Underwriting is a crucial part of the loan approval process. Learn more about what underwriting is Are you self-employed, or do you own a sizable share in a business? You'll need to furnish a few different How To Have The Best Underwriting Experience. Your lender handles most parts of

How the Business Loan Underwriting Process Works. Step 1: Applying for a Small Business Loan. There are several different business loans to choose from and the documents required will vary on the type of lender. Here is a checklist of some of the common required documents.

staffing lending underwriting

loans loan factoring apply fha invoice check quick recourse mortgage advisoryhq easy fast approved before credit bfs application arrangement should

What Is Mortgage Underwriting? Getting Started With Underwriting. Your Choice of a Lender. The Effect of Turn Time. Underwriting is the process your lender goes through to figure out your risk level as a borrower. It involves a review of every aspect of your financial situation and history.

Business loan underwriting — understand how your application is evaluated. Exactly how do lenders decide you're worthy? Top online business loans you can apply for today. How do I explain financial gaps to a lender? Understanding underwriting ratios.

How long does underwriting take? Underwriting—a process in which mortgage lenders verify your assets—typically lasts about a week. Underwriting for a home loan takes a fine-toothed comb through every form, deposit, and credit report, to ensure your creditworthiness.

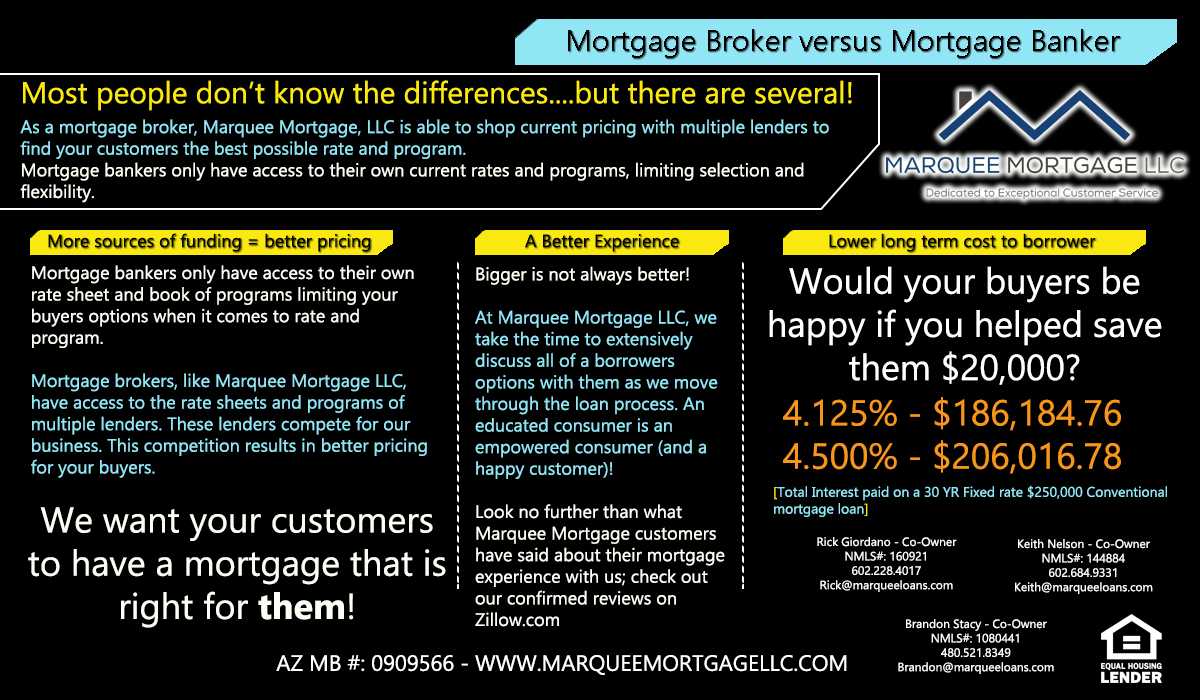

vs broker mortgage banker

What Is Underwriting And How Does It Work? Mortgage underwriting is the process of verifying and analyzing the How To Prevent Loan Rejection: Tips For Getting Approved. 3 Quicken Loans, LLC (doing business as Rocket Mortgage) and Rocket Homes Real Estate LLC are separate

underwriter qwikresume

Mortgage underwriting is a process lenders use to decide a borrower's eligibility for loan approval. Bank explains the steps, what underwriters look for and how long it takes.

