Michigan Wage Garnishment Laws. Michigan law limits how much of your income creditors can garnish (take). You can also potentially stop most garnishments by filing for bankruptcy . Limits on Wage Garnishment in Michigan. In Michigan, a creditor can garnish whichever is less

Learn how to arrange a wage wage garnishment is a court order for an employer Setting up a wage garnishment. SOLVED•by QuickBooks•Intuit Online Payroll•. The garnishment will automatically stop when the employee's total amount garnished reaches this amount.

Wage garnishment is one way creditors can collect debts without your help — they just go straight to your employer. What are your rights in regards to wage How long does it take to garnish wages after judgment, and who can garnish wages? Stop wage garnishment today by filing for bankruptcy.

If a creditor has already gone to court and obtained a garnishee summons allowing them to garnishee your wages, the wage garnishment will only stop once it is paid, or if the creditor agrees to stop it. You can attempt to make a deal with the creditor. Here are two ways you can do this.

How Is Wage Garnishment Calculated? Exactly how much money can be garnished from your paycheck? Title III of the Consumer Credit Protection Act But if you can't pay the garnishment in one blow, then accepting responsibility for a series of installments is a good second choice.

Can bankruptcy stop a wage garnishment in Michigan? If you have had a garnishment or are currently getting garnished it's important to contact Detroit Lawyers immediately! A bankruptcy filing can stop the wage garnishment and potentially recover the money that was taken!

The Garnishment Process. Income Sources. How to Stop a Wage Garnishment. Grounds for Challenging a Garnishment. A parent's wages are usually only garnished for child support when they're severely in arrears—they haven't made full payments in several months.

If the IRS is threatening or has issued a wage garnishment, understand what options you have to stop the IRS wage garnishment or release the levy.

Navigation Home Types of Wage Garnishment Debt related Court fines Student loans Child and Spousal support Taxes How to stop wage garnishment Automatic stay Debt has already been paid Debt you don't own Dispute amount of debt owed Improper Service Indentity Theft or

How to Stop Wage Garnishment in California Examples of Wage Garnishment Contact OakTree Law. *Consider an IRS Offer in Compromise to dispute, pay down or 'wipe-out' tax debt*. How to Stop Wage Garnishments. Your first line of defense is to get educated on wage

How much money can be garnished? The maximum amount of wages garnished varies depending on the garnishment, but they range from 15 percent of disposable earnings for student loans to as much as 65 percent of disposable earnings for child support (if the employee is at least 12 weeks in arrears).

How do I stop wage garnishment? This question is asked a lot of times by garnishees. Wage garnishment happens when an employer is required to pay part of an employee's earnings directly to a creditor to which the employee ("garnishee") owes an overdue debt.

If you are faced with a wage garnishment, bankruptcy is not your only option to stop it. There are a number of things you can do that might prevent a creditor from garnishing your wages. You should file any objections you have to the garnishment, in writing, with the court and and request a hearing.

2 How Wage Garnishment Affects You. 3 Who Can Garnish Your Wages? 4 Wage Versus Non-Wage Garnishment. A wage garnishment is one where the creditor obtains a court order to request funds directly out of your paycheck. A creditor is limited to how much money he can take out of your check.

How Long Does Wage Garnishment Last? Wage garnishment continues until the loan is paid although you might be able to negotiate an earlier end to your wage garnishment in your hearing.

Unless you voluntarily agreed to a garnishment clause in whatever payment contract you signed, garnishment can only be done by means of court action (unless we're talking about the IRS here). Add your answer: Earn +20 pts. Q: How do you dispute garnishment in Michigan?

However, while wage garnishment is a common and high-profile kind of garnishment, remember that Not only are some categories of income entirely exempt, but there is a limit to how much non-exempt More on Stopping Wage Garnishment in Michigan. Getting Legal Help. It may seem

Many Michiganders endure wage garnishments, garnishment of bank accounts, or garnishment of The only way to completely stop a garnishment is to file bankruptcy. The automatic stay put in Legal Guides. Set Aside: HOW TO ATTEMPT TO SET ASIDE Periodic Garnishment: How

