09, 2022 · Read the Rules: Maryland Rules, Title 3, Chapter 600; Maryland Rules Title 2, Chapter 600 . Wage Garnishment Procedure. A creditor begins the wage garnishment process by filing a Request for Garnishment on Wages (Form DC/CV65) with the court. After the request is filed, the court clerk or a judge signs the Request and it becomes a Writ of ...

A wage garnishment is typically an order that gives a creditor the right to receive a portion of your wages each pay period to repay a debt. The wage garnishment continues until the debt is payable in full. Once the debt is paid, the creditor should notify the employer to stop deductions for the debt.

procedures you need to follow to object to a wage garnishment depend on the type of debt that the creditor is trying to collect from you, as well as the laws of your state. Usually, you have the right to written notice and a hearing before your employer starts holding back some of your wages to pay your judgment creditor.

and short how to stop a maryland which garnishment well in chapter 7 bankruptcy can stop it even after it's begun collection creditors must stop the garnishment when a maryland bankruptcy is filed call today for a free consultation to learn your legal rights well in bankruptcy attorney Heather

Wage Garnishment Generally. To "garnish" is to take property - most often a Wage garnishment is a court procedure where a court orders a debtor's employer to hold the debtor's earnings in order If you are not sure how much money the debtor still owes, ask the creditor for a copy of this statement.

Maryland Wage Garnishment Laws. Maryland law limits how much of your earnings that a creditor can attach (garnish) from your wages for repayment of A " wage garnishment ," sometimes called a "wage attachment," is an order requiring your employer to withhold a certain amount of money

garnishment wage irs calculation biloxi wages garnishments

If you are faced with a wage garnishment, bankruptcy is not your only option to stop it. There are a number of things you can do that might prevent a creditor from garnishing your wages. You should file any objections you have to the garnishment, in writing, with the court and and request a hearing.

I stop it, once it has started? Ordinarily, wage garnishment continues until all of the obligations of the debt are paid in full. However, in some circumstances, you may be able to have your garnishment released, or at the very least, reduced. For more information on how to stop wage garnishment, contact the attorneys at McCarthy Law today.

Learn how to stop wage garnishment and keep your paycheck protected from creditors. Don't worry you have options to protect yourself. Having your wages garnished can be overwhelming and scary. There are some things you can do to stop a wage garnishment.

How can you stop wage garnishment? Creditors will send you one last warning letter before they start garnishing you wages. As a last resort, you can file for chapter 7 bankruptcy to stop wage garnishment. Chapter 7 bankruptcy allows people to eliminate most debts and get a fresh

How Long Does Wage Garnishment Last? Wage garnishment continues until the loan is paid although you might be able to negotiate an earlier end to your wage garnishment in your hearing.

Need Help Stopping a Wage Garnishment? Use SoloSuit. Here is an overview of what you need to do to stop a wage garnishment: Respond the the debt collector's demand letter.

garnishment

2 How Wage Garnishment Affects You. 3 Who Can Garnish Your Wages? 4 Wage Versus Non-Wage Garnishment. A wage garnishment is when a creditor collects debt payment from your paycheck. When the creditor has attempted to contact you to no avail, garnishment is their last ditch effort

How to Stop Wage Garnishment. Where You Need a Lawyer: Zip Code or City In a wage garnishment, a court orders a defendant's employer to take a portion from their employee's paycheck and to send that garnishment to the court or to an intermediary agency that processes debt payments.

If the IRS is threatening or has issued a wage garnishment, understand what options you have to stop the IRS wage garnishment or release the levy.

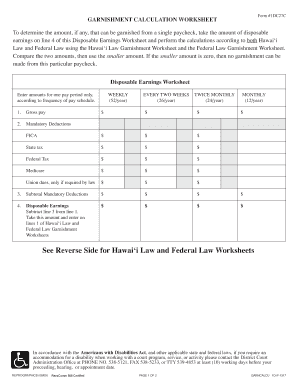

garnishment worksheet calculation hawaii printable form wage blank fill fillable forms calculator pdffiller complaint

29, 2021 · Judgment creditors can use wage garnishment to receive a portion of your earnings each paycheck. Exemptions limit the amount the creditor can take. Some states like Florida, Idaho, Oklahoma, Maryland, Ohio, and Utah follow federal wage garnishment limits to determine what is considered exempt income. Other states offer similar exemptions to ...

A wage garnishment is a legal proceeding. Unless your creditor agrees to withdraw the garnishment, a garnishee can only be stopped through a similar How much can be garnished from my wages? Under the Ontario Wages Act, the maximum a creditor can garnishee is 20% of your gross wages

Wage Garnishment Limits. States are free to offer more protection to debtors in wage garnishment actions than does the federal government; they cannot provide less. Many states follow the federal guidelines, but some protect more of a debtor's wages. For example, in Massachusetts, most judgment creditors can only garnish up to 15% of your ...

