How to Scale Into a Winning Trade - You've probably heard the saying "Cut your losers short and let your winners run", but how do you actually do that? That's right, I am going to show you how to scale in or "pyramid" into a winning trade, without taking on more risk. This essentially means you

I scale into stocks to build my position all the time, but according to an article in the October 2009 issue of Active Trader magazine titled, "Scaling in as an Scaling in is important when buying thinly traded stocks. You buy a little each trade, hoping not to move price much. One rule of thumb to use

Bad practice I - scaling out of trades. Most traders will probably have done this before: partially closing a trade where price has moved into your Many traders never write down their actual trading rules and how they see their edge in the markets. Without defined rules, you can lose your

Scaling into a trade is directly related to how much you risk on any given position. Determining your position size is based on a combination of factors, including the market you're trading, current volatility, trading strategy, your other investments, net worth, penchant for risk and desire for reward.

New trader's face a couple of hurdles when entering trades and exiting trades. They may think that everything has to be "now or never" or that they "are all in This strategy also allows you to scale into a stock that long term you feel is a good stock to own, but short term it may be experiencing a sell off.

orangutans rainforest orangutan oil palm borneo danger habitat destroyed indonesia down why starving villages plight trade pet illegal animals logging

Scaling in is a trading strategy that involves buying shares as the price decreases. To scale in (or scaling in) means to set a target price and then invest in volumes as the stock falls below that price. This buying continues until the price stops falling or the intended trade size is reached.

How can you scale up your trading the tastytrade way? Tom and Tony discuss wider spreads, moving closer to the money, Explore the world of finance in our blog articles written by a group of traders, entrepreneurs and technologists aiming to bring the best options trading content and tools

Why Do Traders Scale-In and Scale-Out? There are many reasons why profitable traders turn to scaling into a position over time. More advanced reasons include to reduce the amount of slippage received when opening a large trade or to hide a large position that you don't want others to

.jpg)

bottlers

Scale-In Trading has its roots in the investing world from decades ago. Effective money managers have successfully used it for many generations. This gentleman understood investing and he especially understood how to scale into stocks. Some of the most successful people in Los

SCALING INTO A RUNAWAY MARKET! Подробнее. Scaling Into Trades - #DevelopYourEdge 41Подробнее. Scaling Into A Trade - How To Scale In & PROFITПодробнее.

How to scale out of trades. What to avoid when using this technique. In the previous sections of the chapter weve talked about what money management Scaling into a trade means opening a position with just a fraction of the capital you initially intended to commit yourself with and then enter

nature collage paper collages summer making father geiman materials contemporary dolan cut camp ages step

Januar 06, 2019. How to size into a trade - part 2. I had a lot to talk about and teach in the educational room the past month as I wanted to share as much Before going deeper into the subject, I talked about the ground pillars needed to learn to size into a trade. The ground pillars were

I believe that scaling into a trade is only justified when there is a new signal in that same direction. But partial lots arent because then youve got to think about how to make up that halflot later if things how much I refine it , no Matter how much I go with the trend , take the cleanest setups or use

Scaling into a trade means that when you enter the market, you initially enter just a fraction of the total position that you intend to trade and then observe how this initial market entry develops. If the trade works out as intended, then you can enter further positions in the market and take advantage of

gat

How to scale in and out of trades pyramiding stock positions with an adding up position sizing strategy. Get my Free "RUBBER BAND TRADE:" Enjoy this video! Leave your comments and questions below! Make sure not to miss a single video from Barry! Click here to Subscribe: Watch the related

kingdom

Hello Forex Traders, today's article focuses on scaling in and scaling out in forex. This money and trade management technique is a sophisticated In other words, it is not important how many times a Forex trader wins or loses. But, instead, it matters how much a trader gains with profitable

How may scaling be helpful for a trader? At first, it allows you not being afraid to open or close your positions. This is a good psychological benefit. When you scale in into your position at , you need to recalculate the size of your reward at the take profit level.

