2 How Wage Garnishment Affects You. 3 Who Can Garnish Your Wages? 4 Wage Versus Non-Wage Garnishment. A wage garnishment is when a creditor collects debt payment from your paycheck. When the creditor has attempted to contact you to no avail, garnishment is their last ditch effort

Learn how to stop wage garnishment and keep your paycheck protected from creditors. Don't worry you have options to protect yourself. How To Stop a Wage Garnishment Before It Starts. Exception: Student Loan Debt And Tax Debt. (1) Negotiate a Payment Plan With Your Creditor.

There are several ways to stop wage garnishment. In Oklahoma, the statute of limitations for a creditor to file an action to recover the debt is five years for a written contract, five years for a domestic judgment and three years for a foreign judgment. Therefore, if a creditor files an action against

Benefit Payments Garnishment Requirements Webinar. This webinar provides participants with the federal rules that are applicable when processing garnishments on accounts receiving federal benefit payments. Enroll Now: Live on: 02/16/2022. Via CD, On-Demand.

24, 2021 · Many arguments stop there and the IRS denies them because they are incomplete. Adding the credentials and experience of the tax professional, your lack of tax knowledge, the information provided to the accountant, and how you reviewed the return and concluded that it was filed correctly will provide necessary facts for a more favorable ...

How to Stop Wage Garnishment. No matter what kind of debt you have; mortgage debt, car payments, credit card debt, student loans or any other type of payment obligation, it's never something you look forward to paying every month. But unfortunately, if you fail to pay your debt, you just

29, 2021 · Judgment creditors can use wage garnishment to receive a portion of your earnings each paycheck. Exemptions limit the amount the creditor can take. Some states like Florida, Idaho, Oklahoma, Maryland, Ohio, and Utah follow federal wage garnishment limits to determine what is considered exempt income. Other states offer similar exemptions to ...

You can stop wage garnishment before it starts. But after garnishment begins, it's much more difficult to recover. Follow these steps to get your loan payments Still, you may be able to request a stop to wage garnishment, such as if you are making minimum wage and you have no extra money to spare.

bankruptcy

Wage garnishment is a procedure by which your employer withholds a portion of your earnings to pay some debt or obligation. Wages can be garnished to pay child support, alimony, back taxes, or a judgment in a lawsuit.

Bureau Wisconsin Department of Revenue PO Box 8901 Madison, WI 53708-8901

How to Battle Wage Garnishment. What are your options to get your finances back on track? Wage garnishment could leave you and your finances reeling. If you are behind in debt repayments, even if through no fault of your own, your creditor could use a garnishment of your wages to ensure the

Procedure to Stop Wage Garnishments in Florida: When a creditor seeks a garnishment, the clerk of the court must send notice to the debtor regarding the Using Bankruptcy to Stop Garnishment: Immediately after a Chapter 7 or Chapter 13 bankruptcy case is filed an automatic stay will be enacted.

Oklahoma wage garnishment laws limit the amount that a creditor can garnish (take) from your paycheck for repayment of debts. Some states set a lower percentage limit for how much of your wages are subject to garnishment. In Oklahoma, wage garnishment laws protect the same

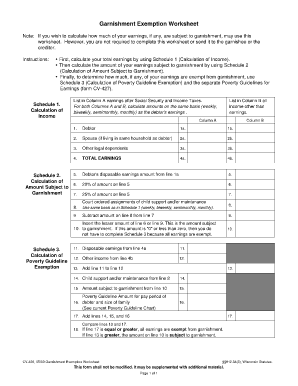

form garnishment worksheet oklahoma exemption wi blank fillable printable pdffiller fill

How Can Bankruptcy Stop a Wage Garnishment? It's has an automatic stay. The stay allows a debtor to obtain instant relief from the garnishment. Should I Talk To a Lawyer About My Wage Garnishment? Yes. If your wages were garnished by a creditor and you live in Oklahoma, contact

Tax attorney Travis Watkins explains how to stop the IRS from garnishing your wages. He also explains the importance of getting your returns filed

Learn how to arrange a wage wage garnishment is a court order for an employer Setting up a wage garnishment. SOLVED•by QuickBooks•Intuit Online Payroll•. The garnishment will automatically stop when the employee's total amount garnished reaches this amount.

Wage garnishment is a legal procedure in which a portion of a debtor's earnings are withheld by his or her employer to repay creditors. Garnishment is a fairly severe consequence and is usually used only when an employee is seriously behind on his or her debts. Debts that may be repaid through

I stop it, once it has started? Ordinarily, wage garnishment continues until all of the obligations of the debt are paid in full. However, in some circumstances, you may be able to have your garnishment released, or at the very least, reduced. For more information on how to stop wage garnishment, contact the attorneys at McCarthy Law today.