Fourth, if the garnishment on your pay check has already begun, you will probably have to file a bankruptcy in order to stop the garnishment. Maryland law and bankruptcy law are constantly changing and the information provided here may not apply to your specific situation.

You might be able to stop the wage garnishment, though, if you can't afford the garnishment or you believe it was made in error. If you believe you have grounds to challenge the garnishment, the paperwork you received notifying you of the judgment will have information about how to proceed.

Learn how you can stop a wage garnishment by contacting Steiner Law Group. A creditor must first obtain a judgment before it can garnish wages. Both Federal and Maryland law provide limited protections for individuals against termination by their employer for a wage garnishment.

More on Stopping Wage Garnishment in Maryland. Getting Legal Help. With a lawyer's assistance, it may be possible to challenge, or at least reduce, garnishment. It may also be possible to attack the judgment as having been granted in violation of the statute of limitations, especially given

You can stop wage garnishment before it starts. But after garnishment begins, it's much more difficult to recover. Follow these steps to get your loan payments Still, you may be able to request a stop to wage garnishment, such as if you are making minimum wage and you have no extra money to spare.

oppose a Claim of Exemption for a wage garnishment If the judgment creditor wants to oppose the Claim of Exemption, within 10 days of the mailing date shown on Item 1 of the Notice of Filing of Claim of Exemption (Form WG-008), the creditor must: Fill out a Notice of Opposition to Claim of Exemption (Form WG-009) and make 4 copies.

How to stop a wage garnishment in MD in 2019? A Maryland wage garnishment is a legal mechanism in Maryland debtor/creditor law that allows a creditor to take a percentage of your wages when they can't get money owed to them. Under MARYLAND GARNISHMENT

Wage Garnishment defined and explained with examples. Wage Garnishment: A court order that a portion of a person's wages be seized to satisfy a If the court is inclined to order wage garnishment, the debtor may be able to stop it by appealing to the judge, asking that his file and order be

Stopping Wage Garnishment - Your Rights and Options in Maryland. Since the wage garnishment laws in Maryland are so strict about the grounds on which an exemption can be granted, the only option for many people is to file for bankruptcy.

Learn how to arrange a wage garnishment. A wage garnishment is a court order for an employer to withhold a certain amount of an employee's wages as repayment for debt. This is different from other after-tax payroll deductions. You can set this up from your Online Payroll product. We'll show you how.

bankruptcy garnishment repossession foreclosure wage

The Maryland wage attachment laws (also called wage garnishment) protect the same amount of wages as the federal wage garnishment laws in some Maryland counties. In others, the rules are more restrictive. However, for a few types of debts, creditors can take more.

24, 2020 · Maryland. Follows federal wage garnishment maximums. ... A bankruptcy does cause an automatic stay order which will stop the wage garnishment against you until either your debts are discharged ...

Wage garnishment, the most common type of garnishment, is the process of deducting money from an employee's monetary compensation (including salary), usually as a result of a court garnishments may continue until the entire debt is paid or arrangements are made to pay off the debt. Garnishments can be taken for any type of debt but common …

A wage garnishment is any legal or equitable procedure where some portion of a person's earnings is withheld by an employer for the payment of a debt. Under CCPA provisions, an employer cannot discipline or terminate an employee whose wages are being garnished for a solitary debt.

Wage garnishment can be challenging to deal with, but there are a number of ways to work with the IRS to stop it. Many or all of the companies featured provide compensation to LendEDU. These commissions are how we maintain our free service for consumers.

Wage garnishment means the government withholds money directly from your wages to repay your student loan. If you request a hearing to challenge the garnishment within 30 days of receiving the Notice of Intent to Garnish, the garnishment process will be put on hold until your hearing.

In Maryland, Wage Garnishment follows the same general process as is followed in every other state for wage garnishment. Though there are exceptions, usually the creditor must begin by filing a lawsuit and obtaining a Money Judgment, which makes the successful creditor a Judgement Creditor.

a Wage Garnishment by Filing for Bankruptcy. Bankruptcy works well to stop most wage garnishments—and you don't need to worry about losing everything you own. Property exemptions apply to more than just wages. Each state has a list of exemptions that a filer can use to protect property needed to maintain a home and employment, such as ...

The Garnishment Process. Income Sources. How to Stop a Wage Garnishment. Grounds for Challenging a Garnishment. A parent's wages are usually only garnished for child support when they're severely in arrears—they haven't made full payments in several months.

Wage garnishment is a procedure by which your employer withholds a portion of your earnings to pay some debt or obligation. Wages can be garnished to pay child support, alimony, back taxes, or a judgment in a lawsuit.

29, 2021 · If the wage garnishment has already started, you can try to challenge the judgment or negotiate with the creditor. But, they’re in the driver’s seat, and if they don’t allow you to stop a garnishment by agreeing to make voluntary payments, you can’t really force them to. You can, however, stop the garnishment by filing a bankruptcy case.