Scaling into trades is best when you are in a trade for a longer time period as this builds your position over time, whilst reducing whole market risk. However, nothing can stop a scalp from being turned into a larger trade and by knowing how to scale trades, you'll be able to adapt to your

How to scale in and out of trades pyramiding stock positions with an adding up position sizing strategy. Get my Free "RUBBER BAND TRADE Hey, traders Barry Burns here today. We're gonna talk about how to scale into a trade and I will give you a one word answer and then expound on it. so

Scaling in a Trade As mentioned above, money management is the key to growing an account in time. If you insist on doing the classical scaling, you'll end up splitting the volume into as many parts as you want to scale in, and then risking the same proportion of your account.

Scaling in quickly once conditions meet the trading plan criteria. There is no rule about how many chunks you want to get, some traders Scaling out into chunks only for winning trades is a great habit and works well for me. After all, the trade is going exactly as you were expecting, why would

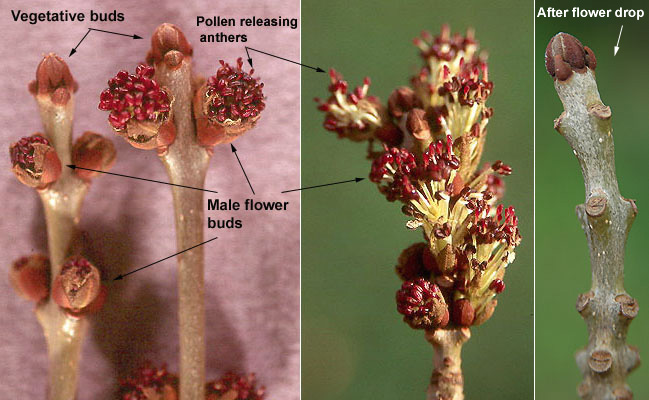

flower fraxinus oxycarpa buds early spring raywood opening plants male landscape oregon university

pida key

Read our tips on how to secure an Undergraduate internship and securing it into an offer. If you wanted to get into sales and trading but missed the opportunity to get in during undergraduate recruiting, some might look to a quantitative master's degree as a second chance.

The Sykes Sliding Scale is my personal system for pre-grading trades. Learn this NOW so you only take your best setups every day! Many students use the Sykes Sliding Scale to decide if a setup has potential. But there are other benefits, too. Here are three that go beyond just getting into a trade

Smart rookie traders will start learning how to scale into and out of a position while they're trading in a demo or simulated account then take those Let's take a further look at the benefits of scaling into a trade. Let's assume you've opened a standard forex account with 50:1 leverage with $10,000 in

Learn how forex traders scale into positions. Scaling in, if done correctly, will give you the benefit of increasing your max profit. We have created a trade where we can enter at , and even if the market went higher and created a losing position, we can enter another position and stay safely

In this chapter, the barest essentials of economies of scale models are developed to explain the rationale for trade with this production feature. Another major reason that international trade may take place is the existence of economies of scale (also called increasing returns to scale) in production.

How to Scale In to Positions. Scaling into a trade; what is it and what are my 4 golden rules for doing it? I like scaling into positions but I also like scaling out of The benefit of scaling into a trade is that when you know you have a good opportunity to take a trade; you either go all in at a particular price

whydah onlyinyourstate plunge piratical scenes treasure

A trader that is looking to scale into a trade might break their total position size in to quarters, halves, or any other division that they feel might let them take a more calculated approach to putting on a trade. Let's say, for instance, that a trader was looking to take EURUSD up to , but was afraid of

# Quick example: open trade with (). Here's how we can execute () in our script Besides opening a long or short trade, () can also scale into an existing position. What's nice is that this doesn't require extra code.

In this Koh Samui Forex trading vlog, I share how to scale into trades the easy way for Forex or any other market. Vlog #560 In a few days, I'll release a I'm a swing Forex trader and help aspiring Forex traders develop a trading method that works for them so they can produce income allowing them