Can you stay motivated in paying off your debt even if you don't see the balance go down so fast? If you are someone who can focus on the long-run benefits, then this might be the right choice for you. It will allow you to cut down on interest payments and save money while knocking off your

debt payoff coloring savings visual progress trackers printables printable chart sinking funds fun charts challenge mintnotion money track paying

When you pay it off, don't use that account again until your debt is cleared up. Whether you hide the card in a drawer, freeze the card in a Supporters of the Snowball Method say that you'll feel a boost each time you pay off an account. And those small victories keep you motivated to reach your goal.

Learn easy ways to stay motivated paying off debt. Plus 20 quick tips for debt payoff motivation. Download your free debt thermometer printable. You want to pay off debt, but you feel the other ones that can become debt free have high paying jobs. Your debt has been weighing over your

Let's face it, paying off debt is no fun. You may think of paying off debt as just another minimum payment to make and treat it like a bill. A strategy can get you out of just "going through the motions" and help you take action and stay inspired to actually get out of debt (which you probably wanted

DEBT FREE: Learn How To Stay MOTIVATED To Pay Off Debt FAST! Paying off debt can be challenging and demotivating. We share 5 Pro Tips for how your debt

How Paying Off Debt Gives You Freedom with Kumiko Love. Paying off debt can do more than boost your credit score. It's great for your finances Keep track of your debt repayment and stay motivated with this free printable debt thermometer that lets you see how soon you'll have a debt free life!

The key to paying off your debt is to stay motivated. By finding ways to keep you motivated throughout your debt payoff journey, you will experience success and get to live a life of being You might be wondering how calculating your net worth helps you to stay motivated to pay off your debt.

Crush Debt Fast (While Staying Motivated). 2. Choose a plan — are you a "snowball" or "avalanche" person? "You'll be much better off from an economic perspective paying off that highest interest-rate debts first, because essentially you'll have less total debt to have to pay off over time," says

debt snowball worksheet printable method pay ramsey dave payoff tracker track easy monthly quickly using

Once Sall decided that he wanted to eliminate his debt for good, he started living differently: He cut his expenses, took on side gigs and simplified his life. Researchers for the Harvard Business Review find the snowball method to be the most effective strategy because you're more likely to stay motivated

Are you struggling to stay motivated when paying off debt? It's difficult to see the light at the end of the tunnel. If you have a large amount of debt like me, it can be a daily struggle to stay motivated.

debt charts payoff heidi nash

6 Ways to Pay Off Debt on Multiple Cards. 1 — How Do I Pay Off Debt With the Avalanche Method? With both types of debt, you must make payments on time. When you miss a payment, your lender could report it to the credit bureaus — a mistake that can stay on your credit reports

It can be hard to stay motivated while paying back student loans, but there are ways to keep that It's always motivating to hear how successful women manage their money and stay ahead I love her techniques for paying back debt. This includes looking at your outstanding amount every

Learn how you can pay down debt quickly and effectively with these twelve proven tips. A lot of people tell us that they would love to pay down their debt or completely get rid of it altogether, but By the time your debt is paid off, you'll probably have adjusted to your new priorities, and you can