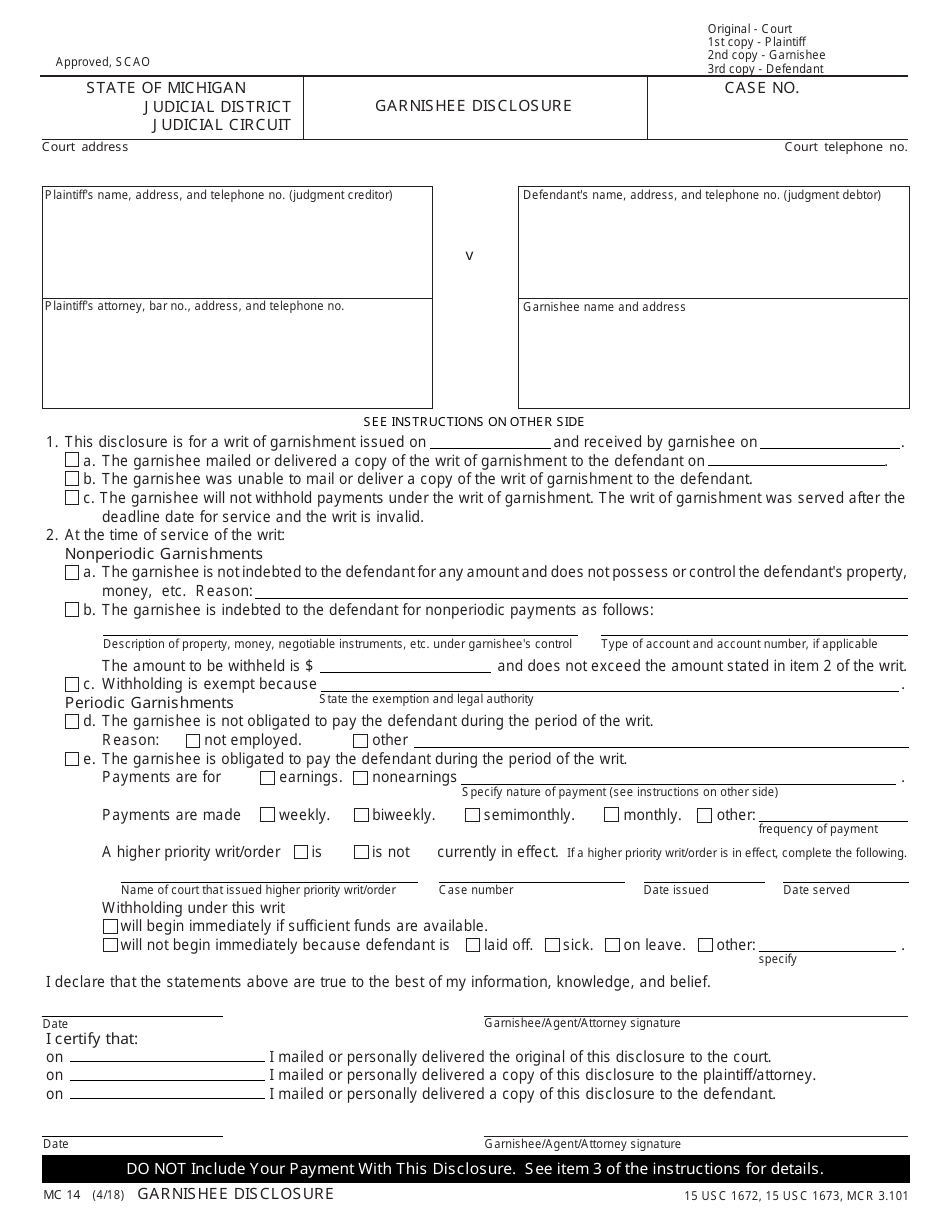

garnishment templateroller disclosure wage garnishee

You might be able to stop the wage garnishment, though, if you can't afford the garnishment or you believe it was made in error. If you believe you have grounds to challenge the garnishment, the paperwork you received notifying you of the judgment will have information about how to proceed.

In this video I discuss strategies on how to stop wage garnishment immediately, both through a bankruptcy filing and through non-bankruptcy

Wage Garnishment defined and explained with examples. Wage Garnishment: A court order that a portion of a person's wages be seized to satisfy a If the court is inclined to order wage garnishment, the debtor may be able to stop it by appealing to the judge, asking that his file and order be

This article explains how garnishment happens and what to expect if it does. In Michigan, it's illegal for your employer to fire you or punish you in any way because of a garnishment. The last resort scenario to stop garnishment is also the most drastic: you can file for bankruptcy.

You can stop wage garnishment before it starts. But after garnishment begins, it's much more difficult to recover. Follow these steps to get your loan payments Still, you may be able to request a stop to wage garnishment, such as if you are making minimum wage and you have no extra money to spare.

Need Help Stopping a Wage Garnishment? Use SoloSuit. Here is an overview of what you need to do to stop a wage garnishment: Respond the the debt collector's demand letter.

Learn how to stop wage garnishment and keep your paycheck protected from creditors. Don't worry you have options to protect yourself. How To Stop a Wage Garnishment Before It Starts. Exception: Student Loan Debt And Tax Debt. (1) Negotiate a Payment Plan With Your Creditor.

Wage garnishment can be challenging to deal with, but there are a number of ways to work with the IRS to stop it. Many or all of the companies featured provide compensation to LendEDU. These commissions are how we maintain our free service for consumers.

How to Stop Wage Garnishment. No matter what kind of debt you have; mortgage debt, car payments, credit card debt, student loans or any other type of payment obligation, it's never something you look forward to paying every month. But unfortunately, if you fail to pay your debt, you just

A wage garnishment is a court-ordered way to collect money owed to a defendant, also called a garnishee. The debt collected is usually for unsecured debt like credit cards, child support, criminal fines, and Michigan Wage Garnishment Lawyers. Where You Need a Lawyer: Zip Code or City

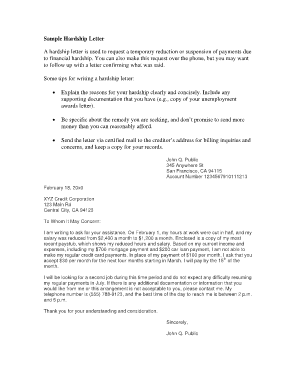

garnishment wage hardship exemption hearing

The Michigan garnishment process results starts with a judgement from your creditor and progresses into taking money from your paycheck. Read below to understand the process of obtaining a garnishment in Michigan and how you have the power to stop it.

A wage garnishment is an order from a court or government agency that is sent to your employer requesting that they withhold a certain amount of money from your 3 Working Out an Agreement with the Creditor Yourself. 4 Filing a Claim of Exemption. 5 Using Bankruptcy to Stop Wage Garnishments.