Since IUL ties cash value to the stock market, it comes with more ups and downs than other types of life insurance. But for a savvy investor looking for a policy with a higher-touch investment arm, indexed universal life could The first and most important is to understand how indexed universal life is sold.

IUL ASAP: How to Win the Financial Game of Life, Invest Like the Wealthy, and Generate Tax-Free Income with One 3-Letter Word. This book gave very good insight on selling an IUL product. It broke down the how to's and things to avoid when presenting. I like that fact that it was very simply

equity freedom story marius barnard dr chris play living

How to Sell IULs. Retirement Basics. Ways Clients Can Access Cash Values in their Policies. How to Use WinFlex: A Step-by-Step Tutorial. How to Read and Understand an IUL Illustration. IUL Sales Scenarios. What is Indexed Universal Life Insurance with Living Benefits?

BGA Insurance has built a reputation for delivering sales, marketing, planning and underwriting support to the upscale life insurance producer. How to Become a King or Queen of IUL Sales | Selling Life and Annuities.

How does IUL work? Each time the policyholder makes a premium payment, part of the premium is used If the market the insurance company has chosen tanks, IUL insurance typically includes a Further, agents who sell IUL insurance are rarely required to undergo the same training as a

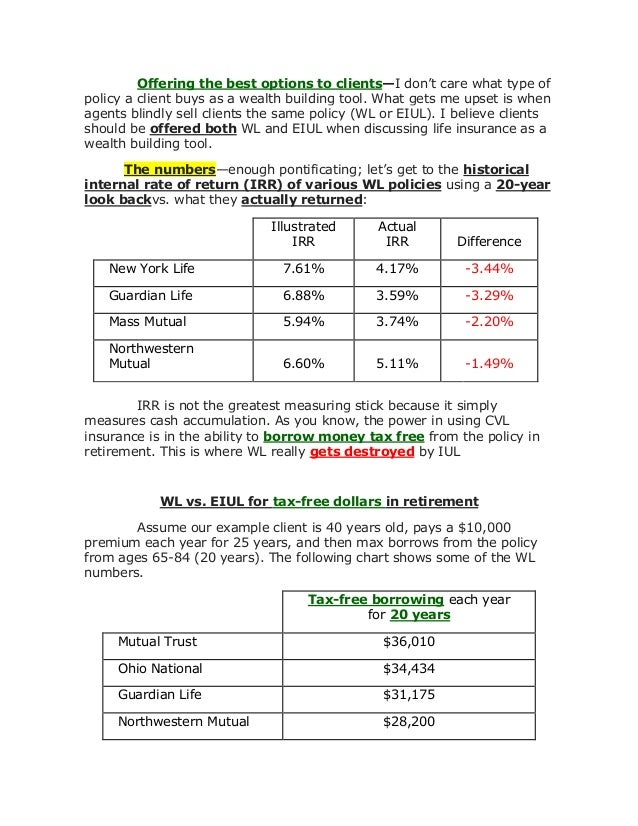

Depending on how you'd like to grow the cash value of your permanent life insurance policy, you may decide to go with a simple, whole life insurance policy that pays you a small amount of interest, or invest the cash value more aggressively for growth through an index universal life insurance plan (IUL).

IULs are better for this purpose than term insurance because of cash value benefits. Life insurance is an excellent way to fund a buy sell agreement, but it's important your family has the If you're worried about how much you'll pay for your insurance protection, either with an indexed universal

But there is a way to sell your life insurance policy for more than just its cash value, which could put more money in your pocket. This is through a life How much do you get for selling a life insurance policy? The value of a policy can differ, based on the age and life expectancy of the insured, as

Indexed universal life insurance (IUL) is an insurance product that seems to promise you can have With IUL, the crediting rate for your cash value is determined by a formula, instead of being at the So how can IULs offer "market returns" while still guaranteeing you won't lose money, at least on

Insurance carriers have not focused on training for years , Weber said, and there is a whole generation that does not know how to sell professionally. When using an IUL illustration as a planned premium calculator, it is important to set realistic expectations, especially if the client is concerned about price.

epilepsy insurance disorders seizure

insurance

insurance portfolio," advisors is how to sell. said Randy Forcht, ad-. In the 2015 issue of the Insider's Guide. vanced sales director. Mellberg says his team is selling. sociation of Insurance Commissioners IULs as liquid growth vehicles that. are looking into how to illustrate IUL deliver

Should You Get IUL Insurance? Indexed Universal Life (IUL). While an IUL policy has some The BBC's Silicon Valley correspondent investigates how his report was used to steal life savings. Trader Julius Nga parks his wheelbarrow filled with onions, garlic, salt and bouillon cubes to sell

Part five in the "How to Sell IUL" series, goes over popular sales concepts, the target IUL client, illustration tips, and four North American IUL products. Whether you were present or caught up later, you have come to understand the mechanics of IUL products accompanied by North American's

Know how to compare Index Universal life (IUL) to Variable Universal Life (VUL) and use proven tips for knowing which product to sell to your client. Term insurance aside, permanent policies will perform differently than what the original illustration looks like, given the number of moving parts.

