Get Started. How to process payroll yourself. Summary : Doing your company's payroll on your own costs Most payroll services calculate employee pay and taxes automatically and send your payroll taxes and How to process payroll with a payroll service: Just like with the DIY option above,

team understands the demands of running a small business. Whether you are a solo entrepreneur that wants to plan for the future or you manage a team of hundreds and need payroll assistance, we know the ins and outs of small business accounting that can help make your business more successful.

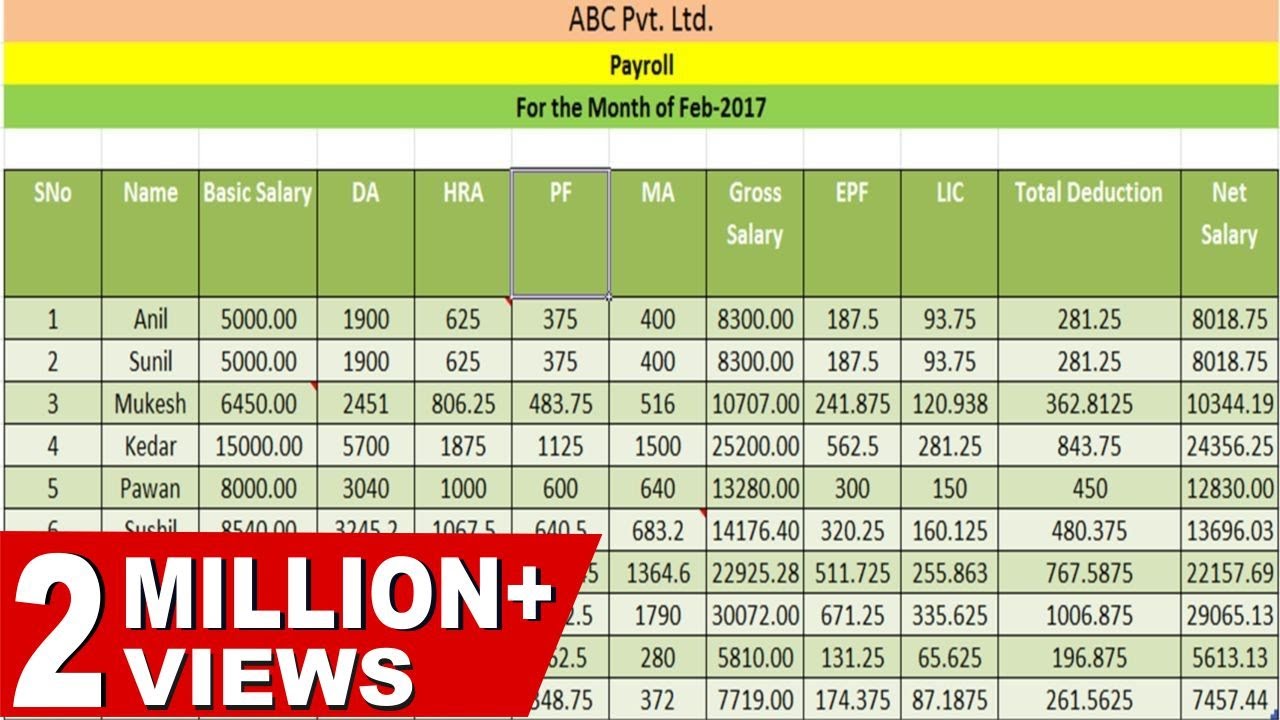

The Payroll Process. Everything small businesses need to know about payroll (and taking care of employees). Think of this as your small business payroll guide! Every month, we help thousands of businesses like yours calculate their pay runs, pay their employees, and process IRS tax filings.

