An employee stock ownership plan (ESOP) is one strategy that can help business owners Plus, ESOPs are simpler to set up than other options, such as worker cooperatives, but can provide similar benefits in terms of providing financial empowerment for employees.

A good ESOP plan (employee stock ownership plan) is an excellent tool for business owners to help raise their company's value and take their business to the next level. It's common for start-up entrepreneurs to look at other companies in similar industries and try to mimic the success they've had.

You need an ESOP template, or employee stock ownership plan. There just has never been one available. So I built it. Only what the hell does an ESOP plan look like and how do you structure up something really special? Well, thinking is really overrated, in my humble opinion.

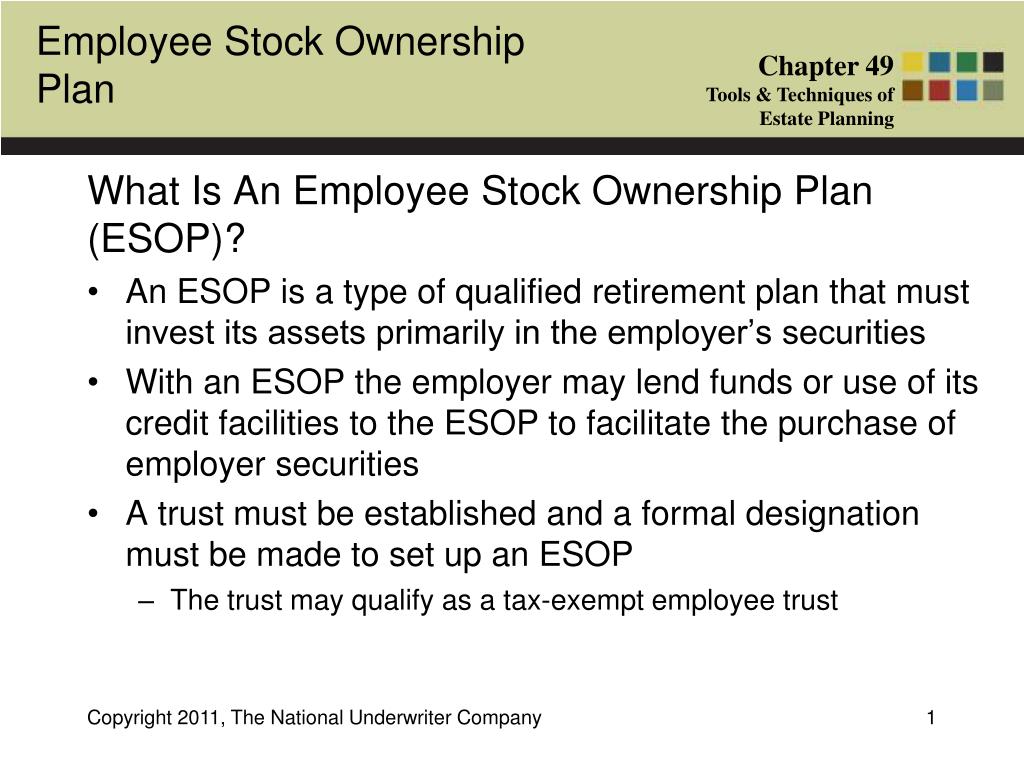

Employee Stock Ownership Plans ("ESOPs") are federally qualified employee benefit programs governed by law. Shares sold to an ESOP are held in a trust: the employees receive beneficial ownership, while and in most instances the selling shareholder retains control.

ESOP is an employee benefit plan that gives your employees ownership interest in the agency and Greg explains what motivated his decision to GL: Well, it stands for Employee Stock Ownership Plan, that is the first thing. It's a Department of Labor regulated program that is intended to allow

Employee Stock Ownership Plans (ESOPs) are also known as Employee Share Ownership Plans. An ESOP business model provide a company's An ESOP opens when a company sets up a trust and makes tax-deductible contributions to it. Each company needs to determine how to

ESOP is a retirement plan, but it is also a corporate finance transaction. It's the tax benefits that Congress has put in place that inspire choosing How do people get started setting up an employee stock ownership plan? The first thing we do is have formal conversations with the owner, get

scam

Why would companies adopt an Employee Stock Option Plan (ESOP)? Employee performance is directly linked to company performance and thus employee remuneration. Employees can only benefit from their ESOP when the market price of the company is above the exercise price which means

07, 2021 · An ESOP (Employee stock ownership plan) refers to an employee benefit plan which offers employees an ownership interest in the organization. Employee stock ownership plans are issued as direct stock, profit-sharing plans or bonuses, and the employer has the sole discretion in deciding who could avail of these options.

