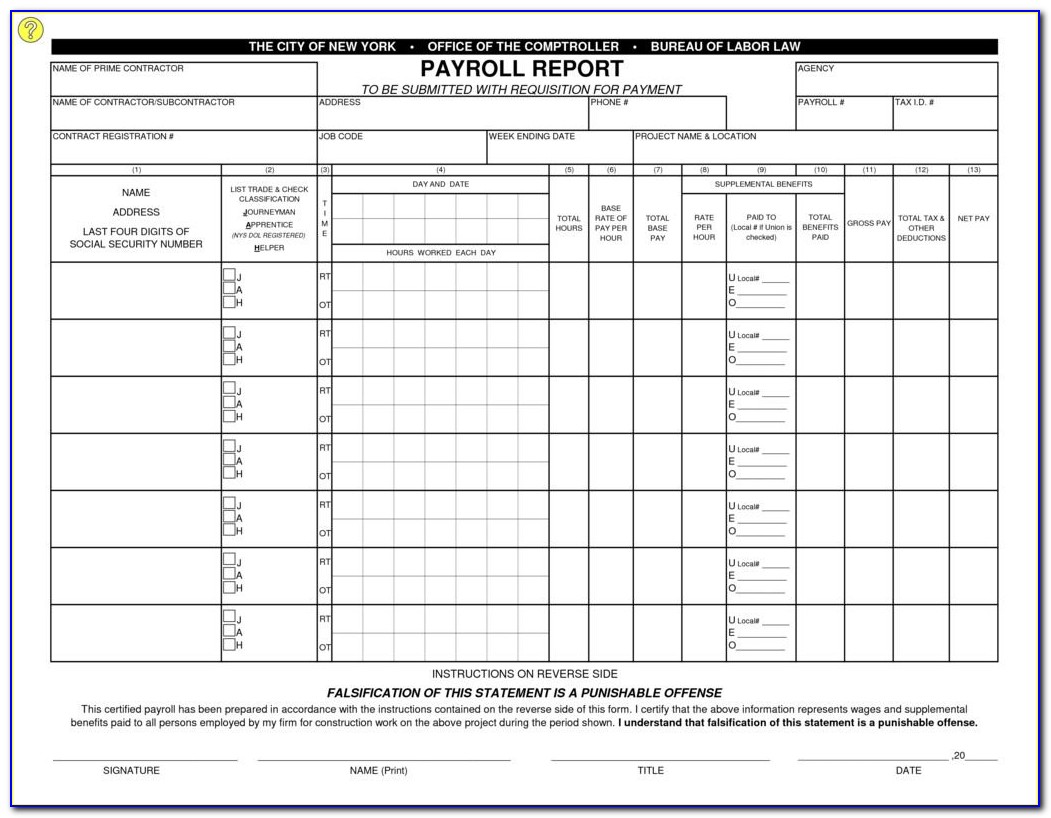

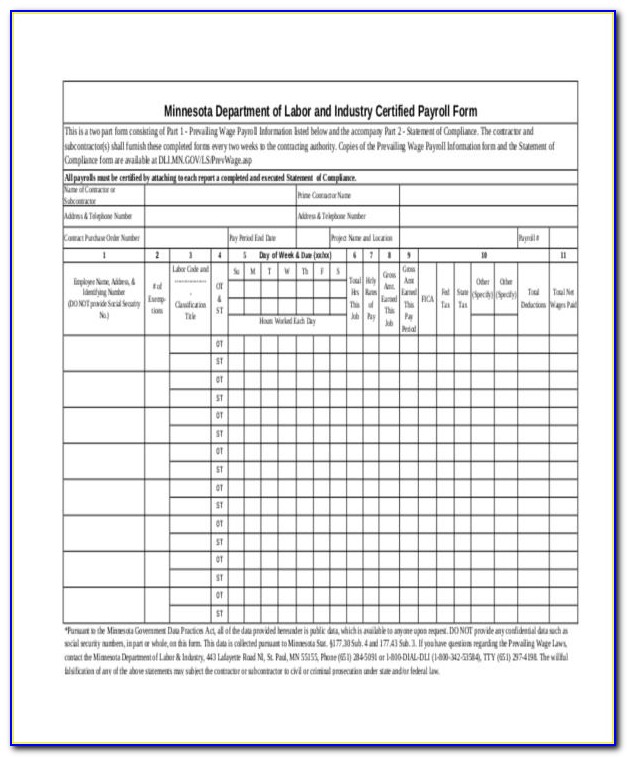

wage prevailing payroll resume

New Jersey's wage garnishment laws are stricter than federal wage garnishment laws. For the most part, creditors with judgments can take only 10 to The creditor will continue to garnish your wages until the debt is paid off, or you take some measure to stop the garnishment, such as claiming

Definition of Student Loan Garnishment. How To Stop Garnishment for Student Loans. Review Your Notice of Intent. Plead Your Case. Key Takeaways. Student loan lenders can garnish your wages to force repayment of loans in default. If you're facing wage garnishment, you should respond to

