In order for a Living Trust to work properly so that you can enjoy the protection and benefits that come along with avoiding Probate, you need to transfer property into a Trust. When planning for whether or not you should put certain assets into your Living Trust, it's usually best to consult a Trust Attorney.

When you transfer property into the trust, you no longer own it as an individual. Review the original trust document to ensure you have the authority to transfer property. Generally, with a living trust, you act as the trustee and you gave yourself this power upon the creation of the trust.

Transferring property out of a trust can be simple or nearly impossible How Revocable Trusts Work. Typically, you act as the trustee if you form a revocable trust. Qualified Personal Resident Trust (QPRT): Parents often use a QPRT to transfer a home to descendants at a low gift tax value.

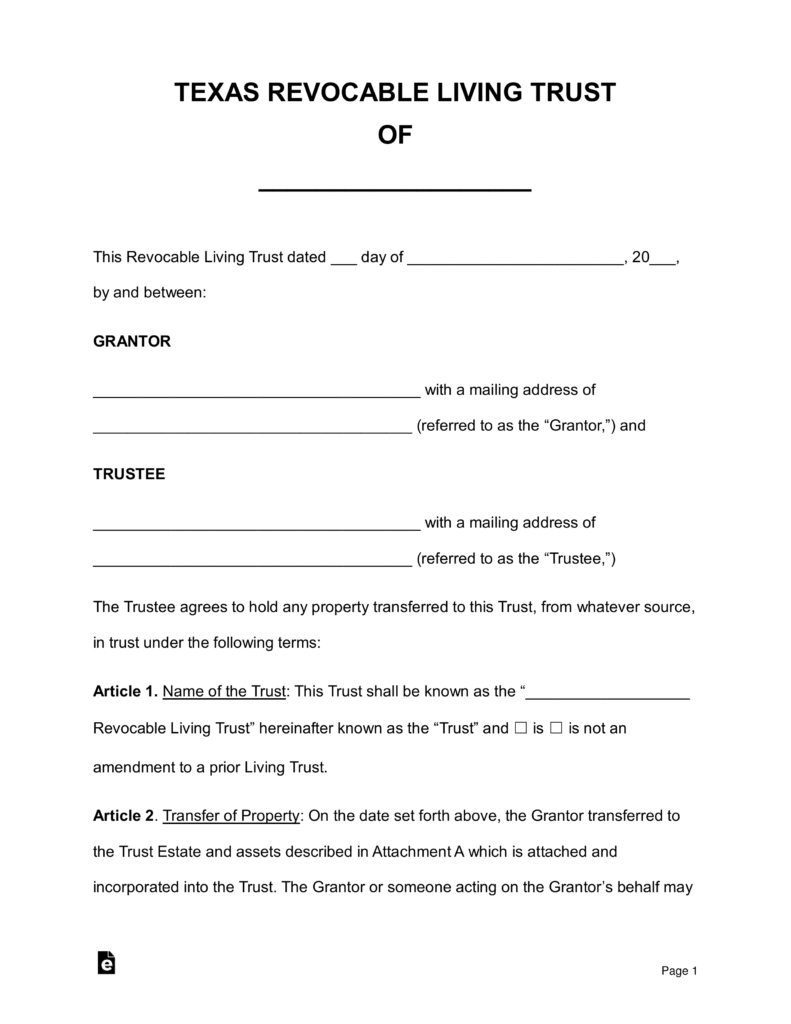

trust texas form living revocable missouri pdf word montana forms eforms odt mo fillable

Additionally, in Arizona, you can transfer real property using a transfer-on-death deed ; this can keep your home out of probate without using a living trust. It happens all the time—people create a trust and forget to formally transfer property to the trust (for example, they never get around to