Employee Stock Option Plans are gradually becoming common among Indian startups. ESOPs provide an option to employees to invest and hold ESOP is an offer to employees of a business that allows them to buy company's stocks at a certain price. The objective of an ESOP is to

Want to know how to set up an ESOP in your startup? Employee share option plans (or ESOPs) are a key tool for startups to incentivise staff and hire Your ESOP rules set out the terms that apply to all options granted under the plan, including the process for granting options, how and when

- 1. How Much Equity to Set Aside in the ESOP? • Options Modeling - Overview. - 2. A Typical Distribution Schedule. When to Create an ESOP? Make employee equity allocations and set up an ESOP sometime between the pre-seed and early-VC stage.

40 years ago, Employee Stock Ownership Plans (ESOP) were virtually unheard of 4. Today there are approximately 7,000 vibrant companies that have ESOPs in place, benefiting over 13 million employees. While there are many reasons why a private company may set up an ESOP,

esop feasibility

.jpg)

witherspoon

10, 2021 · SEP IRAs are simple to set up and run, making them a popular choice for small business owners. ... A KSOP is a qualified retirement plan that combines an employee's stock ownership plan (ESOP ...

03, 2022 · Approximately 6,500 companies have an ESOP, and approximately 14 million workers are ESOP participants, (see Employee Ownership by the Numbers). An ESOP is a type of retirement plan, similar to a 401(k) plan, that invests primarily in company stock and holds its assets in a trust for employees.

ESOP can pay up to the FMV of the share and nothing more. Strategic buyers have the ability to pay more as the search to recoup the difference with future growth opportunities. A lot of ongoing costs exist: Just like every other stock management plan, an ESOP too would have many ongoing administrative costs that have to be paid. You will ...

An ESOP is an employee benefit plan that lets employees own part of the business they work for. Here's how ESOPs work and whether it's right for you. Setting up an ESOP doesn't typically require any input from employees — employers decide whether to set up an ESOP and employees

Employee stock purchase plans (ESPP) and employee stock ownership plans (ESOP) are two of the most popular kinds of employee benefit options . And by being a business owner, you can promote any of these employee stock plans in your company to motivate your employees. To begin with,

esop issuing legalwiz

27, 2022 · ESOP (Employee stock options)/RSU (Restricted stock units) are taxed as perquisites under salary income, upon exercising of the options or on allotment of the shares as the case may be.

About setting up an Employee Share Ownership Plan (ESOP). #ESOP #successionplanning #engagement.

An Employee Stock Ownership Plan (ESOP) in the United States is a defined contribution plan, a form of retirement plan as defined by 4975(e)(7)of IRS codes, which became a qualified retirement plan in 1974. It is one of the methods of employee participation in corporate ownership.

16, 2020 · An employee stock option plan or ESOP for short, is one form of remuneration given to employees, by means of retaining them or to reward them based on their performance. They are usually offered in the form of company shares which gives the employee ownership rights as a shareholder of the company.

