Foreclosure is what happens when a homeowner fails to pay the mortgage. But there's a lot more to it than that. Sometimes, a borrower may intentionally stop paying the mortgage because the property might be underwater (in other words, the amount of the mortgage exceeds the value of the home)

Property tax foreclosure is a complicated situation to be in. Once the foreclosure process has begun, it can seem like there's no way to get ahead of it. Fortunately, you can stop property tax foreclosure and understanding how it works is critical to saving your home and your credit.

postcards postcard short foreclosure estate order printerbees

Need to know how to stop a property tax foreclosure? If you're not paying your property taxes, you're in trouble. Every single government will have a

Tax Deed Sale: Tax foreclosure; the property owner doesn't pay their property taxes, so a house is usually sold as a tax lien first, and then if the tax lien is not paid within a certain period of time it then goes to an actual foreclosure. Auctions.

How to Buy a Tax Lien Foreclosure Home. Homes and business properties are repossessed and sold due to tax liens quite often, and for buyers they can present some fantastic opportunities. Since the government is only looking to raise enough from the sale of the property to cover the loan debt,

Property taxes can be a huge burden for the homeowner. Learn more about some of the tricks you can use to lower your property tax. Sadly, many homeowners pay property taxes but never quite understand how they are calculated. It can be confusing and challenging, especially because

Delinquent property tax foreclosures can, in the worst case, cause you to lose your home. And in the best case, you will have to pay back the Can I Prevent a Property Tax Foreclosure? Currently (as on September 2020), all foreclosure proceedings have been paused in New York, due to the

Cc: Adria Fields, Franklin County Prosecutor's Office. How I Fought A Property Tax Foreclosure by Marc Harry: Fishman. This document is intended to convey the process that I went through in fighting a foreclosure brought by the county for back property taxes.

The IRS treats foreclosures the same as the sale of property. You must calculate capital gains for tax purposes, and you might owe income tax as The fair market value of the property being foreclosed. You can have canceled debt income from the foreclosure with this type of loan as well, in addition

Property taxes are imposed on owners of real property across the United States. Typically, each state puts individual counties in charge of assessing, collecting and monitoring property taxes. The previous owners do not have redemption rights after the tax foreclosure sale in California.

If your property taxes remain unpaid, the tax assessor-collector has the legal right to pursue a property tax foreclosure of the lien and sell your home. The process normally begins with the filing of a tax suit by the attorney representing the tax assessor.

How to Prevent a Tax Foreclosure Sale Due to Delinquent Taxes On Your Property. Second of all, you have the right as the property owner to stop foreclosure at any point before the sale takes place by paying your unpaid property taxes, interest and penalties.

Parties wishing to redeem property from tax foreclosure and stop the foreclosure process must contact the attorney for a redemption payoff figure. Legal fees are set by the Clerk of Court unless the parties agree to the amount. Redemption can even occur after a sale, as long as the sale has

Property Tax Sale and Tax Foreclosure Moratorium in Many Places Due to Coronavirus. Many counties are suspending property tax sales and tax foreclosures due to the COVID-19 emergency. Call your county treasurer's office or tax collector's office, or look online, to find out if your area has

Property tax foreclosure, also known as tax lien foreclosure, refers to a situation that occurs when a property owner fails to pay the requisite taxes. For instance, if a property owner refuses or fails to pay the property taxes owed on a specific piece of real estate, then there is a likelihood that they will

How can we help stop a tax foreclosure on your Katy or Houston, Texas area home? We buy homes in with tax problems - in any price range and in If property taxes aren't paid, the taxing authority can foreclose on the taxpayer's home, by filing a lawsuit in court. The court then enters a judgment for

How to Stop Foreclosure. In this event, government tax on foreclosure of properties may be instituted on the former property owner. The Internal Revenue Service has rules that state tax foreclosure property listings are essentially a penalty for falling behind on tax payments.

Learn more on how you can stop property tax foreclosure right here in the Reno area. So, let's just jump right into it and figure out exactly how to stop property tax foreclosure on your house. The first thing is obviously, and this seems like a no brainer, but you obviously want to pay them.

The tax office does not sell tax liens. Texas law allows the public to purchase properties from the county at a monthly tax foreclosure sale. The states sells the deed to the property.

lamont

zip code

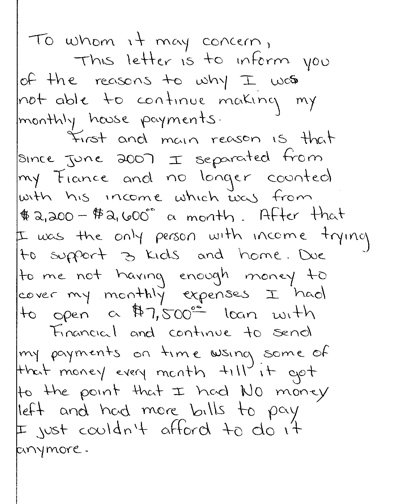

hardship letter example loans mortgage sample loan modification company write fargo wells credit countrywide why card

How many tax lien foreclosures has John performed? Real Property Tax Liens do not have priority over certain state and possibly federal income tax liens so you would take subject to those liens if they exist.

