Wage garnishment can be challenging to deal with, but there are a number of ways to work with the IRS to stop it. Many or all of the companies featured provide compensation to LendEDU. These commissions are how we maintain our free service for consumers.

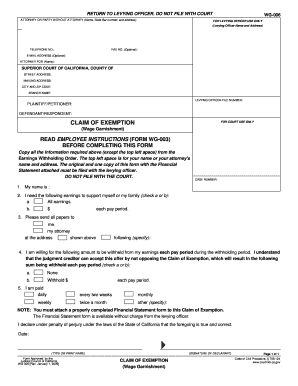

garnishment wage exemption wg claim exemptions exempt pdffiller wg006 wages

How Long Does Wage Garnishment Last? Wage garnishment continues until the loan is paid although you might be able to negotiate an earlier end to your wage garnishment in your hearing.

Statute of Limitations on Debt Collection. Statute of limitations assign a certain time after which suit may no longer be filed and a collector may no longer collect a …

How can consumers stop wage garnishments and keep more or all of their paycheck? How could debtors get around this inconvenient alternative? This is why it is so important for the consumer to try their best to work with the creditor diligently to stop wage garnishments, in order to avoid this

How do I stop wage garnishments? You will need to call the company that is doing the wage garnishments, and they can give you the information that is need to start the How to stop student loan wage garnishments? Prove undue hardship or make 9-12 voluntary ADDITIONAL payments.

Unfortunately, getting a wage garnishment for tax debt is more common than you might think. In 2020, the IRS requested over 780,000 notices of levy on. This guide will explain what a wage garnishment is, how it works, how to stop it, and what you should do if you receive a notice of garnishment

16, 2021 · However, PRA Group could sue you and try to garnish your wages, but this would happen in civil court. A wage garnishment would require a default judgment against you followed by a judge’s order to garnish wages. Call you at work: They also can’t make phone calls to your friends, family members, or employers about your debt.

garnishment wage stop

How to protect yourself from wage garnishment. If your wages are currently being garnished, a creditor has filed a lawsuit against you, or you're worried A bankruptcy does cause an automatic stay order which will stop the wage garnishment against you until either your debts are discharged,

2 How Wage Garnishment Affects You. 3 Who Can Garnish Your Wages? 4 Wage Versus Non-Wage Garnishment. Financial Hardship and Child Support Wage Garnishment. There are some circumstances where you can stop child support payments.

Wage Garnishment. How Can I Stop My Wages From Being Garnished? (3) Stop Wage Garnishment With Bankruptcy. Exception: Domestic Support Obligations. Let's Summarize… Having your wages garnished can be overwhelming and scary.

bankruptcy

This video is for anyone wanting to know how to stop wage channel and/or any subscriptions DOES NOT create an attorney-client relationship.

A wage garnishment can create a big headache when it comes to paying bills and living expenses. If paying for basic expenses seems impossible due to a garnishment, you can take measures to get it reduced. Some wages cannot be garnished at all, but you may have to be proactive to protect them.

Learn how to comply with wage garnishment orders using Online Payroll. A garnishment is the result of a legal proceeding that requires an employer to withhold wages from an employee's pay and remit the money to an agency or creditor.

bankruptcy law services phone number

How to Stop Wage Garnishment. Where You Need a Lawyer: Zip Code or City In a wage garnishment, a court orders a defendant's employer to take a portion from their employee's paycheck and to send that garnishment to the court or to an intermediary agency that processes debt payments.

How to Stop Wage Garnishment in California Examples of Wage Garnishment Contact OakTree Law. *Consider an IRS Offer in Compromise to dispute, pay down or 'wipe-out' tax debt*. How to Stop Wage Garnishments. Your first line of defense is to get educated on wage

In another article about wage garnishments, we talked about who can garnishee your wages in Canada. Compared to other creditors, the Canada Revenue Agency has the most extensive powers of debt collection. One of their collection tools for unpaid taxes is a wage garnishment. Table of Contents.

