Best MT4 Trade Manager EA - created from the sheer frustration of using MT4 to trade. Has partial profits, breakeven, trailing stop loss and more. ... (parabolic SAR, chandelier exit, ... But when price moves further away, this throws all our calculations off.

Exponential Moving Average (EMA) uses two Exponential Moving Averages with periods of 7 and 21. Moving Averages are some of the most popular Parabolic SAR is a trend-following indicator created by J. Welles Wilder. In our strategy, Parabolic serves an additional indicator and a guide mark

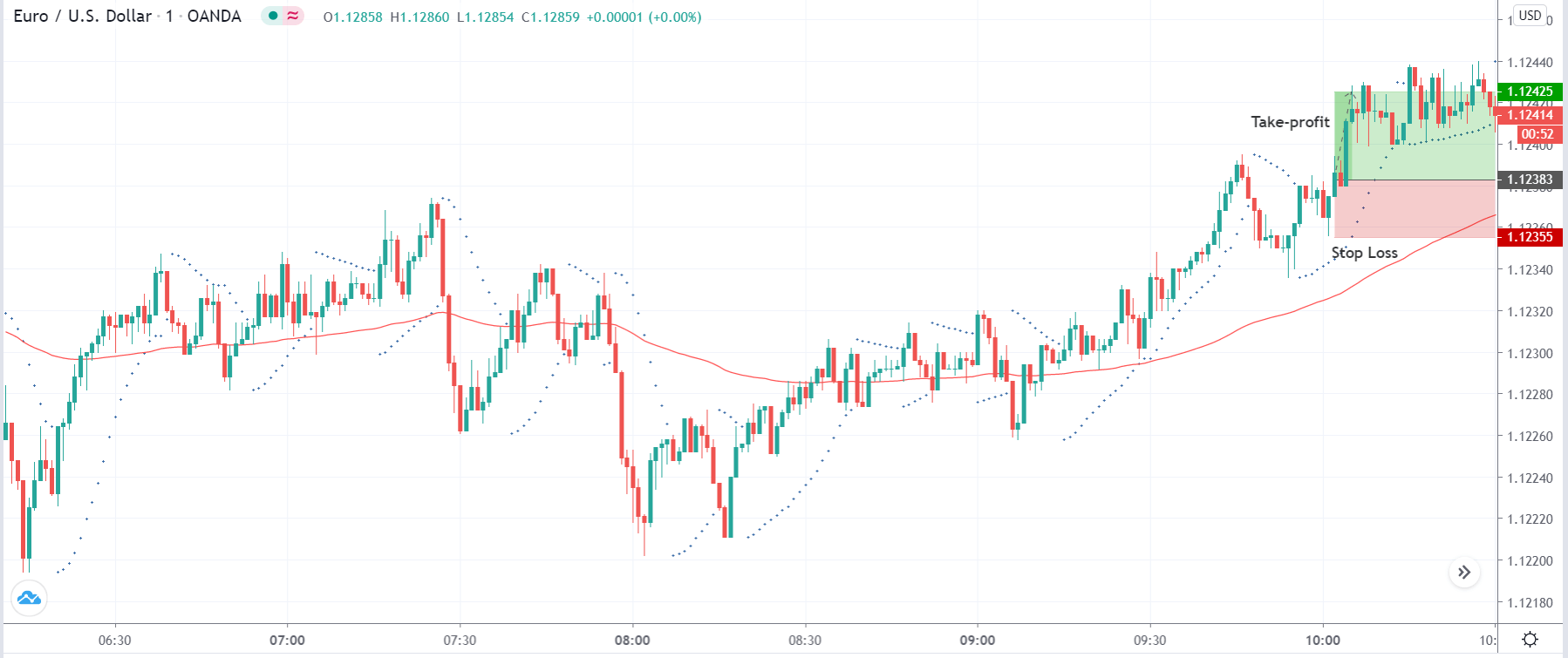

How to use the Parabolic SAR and read its signals. Set stop loss at the level of the Parabolic SAR indicator (red line). With each step we will move it to the level of a new dot. This Parabolic SAR trade strategy allows you to trade on longer timeframes from H1 to H4.

