Wells Fargo recommends that businesses switching accounts "allow time for outstanding checks, debit card purchases and automatic payments to clear," which can take about 10 business days. Dig Deeper: How to Choose an Accountant for Your Business. Switching Banks: A Final Thought.

A separate business bank account keeps your accounts and finances organized. So it's easy to pull If you close your account early for any reason, such as closing your business or switching You should open a business bank account as soon as you start making sales in your business

Business Bank Accounts. Switch to Ulster Bank. Your new account will be set up and regular payments, like your salary will be moved across. We will also advise you how to set up your bill payments.

Switching bank accounts doesn't have to be as complicated as some banks make it. These three steps will help you switch without the hassle. You may also have to go to the bank in person to pick up the check. Give the money one to two business days to transfer. A wire transfer's faster, but

Compare Business Bank Accounts & Loans. What Are You Looking For? Many mainstream UK banks offer a free period for new businesses and switching customers, ranging from 6 to 30 months. How to open a free business bank account. Most free accounts can be opened online.

interest ireland bank words mortgages money conversation which tracker

How to switch your account to another bank. You should review your needs and preferences from time to time. Your new bank must have your new account up and running within 10 working days of the switching date - this is the date agreed between you and your new bank for the process to start.

See how to link your bank account to another account. Make it easy to move money, make payments, and receive funds electronically—often for free. After you provide your bank information, your financial institution needs to verify that you truly own the account. They'll make several "trial deposits"...

The current account switch guarantee service makes switching to a new bank account simpler and faster than ever. Our guide explains how to switch How does the current account switch service work? Open a new account. There is a broad range of UK banks and building societies to

treasury fargo

Compare business bank accounts to switch to How easy is it to change? ...banks offering business accounts are signed up to the Current Account Switch

Signs You Need to Switch Business Bank Accounts. The type of bank account you maintain and where you bank can have a great impact on your business. Another good reason to switch to a different bank is if you are unsatisfied with your current bank's customer service.

How the Current Account Switch Service works. Find out about the stress-free way to switch Current Accounts. Will the Current Account Switch Service automatically transfer new payment arrangements if I set them up at my old bank within 7 working days of the switch date agreed with

Our guide highlights how to switch business bank accounts for small business owners. When you are unhappy if your current provider you might want to look elsewhere. Many small business owners are reluctant to move banking providers, even if they can get a better deal elsewhere.

Your community banker will guide you through the process. Most community banks offer a switch kit that includes a checklist and step-by-step process to help make the transition easier. Community bankers will also advise you on how best to transition your accounts from your current provider.

construction safety renovation practices tools reality manager skills successful australia hat hazards bites truth tips kitome

Switcher Bank Accounts. Switching your business account is the best way to avoid paying excessive monthly fees, gain a better level of support or take advantage of additional customer benefits. If you've already had a business account for some

Start the bank account switch Once your application has been accepted and your current account has opened, you''ll receive a confirmation email. Switching business bank accounts can be beneficial for: Saving money with lower fees and taking advantage of introductory offers.

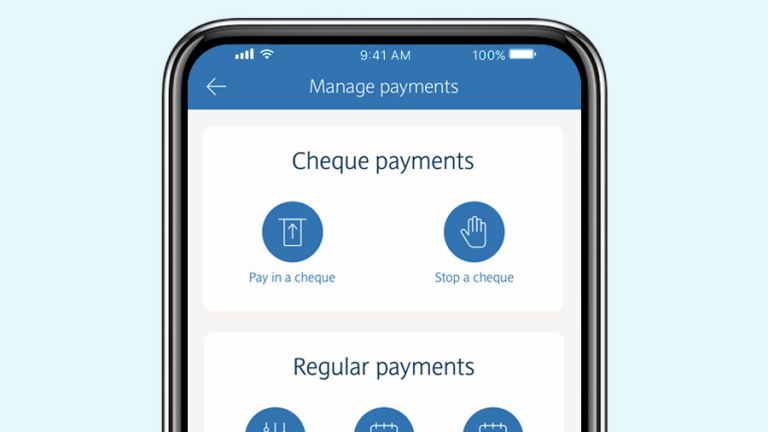

Our business bank account comes with no monthly fees or UK payment charges so you could save money on Here's how to In the app, tap the menu icon to bring up the account menu. The business account you're switching from will be closed on your behalf and your balance,

Some bank accounts don't charge an international transaction fee at all, and other will waive this fee if you meet certain deposit conditions. As Revolut announces it's open for business in Australia, we look at how it compares to the likes of Up bank, TransferWise and 86 400.

Business: ANZ Business Bank accounts, Business Visa Debit cards or ANZ Business Credit Cards. 2. Ensure sufficient funds available. Need help switching? If you're a personal customer with a bank account, follow these steps and we can help switch over your regular payments

How to Close Certain Types of Bank Accounts. Not all account closures are handled the same. Other scenarios may pop up that require extra steps to close a Opening a joint account. Consolidating your banking. Switching from a child account to an adult account. Whatever your reason (or reasons)

Business banking: Choosing a business bank account, what to look for and how to switch. A bank account is a vital tool in running a business and choosing the right one can not only mean lower charges but also remove a great deal of hassle from your day-to-day administration tasks and

Login to add to your reading list. Switching business bank accounts might seem like a huge headache but if you're not completely satisfied with yours and feel that you can get a better deal or service elsewhere then you shouldn't feel tied to it.

How we've helped others switch their business bank account. Finding the right bank account is an essential part of your business. Account providers will be trying to entice you to switch providers to them so they might offer extra benefits, such as free business banking for periods up to 26 months.

Accounts will be switched in phases and you'll receive a notice when those changes are scheduled to occur. If you'd like to switch another account of Please call our 24/7 Business Banking Service team on 13 19 98, or visit us in a Branch, if you wish to discuss this further. Do I need to maintain

barclays cheque pay app mobile bank banking step paying screen using

Do you look after the finances for a business and are you thinking about switching banks? The Current Account Switch Guarantee makes the process smooth

advance hsbc bank account accounts current switch debit card credit cards open visa stay

deposit machine cash rural bank atms soon solar atm standard any micro areas powered via machines shutterstock india roof tops

hurricane preparedness ready icon credit union navy ccu strikes think act valley

Switch business bank account with NatWest Business online today. It's easy to apply online and our Current Account Switch Service makes switching your bank account simple, reliable and stress-free.

How to Keep Your Business and Personal Bank Accounts Separate. Andi Smiles Small business financial consultant. Business loan payments. Transferring money to business savings accounts. Paying yourself every two weeks or every month.

The Current Account Switch Service will contact your old bank and they confirm if the switch can go ahead. We will also advise you how to set up your bill payments. Participating providers of UK business bank accounts have agreed to a basic set of information that they will need from you to

Switching business bank accounts can be tempting, especially if you've just reached the end of free banking offer. Changing to another bank can allow you to take advantage of another sign up offer, enabling you to save money. But how often can you switch bank accounts as a business and

Switch to us for a simple business account and access to our bespoke products and services designed to help your business succeed. Eligible deposits with Lloyds Bank plc are protected up to a total of £85,000. Due to FSCS eligibility criteria not all business customers will be covered.

Your guide to switching business bank accounts, including things to consider before switching and what to look for in a new bank. If you're determined to switch your business bank account, it's important to choose the right provider. Every business is different, so there's no