How do people try to stop garnishment? The garnishment comes not out of someone's request but by a court order, it means that the other party had exhausted all other ways to come to a resolution, so court/judge was involved, filings were done, fees were paid, documents were produced (to prove

Arizona wage garnishment laws limit how much judgment creditors can take from your paycheck. The creditor will continue to garnish your wages until the debt is paid off, or you take some measure to stop the Under Arizona law, 50% of your disposable earnings may be garnished for a support order.

Arizona. Follows federal wage garnishment guidelines. How to protect yourself from wage garnishment. If your wages are currently being garnished, a creditor has filed a lawsuit against you, or you're worried that could happen due to an unpaid debt, there are a few ways you can protect yourself.

In Arizona, there are few ways to stop a garnishment. Typically, you can argue that your income is exempt or that you will suffer extreme hardship. Receive your papers. After a judgment creditor files a garnishment action, they will send you the following papers within three business days.

In Arizona, the wage garnishment process usually starts when a creditor files a writ of Can my employer fire me if my wages are garnished? How long before a creditor can garnish your wages? To stop a wage garnishment that is imminent make sure you respond to the notification and

In Arizona, there are few ways to stop a garnishment. Typically, you can argue that your income is exempt or that you. You can always stop a garnishment by quitting your job. Of course, you would still need to find a way to support yourself. You cannot be fired from your job for having a

I've been garnished since Sept 1st, my work has not sent any money to the CA but is still Credit Repair. Collections. Paid off debt - how to cancel garnishment?

If you are faced with a wage garnishment, bankruptcy is not your only option to stop it. A consumer credit counseling service (CCS) may be able to help you stop a garnishment. Not to be confused with debt repair companies, a CCS is a non-profit agency that can help you negotiate and reach

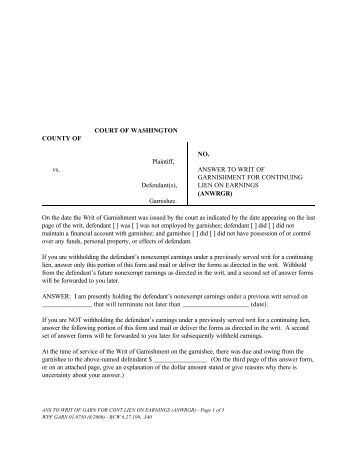

individual Garnishment packets include more detailed instructions as to how to proceed with a Garnishment. CV R: 1/24/19 WRIT OF EXECUTION ARS 22-244, ARS 12-1551: This is a process where a Constable would take non-exempt personal property from

How Much Can Be Deducted in Wage Garnishment? Debt collectors can garnish up to 25% of your disposable wages or the amount by which your Wage garnishment continues until the loan is paid although you might be able to negotiate an earlier end to your wage garnishment in your hearing.

Bankruptcy can stop wage garnishments. If your wages are being garnished, in most cases, we can file your case with a very low payment to allow you to Depends on how much you make and other garnishments from your paycheck. For garnishment of federal debts, you have a right to a hearing

Wage Garnishment Limits. States are free to offer more protection to debtors in wage garnishment actions than does the federal government; they cannot provide less. Many states follow the federal guidelines, but some protect more of a debtor's wages. For example, in Massachusetts, most judgment creditors can only garnish up to 15% of your ...

is a legal process for collecting a monetary judgment on behalf of a plaintiff from a allows the plaintiff (the "garnishor") to take the money or property of the debtor from the person or institution that holds that property (the "garnishee"). A similar legal mechanism called execution allows the seizure of money or property held directly by the debtor.

13, 2022 · The garnishee must also tell the court and all parties if the debtor stops working or is fired. The garnishment terminates 90 days after the end of employment, unless the debtor is re-employed by the garnishee during that period. If there is more than one garnishment, each garnishment must be paid in full in the order it was served on the employer.

garnishment writ rabago

Learn how to stop wage garnishment and keep your paycheck protected from creditors. Don't worry you have options to protect yourself. Wage garnishment is a common problem for millions of Americans. It can be deflating to have your wages garnished. But you do have options to

(To learn about using bankruptcy to quickly stop wage garnishment, see Using Chapter 7 Bankruptcy to Stop Wage Garnishment.) Respond to the Creditor's Demand Letter. Once a creditor has obtained a judgment against you, many states require that it send you one last warning letter before the garnishment begins. This is usually called a "demand ...

24, 2020 · Arizona. Follows federal wage garnishment guidelines. ... A bankruptcy does cause an automatic stay order which will stop the wage garnishment against you until either your debts are discharged ...

