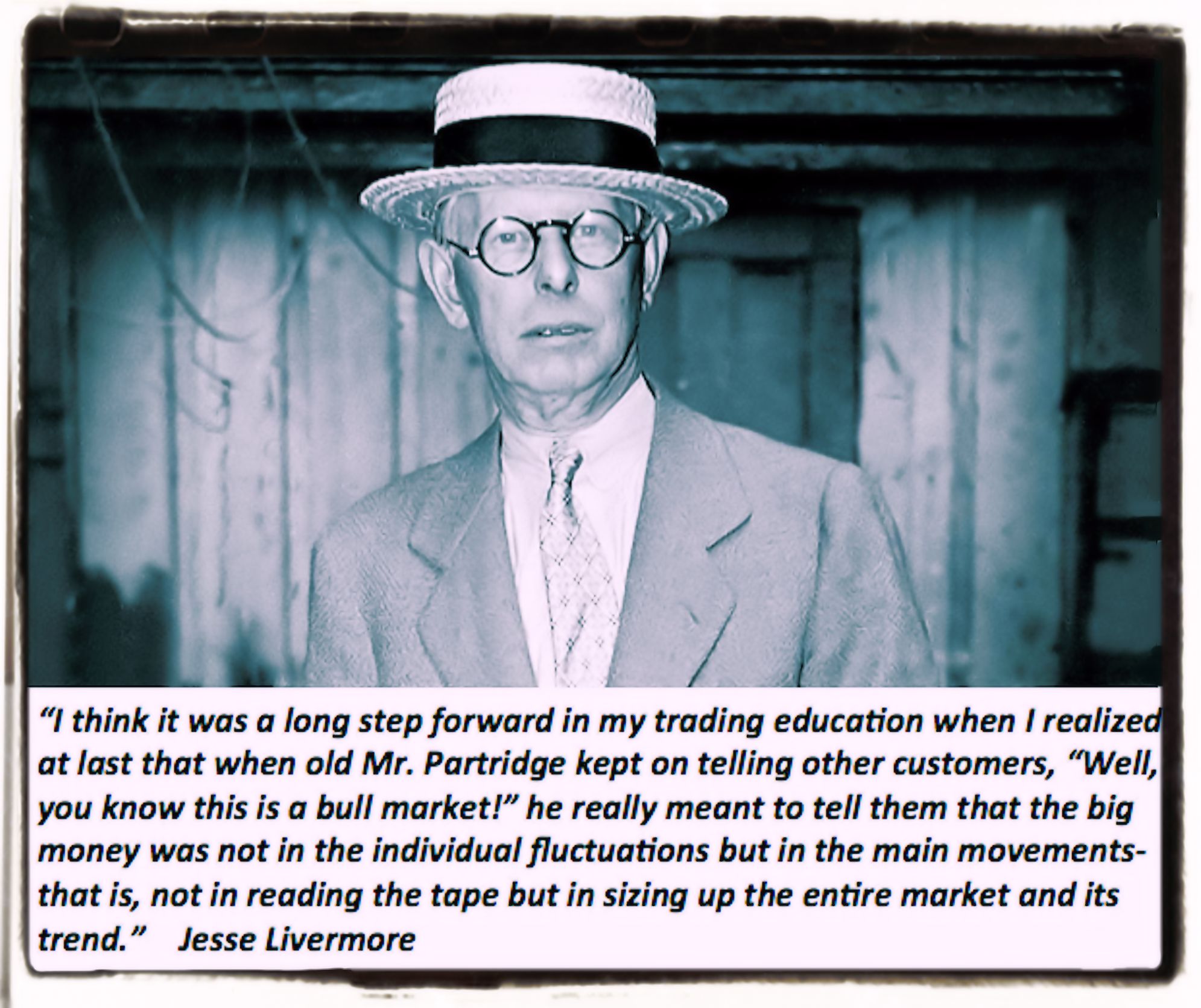

31, 2021 · Livermore, who is the author of How to Trade in Stocks (1940), was one of the greatest traders of all time. At his peak in 1929, Jesse Livermore was worth $100 million, which in today's dollars ...

