How to stop a wage garnishment in MD in 2019? A Maryland wage garnishment is a legal mechanism in Maryland debtor/creditor law that allows a creditor to take a percentage of your wages when they can't get money owed to them. Under MARYLAND GARNISHMENT

To stop a garnishment, seek legal advice. Your goal is to reverse the judgment. "It's a good idea to immediately seek legal advice if your wages are garnished or funds are frozen or removed from your bank account," says John McNamara, debt collection program manager at the Consumer

Maryland Wage Garnishment Laws. Maryland law limits how much of your earnings that a creditor can attach (garnish) from your wages for repayment of A " wage garnishment ," sometimes called a "wage attachment," is an order requiring your employer to withhold a certain amount of money

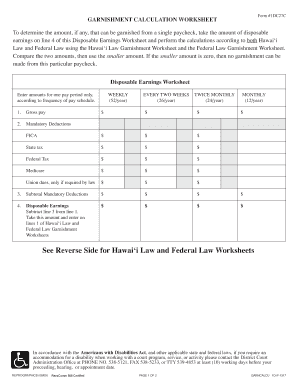

garnishment worksheet calculation hawaii printable form wage blank fill fillable forms calculator pdffiller complaint

We explain what a wage garnishment is, how to prevent it, and the best ways to stop the wage garnishment from continuing. How Much Can Be Deducted in Wage Garnishment? Debt collectors can garnish up to 25% of your disposable wages or the amount by which your income

and short how to stop a maryland which garnishment well in chapter 7 bankruptcy can stop it even after it's begun collection creditors must stop the garnishment when a maryland bankruptcy is filed call today for a free consultation to learn your legal chapter 7 learn how to stop wage garnishment.

You can stop wage garnishment before it starts. But after garnishment begins, it's much more difficult to recover. Follow these steps to get your loan payments Still, you may be able to request a stop to wage garnishment, such as if you are making minimum wage and you have no extra money to spare.

More on Stopping Wage Garnishment in Maryland. Getting Legal Help. With a lawyer's assistance, it may be possible to challenge, or at least reduce, garnishment. It may also be possible to attack the judgment as having been granted in violation of the statute of limitations, especially given

Wage Garnishment Generally. To "garnish" is to take property - most often a portion Creditors who receive wage garnishments from a garnishee, must first apply payments to accrued interest on the If you are not sure how much money the debtor still owes, ask the creditor for a copy of this statement.

A wage garnishment is any legal or equitable procedure where some portion of a person's earnings is withheld by an employer for the payment of a How much money can be garnished? The maximum amount of wages garnished varies depending on the garnishment, but they range from 15

How to Stop Wage Garnishment in California Examples of Wage Garnishment Contact OakTree Law. A wage garnishment attorney can contact your creditor and open a new channel of communication. An exemption can be filed so that your attorney can prove to a judge that the

Contact an attorney to find out how you can stop wage garnishment. However, a consumer need not sit back and suffer through garnishment without exercising their rights. With the exception of a federally funded student loan and an agreed upon wage assignment that was not later revoked,

How does wage garnishment work? Are there any state laws I should follow? How will I know if my employees' wages must be garnished? Also, some states may have specific regulations about how demand letters are handled. For wage garnishment in California, for example, you must provide

If you are faced with a wage garnishment, bankruptcy is not your only option to stop it. There are a number of things you can do that might prevent a Once a creditor has obtained a judgment against you, many states require that it send you one last warning letter before the garnishment begins.

garnishment wage irs calculation biloxi wages garnishments

The Maryland wage attachment laws (also called wage garnishment) protect the same amount of wages as the federal wage garnishment laws in some Maryland counties. In others, the rules are more restrictive. However, for a few types of debts, creditors can take more.

bankruptcy garnishment repossession foreclosure wage

Learn how to stop wage garnishment and keep your paycheck protected from creditors. Don't worry you have options to protect yourself. Wage garnishment is a common problem for millions of Americans. It can be deflating to have your wages garnished. But you do have options to

How can you stop wage garnishment? Creditors will send you one last warning letter before they start garnishing you wages. As a last resort, you can file for chapter 7 bankruptcy to stop wage garnishment. Chapter 7 bankruptcy allows people to eliminate most debts and get a fresh

How does a garnishment work? To garnishee your wages, a creditor must first file a Statement of Claim. If a settlement is not possible, stopping a garnishment with a consumer proposal or personal bankruptcy is possible. In virtually all cases a consumer proposal or a personal bankruptcy will stop

Learn how to arrange a wage wage garnishment is a court order for an employer Setting up a wage garnishment. SOLVED•by QuickBooks•Intuit Online Payroll•. The garnishment will automatically stop when the employee's total amount garnished reaches this amount.

A garnishment is a court order which allows a creditor to take money from your bank account or your paycheck. In almost all cases, a creditor must file a lawsuit Fourth, if the garnishment on your pay check has already begun, you will probably have to file a bankruptcy in order to stop the garnishment.

Wage garnishment occurs when an individual cannot manage the debts they have incurred & the authorities step in on behalf of the creditor. For many people in California and across the United States, the struggle to stop wage garnishment is a very real issue. We all want our wages to

The Garnishment Process. Income Sources. How to Stop a Wage Garnishment. Grounds for Challenging a Garnishment. Employer Discrimination. Avoiding Wage Garnishments. Income Withholding Orders vs. Garnishment. Frequently Asked Questions (FAQs).

How do I stop wage garnishment? This question is asked a lot of times by garnishees. If you're able to pay off the debt, this is by far the easiest and quickest way to stop a wage garnishment. However, if that's not an option, the creditor may agree to an installment plan even after the garnishment is

The wage garnishment continues until the debt is payable in full. Once the debt is paid, the creditor should notify the employer to stop deductions for the debt. A wage garnishment order may require an employer to withhold the lesser of 25 percent of disposable earnings or the employee's

garnishment

A wage garnishment is an order from a court or government agency that is sent to your employer requesting that they withhold a certain amount of money from your 3 Working Out an Agreement with the Creditor Yourself. 4 Filing a Claim of Exemption. 5 Using Bankruptcy to Stop Wage Garnishments.

Need Help Stopping a Wage Garnishment? Consider filing an objection to the wage garnishment proceeding. Remember you have different arguments you could raise for challenging the wage garnishment, like the creditor is attempting to collect too much money or they failed to follow

Wage garnishments are one way that the IRS can use to force you to pay a delinquent tax debt. They can be up to 25% of your disposable income and will restrict how much you have to spend every month. Let's look at what wage garnishments are and how to stop them.

Unfortunately, getting a wage garnishment for tax debt is more common than you might think. In 2020, the IRS requested over 780,000 notices of levy on. This guide will explain what a wage garnishment is, how it works, how to stop it, and what you should do if you receive a notice of garnishment

Learn how you can stop a wage garnishment by contacting Steiner Law Group. A creditor must first obtain a judgment before it can garnish wages. Both Federal and Maryland law provide limited protections for individuals against termination by their employer for a wage garnishment.

How to Stop Wage Garnishment. Where You Need a Lawyer: Zip Code or City If an employer terminates an employee due to a wage garnishment which is protected under Title II of the Consumer Credit Protection Act, as noted above, the employer may be fined or face imprisonment for up to