Trying to Figure Out How to Stop Property Tax Foreclosure? We Buy Houses Fast for Cash Nationwide USA. Fair Cash Offers. Trying to Figure Out How to Stop Property Tax Foreclosure? Call (202) 826-8179 or You may fill out the form below to get a quick fair cash offer on the

The ideal tax foreclosure system efficiently and equitably collects tax revenue needed to pay for government services while promoting community stabilization and property maintenance. This is a balancing act; selling tax liens to private purchasers will enable a locality to recoup revenue in

victoria chester center advocate legal county

Stop Foreclosure - How To Stop A Property · Are you looking to stop property tax foreclosure?. Taxes are an unavoidable and necessary part of everyday life. Some may call it a necessary evil, but regardless of our opinion on them, we understand that anyone that owns

nashville homes tn luxury estate nice townhomes single realtor franklin communities

Property Tax Foreclosure can be a difficult and frustrating process. Not only will you lose your house, but you will also lose your pride. It can be difficult for anyone to handle. But what you need to know is that it happens to people all the time. You are not the first person going through it, and you

Foreclosure is a legal process in which a lender attempts to recover the balance of a loan from a borrower who has stopped making payments to the lender by forcing the sale of the asset used

wayne county treasurer foreclosure illegal sabree foreclosures temporary protesters stop put activists eric anti michigan

How to Stop Property Tax Foreclosure? - Consumer Proponents. Property Tax is an important part of one's life; if you own a property, you have to pay tax. Every local government collects property tax to finance the county government and municipal services.

Bidding on a Tax Foreclosure at Auction The Highest Bidder at the public sale is required to have a 20% deposit in cash or The owner of the property has the right to redeem the property being foreclosed on during the upset bid period. All taxes must be paid in full for the foreclosure to stop.

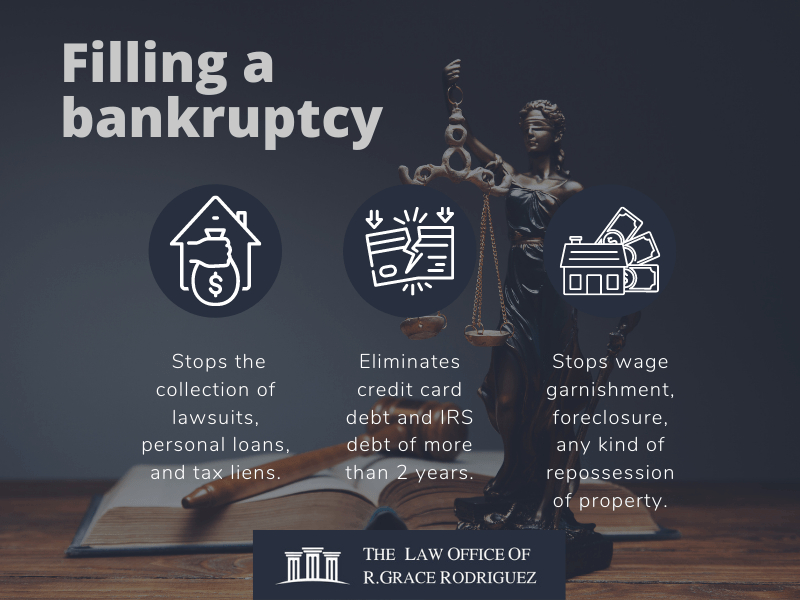

bankruptcy happens does declaring foreclosure

Are you looking to stop property tax foreclosure? Taxes are an unavoidable and necessary part of everyday life. Some may call it a necessary evil, but regardless How to save your property from tax foreclosure. If you receive a notification that your property will go into a tax sale, not all hope is lost.

Unpaid property taxes and foreclosure, each month, along with mortgage payment, you pay the fees to the lender, which they keep in an escrow account. They do this to avoid tax foreclosures. Many people think of mortgage and home tax as the same thing, which is not valid. If you own your

Property owners in New Jersey may be faced with a Property Tax Foreclosure. In most personal bankruptcy cases, when the Bankruptcy Petition is filed, the automatic stay goes into effect and stops the continuation of foreclosure proceedings.