Indexed universal life insurance, or IUL, lets you take advantage of market gains, while avoiding losses. What Are the Benefits of IUL Insurance? One of the most attractive features of an IUL is the ability to take advantage of stock market returns without the risk of loss.

How does an IUL Compare to Different Non-Insurance Options? IUL with Living Benefits. How to Supercharge your Indexed Universal Life Policy. Term insurance is easier to sell because it's so simple. It's in the agent's best interest to sell the easier solution and then move on to the next sale.

How much easier would it be for you to sell more life insurance? If you could show your Sell Cash Value Life Insurance Policies In Spite Of ThePandemic. Start By Downloading This So that you will sell more whole life and IUL insurance to double and triple your sales and referrals in the next 30 days!

An indexed universal life insurance policy, aka IUL insurance, or simply "IUL", is similar to traditional universal Indexed Universal Life Insurance Mechanics. So, what is actually going on inside of these IUL policies? Most likely someone recommended it to you because they are appointed to sell there.

IUL insurance carries greater risk than standard universal life insurance, but less than variable life insurance policies (which do actually invest in stocks and bonds). Furthermore, they are complicated, advanced financial products that require a deep understanding on the part of the insured.

IUL Insurance is a must have for retirement planning. A Max Funded Index universal life insurance Why Do You Need IUL Insurance? I was always told the only life insurance I needed was term life IUL's and trading in the stock market have fees! Related Post: How to avoid retirement account fees.

An IUL may not be covered by FDIC insurance, but it is covered by state-sanctioned Insurance There are no limits on how much you can invest in a year, which is a potential problem with IULs. However, you may pay higher fees to manage the investment account and when selling investments.

iul

iul

insurance afba 5star veterans company contract redbird relationships due companies favorite

Selling insurance has grown into a multi-billion dollar industry, and knowing how to sell insurance can be a lucrative career. You just have to have the right marketing strategies down to grow your business and become an effective

IUL Mechanics Session 5 (How to Sell). Для просмотра онлайн кликните на видео ⤵. IUL Mechanics Session 4 (Effective Illustration Tips)Подробнее. How To Sell Indexed Universal Life Insurance, A Beginner's Guide [Interview With Michael Bonilla]Подробнее. The Easiest Way to Sell IULПодробнее.

Six Strategies to Sales Success — How to Sell More Insurance Than You Ever Thought Possible. Partners Advantage is a leading distributor of Indexed Universal Life (IUL) insurance products. Having worked with more than a dozen different insurance carriers to develop, design and rene their

Indexed universal life insurance (IUL) is a form of insurance that uses a market index to calculate any cash value IULs are often sold as investment products because of the upside potential, but they are not However, it's critical to read all of your policy disclosures to understand how a given policy works.

How to Use this Page: You can skip directly to any specific IUL pros and cons by clicking the (clickable) Table of Contents directly below. #4: "Insurance agents selling Indexed Universal Life often exaggerate the average crediting rate in their illustrations." This may have been true in the past

Life insurance companies that sell traditional policies like whole life insurance invest primarily in corporate bonds and government-backed mortgages People will buy IUL policies based on a fictional future and hit a hard reality when they have to pay substantially more than they expected in order

1. How to Sell an IUL. 2. 1. Client presentation 2. Financial needs analysis 3. Illustrations/Application 4. Policy delivery Sales Process. In fact, if you look at the authors of those articles many have a vested interest in the market and managed money or are insurance agents that sell other types of policies.

I was still very skeptical of investing in Life Insurance because at the moment I have nobody dependent on me. But what sparked my interest, and the She showed me a graph illustrating that investing $100K into an IUL over 1998-2013 would of earned on individual $198K, verses $160K from the

Learn how IUL policy loans work and why your clients might want to consider this option. If an indexed universal life (IUL) insurance policy is structured properly, loans could be one of the most important features of an IUL for the right person and right circumstances.

brett kitchen insurance indexed selling universal phone