How to Stop a Garnishment. Once a garnishment has started, a person has very few options for stopping it. The return of garnished funds may not be possible or may not make sense in certain situations, such as garnishment for child support arrears or garnishment for a

27, 2022 · The garnishment rules are strictly enforced. A garnishment that deviates in any way from the statute’s garnishment rules should be dissolved and the funds released. The garnishment statutes set out procedures for garnished debtors to assert a claim of exemption or other legal defenses to the garnishment.

garnished wages bankruptcy

Wage garnishment is also one of the main reasons that people in Arizona file for bankruptcy as it is difficult to make ends meet when at least 15% of your wages are going to pay the judgement that the creditor has against you. The only other way to stop a wage garnishment is to declare bankruptcy.

Regulations on how to object to a garnishment vary from state to state, so it's important to talk with an attorney familiar with the laws where you live. List the evidence you have and request that it stop the garnishment proceedings. Again, the time you have to dispute a garnishment or bank levy

Accordingly, how does wage garnishment work in Arizona? Under Arizona law, the creditor can garnish up to 25% of your take home paycheck. Garnishment can be stopped quickly and the underlying debt can be eliminated by filing Chapter 7 or Chapter 13 bankruptcy. The faster you

How does a garnishment work? To garnishee your wages, a creditor must first file a Statement of Claim. If a settlement is not possible, stopping a garnishment with a consumer proposal or personal bankruptcy is possible. In virtually all cases a consumer proposal or a personal bankruptcy will stop

Learn the different options for avoiding a garnishment, stopping a garnishment, and getting back the money that was already garnished. In this guide, we go into detail about garnishments: what they are, how they are initiated, and what you can do to stop a garnishment and avoid losing your assets.