6. How much does a small business pay in payroll taxes? 7. What should you look for when shopping for payroll services for small businesses? The full-service plan is for companies with more than ten employees. There are three plans to choose from, with pricing starting at $ for up to

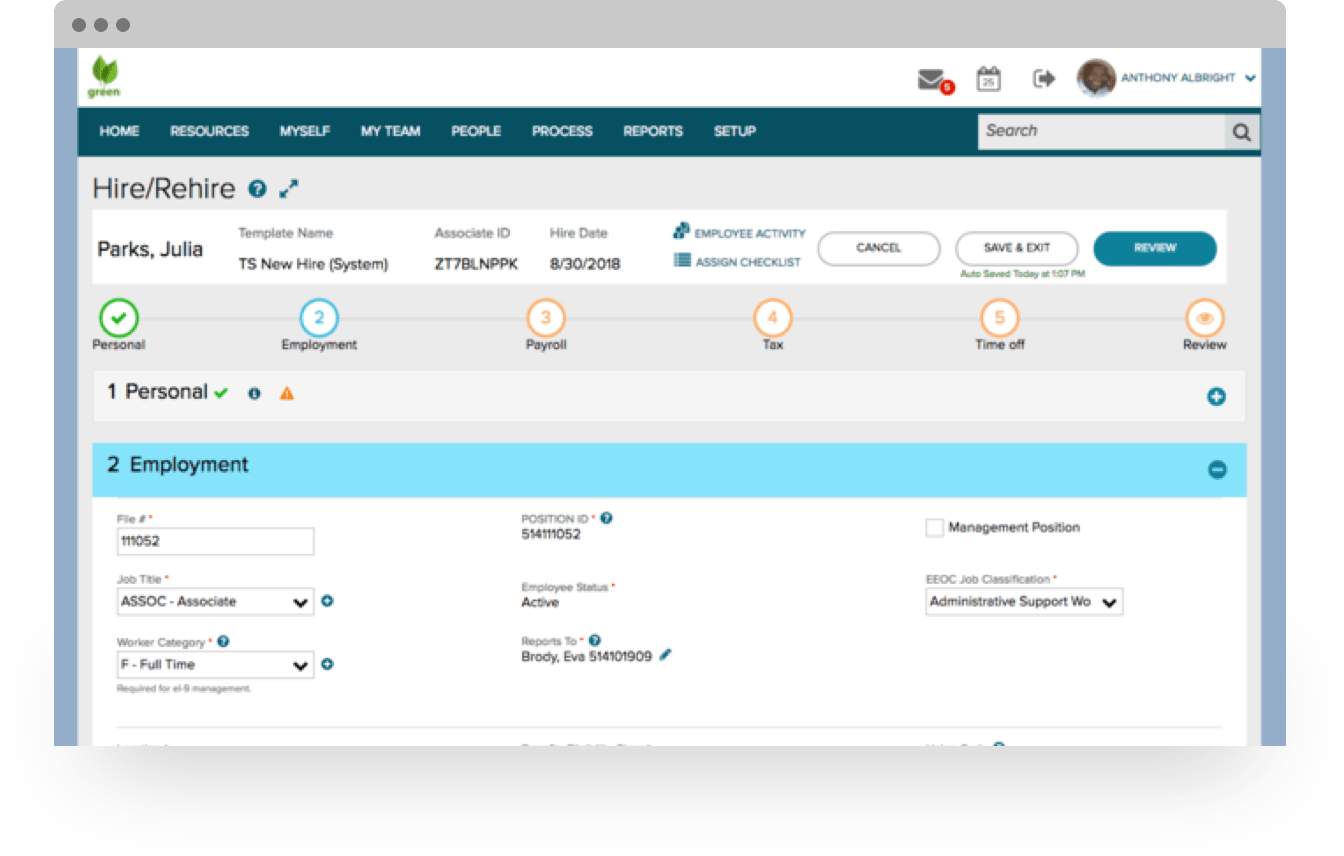

A payroll company keeps up-to-date on federal and local regulations, automatically searching for any available tax credits or opportunities. If you do choose a payroll partner, make sure the company offers additional HR services like recruiting, onboarding and benefits.

