Virginia Garnishment Law. Before anyone can garnish you, excluding government entities and some very narrow, unusual exceptions, they have to sue you. The trust purpose of a lawsuit is to get the judicial stamp of approval that you owe the debt to the creditor who sued you.

Stop wage garnishment from creditors in California who have won a judgment against you in court. If you are facing wage garnishment in California then there are several steps you can take to stop the garnishment. In California when a creditor obtains a judgment against you and can determine

Get started for only $60! Call today to speak to an attorney!America Law Group, Inc. has over 10 convenient locations throughout Virginia!Visit our

Live in Virginia? Facing a Garnishment? Just received a Garnishment Summons? Looking for an option other than Bankruptcy? Here are some non-bankruptcy alternatives.

In Virginia, a creditor can garnish the lesser of 25% of your disposable earnings, or the amount by which your disposable earnings exceed 40 times the federal The creditor will continue to garnish your wages until the debt is paid off, or you take some measure to stop the garnishment, such

Understanding how to stop garnishments can save you time and money. Garnishments are a scary thing. A creditor wants to take money out of your paycheck or your bank account. In Virginia, a creditor can perform either a wage garnishment or a bank garnishment.

To stop a garnishment, seek legal advice. Your goal is to reverse the judgment. "It's a good idea to immediately seek legal advice if your wages are garnished or funds are frozen or removed from your bank account," says John McNamara, debt collection program manager at the Consumer

Virginia law allows some people to garnish your wages without a judgment first. Your wages can be garnished without a judgment for the following debts:[1] A lawyer would be invaluable for helping you determine how best to proceed. Although it is difficult to "stop" a garnishment completely, you

bankruptcy attorney

Wage Garnishments and Child Support. How to Stop Child Support Garnishment. ••• Yellow Dog Productions/Getty Images. How Much Can Be Garnished? The Garnishment Process. Income Sources. How to Stop a Wage Garnishment. Grounds for Challenging a Garnishment.

How do I stop a garnishment in Colorado? What happens when an employee gets garnished and his employer takes him off the payroll and pay him "under The garnishment comes not out of someone's request but by a court order, it means that the other party had exhausted all other ways to come to

Virginia Garnishments: Find out more about garnishments in Virginia. How to stop a garnishment, how to recover your garnishment money, etc. The legal system can intimidate and a garnishment can be push your life over the financial cliff. If you get a garnishment summons - don't wait.

If you decide to object to the wage garnishment, there are a number of different objections you could potentially raise, including An example of an improper garnishment would be if a creditor fails to provide you timely notice of the wage garnishment.

bankruptcy

attorney foley

How to Stop Wage Garnishment? In the state of Virginia, garnishment laws are typical of many other states in that they are stricter than federal garnishment laws.

Virginia. The garnishment continues until you pay the taxes owed in full, you set up an agreement with the IRS, or until the arrival of Collection Statute Expiration Date for tax years that carry a liability. Filing for bankruptcy automatically stops the wage garnishment. In some cases, bankruptcy

bankruptcy greenbelt

How to Stop a Garnishment. Once a garnishment has started, a person has very few options for stopping it. The return of garnished funds may not be possible or may not make sense in certain situations, such as garnishment for child support arrears or garnishment for a

Virginia Wage Garnishment Laws. Garnishment is one way that a creditor can seek payment from a debtor who is not voluntarily paying a monetary judgment (or court determination of an obligation to pay money). In garnishment, the creditor doesn't look to get the money owed it directly from the