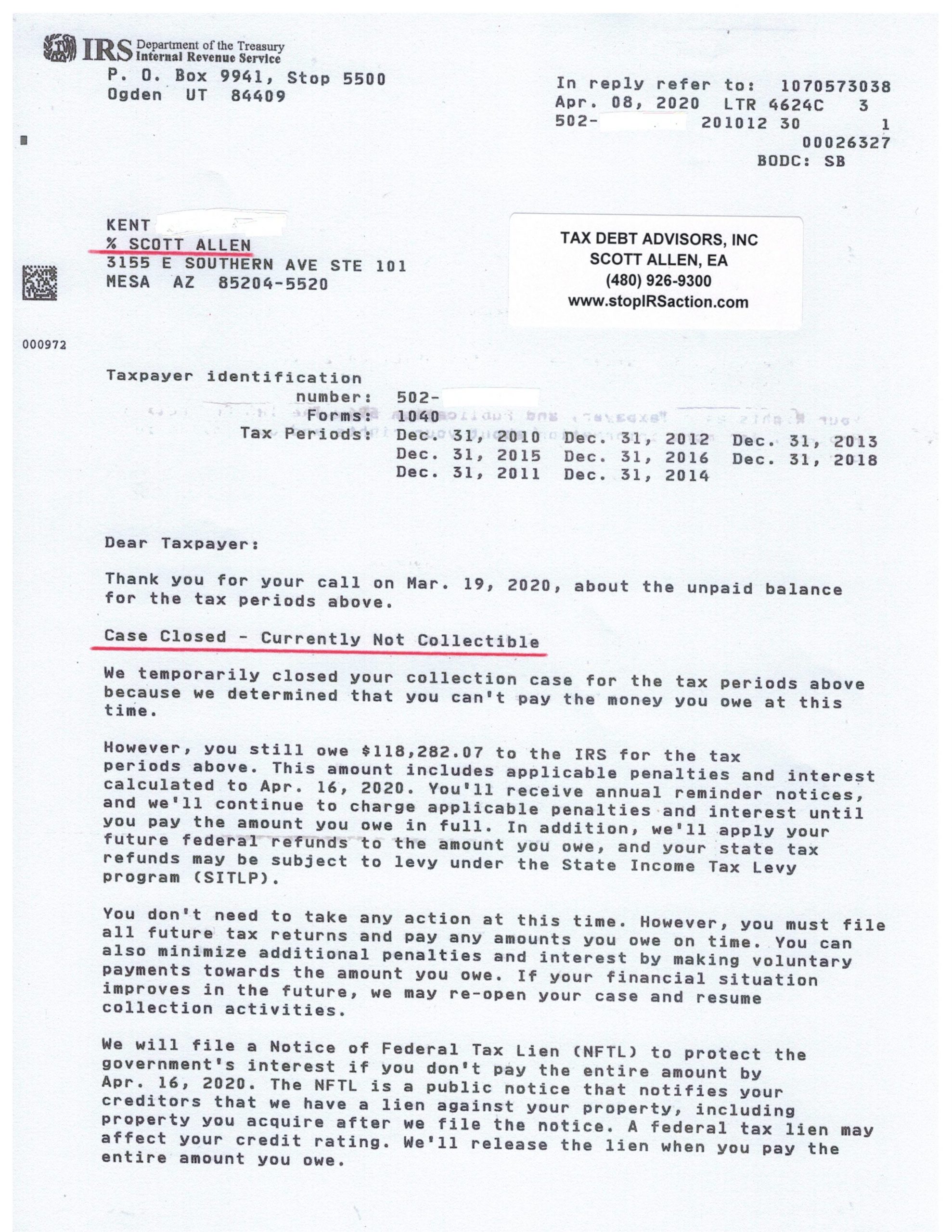

irs garnishments garnishment

The Garnishment Process. Income Sources. How to Stop a Wage Garnishment. Grounds for Challenging a Garnishment. Grounds for Challenging a Garnishment. You're limited to just four scenarios when you're objecting to a garnishment: You actually had custody at the time you did

Wage garnishment in Arizona is a remedy available to creditors—which means that it is a way that creditors, or people who are owed money, can look to collect from debtors, or people who owe them money. Specifically, wage garnishment is when a creditor has the right to have part of the debtor'

The Arizona bankruptcy court utilizes a system known as the Electronic Court Filing system (ECF) that allows bankruptcy attorneys to file documents electronically 24 hours a day 7 days a week. If you move quickly you will be able to stop the garnishment before it ever happens by filing for bankruptcy.

garnishment wage repaid garnished wages

Wage Garnishment. In Arizona, creditors may garnish 25% of your disposable earnings. This is equal to your income, after taxes and government benefits. Retirement and long-term disability, or social security income are protected.

that happens, then the judgment creditor must file papers with the court to start the garnishment process. Once a creditor is attempting to garnish your wages, you might be able to challenge the garnishment by raising an objection. The procedures you need to follow to object to a wage garnishment depend on the type of debt that the ...

How Is Wage Garnishment Calculated? Exactly how much money can be garnished from your paycheck? Title III of the Consumer Credit Protection This can help you avoid a drawn-out process of installment payments. But if you can't pay the garnishment in one blow, then accepting

If the IRS is threatening or has issued a wage garnishment, understand what options you have to stop the IRS wage garnishment or release the levy.

State of arizona employee wage garnishments creditor garnishments. How will the garnishment deduction be calculated? The amount deducted is calculated in accordance with Federal and State What is the deadline for submitted paperwork to change/stop a garnishment?

How Can I Stop a Florida Wage Garnishment? If you have been notified that your wages will be garnished, you will need to act quickly. Using Bankruptcy to Stop Garnishment: Immediately after a Chapter 7 or Chapter 13 bankruptcy case is filed an automatic stay will be enacted.

In Arizona (justice court) a motion is filed with the court, then sent to the creditor for an answer (15 days?) and then sent back to me/ my spouse for a Our Religious exempy church does not, and has never honored a garnishment for and employee. I need to know under what kind of exemption

How to Stop Wage Garnishment in California Examples of Wage Garnishment Contact OakTree Law. The IRS takes into consideration how many dependents you have before setting a garnishment rate. In the state of California and owe back taxes, they can garnish up to 25% of

wage garnishment laws in Arizona are generally the same as federal wage garnishment laws, with a few added protections. The creditor will continue to garnish your wages until the debt is paid off, or you take some measure to stop the garnishment, such as claiming an exemption with the court. Your state's exemption laws determine the amount ...

garnishment wage

Wage Garnishment In Arizona Learn How Filing Bankruptcy Can Help You With Possibly Stopping Wage Garnishment Ask Ou Wage Garnishment Filing Bankruptcy Sample Letter Of Explanation For Bankruptcy Inspirational Underdog Law Blog How To Stop Collections After Bankruptcy Law

garnishment wage form worksheet calculation kansas writ forms answer lien continuing

How Does Wage Garnishment Work in Arizona? Wage garnishment is the name given to the legal proceedings in which an employer is required by Of course, the best way to stop your wages from being garnished is to make good faith attempts to pay down your debt. If you are unable to do

for Support (if the judgment debtor owes back child support or maintenance/alimony). Writs of Garnishment for Support have priority over all other Writs, regardless of when they are served. A Writ of Garnishment is effective for 182 days (or 91 days, for a judgment that was entered before 8/8/2001).

loan modification sml banner