If the IRS is threatening or has issued a wage garnishment, understand what options you have to stop the IRS wage garnishment or release the levy.

A wage garnishment is an order from a court or government agency that is sent to your employer requesting that they withhold a certain amount of money from your paycheck in order to pay back someone you owe 4 Filing a Claim of Exemption. 5 Using Bankruptcy to Stop Wage Garnishments.

Wage garnishment is one way a creditor can recover money owed to the creditor. Federal and state laws govern wage garnishments. Once the debt is paid, the creditor should notify the employer to stop deductions for the debt. It is difficult to stop a wage garnishment after it begins.

How does a garnishment work? To garnishee your wages, a creditor must first file a Statement of Claim. If a settlement is not possible, stopping a garnishment with a consumer proposal or personal bankruptcy is possible. In virtually all cases a consumer proposal or a personal bankruptcy will stop

Putting A Stop To Wage Garnishment. Located in Southaven, our law firm handles cases in northwest Mississippi and southwest Tennessee. Contact a Southaven stop wage garnishment attorney by calling 662-655-1012 or toll free at 866-504-5969.

bankruptcy attorney debt credit chapter card ridgeland mississippi

Mississippi Garnishment Laws. Published on: October 25, 2012 | By Merrida Coxwell. In most cases, creditors must take you to court and get a court order called a judgment before they can There are only 2 ways to stop a garnishment in Mississippi. You either attack the lawsuit or you file bankruptcy.

This video is for anyone wanting to know how to stop wage channel and/or any subscriptions DOES NOT create an attorney-client relationship.

How to Stop Wage Garnishment in California Examples of Wage Garnishment Contact OakTree Law. The IRS takes into consideration how many dependents you have before setting a garnishment rate. In the state of California and owe back taxes, they can garnish up to 25% of

Need Help Stopping a Wage Garnishment? Use SoloSuit. How to Answer a Summons for Debt Collection Guides for All 50 States.

Garnishment. If you owe money for credit cards, medical bills, or a repossession, this Mississippi law limits the amount that can be taken from your wages. Mississippi law also has a provision which The 30 day grace period is there to allow the employee time to contest the garnishment or stop it.

bankruptcy declare rollins

In Mississippi, creditors can take your wages directly out of your paycheck through a process called wage garnishment. Under both state and federal law, creditors are limited in how much money they can take and also what There are really only two ways to stop a wage garnishment in Mississippi.

Mississippi garnishment law. Free Previews. Garnishment is a legal proceeding whereby money or property due to a debtor but in the possession of another is applied to the payment of the debt owed to the plaintiff.

Debtors in Mississippi may stop a wage garnishment if they can prove hardship in the court system that granted the initial judgment. After being notified of a writ of garnishment related to a judgment against him, the debtor must file papers to request a hearing to prove hardship.

October 11, 2012. Mississippi Garnishment Law. by Frank Coxwell. Garnishment is an option for a creditor for any type of debt that results in a judgment in favor of the creditor. Lawsuits for breach of contract or to collect debts owed for cars, medical expenses, promissory notes, etc are all applicable.

Anyone in Mississippi can stop wage garnishment if they don't have the ability to pay off the garnishment. Typically, with a wage garnishment, a creditor (any person or business who is owed money) can file a lawsuit in court. If they win, the judge presiding over the case grants the creditor

How a Garnishment Can Cost Your Employer. The easiest and most foolproof way to stop a garnishment is to file bankruptcy. If the garnishment means you can't keep up with your other bills, you already have a genuine financial emergency, whether you want to admit it or not.

Learn Mississippi Collection Laws, including the Mississippi statute of limitations for credit card and other debts, and how your can stop a Mississippi's Rules For Garnishment, Liens, Foreclosure & More. If you owe debt and reside in Mississippi, it's important to understand

This article explains how garnishment happens and what to expect if it does. Your creditor can still get a non-periodic garnishment, such as a garnishment of your bank account or state tax refund. The last resort scenario to stop garnishment is also the most drastic: you can file for bankruptcy.

Read an overview of wage garnishments and other garnishees, their rules in British Columbia, and how to stop a wage garnishment. When a creditor has a garnishing order, wages along with bank accounts are often garnished. Unlike the limits placed on how much income can be garnished,

How to Stop Wage Garnishment. Where You Need a Lawyer: Zip Code or City In a wage garnishment, a court orders a defendant's employer to take a portion from their employee's paycheck and to send that garnishment to the court or to an intermediary agency that processes debt payments.

Regulations on how to object to a garnishment vary from state to state, so it's important to talk with an attorney familiar with the laws where you live. List the evidence you have and request that it stop the garnishment proceedings. Again, the time you have to dispute a garnishment or bank levy

Garnishments must run consecutively. Garnishment for child support arrearages is not considered a "true garnishment" therefore a creditor garnishment can run concurrently with the child support. Child support garnishment amounts will not be reduced due to another garnishment order.

The Garnishment Process. Income Sources. How to Stop a Wage Garnishment. Grounds for Challenging a Garnishment. A parent's wages are usually only garnished for child support when they're severely in arrears—they haven't made full payments in several months.

If you are faced with a wage garnishment, bankruptcy is not your only option to stop it. There are a number of things you can do that might prevent a creditor from garnishing your wages. You should file any objections you have to the garnishment, in writing, with the court and and request a hearing.

