garnishment wage allowable

How much money can be garnished? The maximum amount of wages garnished varies depending on the garnishment, but they range from 15 percent of disposable earnings for student loans to as much as 65 percent of disposable earnings for child support (if the employee is at least 12 weeks in arrears).

Wage garnishment can create a lot of paperwork for your employer, and if you have more than one garnishment in a year you may lose your job. However, if you live in Ohio you have several methods you can use to stop a wage garnishment.[1] X Research source.

Here's how Indiana regulates wage garnishments. Generally, Indiana follows federal law limits on wage garnishments. In Indiana, there are two ways to stop a garnishment. You can either pay the full amount owed according to the money judgment against you, or you can file for bankruptcy.

A wage garnishment is typically an order that gives a creditor the right to receive a portion of your wages each pay period to repay a debt. The wage garnishment continues until the debt is payable in full. Once the debt is paid, the creditor should notify the employer to stop deductions for the debt.

How to Stop Wage Garnishment. Where You Need a Lawyer: Zip Code or City In a wage garnishment, a court orders a defendant's employer to take a portion from their employee's paycheck and to send that garnishment to the court or to an intermediary agency that processes debt payments.

In the state of Indiana, only one garnishment can be active at any given time. The other garnishment has to wait until the first one is done. That depends on the circumstances. Indiana reserves the right to jail parents found in contempt of court for failure to pay any child support in arrears no matter

How to Stop Wage Garnishment? Garnishment Laws Blog. Indiana Garnishment Laws. Like every other state in America, Indiana has millions of debtors. The downfall of the American real estate market, the past crash of the stock market, the desire of the American middle class for

How to protect yourself from wage garnishment. If your wages are currently being garnished, a creditor has filed a lawsuit against you, or you're worried that could happen due to an unpaid debt, there are a few ways you can protect yourself. Check the laws and exemptions in your

Wage garnishment can be challenging to deal with, but there are a number of ways to work with the IRS to stop it. Many or all of the companies featured provide compensation to LendEDU. These commissions are how we maintain our free service for consumers.

In another article about wage garnishments, we talked about who can garnishee your wages in Canada. Compared to other creditors, the Canada Revenue Agency has the most extensive powers of debt collection. One of their collection tools for unpaid taxes is a wage garnishment. Table of Contents.

Indiana wage garnishment laws limit how much judgment creditors can take from your paycheck. A " wage garnishment ," sometimes called a "wage attachment," is an order requiring your employer to withhold a certain amount You can also potentially stop most garnishments by filing for bankruptcy .

Wage garnishment is one way creditors can collect debts without your help — they just go straight to your employer. What are your rights in regards to wage How long does it take to garnish wages after judgment, and who can garnish wages? Stop wage garnishment today by filing for bankruptcy.

Learn how to arrange a wage wage garnishment is a court order for an employer to withhold a Setting up a wage garnishment. SOLVED•by QuickBooks•Intuit Online Payroll•. 427•. The garnishment will automatically stop when the employee's total amount garnished reaches

Wage Garnishment defined and explained with examples. Wage Garnishment: A court order that a portion of a person's wages be seized to satisfy a If the court is inclined to order wage garnishment, the debtor may be able to stop it by appealing to the judge, asking that his file and order be

If you wish to stop wage garnishment in Indiana there are several options available to you. Pay the Debt and Avoid the Suit. There are situations where the garnishment against a person is too harsh and because of it a person can't afford their food and housing and health needs.

How to Stop Wage Garnishment. No matter what kind of debt you have; mortgage debt, car payments, credit card debt, student loans or any other type of payment obligation, it's never something you look forward to paying every month. But unfortunately, if you fail to pay your debt, you just

How to Battle Wage Garnishment. What are your options to get your finances back on track? Wage garnishment could leave you and your finances reeling. If you are behind in debt repayments, even if through no fault of your own, your creditor could use a garnishment of your wages to ensure the

Wage garnishments can cripple you financially. Wage garnishment lawyer Jerry E. Smith and his legal team help people like you every day. If you want to talk about how to stop wage garnishment in Indiana or have decided you need legal help with a bankruptcy matter, CPA and

How Can a Creditor Garnish My Wages? Most creditors will not be permitted to seek a wage garnishment until they have first obtained a judgment Procedure to Stop Wage Garnishments in Florida: When a creditor seeks a garnishment, the clerk of the court must send notice to the

How Long Does Wage Garnishment Last? Wage garnishment continues until the loan is paid although you might be able to negotiate an earlier end to your wage garnishment in your hearing.

You might be able to stop the wage garnishment, though, if you can't afford the garnishment or you believe it was made in error. If you believe you have grounds to challenge the garnishment, the paperwork you received notifying you of the judgment will have information about how to proceed.

How Is Wage Garnishment Calculated? Exactly how much money can be garnished from your paycheck? Title III of the Consumer Credit Protection Act But if you can't pay the garnishment in one blow, then accepting responsibility for a series of installments is a good second choice.

Need Help Stopping a Wage Garnishment? If you need help filing the necessary legal documents to stop a wage garnishment, consider utilizing the services available through SoloSuit.

bankruptcy

How can you stop wage garnishment? Creditors will send you one last warning letter before they start garnishing you wages. As a last resort, you can file for chapter 7 bankruptcy to stop wage garnishment. Chapter 7 bankruptcy allows people to eliminate most debts and get a fresh

2 How Wage Garnishment Affects You. 3 Who Can Garnish Your Wages? 4 Wage Versus Non-Wage Garnishment. A wage garnishment is one where the creditor obtains a court order to request funds directly out of your paycheck. A creditor is limited to how much money he can take out of your check.

Originally Answered: How do I stop wages from being garnished? Paying your debts is the only way to stop wages from being garnished. You can job-hop form one job to the next to try to stay ahead of the garnishment, but the instability of such a strategy honestly makes matters worse instead of better.

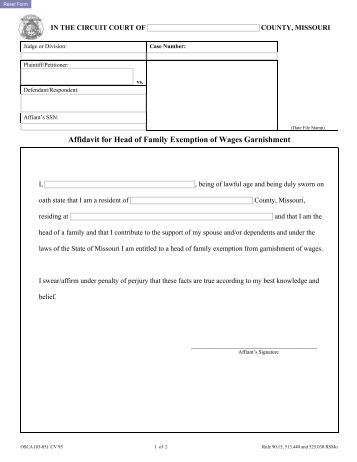

garnishment wage laws wages affidavit exemption

If you are faced with a wage garnishment, bankruptcy is not your only option to stop it. There are a number of things you can do that might prevent a creditor from garnishing your wages. You should file any objections you have to the garnishment, in writing, with the court and and request a hearing.

This video is for anyone wanting to know how to stop wage channel and/or any subscriptions DOES NOT create an attorney-client relationship.

bankruptcy indianapolis attorneys stop wage garnishment money clipart giving exchange receive

A bankruptcy filing stops wage garnishment in its tracks and gives you control over your financial life once again. Alabama limits the amount garnished to 25 percent of disposable earnings, which is consistent with federal law. For child support obligations, this increases up to 60 percent.

Wage garnishment in Indiana is allowed under Indiana Code Title 34, Article 25, Chapter 3: Garnishment, and IC , and The following remedies, found in Indiana Indiana Code Title 34 Article 25, are allowed when a court awards a judgment to a creditor who filed a