How to Stop Wage Garnishment in California Examples of Wage Garnishment Contact OakTree Law. Types of Wage Garnishments. Credit Card Debt - No one really plans to go into credit card debt, but it seems to be a pretty common pitfall for most Americans.

A wage garnishment is typically an order that gives a creditor the right to receive a portion of your wages each pay period to repay a debt. The wage garnishment continues until the debt is payable in full. Once the debt is paid, the creditor should notify the employer to stop deductions for the debt.

How to Stop Wage Garnishment? Garnishment Laws Blog. Types of Garnishments in Oklahoma. Garnishments take place at the state and local level, even where a federal The state of Oklahoma recognizes two basic types of garnishments, each with its own personality so to

The Garnishment Process. Income Sources. How to Stop a Wage Garnishment. Grounds for Challenging a Garnishment. A parent's wages are usually only garnished for child support when they're severely in arrears—they haven't made full payments in several months.

You might be able to stop the wage garnishment, though, if you can't afford the garnishment or you believe it was made in error. If you believe you have grounds to challenge the garnishment, the paperwork you received notifying you of the judgment will have information about how to proceed.

, Wage Assignments, and Garnishment.—Regulation of banks and banking has always been considered well within the police power of states, and the Fourteenth Amendment did not eliminate this regulatory authority. 243 A variety of regulations have been upheld over the years.

How can you stop wage garnishment? Creditors will send you one last warning letter before they start garnishing you wages. As a last resort, you can file for chapter 7 bankruptcy to stop wage garnishment. Chapter 7 bankruptcy allows people to eliminate most debts and get a fresh

Wage Garnishment defined and explained with examples. Wage Garnishment: A court order that a portion of a person's wages be seized to satisfy a debt. Wage garnishment is a process in which an individual's employer deducts money from his wages as a result of a court order.

02, 2015 · This purpose of this guide is to provide non-custodial parents with a true understanding of what it means to be taken off child support.

How much money can be garnished? The maximum amount of wages garnished varies depending on the garnishment, but they range from 15 percent of disposable earnings for student loans to as much as 65 percent of disposable earnings for child support (if the employee is at least 12 weeks in arrears).

watkins travis irs harold wesley lawyer saves taxpayer offer testimonial curtis compromise satisfied offices client law

, it happens only if an income-withholding order and a wage garnishment won't work. Courts recognize that a jailed parent cannot earn money to make child support payments. For information on other methods of collecting child support, including wage withholding orders, liens, posting bonds, and more, see our Enforcement of Child Support ...

Most wage garnishments are a result of a creditor or debt collector trying to collect on a judgment that was previously entered against you. In order to stop a wage garnishment, you normally must take some action. Alternatively, the wage garnishment will continue until the debt associated with

Need Help Stopping a Wage Garnishment? If you need help filing the necessary legal documents to stop a wage garnishment, consider utilizing the services available through SoloSuit.

In another article about wage garnishments, we talked about who can garnishee your wages in Canada. Compared to other creditors, the Canada Revenue Agency has the most extensive powers of debt collection. One of their collection tools for unpaid taxes is a wage garnishment. Table of Contents.

If you are faced with a wage garnishment, bankruptcy is not your only option to stop it. There are a number of things you can do that might prevent a creditor from garnishing your wages. You should file any objections you have to the garnishment, in writing, with the court and and request a hearing.

Can bankruptcy stop a wage garnishment in Michigan? If you have had a garnishment or are currently getting garnished it's important to contact Detroit Lawyers immediately! A bankruptcy filing can stop the wage garnishment and potentially recover the money that was taken!

How Can I Stop Garnishment by a Debt Collector? If there is a judgment against you, the court will send a demand letter to you requesting payment of the judgment amount. Our attorneys can help you find out how to stop wage garnishment in Ohio in the manner that is best for your individual situation.

A wage garnishment typically happens when a person who owes at debt (debtor) to a creditor has ignored all other means of debt resolution and the creditor has taken the matter to the legal system. When a court grants a wage garnishment, the debtor either did not appear in court at the

How Long Does Wage Garnishment Last? Wage garnishment continues until the loan is paid although you might be able to negotiate an earlier end to your wage garnishment in your hearing.

Wage garnishments can cripple you financially. Wage garnishment lawyer Jerry E. Smith and his legal team help people like you every day. You have three bankruptcy options to have your debts discharged and to make wage garnishments stop. How to Stop Wage Garnishment in

29, 2021 · Once your creditor has a default judgment because you did not respond to the lawsuit, or a judgment because the lawsuit was successful, they can ask the court for a wage garnishment order or a bank account levy. Wage garnishment gives your creditor the power to take money directly from your paycheck until the debt is paid in full.

16, 2021 · Persistently contacting you after you notify them to stop. Calling you before 8:00 and after 9:00 Pushing hard for debt collection after your request to validate the debt. Making arrest and legal threats such as wage garnishment …