*The price is trading ABOVE both MA's (50- MA and 21 MA) as well as trend line , * LOOK too bullish when ever its trade above the both MA's as well Nothing fancy, sometimes you get beautiful charts on interesting tangible technology. I believe a third parabolic move should take the coin above $

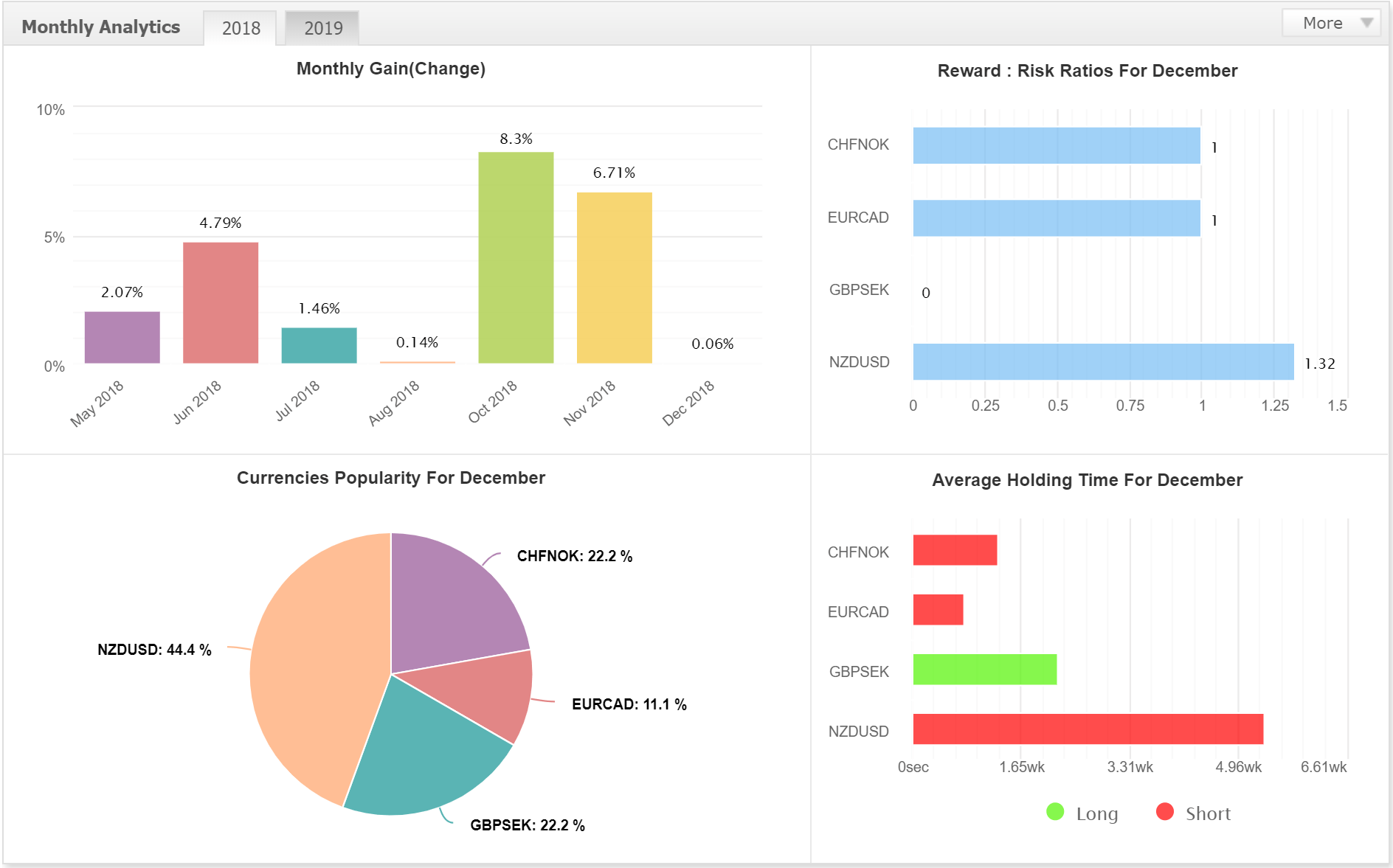

forex results did mt4

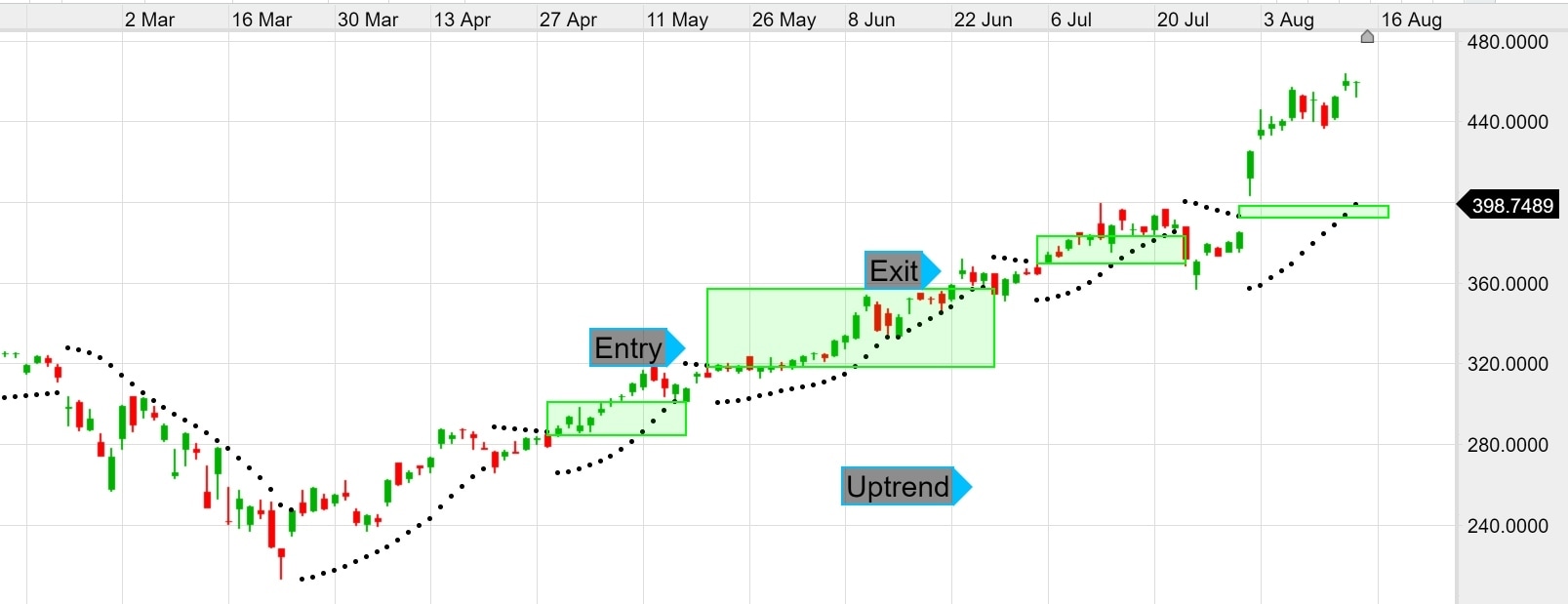

The perks of trading a parabolic move could be massive if executed properly since they provide significant profitability. A brief introduction on parabolic Investors around the world prefer to trade parabolic moves for a longer-term. Attempting to spot parabolic on short-term charts, is a

strategy fire trading rapid scalping technique reliable forex academy roundup

ichimoku kinko hyo indicator trade chart forex signals strategy babypips amazing resistance support complicated indicators sure looks

The parabolic SAR trading strategy is essentially a trend trading strategy. It is used to identify a particular trend, and it attempts to forecast Examples of trend trading technical indicators include the moving average indicator, the relative strength index (RSI) and the average directional index (ADX).

parabolic

Day Trading: Parabolic Moves. Hello Good fellas, Having had all these indicators, I have traded many parabolic moves poorly and lost money or missed the boat. I can't feel the confidence to drop big money into a trade.

Parabolic moves have become a regular occurrence in today's market, whether you are someone who looks to fade these moves or someone who wants to

Parabolic SAR (PSAR) is a technical indicator for traders to spot an uptrend of the downtrend price When to Use Parabolic SAR in Crypto Trading. The Parabolic SAR indicator has great benefits if it is Incorporating the exponential moving average (EMA) with the PSAR is one of the most

The Parabolic SAR indicator can be an incredibly useful addition to your trading. Learn all about how to trade the Forex markets with it here! How to Use the Parabolic SAR Indicator. September 01, 2021 10:00 UTC. Reading time: 9 minutes. Some of the most powerful moves in the financial

The parabolic move should be progressing with no major retraces within the movement, no deep lows or highs that go counter the whole move. With parabolic extensions, it is critical to understand how parabolers tend to behave and correct R sizing works in When to avoid trading parabolic extension.

The parabolic SAR attempts to give traders an edge by highlighting the direction an asset is moving, as well as providing entry and exit points. In this article, we'll look at the basics of this indicator and show you how you can incorporate it into your trading strategy.