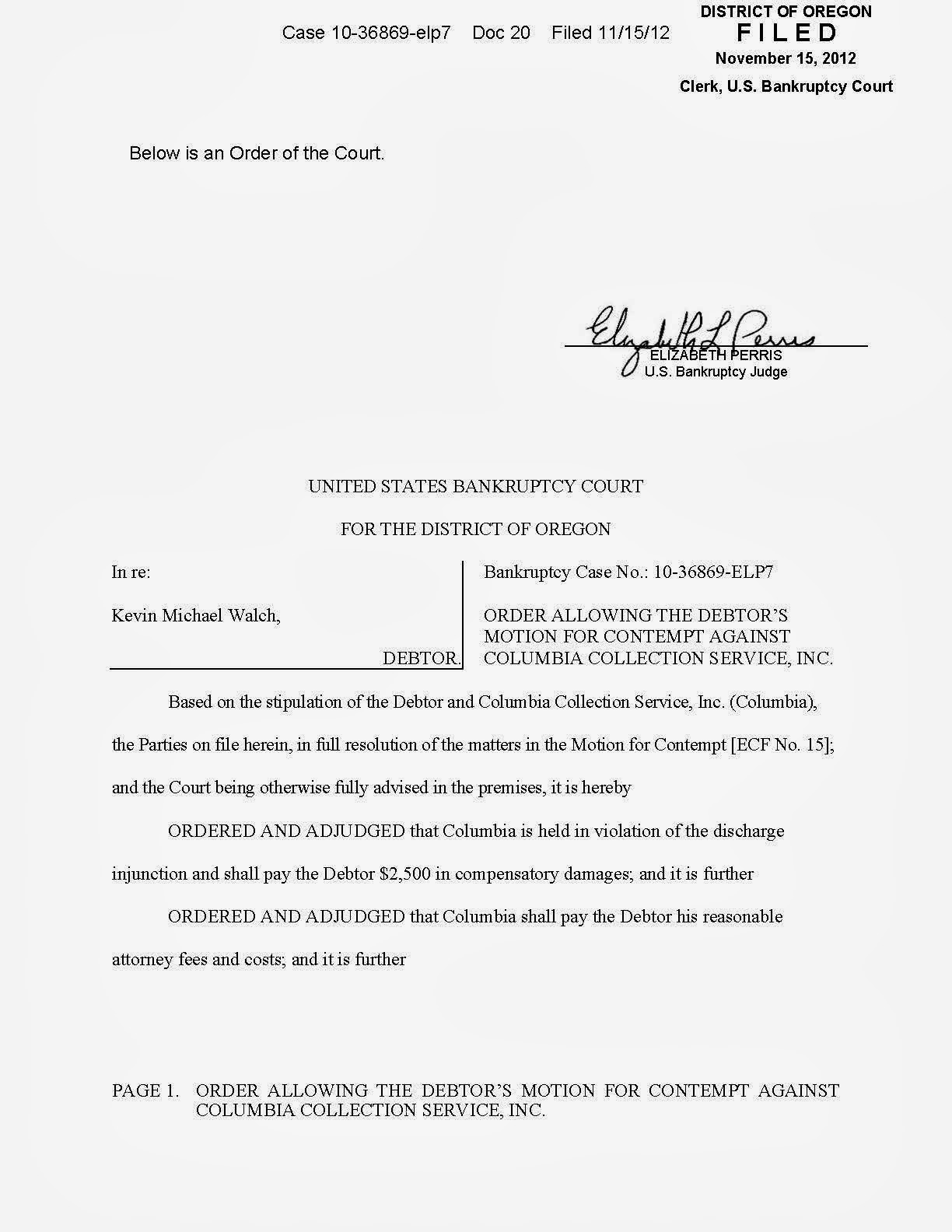

garnishment wage contempt qo

Garnishment in virginia. Traditionally, the process of garnishment has been available to a creditor at two stages of a legal proceeding to accomplish two dis-tinct purposes. Before judgment, the defendant's property in the hands of a third person could be placed within the custody of the law

If you are faced with a wage garnishment, bankruptcy is not your only option to stop it. There are a number of things you can do that might prevent a creditor from garnishing your wages. You should file any objections you have to the garnishment, in writing, with the court and and request a hearing.

bankruptcy

How Can I Stop Wage Garnishment? If you've already received notice that your wages are going to be garnished, there are at least four ways to stop garnishment: Win Your Hearing. As soon as you receive the notice of intent from the Department of Education to garnish your wages you should

How Can I Stop Garnishment by a Debt Collector? If there is a judgment against you, the court will send a demand letter to you requesting payment of the judgment amount. Our attorneys can help you find out how to stop wage garnishment in Ohio in the manner that is best for your individual situation.

A non-governmental creditor with a judgment in Virginia can garnish up to 25 percent of your wages and all of the money in your savings and checking account. So how do you stop the garnishment permanently?

How does a garnishment work? To garnishee your wages, a creditor must first file a Statement of Claim. If a settlement is not possible, stopping a garnishment with a consumer proposal or personal bankruptcy is possible. In virtually all cases a consumer proposal or a personal bankruptcy will stop

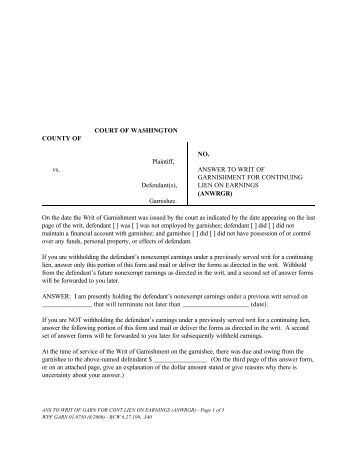

garnishment wage writ federal dol

How Can I Stop a Florida Wage Garnishment? If you have been notified that your wages will be garnished, you will need to act quickly. Procedure to Stop Wage Garnishments in Florida: When a creditor seeks a garnishment, the clerk of the court must send notice to the debtor regarding

Garnishment - How to Stop Garnishment - What to do if Garnished. 2015-06-25 Richard West Law Office. The Virginia Homestead Exemption is a power tool to protect wages, bank accounts, and property in and out of bankruptcy from creditors.

How to Stop Wage Garnishment in California Examples of Wage Garnishment Contact OakTree Law. *Consider an IRS Offer in Compromise to dispute, pay down or 'wipe-out' tax debt*. How to Stop Wage Garnishments. Your first line of defense is to get educated on wage

In Virginia, your creditor may garnish your paycheck, garnish your bank account, place liens on your property and serve you with a Summons to Answer Interrogatories. Of these creditor remedies, the wage garnishment is the most effective against debtors. Virginia law allows a creditor to take 25%

Most garnishments in Virginia are by consumer creditors. Under Virginia law, there are only a few ways to stop a garnishment. You could make a lump-sum payment to pay off the judgment or allow the garnishment to continue until the judgment is fully paid.

Wage garnishment is one way creditors can collect debts without your help — they just go straight to your employer. What are your rights in regards to wage garnishment in California? Stop wage garnishment today by filing for bankruptcy.

How a Garnishment Can Cost Your Employer. The easiest and most foolproof way to stop a garnishment is to file bankruptcy. If the garnishment means you can't keep up with your other bills, you already have a genuine financial emergency, whether you want to admit it or not.

How Long Do Wage Garnishments Last? What makes the Florida wage garnishment particularly effective is the ongoing nature of the writ. Florida's wage garnishment exemptions do not apply to garnishments initiated by the federal government to collect judgments owed to government agencies.