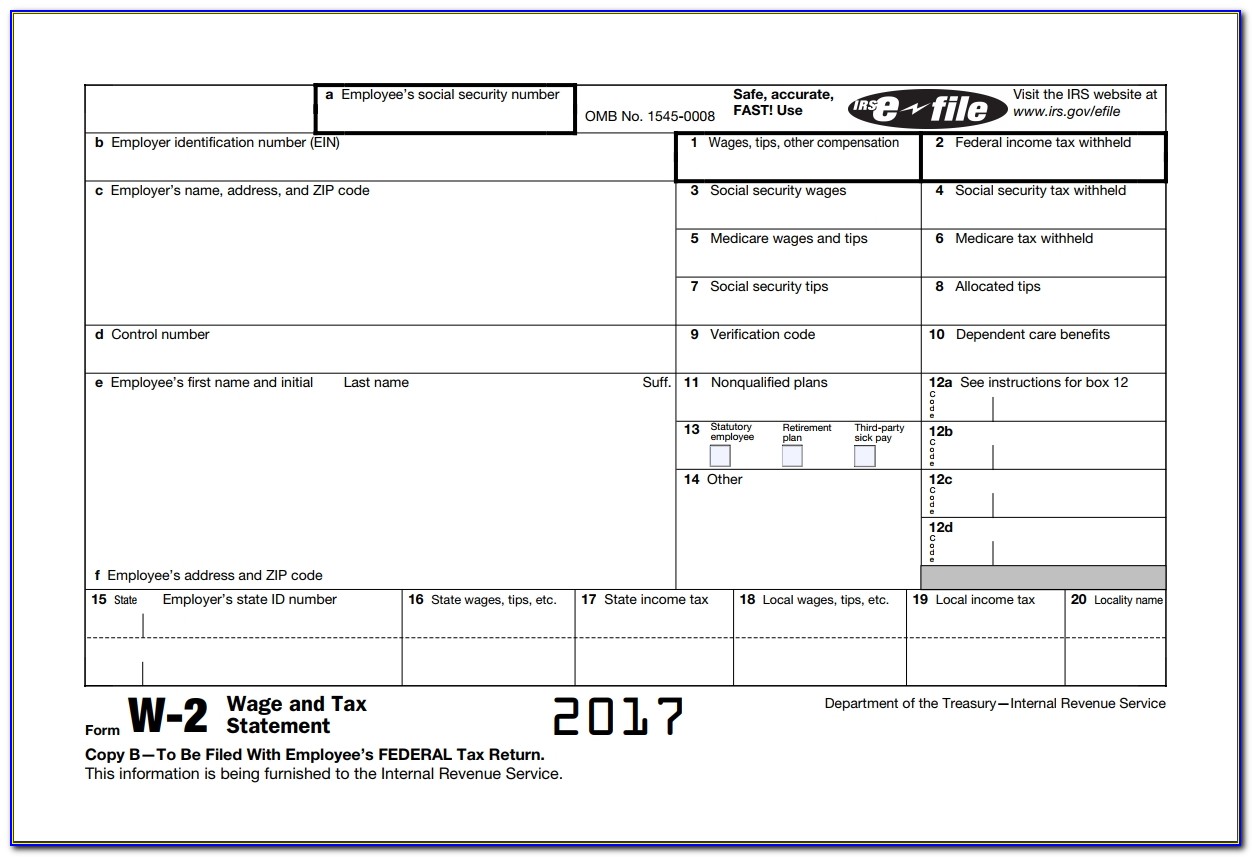

irs wage garnishment taxable vincegray2014

How Is Wage Garnishment Calculated? Exactly how much money can be garnished from your paycheck? Title III of the Consumer Credit Protection Act But if you can't pay the garnishment in one blow, then accepting responsibility for a series of installments is a good second choice.

Can bankruptcy stop a wage garnishment in Michigan? If you have had a garnishment or are currently getting garnished it's important to contact Detroit Lawyers immediately! A bankruptcy filing can stop the wage garnishment and potentially recover the money that was taken!

If the IRS is threatening or has issued a wage garnishment, understand what options you have to stop the IRS wage garnishment or release the levy.

Wage garnishments can cripple you financially. Wage garnishment lawyer Jerry E. Smith and his legal team help people like you every day. You have three bankruptcy options to have your debts discharged and to make wage garnishments stop. How to Stop Wage Garnishment in

A wage garnishment is a legal proceeding. Unless your creditor agrees to withdraw the garnishment, a garnishee can only be stopped through a similar How much can be garnished from my wages? Under the Ontario Wages Act, the maximum a creditor can garnishee is 20% of your gross wages

How to Stop Wage Garnishment. Where You Need a Lawyer: Zip Code or City In a wage garnishment, a court orders a defendant's employer to take a portion from their employee's paycheck and to send that garnishment to the court or to an intermediary agency that processes debt payments.

stop debt collecto garnishment

Wage garnishments are one way that the IRS can use to force you to pay a delinquent tax debt. They can be up to 25% of your disposable income and will restrict how much you have to spend every month. Let's look at what wage garnishments are and how to stop them.

