Crypto funds are popping up all over, and I've helped many clients navigate the murky waters of regulatory compliance around ... Boy, do we have a good one today. How to start a hedge fund from scratch! The title is pretty self-explanatory for this

Looking at how crypto hedge funds are using Bitcoin and other cryptocurrencies other than for investment purposes, we asked whether they stake, lend or borrow digital assets. The activities listed below were highlighted by the funds. Percentage of crypto hedge funds involved in staking,

Hedging Bitcoin: A Crypto Risk Management Strategy. Author: Contributor Date: July 29, 2021. Why Hedge Cryptocurrency? How to use Hedging to minimize trading risks? A diversified strategy generally and preferably involves putting funds into investments that do not move in a uniform direction.

Crypto hedge funds are bringing their billions to crypto. Here's how they're changing the investment landscape What is a Crypto Hedge Fund? While the majority of day traders bet their own money on being able to That trade has started to bleed into Ether as well, which has helped the price of

Just like hedge funds, crypto funds come in all shapes and sizes, and investors tend to look at them through their usual hedge-fund analysis prism. This is part one of a two-part series on how to sort crypto funds — read part two on how to analyze actively trading crypto funds with some

How To Start Your Own Crypto Hedge Fund? How Crypto Hedge Funds are Governed What are crypto hedge funds? At its most basic, a crypto hedge fund is a trading platform

hedge

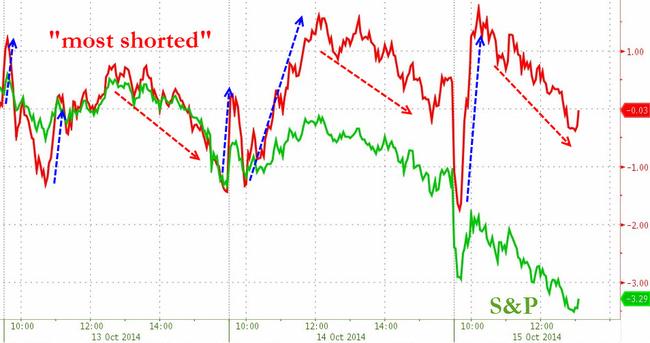

suddenly stocks tanking

How Do You Categorize Hedge Fund Strategies? You could classify hedge funds according to dozens of criteria Often, hedge funds using these strategies will long one security and short another security in the same company's capital Finally, some of these assets are so new (crypto) that there's

How does the experience differ from going to say an L/S equity fund? Anyone familiar the the research and investing style of crypto hedge funds? Are they just buying up tokens they think have potential or are they constructing portfolios using the derivatives like you can get on FTX?

Cryptocurrency funds infographic. Top 10 crypto funds, digital asset fund assets under management, top crypto fund countries and cities. New crypto fund launches for 2017 and 2018 and more. View crypto hedge fund and venture capital charts and graphs in this crypto fund infographic.

prnewswire successive hedge ketil prnewsfoto

A cryptocurrency hedge fund is an actively managed investment fund that pools capital from investors (usually individual retail investors) and invests in cryptocurrencies, often with complex portfolio-construction strategies and sophisticated risk management techniques.

margin stocks

This crypto hedge fund seeks to generate capital appreciation while reducing risk. In a crypto ETF, the fund tracks the price of a cryptocurrency (or multiple currencies). Thus, it gives individual investors easier access to cryptos without learning how to open and use bitcoin wallets, etc.

let london pm prisoners violent boris

Building a Crypto Hedge Fund. wingz (65). in #trading • 5 years ago (edited). So given everything, how do you build a crypto hedge fund?... Or more aptly put how do you maximise the return If you don't get reputation in the market nobody will give you money. Majority of traders start small, and

When you start a crypto hedge fund, you get to invest in cryptocurrencies held by affluent investors. Learn strategies and make wise decisions to reap Attractive: Crypto hedge funds seek to attract market participants such as institutional investors and third-party custodians. The volatile swings