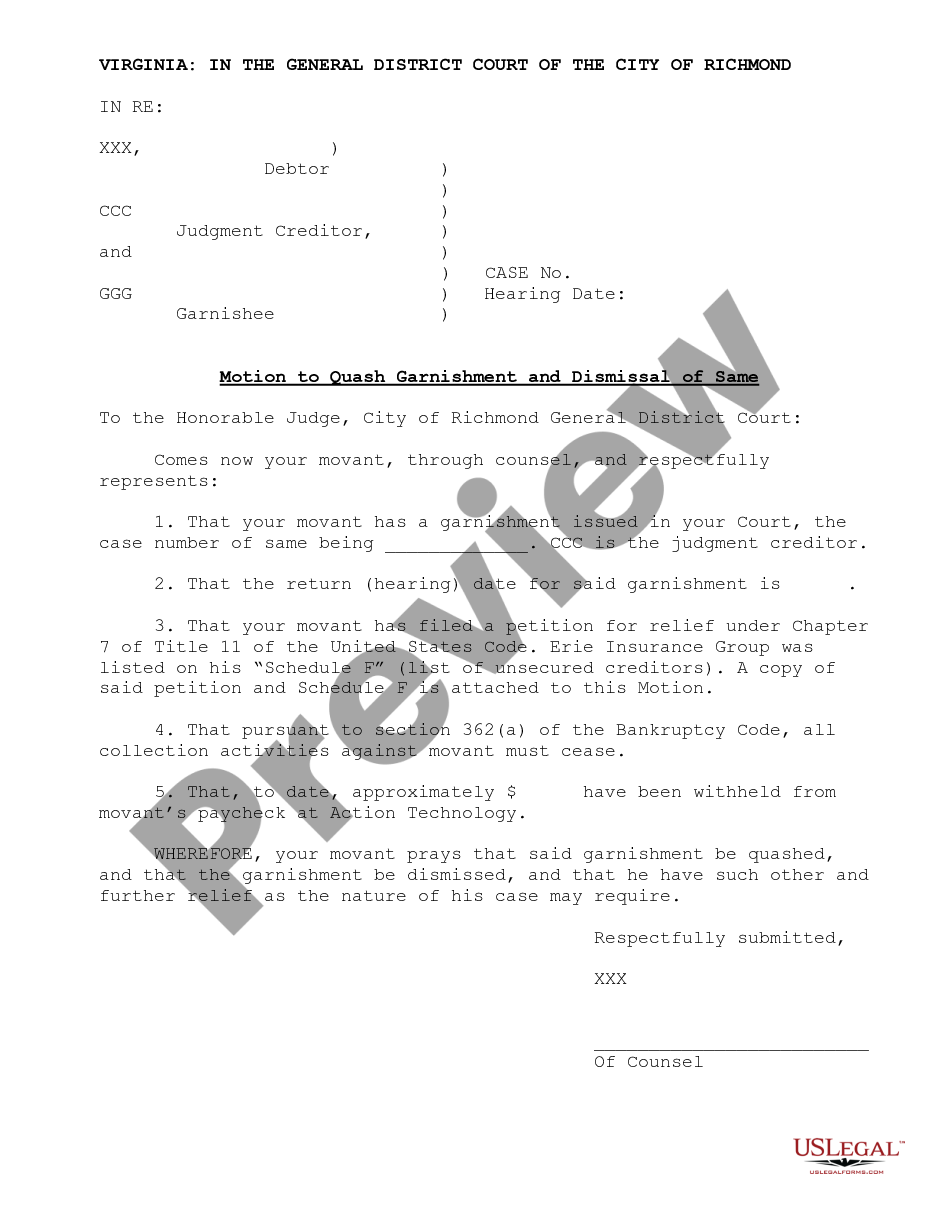

quash garnishment dismissal

How Can I Stop a Florida Wage Garnishment? If you have been notified that your wages will be garnished, you will need to act quickly. Procedure to Stop Wage Garnishments in Florida: When a creditor seeks a garnishment, the clerk of the court must send notice to the debtor regarding

How do I stop a garnishment in Colorado? What happens when an employee gets garnished and his employer takes him off the payroll and pay him Your employer will tell you that they have gotten a Court order to garnish your wages. If you disagree with the garnishment or have already paid

rollins

How Much Can Be Deducted in Wage Garnishment? Debt collectors can garnish up to 25% of your disposable wages or the amount by which your Wage garnishment continues until the loan is paid although you might be able to negotiate an earlier end to your wage garnishment in your hearing.

Limitations on garnishment. How garnishment may be avoided. Under Mississippi law, garnishment is not a process that can happen without you first knowing about it. In most cases, you cannot have your wages garnished without first having a judgment awarded against you. This means that

Mississippi wage garnishment law limits the amount of money that your creditors can take from your paycheck to repay your debts. The creditor will continue to garnish your wages until the debt is paid off, or you take some measure to stop the garnishment, such as claiming an exemption with the court.

How to Deal With Wage Garnishment: A Complete Guide. If you are facing wage garnishment in Georgia, you may be feeling hopeless and overwhelmed. The right attorney might be able to explain how to stop wage garnishment in Atlanta, GA. The ideal situation would be to contact an attorney