Navigating the business loan underwriting process may seem overwhelming but it doesn't have to be if you understand how it works. Submitting an incomplete application for a business loan can lead to snags in underwriting to your application being denied outright.

How much time can automated underwriting save? How are lenders benefitting from Automated underwriting helps mortgage loan providers profit from cost cuts in manual Additionally, loan origination systems manages the application and issuing process for lenders of various types of loans.

Any idea on how I would learn about how to underwrite new business loans, equipment leases, and performing the collateral analysis so I can have an idea of what I'd be doing before the interview. The HR rep at the bank was not helpful at all regarding this, but just said to study up on my excel.

Understand how the underwriting process works so you can improve your approval odds. The loan processor evaluates these documents before moving you onto the underwriting step. The processor looks for any discrepancies in your documents.

Underwriting (UW) services are provided by some large financial institutions, such as banks, insurance companies and investment

How to improve your loan approval odds. Worried that the lender may turn down your commercial real estate property loan? You can increase your Knowing how to underwrite real estate can make a big difference to you as an investor. Understanding what's involved with underwriting and what

How to Underwrite a Business Loan? ().

You need to know how to underwrite commercial construction loans. This article will serve as a primer. The next ratio to look at when underwriting a commercial construction loan is the profit ratio. The profit ratio is the difference between the fair market value of the property, upon completion

Underwriting—financing or guaranteeing—is the process through which an individual or institution takes on financial risk for a fee. Underwriting helps to set fair borrowing rates for loans, establish appropriate premiums, and create a market for securities by accurately pricing investment risk.

Business loan underwriting is the step between applying for and getting a decision on your loan. Collateral provides possible sources of repayment if a business is unable to repay its debt.

Learn how to underwrite a mortgage. In order to analyze a potential borrower's loan request, a mortgage underwriter will be required to examine the borrower's credit reports and income history, which may require pay stubs and/or W-2 statements.

Preview - How to underwrite a loan from the training course.

Underwriting is a crucial aspect of the loan process: a home loan, business loan, car loan, or personal loan. This is one of the essential factors influencing loan underwriting. A credit score reflects your creditworthiness and shows how prudent you've been in managing and repaying

Underwriting is a common practice used in the commercial, insurance and investment banking industries. An underwriter works for mortgage, loan, insurance or investment companies. During the underwriting process, they do everything from evaluate your health to assess your financial status.

Underwriting is the process by which we evaluate the creditworthiness of a business to see if it qualifies for one of our loans. Curious as to how your underwriter so accurately evaluates your loan application in such a short time frame? We've pulled together bite-sized answers to some of the

What Are Underwriting Small Business Loans And How Do They Work? What Is the Loan Underwriting Process? A loan underwriting process is used by a lender to evaluate a borrower's eligibility for a loan based on an analysis of their credit, capacity, and collateral, and for what

startups startup cashflow newsflashing

upstart loans peer legit scam lender specializes providing personal

Underwriting may sound scary, but it becomes a lot less scary when you know what it all entails. Let's go through the entire underwriting process, so you can sleep better as you prepare to get that approval. What is the purpose of mortgage underwriting? To get started, let's talk about risk.

balance sheet financial finance loans nicholas remaining credit allowance carried

This document describes how to review and underwrite USDA Office of Rural Development (USDA) mortgage loan applications. In purchase transactions where the seller is a corporation, partnership, or any other business entity, the borrower must not be an owner of the business entity selling

The mortgage underwriting process lets lenders analyze your finances and evaluate whether you can afford a loan. Best LLC Services Best Registered Agent Services How To Start A Business.

Low-interest personal loans. How to calculate loan interest. Before underwriting, a loan officer or mortgage broker collects the many documents necessary for your application. Lenders also have to account for the business of making mortgages — they can't take on more risk than what

How to Get a Business Loan. Business Loans Without a Credit Check. For Bad Credit. Underwriting Process. Additional Topics. So let's talk about underwriting small business loans, what that means, how it works, and how you can better prepare your loan application for the underwriting process.

This experience has provided me with insight as to how loans are underwritten and approved. I have worked with a lot of very talented senior bankers This process is commonly known as Commercial Loan Underwriting. A business owner should understand the essential basics of this process

VA's underwriting standards are incorporated into VA regulations at 38 CFR and explained in this chapter. This chapter addresses the verifications, procedures, and analysis involved in underwriting a VA-guaranteed loan. It provides guidance on how to treat