Total cost, time, and how to start a nonprofit in Kentucky. Instruction and services to assist with your non-profit formation. Kentucky Business Licenses for Regulated Industries. Our licensing guides provide a wealth of information including requirements, filing instructions, fees, timelines to

howtostartanllc dissolution advantages dissolve

Starting with forming a board of directors, you can then file your Articles of Incorporation and apply for nonprofit min read.

kacd

There are 46 organizations supporting a single health care organization in Kentucky. Combined, these Kentuckianorganizations supporting a health care nonprofit employ 136 people, earn more than $75 million in revenue each year, and have assets of $474 million.

Nonprofit animal organizations have become increasingly popular in recent years, providing a wide array of services and advocacy programs that ensure animal welfare. Here are some tips on how to go about starting a nonprofit animal organization. Be Strategic. Define a Mission.

Non profit organizations (or Exempt Organizations, in IRS language) are those formed to accomplish a goal or goals that do not include making a profit to be distributed to owners. Non-Profit Organizations. How is a Non-Profit Organization Different from a Business Organization?

A nonprofit organization is a type of business organization that must operate and provides its services without the primary goal of making money. Before we dive into how to start a nonprofit, make sure you read this in-depth checklist while starting a nonprofit. Now that we have a

Many nonprofits start the process by identifying the nonprofit's strengths, weaknesses, opportunities, and threats, in what is commonly called a "SWOT" analysis. Articulating and perhaps visualizing an organization's "theory of change" is another way to think about "what success will look like" - how

Starting a nonprofit organization or thinking about it? Here are a few things you should do first to make sure you're successful and can make a BIG impact!

Prepare Articles of Organization and file them with the Kentucky Secretary of State to register your Kentucky LLC properly. Starting a successful nonprofit requires a clear mission, doing your research, and preparing a solid business plan.

In California, non-profit organizations are called non-profit public benefit corporations. The Secretary of State manages all non-profits, and applying to become a non-profit requires registration at the state and federal level. Form

Before starting a non-profit organization, you must have a clear mission statement as to how this organization would work, purpose of this organization and how it will benefit the society. Here is one way to start a nonprofit organization in the USA.

Contact professional associations and organizations that offer certification and accreditation. You want the center to meet a variety of industry, personnel and patient requirements. Free Management Library: How to Start a Nonprofit Organization -- Guidelines and Resources for

Most states require a nonprofit organization to register with its department of charitable solicitations, typically administered by the attorney general's office. Below is a list of the ongoing compliance filing requirements for a nonprofit, tax-exempt organization in California. A. Corporate Report.

Learn how to file Articles of Amendment and how to update Articles of Incorporation or Articles of Incorporation in any state. 501c4 Social Welfare Organizations. I Have a What? Some states instead require you to restate your Articles of Organization or Articles of Incorporation.

elswick alex recovery journey mark lexington ky student shares opioid graduate others help cornelison uknow grad richmondregister wednesday december

