Student loans tend to be 15 percent and can be as much

How To: Wage Garnishments. A garnishment is a legal way for a creditor to receive payment for a debt owed by an individual. General garnishments are commonly granted to a creditor by a court order to receive payments by attaching the person's wages, whereas debts owed to a state or

Wage garnishment is a legal procedure in which a portion of a debtor's earnings are withheld by his or her employer to repay creditors. Garnishment is a fairly severe consequence and is usually used only when an employee is seriously behind on his or her debts. Debts that may be repaid through

Wage garnishment happens when a court orders that your employer withhold a specific portion of your paycheck and send it directly to the creditor or person to whom you owe money, until your debt is resolved. » MORE: How to stop a wage garnishment. There are two types of garnishment

How Wage Garnishment Affects You. Wage garnishment is more than an inconvenience — it may have significant consequences A wage garnishment is one where the creditor obtains a court order to request funds directly out of your paycheck. A creditor is limited to how much money he can

garnishment wage laws

Wage garnishment is available if the defendant receives regular wages that are above the poverty line, and he or she doesn't already have other garnishments in effect.[6] X Research source. You only have a certain period of time to collect on your judgment.

If you are facing wage garnishment in Georgia, you may be feeling hopeless and overwhelmed. The right attorney might be able to explain how to stop wage garnishment in Atlanta, GA. The ideal situation would be to contact an attorney to help you before a garnishment has been ruled against you.

garnishment wage stop check keep them pay slideshare education

notice failure pay rent termination alabama tenant megadox behind forms templates legal

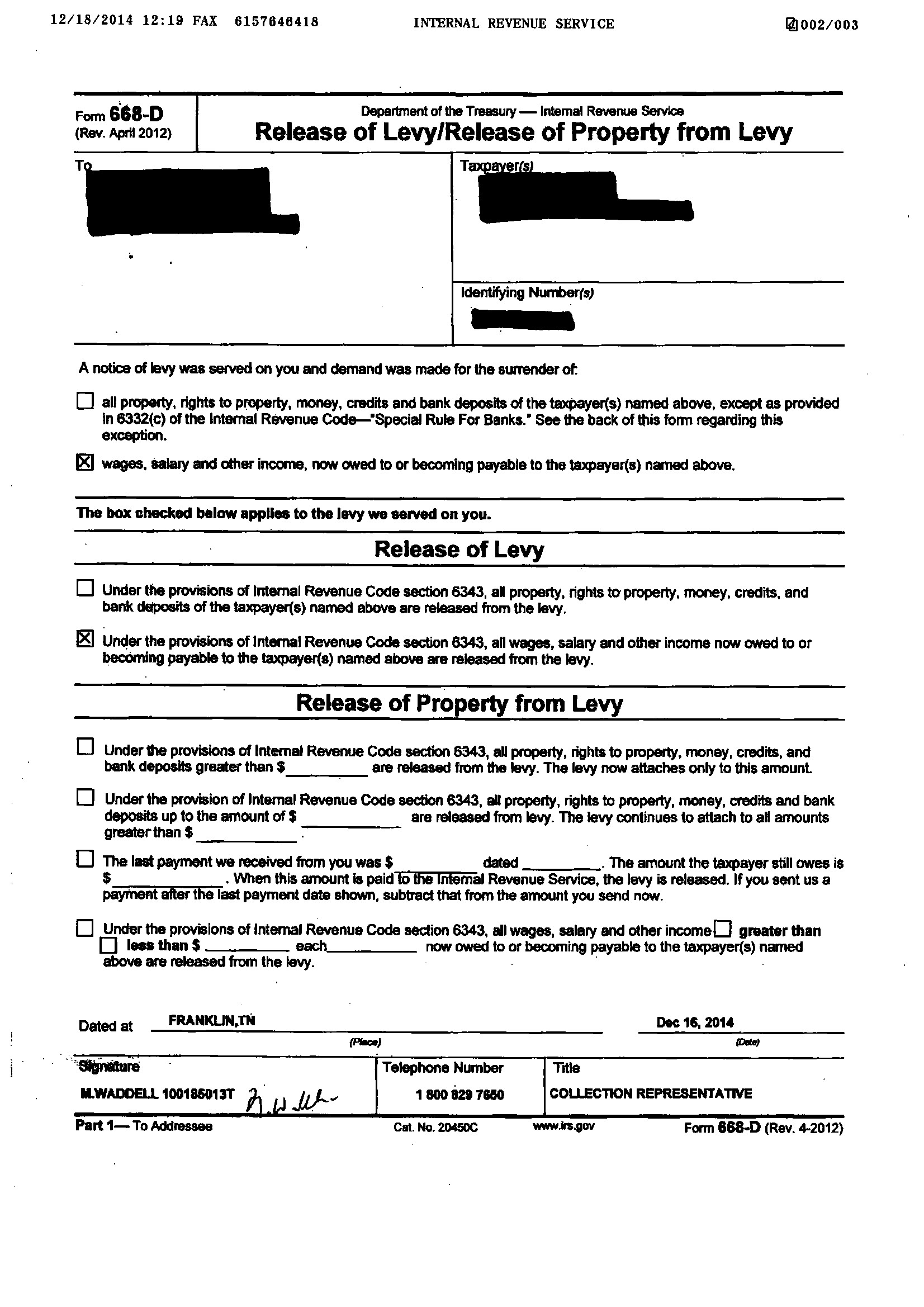

release garnishment wage irs levy tax

garnishment levy wage tax calculation worksheets worksheet release ge excel db sponsored links

A wage garnishment occurs when a court or the government orders your employer to set aside some of your earnings to pay a debt. For most people, it is worth it to take the time and effort to vacate the judgment. Look here for instructions on how to vacate a judgment.

nc carolina north debt legal global solutions client letter advocates stop tro sued law others state getoutofdebt fight

garnishment wage misconceptions common wages laws adp

child support garnishment quickbooks wage

Wage Garnishments for Taxes. If the IRS intends to garnish your wages, you should receive written notice of its intent to levy your wages. You'll be given an opportunity to claim exemptions depending on your household size and income on a form provided by the IRS.

Learn how to arrange a wage garnishment. A wage garnishment is a court order for an employer to withhold a certain amount of an employee's wages as repayment for debt. This is different from other after-tax payroll deductions. You can set this up from your Online Payroll product. We'll show you how.

Stop wage garnishment from creditors in California who have won a judgment against you in court. If you are facing wage garnishment in California then there are several steps you can take to stop You can also vacate a judgment if you can show that the entry of default was the result of "

Judgments Vacating Default Judgments Wage & Paycheck Garnishment. Often someone's first notice that they have been sued by a creditor comes when their employer informs them that their wages are being garnished because of a judgment.