Select a hedge fund strategy. Hedge funds managers usually get their start by achieving a successful investing track record throughout years of industry experience. This is how they attract their first clients and build out their funds. But even with the requisite experience, you'll also need an overall vision

How do crypto hedge funds manage their cryptocurrencies since there are no custodial services for cryptocurrencies? Is it possible to get a +50% return Here are a few articles to help you get started: How to start a hedge fund (in 5 steps) Types of hedge funds Basic questions for anyone wanting

Like traditional hedge funds, crypto hedge funds are a great choice if an investor is looking to How do They work? As mentioned earlier, a hedge fund manager utilizes either the discretionary or the There are two types of crypto hedge funds that are currently ruling the markets. One is the kind

A crypto hedge fund is basically a crypto trading platform where you pay someone else to do the trading. Crypto hedge funds are similar to traditional Here's a short primer on how to build your own simple crypto hedge fund: Define your strategy: There are many different ways to trade, but

Statistics on crypto hedge funds The firms estimate that global crypto hedge funds had about $ billion in assets under management last year, up from $2 billion in 2019. Based on a recent study, traditional hedge funds have started to dip their toe into the water of cryptocurrencies .

Most crypto hedge funds have monthly instead of quarterly redemption notices, on the basis that the fund's positions are all assumed to be liquid. As a general point, it will be more difficult for you as a crypto hedge fund manager to justify long redemption notices, gating, and side-pockets than in

The crypto hedge fund seeks to maximize returns by adding newly offered coins (ICOs) to the mix. Hedge funds have long been a popular choice for risk-averse investors and rely on the fund's visionary founder and teams of analysts to guide their money in the right direction.

A hedge fund that somehow figures out how to put the mining part of crypto assets to use would have a clear unfair advantage over the others. I have spent countless hours perfecting its economics. Over time, I got so intrigued with the idea that recently I have started pursuing it myself along with a team.

I started my hedge fund in 2012. Most hedge funds fail because founders overlook the back office while preferring to focus on strategies (don't we all?). Enjoy a colorful crypto journey with Ledger. Secure your crypto assets with the world's most popular hardware wallet. And differentiate the

For crypto hedge funds especially, which make thousands of transactions across dozens of different exchanges and platforms, GPs must contract with How to Start a Hedge Fund. SEC's Analysis of the Market for Unregistered Securities Offerings. Tax Treatment of Partnership Funds and Mergers

The story of how Surf Finance built a $5m hedge fund on an Aragon DAO. With a vague idea of harnessing the wisdom of crowds and latent talent in the crypto community, he began to build a Discord channel by inviting thoughtful members of other projects to discuss the crypto markets

How to Get Started in Crypto Learning. Crypto Hedge Funds - An Ecosystem Map. For many of the crypto funds mentioned below, the minimum investment is usually around $100,000 to $250,000. Many of the funds offer monthly or quarterly liquidity, except the venture funds

Hedge Funds Investing in Cryptocurrency Outright. This article is directed primarily to managers looking to start a cryptocurrency fund to invest in Bitcoin and alternative coins directly. For a comprehensive overview of how to start a cryptocurrency fund, including regulatory

Bitcoin Reserve runs a crypto hedge fund called an "arbitrage fund." This fund trades across different crypto exchanges at the same time to try and "correct market inefficiencies." This is an interesting strategy because many cryptocurrencies follow different prices across different crypto exchanges.

Matthew Dibb of crypto hedge fund Astronaut Capital also shared his price outlooks for bitcoin and ethereum. A crypto hedge fund manager breaks down his 3 trading strategies, including a liquid fund that has returned 1,240% since June 2019 — and shares the next alpha-generating trend on

Hedging with futures is best suited for crypto investors that carry the standard coins and want to hedge their Perpetual swaps (perpetuals) have recently grown in popularity as more and more crypto exchanges have started to offer them. It also gets you started on using options for hedging.

bitcoin mining companies