ЛитМир - Электронная Библиотека > Livermore Jesse > How To Trade in Stocks > Стр.1. I. Вызов биржевой игры. II. When does a stock act right?

livermore jesse trade stocks pdf preface pattern

Jesse Livermore tells how he did to be one of the greatest traders of all time, stock market legend Jesse Livermore made and lost vast fortunes and lived a life Written by Livermore in 1940, the last year of his life, "How to Trade in Stocks distills the wisdom of his 40 years as a trader.

livermore jesse trading wisdom strategy english lessons culture

livermore jesse chart speculative trade lauriston stocks 1929 debt lows highs

So when Jesse Livermore, with characteristic frankness, draws back the curtain and reveals pub-licly his rules for cornbining time element and prices he takes the How to trade in stocks. It is difficult to exercise patience with such peo-ple. In the first place, the inquiry is not a compli-mcnt to

livermore jesse bucket quotes would market trade bear boys hand shops write inside

While Livermore never (to my knowledge) wrote about the specifics of his trading system/s, the 2 books "Reminiscences of a Stock Operator" - which you've already referenced - and "Jesse Livermore: World's Greatest Stock Operator" go into quite a

trade stocks jesse livermore market trading pdf richard smitten relative volume plunger boy secrets pipbear coa bi money markets ebookdownloadfree

Jesse Livermore' s. Methods of. Trading in Stocks. Richard D. Wyckoff. All rights reserved ... Reminiscences of a Stock Operator is the fictionalized biography of Jesse Livermore, one ...

21 Trading Lessons From Jesse Livermore. 1. Nothing new ever occurs in the business of speculating or investing in securities and commodities. 20. Do not become completely bearish or bullish on the whole market because one stock in some particular group has plainly reversed its course from

Jesse Livermore was the most successful stock trader who ever lived. How to trade in stocks offers market participants an insight look at his trading system.

Jesse Livermore wrote one book: How to Trade in Stocks: The Livermore Formula for Combining Time, Element and Price. It was published in 1940. The book is very rare and not easily found. Some excerpts from the original version are below

Jesse Livermore How To Trade In Stocks (1940 original) EN.

Jesse Livermore was a loner, an individualist-and the most successful stock trader who ever lived. Written shortly before his death in 1940, How to Trade Stocks offered traders their first account of that famously tight-lipped operator's trading system. Written in Livermore's inimitable, no-nonsense

This is a book written by Jesse Livermore which was published in 1940, with new material added by Richard Smitten. The full title of the book is "How to The full title of the book is "How to Trade in Stocks: The Classic Formula for Understanding Timing, Money Management, and Emotional Control".

' 25, 2019 · Jesse Livermore's How To Trade In Stocks|Jesse Livermore, The Jack Readers - Book 5|Thos. Cartwright, Firestone Rings: The Two Moons Of Rehnor, Book 4|J. Naomi Ay, A History Of Taxation And Taxes In England To 1885 (Volume 4)|Stephen Dowell

Sự nghiệp của Jesse Livermore như một khúc chói sáng trong lịch sử đầu cơ. Ông luôn là tâm điểm chú ý giống như một tâm điểm trên thị trường ngay từ khi còn trẻ, nổi tiếng với biệt danh "cậu bé đầu cơ". Livermore thật sự là một nhà đầu cơ, có những lúc khối lượng trong giao dịch của Ông làm đá

Jesse L. livermore. Duell, sloan & pearce new york. J. murkey. LiBRARY. copyright, 1940, by JESSE L. LIVERMORE. All vights reserved, including the right to reproduce this book or portions thereof in any form. first edition.

When you trade stocks using the Livermore method, you only go long during a bull market and short during a bear market. Step 2 - Prepare to Open Livermore traded the two hottest stocks from each selected sector that he wanted to be in. Again, a simple technical method of seeing which stocks

Lauriston Livermore (July 26, 1877 – November 28, 1940) was an American stock trader. He is considered a pioneer of day trading and was the basis for the main character of Reminiscences of a Stock Operator, a best-selling book by Edwin Lefè one time, Livermore was one of the richest people in the world; however, at the time of his suicide, he had liabilities …

The Success Secrets of a Stock Market Legend Jesse Livermore was a loner, an individualist-and the most successful stock trader who ever lived. Written shortly before his death in 1940, How to Trade Stocks offered traders their first account of that famously tight-lipped operator's trading system.

livermore

JESSE LIVERMORE was known as the Boy Plunger and also the Great Bear of Wall Street. He was known for having made and lost a few times In this article, I am going to share with you the most important lessons I have learned after reading Jesse Livermore's book- How to Trade in Stocks.