Parabolic moves occur when a market moves up or down in an exponential type way, leading to what looks on a chart like the formation of a parabolic curve. These are very rare moves that typically occur from periods of rampant speculation or at the end of bubbles. They can be hard to trade too,

Parabolic SAR Calculation. How to Trade With the PSAR. Pros and Cons. The parabolic stop and reverse, or the PSAR, is a trend-following indicator used in trading. The PSAR indicator uses the most recent extreme price along with an acceleration factor AF to determine where the indicator dots

forex eurusd emini

A parabolic move is a short-term fluctuation in price. Parabolic moves will often be followed by a sharp decline in price value. When you see parabolic stocks, a key concept to understand is a stock's float. The float is number of shares of a stock that are available to trade on the open market.

The term "parabolic move" came about as trader slang. Traders seldom consider a stock's capital structure during their pre-trade analysis process. Parabolic penny stocks are generally quite easy to find with a stock screener because how few filters you need.

How do you make sure that you are on the right side of parabolic moves like $DWAC? Today, we are going to cover the top 7 lessons you need to pull away from the $DWAC run whether you traded it or just sat on the sidelines. Keeping these lessons in the back of your mind at all times will keep you

sar parabolic

This moving average and Parabolic SAR trading strategy will show you how to use the parabolic SAR indicator effectively and how you can add this trading system into your daily trading techniques. The Parabolic SAR (PSAR) is an indicator favored by technical traders that captures reversal signals.

Parabolic moves are very hard to trade since buying or selling a parabolic move is very dangerous. Jon Morgan has also uploaded a video in our live trading room, explaining how to set up his charts. He will explain how to use the oscillators in conjunction with the Gann Theory.

Check out how the Parabolic SAR worked as an exit signal in EUR/USD's daily chart below. When EUR/USD started sliding down in late April, it seemed like If you stubbornly decided to hold on to that trade thinking that EUR/USD would resume its drop, you would've probably erased all those

are then ready to study the 2nd part of the course, How to Trade Price Action. IMPORTANT: All course videos are now served from an anti-piracy hosting system to block video downloads. Until further notice, Apple’s Safari browser is not supported.

Trading Parabolic Price Moves. What happens when a stock goes parabolic? How do you trade those parabolic price moves? Always ask yourself what is causing this. Why is the market behaving like this?

Trading the trend in any market is a great trading strategy and using the Parabolic SAR to find reversal points in the direction of the Forex trend makes it even better. We are going to use the 100 period exponential moving average to show us the trend.

parabolic sar forextraininggroup

parabolic scalping sar fibonacci parameters

How To Calculate Parabolic SAR. (If this section causes giddiness, feel free to skip to the trading strategies below. #3: Parabolic SAR with Moving Average. Find the Directional Movement System too complicated? You might want to opt for a more straightforward trading tool to determine

Parabolic movers in the financial market refer to a situation where a stock moves sharply higher than how it moves on average. For example, if a stock trades within a range of between $10 and $12, a parabolic move will be a situation where it moves sharply to $30 in a single day.

Parabolic moves are impossible to predict… First of all, as I don't play the game of prediction, I rule out the possibility of actually systematically identifying these opportunities in advance and participating in the parabolic move before it becomes obvious.

Parabolic Reversals give traders an edge. It isn't an easy edge, but with practice, it can be a profitable edge. Here we see the three parabolic candles, followed by another exhaustive move higher. How To Practice Parabolic Reversals. Deliberate practice is the key to success in day trading.

Parabolic SAR is used mostly as an exit indicator. Close buy position when price moves below the Parabolic SAR and close sell position when price moves Thus, we have seen how to calculate Parabolic SAR as well as its application in trading. We have also understood the advantages

How a Parabolic Curve does looks like? The Parabolic curve pattern is a curved trend line likened to an arc Stock moves parabolic at the end of high uptrends. This pattern surfaces when panic buying comes in and Cradle Candlestick Pattern: Definition & How to Trade it. What is the Cradle Pattern?

Find out what is parabolic SAR and how to use it in trading. Parabolic SAR is a form of technical analysis that can be implemented for a comprehensive trading strategy, when analysing how to trade financial assets, such as indices, shares, commodities and currencies.

parabolic curve pattern forex trading app

Parabolic SAR is one of the best tools to catch the trend and accompanied by the Moving Averages the profitable trend doesn't have any chance to be missed! We show only one way to trade, however, nothing should stop the curious minds to try different settings and check how it can influence the

Parabolic moves occur when a market moves up or down in an exponential type way, leading to what looks on a chart like the formation of a parabolic curve. These are very rare moves that typically occur from periods of rampant speculation or at the end of bubbles. They can be hard to trade too,