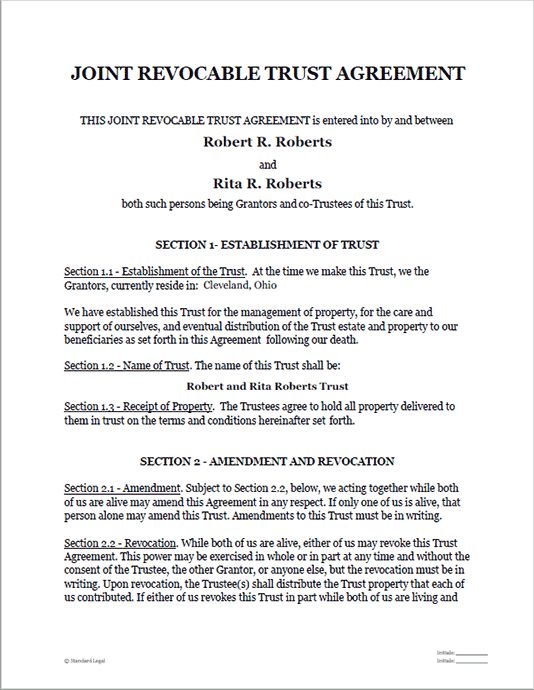

revocable attorneys

Find out how you can benefit from an Arizona living trust. Let DoNotPay create a standard living trust for you in minutes! Creating a living trust is one way to plan the transfer of your assets and property while you're still alive. There are many types of living trusts, but the most popular are

An Arizona living trust is a legal document that allows you to transfer legal ownership of assets during your lifetime into a trust, as part of your estate planning. You can continue to use and control the assets during life. After your death, the assets in the living trust are transferred to those people

How does a trust work in AZ? A living trust in Arizona is a legal document that allows a person to transfer legal ownership of the assets they accumulated How do trusts avoid taxes? They give up ownership of the property funded into it, so these assets aren't included in the estate for estate

How to Transfer Property into Trust without unnecessary cost and delay to your estate? The only way to transfer real estate is by deed or probate. If

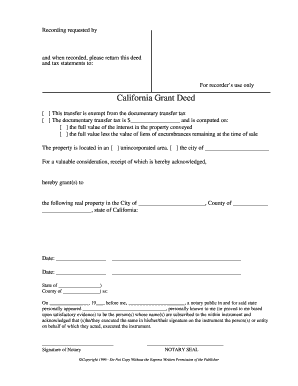

deed grant form california sample forms fillable blank printable fill 1996 pdffiller

trust revocable forms living form printable florida trusts pdf template eforms word wills receipt rental vertex spendthrift lading bill odt

How do I transfer property to a trust in California. How. Details: Trust property refers to assets that have been placed into a fiduciary relationship between a trustor and trustee for a designated beneficiary.

Divorce Community property in divorce Joint tenancy Property title report Real estate Estates Estate property Title transfers and estate planning Trusts Living trust. It is up to you to ensure that the Deed in fact meets all the legal requirements needed to transfer the property into the your trust.

If a trust holds real estate, the trustee will need to sign a new deed, transferring the property to the new owner - the trust beneficiary. Every state has rules about deeds—what language they must contain and how they must be notarized or witnessed. There are even rules about how much

Living Trusts in Arizona. You can name yourself as trustee, but you need to name a successor trustee who will manage the trust after your death. You can still sell property after you transfer it into a living trust. The first and most common approach is to sell the property directly from the trust.

How to transfer property into a trust. 3 minute read. Finally, property owners often try to combine a memorandum of trust and a conveyance into a single document. These problems can create problems with title to the real property, referred to as a cloud on title, and often result in costly

Properly transferring your real property into a living trust ensures your desires upon death are upheld. Many people fail to file the proper deeds after The trust might outline how those assets are to be liquidated and distributed. For example, a minor child who is named as a beneficiary may have