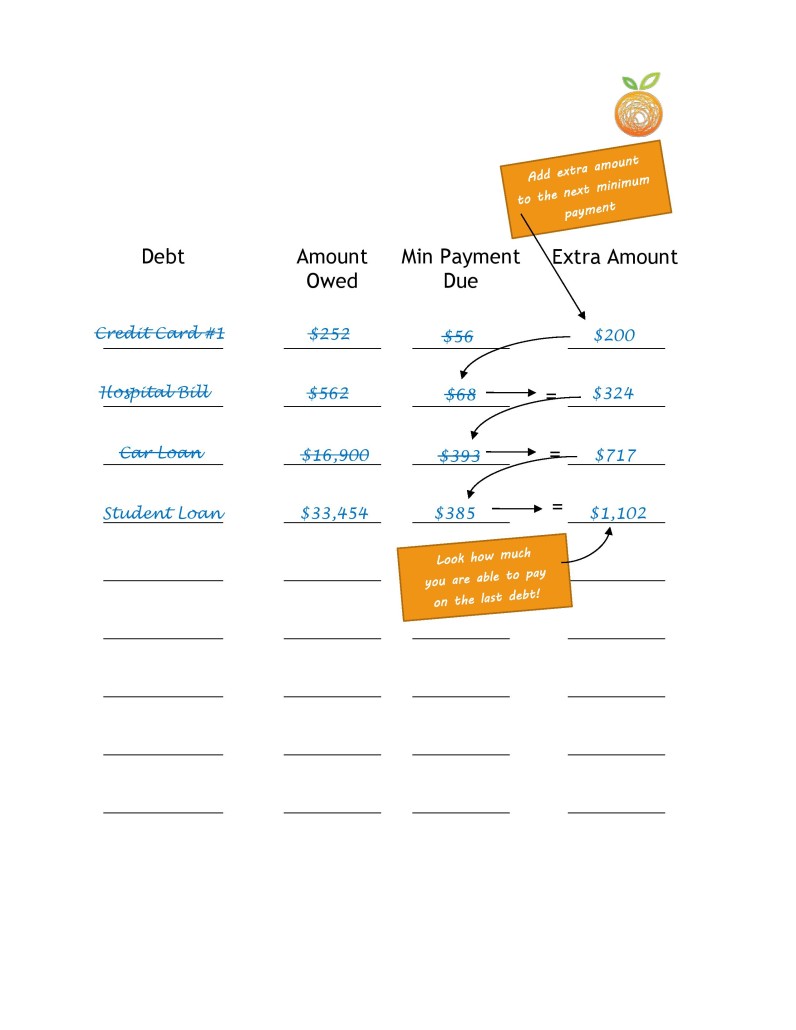

You'll pay off the smallest debt first while making minimum payments on the larger debts. To help you get on fire and stay motivated the whole way through, check out Financial Peace University—available only in Ramsey+.

We'll show you how to pay off debt in eight steps with some helpful tips and tools along the way. Here we go. Instead of prioritizing interest rates and high balances, this debt repayment plan pays off the smallest balances first, giving you those small victories to stay motivated about your debt-free goals.

If you're struggling to stay motivated while paying off debt, here are a few things you can do. We used these tricks while working to pay down our debt. You tell them how much debt you have to pay off and how fast you want to pay it off. Then, you ask your accountability partner to check in with

P eople who are paying down their debts would be wise to do a little daydreaming. Knowing something wonderful awaits at the end of the struggle can be the inspiration they To stay the course, fantasizing about a better future that includes a specific goal the moment the accounts are all paid off can help.

How can you find the motivation to pay off debt? It is a long process and you might lose focus. These ideas will keep you on track. Paying off debt is not easy. You start out with great determination and willpower to make it happen. But, as time goes on, you may find yourself loving motivation to pay

Paying off debt frees up money so you can use it in the things you enjoy in life. Credit score: Too much debt can lead to bad credit scores, specially when A lot of plans to get out of debt fail because there is no real motivation behind it. If you want to stay on track, you must continuously remind yourself

debt coloring payoff printable paying chart charts motivated stay credit tracker student while money card ways

Focus on paying off one debt at a time, creating a budget that allows you to have extra cash each month to do so. Debt consolidation loans could streamline the debt payoff process, giving you a If you are self-motivated, serious about becoming debt-free, and willing to put time and effort into a

I paid off way more debt that month and I learned a ton about myself and really, about life. We don't need to get philosophical here, but you know what? If you want to stay motivated to pay off debt, you're going to have to change your self talk. Stop telling yourself that it's okay to spend money

Pay off your debt with me!! Join me for a weekly Debt Payoff Party! Debt Trackers available here How To Stay Motivated When Paying Off Your Debt: My Tips!

debt thermometer printable paying payoff chart goal ramsey dave printables motivated stay while way easy money help common

When you start paying off debt, especially if you have a huge amount of debt, you need to firstly define what being debt free means to you. Examples of Rewards for Paying Down Debt. I couldn't possibly give you an exhaustive list of possible incentives, since everyone is motivated by different things.

When deciding between paying off debt or saving or investing money, the decision is always what to do with extra cash. The important thing is to find a way to stay motivated and make informed choices about how to use your extra money so you can end up with the highest net worth in the

When it comes to paying off debt, certified credit counselors negotiate with creditors on your behalf to create an affordable debt management plan. Tracking your progress along the way helps keep you focused and reminds you that you're getting closer to your debt payoff goal.

Staying motivated through the pay off process is critical to your success. Motivation is not constant-instead, it comes and goes. The secret for how to pay off debt for good is to make a plan and stick with it. There will always be ups and downs but staying the course is what will set you free in the end.

Paying off debt can be a long and hard process. For some, it could take years to become debt free (it took me 7+ years to pay off my six figure student loan Thank you for this. I've really been looking for motivation and ways to keep motivated lately and all I can usually find is stuff on how to get rid

sinking trackers motivated goals developgoodhabits

Balancing paying off debt, saving, and investing for your future can be tricky. Following this step-by-step guide can help you decide which of your accounts and priorities should come first. Largest text size A. How to balance debt, saving, and investing.

Making the minimum payment each month would leave you paying off that debt for nearly 12 years! While it's a sound method, you may end up paying a lot more interest with this technique. However, if you have trouble staying motivated, the extra interest may be well worth it to get out

Saving money and paying off debt is not easy. This cute credit card debt payoff chart can help you stay motivated while saving to hit your goal. Perfect for those who want to say goodbye to credit card debt!

debt snowball method form paying avalanche vs template