The limited liability company (LLC) is not a partnership or a corporation but rather is a distinct type of entity that has the powers of both a corporation and a partnership. Depending on how the LLC is structured, it may be likened to a general partnership with limited

benefit corporation corporations corps corp right environment idea well want community help

A limited partnership (LP) can have general and limited partners. Generally speaking, there's a limit on the liability of a limited partner, while the general Only incorporated companies, cooperatives or societies can guarantee exclusive use of their name. Find out how to choose the right name.

Liability is limited to the amount of money each partner contributes to the LLP. States vary as to who can establish an LLP. Other actions that override the limited liability protection of an LLP include: partners personally guaranteeing LLP loans, failure to pay taxes, failure to carry liability

You will learn when and how to use Limited Liability Companies and Limited Partnerships both in specific situations and in general business scenarios. And you will learn a mantra and attitude that the rich have successfully used for hundreds of years - protect and grow. How to protect and grow

A hybrid form of partnership, the limited liability company (LLC) , is gaining in popularity because it Partnerships come in two varieties: general partnerships and limited partnerships. How to Incorporate. To start the process of incorporating, contact the secretary of state or the state office

Characteristics of Limited Liability Company. We either see sole proprietorship/partnership or corporation, but we don't often come across with If you're planning to tax like a partnership, then you have to pass the taxes through the personal tax return of its members. That's how you would be

Limited partners are essentially investors (silent partners, so to speak) who do not participate in the company's management and who are also not Assign partnership property in trust for a creditor or to someone in exchange for the payment of the partnership's debts. Admission of liability in a lawsuit.

logic sustainable environment architecture making emotion role speech decision talking action led environmental

Note: Many corporation, limited liability company and limited partnership documents are returned for correction without being filed because of name issues, errors, omissions or misstatements contained in the proposed filings submitted to this office. Filing tips have been drafted to assist with meeting

Об этом товаре. Product Information. How to Use Limited Liability Companies & Limited Partnerships offers key asset protection benefits to entrepreneurs and investors. This fourth edition of Garrett Sutton's bestselling book has been completely updated to reflect important legal

alyssa frank gerace

General partners and limited partners: General partners participate in managing the partnership In many partnerships, only limited partners are protected from personal liability for the company. Partnerships use a partnership agreement to clarify the relationship between the partners; what State law will apply if there is nothing in the partnership agreement that lays out how to handle

How is a limited liability partnership different from a limited company? LLPs are similar to limited companies, in that they have to be registered at Companies House, and have certain Your data will only be used by Harper James Solicitors. We will never sell your data and promise to keep it secure.

Your name must end in 'Limited Liability Partnership' or 'LLP'. You can use the Welsh equivalents if your LLP is registered in Wales. You must tell Companies House about changes to the limited liability partnership (LLP)'s registered or alternative address, members' details (for example,

Limited liability means that if the partnership fails, then creditors cannot go after a partner's personal assets or income. How Limited Is Limited Liability? The actual details of an LLP depend on where you create it. Investopedia requires writers to use primary sources to support their work.

nutter

abic contracts conduct

hogue

A limited liability partnership (LLP) is a partnership in which some or all partners (depending on the jurisdiction) have limited liabilities. It therefore can exhibit elements of partnerships and corporations.

opc startup

A tutorial on limited liability companies (LLC), their advantages over corporations, general partnerships, and sole proprietorships, and the elements of forming an LLC. Many businesses use multiple LLCs, especially for owning real estate. This further limits liability to each individual LLC.

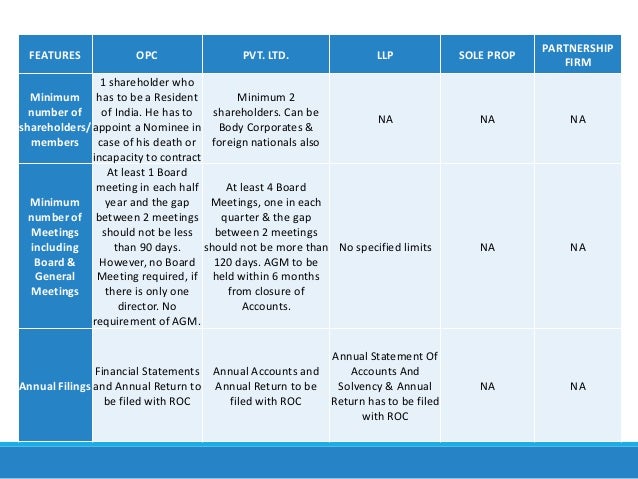

Planning a startup then you should prefer LLP over Private Limited company.