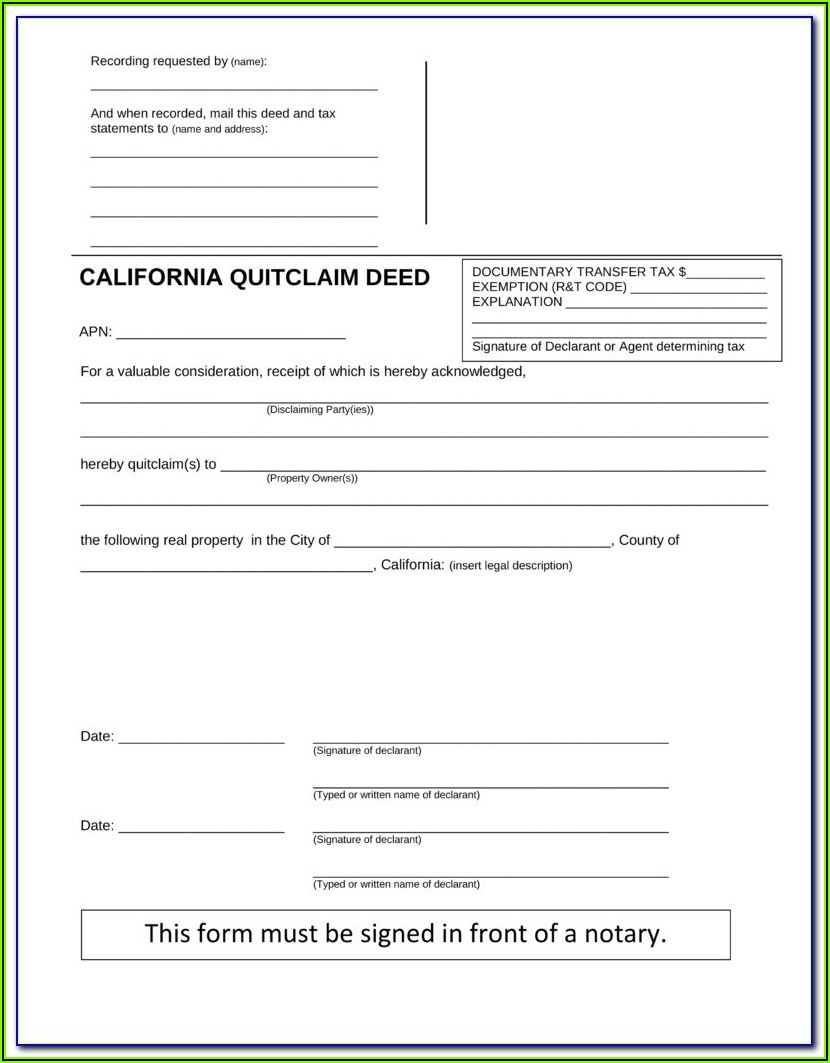

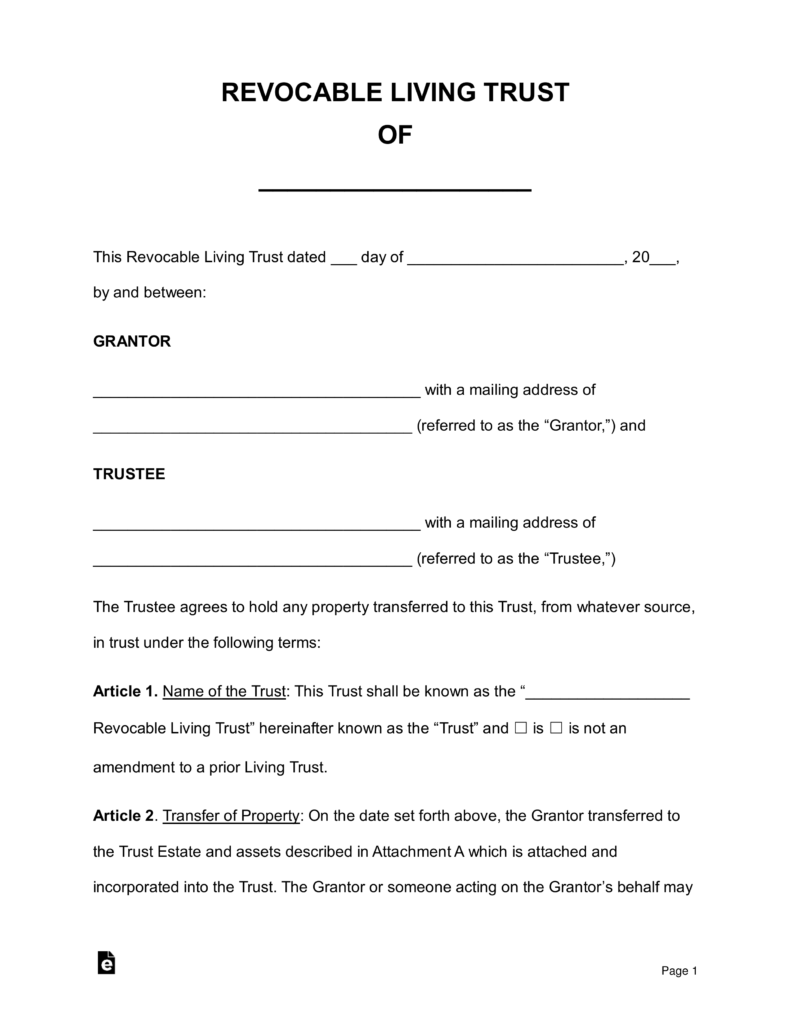

The living trust is created with the execution of Declaration of Trust by the Grantor(s). The declaration will detail the terms and conditions of the living trust, including who will serve as the Trustee. A warranty deed or quit claim deed is commonly used to transfer real property to the trust.

Transfer the property you've determined you want included into the trust. This requires some paperwork. A living trust won't have a big impact on your taxes in Arizona. Still, it's smart to have a working knowledge of the Arizona estate tax and the Arizona inheritance tax you're estate planning.

How To Fill Out Deed Trust Form Az? If you're seeking correct Arizona Warranty Deed from Individual to a Trust exemplars, US Legal Forms is what you The act of transferring a property that is owned by an individual into a trust, will see the trust liable to pay stamp duty on acquisition of the asset.

How to Transfer Arizona Real Estate Locate the Prior Deed to the Property. The Arizona quitclaim deed is a form used to transfer property from one person to another without any warranties as to whether the title is clear. Beside above, how do you transfer real estate into a living trust?

How to Transfer Financial Assets (Not Real Estate). For most people the real estate they own will be the largest financial asset they have. Making sure your real estate is correctly funded into your trust is a critical task.

In an irrevocable trust, the grantor names a trustee to oversee the assets included in the vehicle. These properties and other assets are no longer the The grantor cannot sell the property and income from the included assets would go into a trust account. Depending on how the document

Trustee - The Trustee has authorization to manage all assets as determined by the Grantor in the Trust. How to Make a Living Trust in Arizona. You can create a Trust in Arizona by downloading and completing your preferred document type (Revocable or Irrevocable).

Transfer Real Property Into A Living Trust In Arizona. Wasn't it enough just to create the trust? No, Jenna needed to learn how to transfer her real property to her living trust.