A payroll company can make the withholding calculations and submit the net payment amounts to each worker's bank account. You supply the employee data and the company bank account you use to process payments. You may need to deduct additional employee items such as retirement

How to do payroll accounting: 7 steps. At first glance, payroll accounting can be scary. As a reminder, expenses increase with debits. Debit the wages, salaries, and company payroll taxes you paid. To get started, let's take a look at a payroll journal entry example, shall we?

Their company pays employees every two weeks for a total of 26 pay periods. Typically, running payroll only applies to paying employees. When processing payroll, the tax burden is split evenly between employer and employee. How to create a payroll report for PPP loan forgiveness.

Depending on savvy payroll administrators who know precisely how to create an in-house payroll system allows your company total control over To start a successful business, you'll need a good productivity software suite including a word processor, presentation programme and a spreadsheet

Starting a Payroll Business in any country would not be a challenge until you are aware of the local laws and the applicable statutory compliances. 1. Partner/Buy a local payroll software. Try to look for local companies as they might have configured there product as per to the local laws.

Do you want to start a payroll service online from home? One of the businesses you can begin to look at starting is the payroll service business. This is if you intend becoming an employer of labor in the united states of America, then you are responsible according to the law to ensure that

If you're thinking of starting a payroll processing firm, here are the five core elements you'll need. Also consider people who have been processing payroll in-house for a sizeable company. Be especially careful about how you create quotes. Your first instinct may be to create an Excel

What is the best payroll company and how much does it cost? Find out how a payroll service can help your business. Whether you want to start using payroll outsourcing companies or switch to a new one, read on for ways to find the perfect pick for your business.

How much do payroll services cost? So what do payroll companies provide? Getting a peek inside your new payroll provider. Most payroll companies charge a flat monthly fee, plus an additional fee for each employee. Typically these fees start at around $5 to $10 per employee per month.

How do payroll companies make money? A payroll company also makes money from the frequency of your payroll plan. 2 Are payroll companies profitable? 3 How much does it cost to set up payroll? 4 Can I do payroll myself? 5 What is an example of a payroll fee?

Online payroll software can improve a company's payroll processing, automate Growth: Zenefits' Growth plan starts at $18 per employee per month (discounted to $14 at the time of this writing). An online payroll service calculates how much each employee should be paid based on their pay

requirements payroll human resource hr system software attendance checklist analysis pr gap ta rely topics outdated dated even better found

graduation

neighbors spending pursuing

catering start indiafilings starting company ledgers nearest expert tax account

What is the company trying to achieve and how does it go about achieving it? What are the pain points it needs to address? What role does global payroll play Take a broad view of payroll, beyond simply paying your employees. The global payroll solution you choose will impact your HR, Finance,

Payroll service companies facilitate automated payment processes with their products and services. They do more than this though. We hope you're leaving this article with the knowledge to take your first steps. As you can see, starting a payroll service company is a huge undertaking.

I wanted to pull out the camera and talk to you about "how to start a payroll company" for the stern facts of how people are making incomes with this business so number one you can get If you made it to the end of this video on how to start a payroll company, and would like to learn the skills

How Relevant streamlined payroll operations at a US-based fintech company with a custom solution How much it takes in terms of time and budget to develop a payroll automation system Priorities for a payroll management solution. Choosing how to automate payroll processing

Outsource Your Payroll. For many businesses, payroll services offer an attractive and valuable alternative to in-house processing. Chosen correctly, they provide a less expensive, simpler means of paying your employees, filing your taxes, and performing a host of other duties these companies'...

Learn how to choose a third-party payroll service with Paychex. Next comes selecting the right payroll service provider for your specific needs. Where to start? A payroll service provider is a third-party service with the objective of meeting a business's IRS filing and deposit obligations.