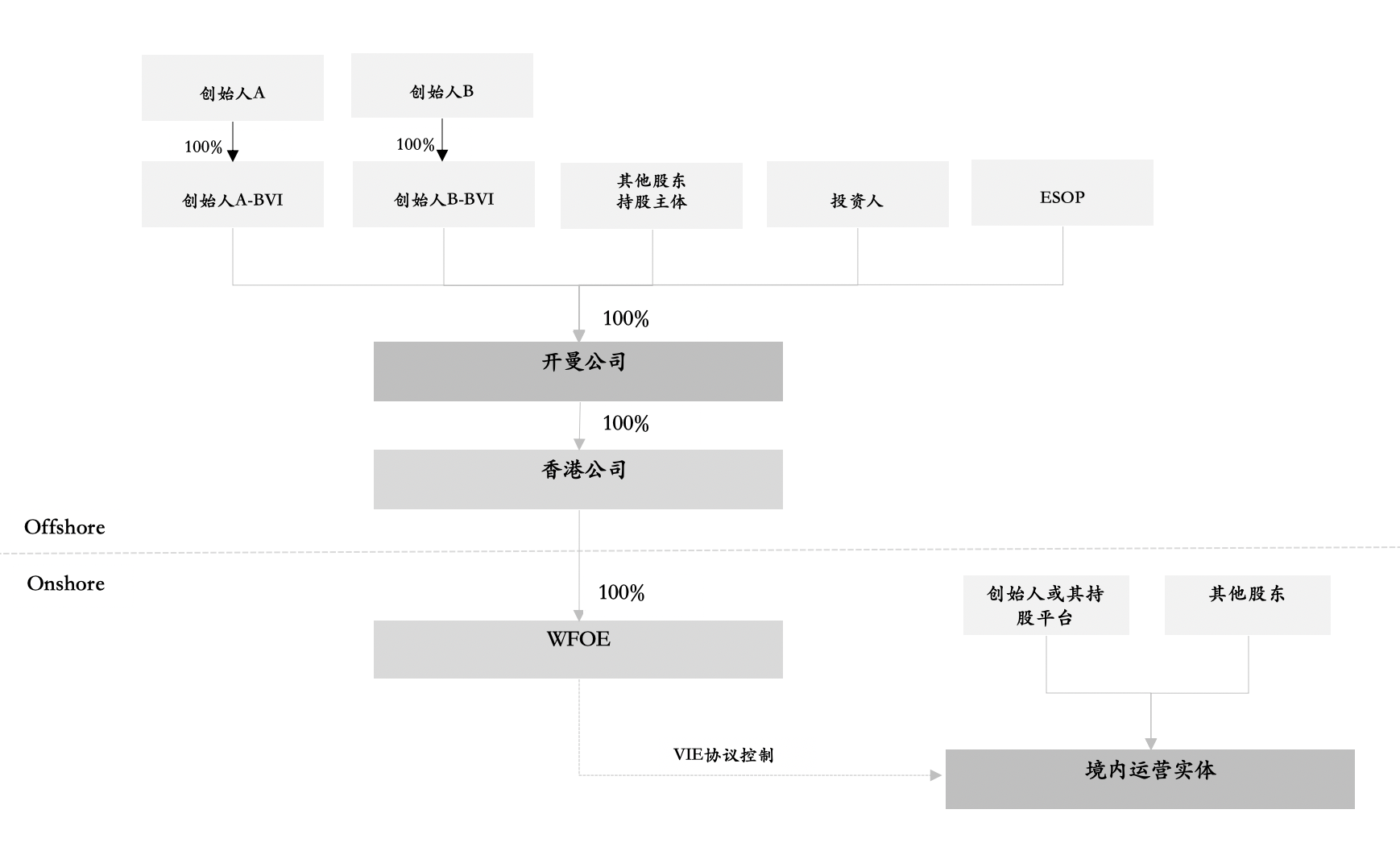

vie structure webmaster domeet schematic typical diagram architecture

ownership employee benefits

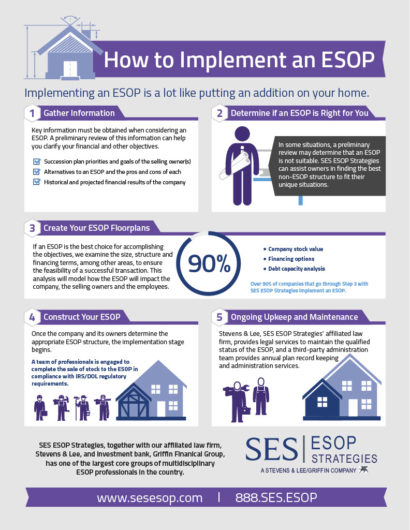

Steps to Set Up ESOP in Your Startup. Written by: Srikanth PrabhuPublished on: 27 Aug, 2021. Earlier, creating an ESOP pool used to be a precondition for investing from In this post, we've discussed how you can roll out ESOP in your company and start granting stock options and administering them.