How to Stop Wage Garnishment. No matter what kind of debt you have; mortgage debt, car payments, credit card debt, student loans or any other type of payment obligation, it's never something you look forward to paying every month. But unfortunately, if you fail to pay your debt, you just

Need Help Stopping a Wage Garnishment? Use SoloSuit. Here is an overview of what you need to do to stop a wage garnishment: Respond the the debt collector's demand letter.

2 How Wage Garnishment Affects You. 3 Who Can Garnish Your Wages? 4 Wage Versus Non-Wage Garnishment. A wage garnishment is one where the creditor obtains a court order to request funds directly out of your paycheck. A creditor is limited to how much money he can take out of your check.

wage prevailing payroll garnishment

Wage Garnishment defined and explained with examples. Wage Garnishment: A court order that a portion of a person's wages be seized to satisfy a If the court is inclined to order wage garnishment, the debtor may be able to stop it by appealing to the judge, asking that his file and order be

A wage garnishment is typically an order that gives a creditor the right to receive a portion of your wages each pay period to repay a debt. The wage garnishment continues until the debt is payable in full. Once the debt is paid, the creditor should notify the employer to stop deductions for the debt.

Wage garnishment is one way creditors can collect debts without your help — they just go straight to your employer. What are your rights in regards to wage How long does it take to garnish wages after judgment, and who can garnish wages? Stop wage garnishment today by filing for bankruptcy.

bankruptcy attorney filing jersey

Wage garnishment is a procedure by which your employer withholds a portion of your earnings to pay some debt or obligation. Wages can be garnished to pay child support, alimony, back taxes, or a judgment in a lawsuit.

If you are faced with a wage garnishment, bankruptcy is not your only option to stop it. There are a number of things you can do that might prevent a creditor from garnishing your wages. You should file any objections you have to the garnishment, in writing, with the court and and request a hearing.

You can stop wage garnishment before it starts. But after garnishment begins, it's much more difficult to recover. Follow these steps to get your loan payments Still, you may be able to request a stop to wage garnishment, such as if you are making minimum wage and you have no extra money to spare.

How do you stop (or avoid) a wage garnishment? A garnishment of wages is a court order as a result of the debtor refusing to pay his/her debt, or worse , refusing to discuss alternate acceptable terms to repay a debt. If legal action has been taken, the debtor has already proven to the world

This video is for anyone wanting to know how to stop wage channel and/or any subscriptions DOES NOT create an attorney-client relationship.

You just need to know how to stop wage garnishment from happening. If you have received a notice of wage garnishment, sometimes referred to as income withholding, it can be very stressful. While this type of court order is no joke, it's important not to panic.

Learn how to stop wage garnishment and keep your paycheck protected from creditors. Don't worry you have options to protect yourself. How To Stop a Wage Garnishment Before It Starts. Exception: Student Loan Debt And Tax Debt. (1) Negotiate a Payment Plan With Your Creditor.

How to Stop Wage Garnishment? Garnishment Laws Blog. The same is true for wage garnishment in New Jersey. And if you want to read the exact wording of the state statute, simply tap into the digital law books and go here: NJ Rev Stat § 2A:17-50 (2013).

Learn how to comply with wage garnishment orders using Online Payroll. A garnishment is the result of a legal proceeding that requires an employer to withhold wages from an employee's pay and remit the money to an agency or creditor.

Stop Wage Garnishment. rating based on 12,345 ratings. How to Prevent a Wage Garnishment. While it can often seem like a standard part of the national conversation, debt is a terrifying reality.

You might be able to stop the wage garnishment, though, if you can't afford the garnishment or you believe it was made in error. If you believe you have grounds to challenge the garnishment, the paperwork you received notifying you of the judgment will have information about how to proceed.

wage prevailing payroll

One way to stop a wage garnishment is to file a claim for exemption. In some states, you may claim exemptions if you provide support to a dependent, you are the head of household providing more than 50 percent of support for a child or other dependent or if your income falls into a special category.

A bankruptcy filing stops wage garnishment in its tracks and gives you control over your financial life once again. Alabama limits the amount garnished to 25 percent of disposable earnings, which is consistent with federal law. For child support obligations, this increases up to 60 percent.

Stopping Wage Garnishment. First, inform yourself about the underlying judgment. Take the income execution form to the court clerk. Get a copy of your file. Then see a consumer lawyer in your area. Stopping a wage garnishment starts with careful analysis of how the creditor obtained the

IRS wage garnishment can be stopped in essentially two ways; Either solve your tax problem or to cancel or delay the effects of the wage levy. Obviously it's better to resolve the IRS problem than to delay it however often an individual's situation may require some actions to delay or negate the