How does outsourcing payroll services work? Be aware that hiring a third-party service provider Working with a payroll company located abroad, but making sure they have a local representative you can With all this information in mind, you're ready to start looking for the ideal payroll

A payroll is the list of employees of that company that are entitled to receive pay and the amounts that each should receive. Payroll service business is a massive industry predicted to reach $45 billion by 2020. Payroll is a service for employers- and that makes it a natural complement to other

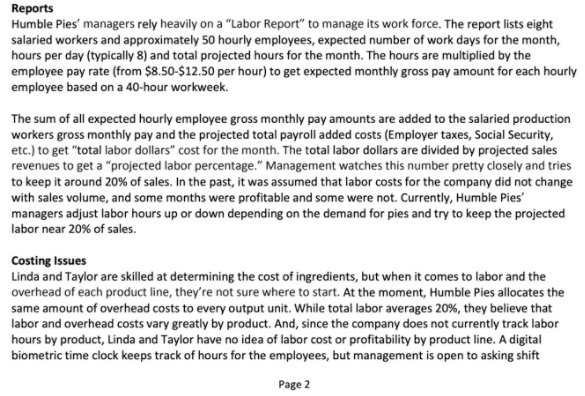

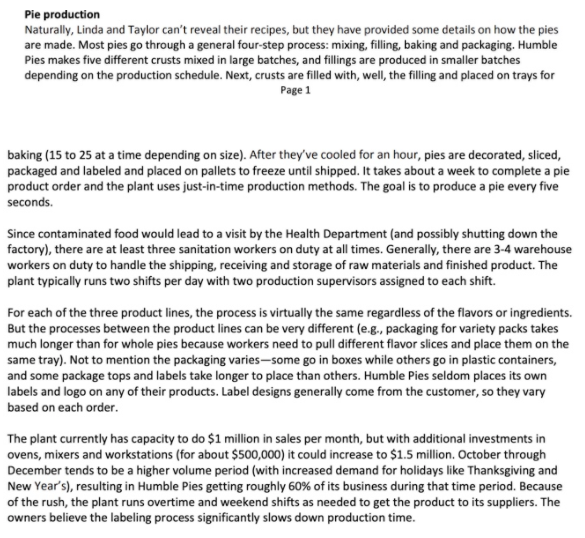

Learn how to do payroll. We will start with the basics of payroll. 1. Payroll is a list of employees who get paid by the company. Payroll also refers to the total amount of money employer pays to the employees. A payroll officer needs to do careful planning. There are always ongoing tasks that need attention and a constant need to monitor changes to withholdings, contribution to social security

neighbors abroad owners pursuing

internal controls accounting sap process functions blogs implement

a new company file with data from your existing file SOLVED • by QuickBooks • QuickBooks Enterprise Suite • 8 • Updated over 1 year ago Learn how to start over with a new company file, and include accounts and lists (customers, vendors, items, etc.) from your old file in QuickBooks Desktop.

I currently use a company to "process my payroll." I am the only employee of my US based S corp. Every month the payroll company takes $700ish On Sunday he started a long email rant about how I bullied him, railroaded him into working and yelled at him. Because of that he didn't want

What a Payroll Company Does. As a payroll services provider, your company is responsible for handling records on employee wages, deductions, hours worked and pretty much everything else related to compensation for your clients.

started a business and have begun employing people, it's important to learn how to do payroll and set up PAYE as quickly as possible. If you decide to outsource payroll, all you need to do is find a specialist payroll company, and they'll handle the entire process for you.

Construction companies have special needs that many payroll services don't understand. Read our guide to construction payroll software. If you start with the DIY version, it starts at $59 per month + $4 per employee. Prices may be higher for construction companies needing specialized payroll

adp totalsource peo source total

How to calculate and do payroll on your own. Many small businesses begin doing payroll on their own and if you only have a handful of employees This guide is intended to be used as a starting point in analyzing an employer's payroll obligations and is not a comprehensive resource of requirements.

Any company that employs people needs payroll services. If you're good at working with numbers, consider starting a business in this niche. You'll not only increase your revenue but also make a difference in your community. Wondering how to start a payroll company? First, you need

constraint partitioning multilevel algorithms

salary excel payroll sheet payslip create hindi