Learn about what an ESOP (employee stock ownership plan) is, its uses and benefits and how to begin one at your company. How do ESOPs work? When a business sets up an ESOP, they establish a trust to act as a separate legal entity to hold shares of company stock.

esop plan ownership employee presentation its retirement

believe our employees should share in the success of our company in a tangible way. That's why we created an Employee Stock Ownership Plan ("ESOP") more than 30 years ago. Participating in the ESOP program means employees are part owners of the company and benefit financially from a job well done.

Employee stock options refer to a kind of compensation contract between an employer and an employee that carries some characteristics of financial options. Let us get into the details of this plan and understand the concept -. What exactly is ESOP? As per Quoting of Section

An employee stock ownership plan (ESOP) is an employee-owner program that provides a How to structure ESOP? Tax implications. What is an ESOP? In essence, an Employee Stock Option ESOP plans (a type of ESOW) give employees the right to purchase shares in the company at

24, 2020 · An ESOP is a kind of employee benefit plan, similar in some ways to a profit-sharing plan. In an ESOP, a company sets up a trust fund, into which it contributes new shares of its own stock or cash to buy existing shares.

Find out how you can use Employee Share Ownerships Plan (ESOP) to recruit, retain, and reward your employees. Sean Wallace, from Wallace Corporate Counsel, explains when and why you should consider an ESOP and how to implement an ESOP in your business. in this blog, we

Many founders setting up an ESOP Plan for the first time might be affected by the Where-do-I-start syndrome! As if understanding the umpteen ESOP Here is a curation of excerpts from founders talking about their ESOP Plan and how it can be structured to attract and retain the best talent.

If you have decided an employee stock ownership plan (ESOP) is worth investigating, there are several steps to take to implement a plan. You should carefully evaluate your options and tell your attorney just how you want the ESOP to be set up. This could save you a considerable amount

(k) "Plan" means this employee share ownership plan as amended from time to time in accordance ESOP Plan - Private Company Page 3. (q) "Seasonal Part Time Employee" means a part time During an Offering, each Eligible Employee may purchase up to the number of Shares calculated

set up your account on , you’ll need your plan number (091080), name, Social Security number and date of birth. Decide how much to contribute. You can contribute between 1 and 50% of your pay. Select your asset allocations. You can choose to invest your contributions in the plan among a range of investment options.

Employee stock ownership plan (ESOP) information from the National Center for Employee Ownership, the leading authority How ESOPs Work. See our infographic on how an ESOP works. Companies set up a trust fund for employees and contribute either cash to buy company

smith stephen attorney indianapolis indiana georgia employee retired

To set up an ESOP, you'll have to establish a trust to buy your stock. Then, each year you'll make tax-deductible contributions of company shares, cash for Furthermore, the cost of setting up an ESOP is substantial, perhaps $40,000 for the simplest of plans in small companies. Moreover, any time

Leveraging the ESOP Pool to plan growth. Employee ownership and shared capitalism as concepts are relatively new A wisely strategized ESOP plan can be the silent navigator in the startup's success story. When strategized properly, Employee Stock Ownership Plans (ESOPs) turn out to be

stock ownership, or employee share ownership, is where a company's employees own shares in that company (or in the parent company of a group of companies). US Employees typically acquire shares through a share option plan. In the UK, Employee Share Purchase Plans are common, wherein deductions are made from an employee's salary to purchase shares …

An Employee Stock Ownership Plan invests in the employer's company. The difference with an employee stock ownership plan, as compared to a worker corporative, is that with an ESOP the company's capital is not evenly These contributions to the trust are tax-deductible up to certain limits.

Employee Share Ownership Plans (ESOPs) are gaining in popularity as awareness of their benefits increases. In this comprehensive ESOP guide we'll explain The first step to setting up an ESOP is to decide on your objectives for the scheme, including creating an ownership mindset with staff,

How does an ESOP work? • The company sets up an ESOP Into that trust, the company can either contribute cash to buy shares of stock from existing owner(s) at no more than the fair market value, or if the owner does not want to sell shares, the company can issue new