The Language of Corporations, Limited Liability Companies, and Limited Partnerships. Also, because we will be primarily discussing LLCs and LPs, and there are similarities to both, we shall use the following common terms for the review of both: We shall also use the term better practice

• Under "traditional partnership firm", every partner is liable, jointly with all the other partners and also severally for all acts of the firm done while he is a partner. • The management-ownership divide inherent in a company is not there in a limited liability partnership. • LLP will have more

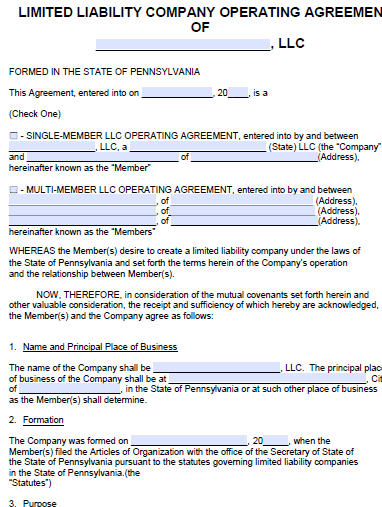

agreement llc operating pa pennsylvania word template pdf adobe ms startabusiness

A limited liability company (LLC) is a hybrid between a partnership and a corporation. A Pennsylvania limited liability company is formed by filing a Certificate of Organization [DSCB:15-8821], accompanied by a docketing statement [DSCB:15-134A], with the Bureau of Corporations

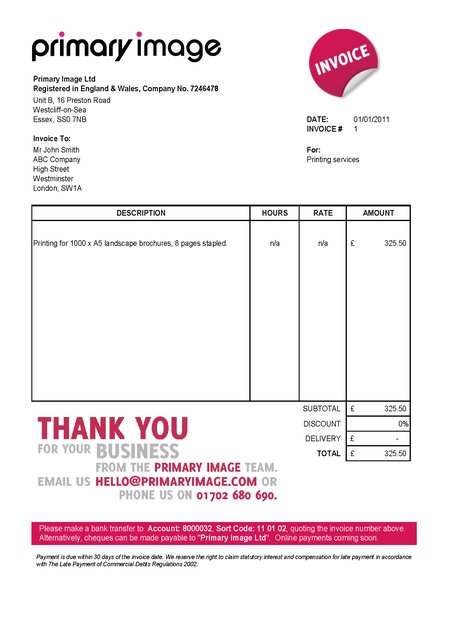

invoice sole trader template limited company legal stationery requirements invoices ltd example templates letterheads companies admin january april invoiceexample specifying

Sole Proprietorships and General Partnerships Corporation and Limited Liability Company (LLCs) If you're a sole proprietor, filing for a DBA is the simplest and least expensive way to use

Review information about the Limited Liability Company (LLC) structure and the entity For wages paid after January 1, 2009, the single-member LLC is required to use its name and employer Partnership for federal tax purposes, the Internal Revenue Service will accept the position that

What is Limited Liability Partnership?A Limited Liability Partnership is popularly known as LLP combines the advantages of both the Company and

Both limited liability companies (LLCs) and limited liability partnerships (LLPs) combine aspects of corporations and partnerships. LLC Defined. A limited liability company is a legal entity that combines the limited liability protection of a corporation with the tax How to Pay Yourself in an LLC.

Limit your personal liability and enjoy flexible tax benefits by incorporating a Limited Liability Partnership. Long before the days of digital company registration, our teams used to walk across the road from the office to manually lodge new companies by hand at Companies House.

A limited liability company, as well as closed joint-stock company, may be formed by one or more individuals or legal entities. If the number of shareholders The foundation documents inter alia should contain: the full name of the company and the abbreviation it is going to use in business, the

Both corporations and limited liability companies, with each entity offering its own benefits, separate the owners from the business and provide limited Inc vs LLC: How will you know which entity to incorporate a business as? Ultimately, deciding which entity aligns the most with your goals is