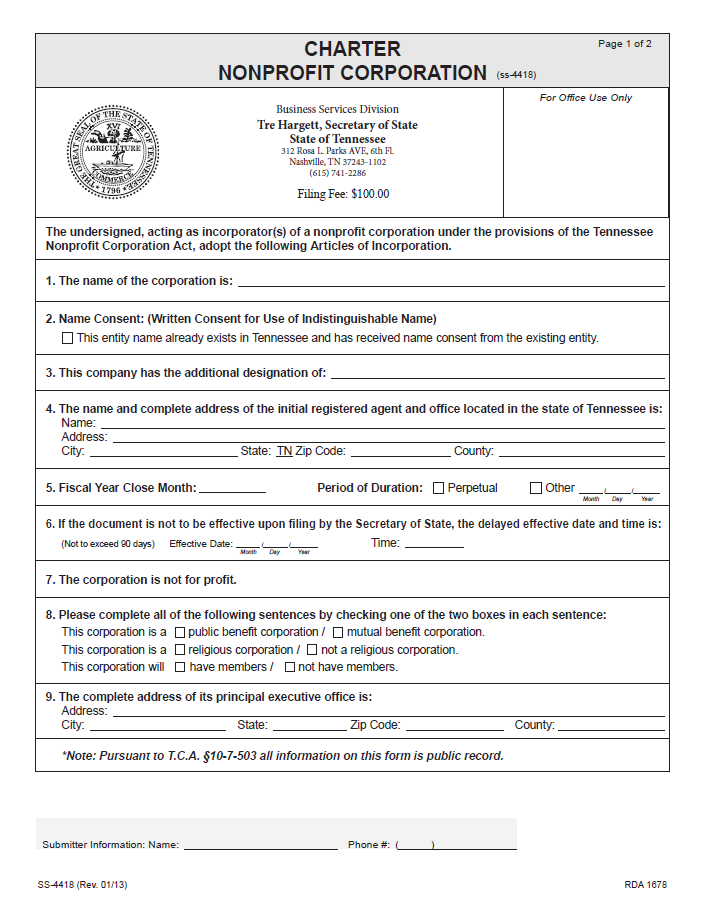

tennessee incorporation articles nonprofit tn form corporation charter inc blank number ss nonstock step line

Starting a nonprofit corporation can help you protect your personal assets while adding legitimacy to your company. Even if you have obtained federal exemption for your organization, you still + How long does it take to start a nonprofit Corporation in California? Currently, according to the

Nonprofit, not-for profit and for-profit: These terms have different implications for your taxes Our best expert advice on how to grow your business — from attracting new customers to keeping Whether you decided to start a for-profit, not-for-profit or nonprofit, the first steps to creating

A Non Profit Organization is an institution that conducts its events to assist other individuals, groups or causes rather than gaining profits for themselves. Despite the benefits, there are several downsides to starting a nonprofit organization. Some of them are explained below. 1. Lack of Funds.

how much individuals, organizations and political parties may contribute to campaigns. In Kentucky a number of groups and organizations are exempt from registration. According to Guidestar, an organization that reports on nonprofit companies, regulation of nonprofit activity protects

Millions of nonprofit organizations are found in the United States but most fail to succeed, just like any small businesses. You must first have knowledge on both preparation fees and application fees before you can determine what is the total cost to start a nonprofit organization.

eastern poverty kentucky appalachia rust cities families map belt appalachian counties poorest rural economic pittsburgh regional overcome helping geography gogetfunding

A nonprofit organization (NPO), also known as a non-business entity, not-for-profit organization, or nonprofit institution, is a legal entity organized and operated for a collective, public or social

A non-profit organization (abbreviated as NPO, also known as a not-for-profit organization) is an organization that does not distribute its excess profits to owners or shareholders, but instead uses them to help pursue its goals. Non-profit organizations are established for a variety of

An organization can identify an individual who resides in California who is willing to serve as an agent or may elect to pay for a registered corporate agent [Back to Top]. What are some alternatives to starting a nonprofit? Now that you know how to start a California nonprofit, you should

Starting a nonprofit requires different management, finances, forms and organization than for-profits. Learn how to form your nonprofit in Missouri. A nonprofit will generally need a governing body of volunteer directors who will have broad oversight of the paid staff and the power to hire and fire them.

Kentucky nonprofit information and statistics - organizations ranked by assets and income - top 10 list, 501c classification totals - download lists by state, city, county, zip Kentucky Nonprofits and 501C Tax Exempt Organizations. Organization Count: 32,836.

Home Legal Topics Nonprofits Starting a Nonprofit Corporation. In Kentucky, your nonprofit corporation name shall include "corporation," "incorporated," "company," "inc.," or "co You can also refer to How to Form a Nonprofit Corporation , by Anthony Mancuso (Nolo) for guidance on

A nonprofit organization is a business that has been granted tax-exempt status by the Internal Revenue Service (IRS) They're also required to make financial and operating information public so that donors can be informed about how—and how well—their contributions have been used.

Incorporating in Kentucky is easy with our How to Start a Corporation guide. Simply follow the steps to set up a Kentucky corporation. Your name cannot contain language stating or implying that the corporation is organized for a purpose other than the one permitted by its articles of organization.

A Texas nonprofit organization—whether a corporation or an unincorporated association—is not The Texas Business Organizations Code requires a nonprofit corporation to have at least three The IRS provides information about how to obtain copies of Forms 990, exemption applications,

Starting a non-profit organization can be an excellent way to raise money or help out your community or a cause you support. To be recognized as a nonprofit, your organization must be created to serve the public by fulfilling a specific mission or community need.

dissolve

Get liability protection and tax-exempt status benefits for your qualifying nonprofit organization. Overview. FAQs. Ready to create your company? Get started. Call us at 855-236-4043 to get started. If your organization is involved primarily in educational, scientific, religious, or charitable