A wage garnishment is typically an order that gives a creditor the right to receive a portion of your wages each pay period to repay a debt. The wage garnishment continues until the debt is payable in full. Once the debt is paid, the creditor should notify the employer to stop deductions for the debt.

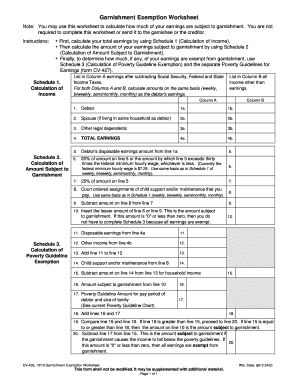

exemption garnishment worksheets form fillable blank pdffiller garnishee printable

garnishment wage jaafar illinois

How can you stop wage garnishment? Creditors will send you one last warning letter before they start garnishing you wages. As a last resort, you can file for chapter 7 bankruptcy to stop wage garnishment. Chapter 7 bankruptcy allows people to eliminate most debts and get a fresh

A wage garnishment is any legal or equitable procedure where some portion of a person's earnings is withheld by an employer for the payment of a The maximum amount of wages garnished varies depending on the garnishment, but they range from 15 percent of disposable earnings for

How Is Wage Garnishment Calculated? Exactly how much money can be garnished from your paycheck? Title III of the Consumer Credit Protection Act specifies The legal resources website Nolo states: "Wage garnishments are usually continuous, being withdrawn from each paycheck until paid."

Even if a person stops creditors from garnishing wages, the debts do not disappear. If you are facing wage garnishment and do not know how to get out from underneath your debts, speak with an experienced Wisconsin debt relief attorney who can let you know your options.

Wisconsin Wage Garnishment for Spouse's Debt | Wisconsin is a community property state. Generally, a spouse has liability for the other spouse's debts, Can my husband's wages be garnished for my debt? I live in Wisconsin. I think a garnishment of my wages may happen.

Limits on Wage Garnishment in Wisconsin. Under Wisconsin law, most creditors can garnish To find more information about wage garnishment limits in Wisconsin, go to the Wisconsin A creditor can continue to garnish your wages until the debt is paid off, or you take some measure to stop

If you are faced with a wage garnishment, bankruptcy is not your only option to stop it. There are a number of things you can do that might prevent a creditor from garnishing your wages. You should file any objections you have to the garnishment, in writing, with the court and and request a hearing.

Need Help Stopping a Wage Garnishment? If you need help filing the necessary legal documents to stop a wage garnishment, consider utilizing the services available through SoloSuit.

Isolating a method to stop wage garnishment ordered by a court in the State of Wisconsin begins with reviewing the genesis of the underlying debt. Filing a personal bankruptcy under Chapter 7 or Chapter 13 may work to stop the garnishment of wages depending on the type of debt at issue.

How To Stop Garnishment for Student Loans. Review Your Notice of Intent. Plead Your Case. Student loan lenders can garnish your wages to force repayment of loans in default. If you're facing wage garnishment, you should respond to your notification from lenders and seek a

You might be able to stop the wage garnishment, though, if you can't afford the garnishment or you believe it was made in error. If you believe you have grounds to challenge the garnishment, the paperwork you received notifying you of the judgment will have information about how to proceed.

How to Stop Wage Garnishment. No matter what kind of debt you have; mortgage debt, car payments, credit card debt, student loans or any other type of payment obligation, it's never something you look forward to paying every month. But unfortunately, if you fail to pay your debt, you just

You can stop wage garnishment before it starts. But after garnishment begins, it's much more difficult to recover. Follow these steps to get your loan payments Still, you may be able to request a stop to wage garnishment, such as if you are making minimum wage and you have no extra money to spare.

Read an overview of wage garnishments and other garnishees, their rules in British Columbia, and how to stop a wage garnishment. An Overview of Wage Garnishment in BC. Wage garnishments or seizures are an extreme collection method that creditors may use to recover

With a wage garnishment, your employer will withhold a certain amount of money each pay period until the debt is satisfied. You can try to meet with an attorney to answer any questions you might have about wage garnishment and how to stop it.