Livermore, who is the author of How to Trade in Stocks (1940), was one of the greatest traders of all time. At his peak in 1929, Jesse Livermore was worth $100 Livermore liked trading in stocks that were moving in a trend, and he avoided ranging markets. When prices approached a pivotal point,

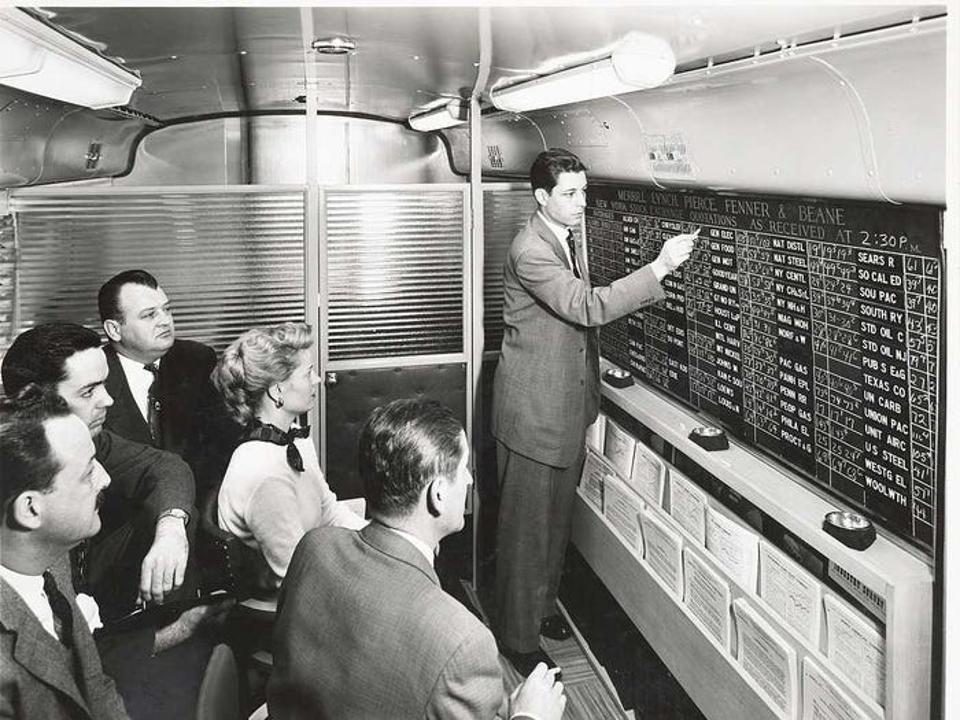

News Learn how global markets work, how they are interrelated, and how individual companies and sectors can influence their movements.

traded DNA Sequencing companies. Find the best DNA Sequencing Stocks to buy.

Jesse Livermore is a stock market legend who made and lost four stock market fortunes in 40 years. His other books include How to Trade Like Jesse Livermore and a number of novels.

The Success Secrets of a Stock Market Legend Jesse Livermore was a loner, an individualist-and the most successful stock trader who ever lived. Written shortly before his death in 1940, How to Trade Stocks offered traders their first account of that famously tight-lipped operator's trading system.

livermore

JESSE LIVERMORE was known as the Boy Plunger and also the Great Bear of Wall Street. He was known for having made and lost a few times In this article, I am going to share with you the most important lessons I have learned after reading Jesse Livermore's book-How to Trade in Stocks.

The career of Jesse L. Livermore is a bright patch in the pattern of speculation. He has been in the public eye as a stock-market factor almost continuously since as a youth he flashed like a comet across the speculative skies and became known as the millionaire Boy Plunger.

with the Trend "Successful traders always follow the line of least resistance. Follow the trend. The trend is your friend." -- Jesse Livermore. The bot uses consistent, objective criteria to …

Jesse Livermore, whose life spanned the 19th and 20th centuries, didn't get a master's degree in macroeconomics or a in cognitive behavior. 28, 1940. But his book "How to Trade in Stocks" remains a gem. As the following quotes from the first chapter "The Challenge of Speculation,"

Jesse Livermore was a loner, an individualist - and the most successful stock trader who ever lived. Written shortly before his death in 1940, How to Trade Stocks offered traders their first account of that famously tight-lipped operator's trading system. Written in Livermore's inimitable, no-nonsense

livermore jesse quotes famous trader trading english carl

How to Trade Stocks offered traders their first account of that famously tight-lipped operator's trading system. Written in Livermore's inimitable, no-nonsense style, it interweaves fascinating autobiographical and historical details with step-by-step guidance on