Transferring personal property into a trust requires little more than a signed statement or trust document listing the assets the grantor is transferring. However, if the personal property is titled - that is, if ownership is shown by a title - the title must be transferred through the appropriate agency

(405) 213-0856. July 3. How to Transfer Property into Trust. Cortes Law Firm Oklahoma City Estate Planning Attorney. recommended reading. I cannot over state how important it is to have a fully funded revocable living trust. A fully funded trust means that you have transferred all of your

Affordable living trusts in Arizona, click or call 480-229-6220 to establish guardians, reduce contests and avoid probate. The Trustors that create a trust will also benefit from reviewing the tasks of the successor trustees to help Successor Trustee Guide. Transferring Assets Into A Living Trust.

Arizona trust law requires trustees to fulfill certain obligations. Trustees who disregard their obligations may be required to repay the trust I recommend these guys to anyone who gets into an automobile accident, they are great! My boyfriend and I got into a 3 car pile up earlier this year

Do I need a trust in Arizona? If you are interested in setting up an estate plan that goes into effect Unlike a will that is executed after you pass, a trust allows you to transfer management of your A trust can also distribute property, specify contingencies, and outline how assets are to be used,

The Arizona Trust Code also defines circumstances when a trustee may be removed by the Court. Who may remove a trustee under Arizona law? Sometimes, circumstances warrant emergency protection of the trust property or other remedies before the Court decides whether to remove

In Arizona, if you have less than $75,000 worth of real estate and $50,000 worth of personal Another reason to do a trust is to help specify how your assets are controlled and managed if you become With respect to property not transferred into the trust, expensive probate may become

A nonprobate device to transfer residential real property to a named beneficiary upon the owner's death. Like a will, no consideration is required and the beneficiary's acceptance is not That would be a very odd thing to do because the whole purpose of Beneficiary Deeds in Arizona is to avoid probate.