A Living Trust or Revocable Trust, or a Revocable Living Trust, are the same Trust. The word "revocable" says it all. The "Grantor" the guy with Although a trust can be created solely by verbal agreement it is normal for a written document to be prepared which evidences the creation of

of Trust Funds by Trustee in California . Basically, If the trustee misappropriated trust funds, used the trust funds for their own benefit and without the approval of the beneficiaries. The best approach is to take court action and submit a …

Revocable trusts most likely have family or a friend as a trustee. Other types of trust often have professional trustees, such as a lawyer or bank trust officer. Find out if Rose is eligible for any financial or health care benefits from an employer or a government.

While an irrevocable trust, unlike its revocable counterpart, is designed to be permanent, there are instances when a change would be best. Each trust should list the procedure for replacing a trustee. If your irrevocable trust didn't spell this out, take a look at your state's laws on the matter instead.

trustee is the individual named in a trust who is responsible for managing the trust after the death or incapacity of the person or persons who created the trust. For example, if the trust was created by a married couple, after they both have passed, they may name their eldest child, brother, sister, or family friend as successor trustee.

Grantor of a revocable trust would implicitly hold this power with a third-party trustee, given their power to amend or revoke the trust. In an irrevocable trust, the trust instrument may, in some instances, grant the beneficiaries a power to remove a trustee by a majority vote.

Starting with a Revocable Living Trust. Many trusts will start out as revocable, meaning that the grantor may change the terms of the trust. However, at some point a revocable trust can become irrevocable, meaning that the terms are immutable unless the beneficiaries agree to change the terms.

Can a Trustee Remove a Beneficiary from a Trust | RMO Lawyers. 9 Revocable Living Trust Mistakes.

The trust deed will outline instructions for the trust, including how the trust may be amended. As such, before you remove a trustee or beneficiary, look to your trust deed for the correct process. It is best practice to seek legal advice before attempting to amend your trust.

Changing the wording of the trust document is only part of removing a trustee and adding a new one. If you are the sole trustee of your revocable living trust and you want to give someone else the ability to act as trustee with you, you could execute a power of attorney granting the authority to

revocable trust doesn’t protect your property against creditors, lawsuits against you or estate taxes, because you technically retain ownership of the property held within it. Irrevocable Trusts are Different. You cannot act as trustee when you create an irrevocable trust and place property into it, called “funding” the trust.

Revocable vs. Irrevocable Trusts. Though trusts can be set up to fulfill a variety of different A revocable trust is one that can be revoked or amended at any time during the lifetime of the You may also be able to act as your own trustee or appoint and remove other trustees at your discretion.

A revocable living trust is a trust document created by an individual that can be changed over time. For all your hard work, you will not receive a tax benefit from a revocable trust. Your assets in the trust will continue to incur taxes on their gains or income and be subject to creditors and legal action.

the trust is revocable, or if you waived in writing your right to a report, the trustee does not have to provide information unless the trust document says s/he must. What can the Court do if the trustee is not doing his or her job? The Court can remove a trustee and make the trustee pay the beneficiaries for any loss to the trust.

trust wills revocable probate chart single couple

Because the trust is revocable, you can change your mind at any time (unless you become incapacitated). The trustee will manage the property owned by the trust. If you remove property from a trust or revoke your trust entirely, you need to decide what you want to do with your property.

Grounds for removal of trustee, other remedies. Sacramento, California estate law and trust attorneys ready to assist with trustee removal or A careful review of the trust instrument is recommended in order to determine whether a non-judicial procedure to remove a trustee is available, prior to filing

trust affidavit sample amendment consent waiver living service form template document divorce process rocketlawyer

A revocable trust and living trust are separate terms that describe the same thing: a trust in which the The trustee determines how the assets are invested and to whom they are distributed when the owner of The owner of a revocable trust may change its terms at any time. He or she can

Use our revocable living trust form to create, download, and print a powerful estate planning document you can rely on. A revocable living trust is an The grantor may remove an appointed trustee at any time during the grantor's lifetime by notifying that trustee, and the grantor may appoint additional

But the revocable living trust owns the grantor's assets, and the trust doesn't die. Those assets can therefore be transferred to beneficiaries, effectively settling the trust, without How long it takes to settle a revocable living trust can depend on numerous factors. Where the Successor Trustee Lives.

How to Remove a Trustee from a Revocable Trust. Trustee Removal is an option for beneficiaries or heirs who feels the Trustee has either threatened or has taken action against the terms of the Trust. One reason is self-dealing, as opposed to having the best interests of the beneficiaries.

Trust agreements usually allow the trustor to remove a trustee, including a successor trustee. This may be done at any time, without the trustee giving reason for the removal. To do so, the trustor executes an amendment to the trust agreement.

true false amount tax gifts following order transfer taxes making questions federal chapter gift rate lifetime million estate both

fiduciary duty breach trustee complaint

Wondering how to Delete Selected Option Revocable Living Trust easily? Drag & drop a template to modify it with PDF editor, or try the form building feature and make one on your own. Trust real estate is removed from a trust via a property deed. There are several types of property deeds.

15, 2015 · Changing a living revocable trust would not remove your brother as power of attorney and executor. That would require a change in the durable power of attorney and the will respectively. If the bank account with your mother’s and brother’s name on it is not in the trust, then you can’t access it, because it is not a trust account.

simple answer is yes, a Trustee can also be a Trust beneficiary. In fact, a majority of Trusts have a Trustee who is also a Trust beneficiary. Being a Trustee and beneficiary can be problematic, however, because the Trustee should still …

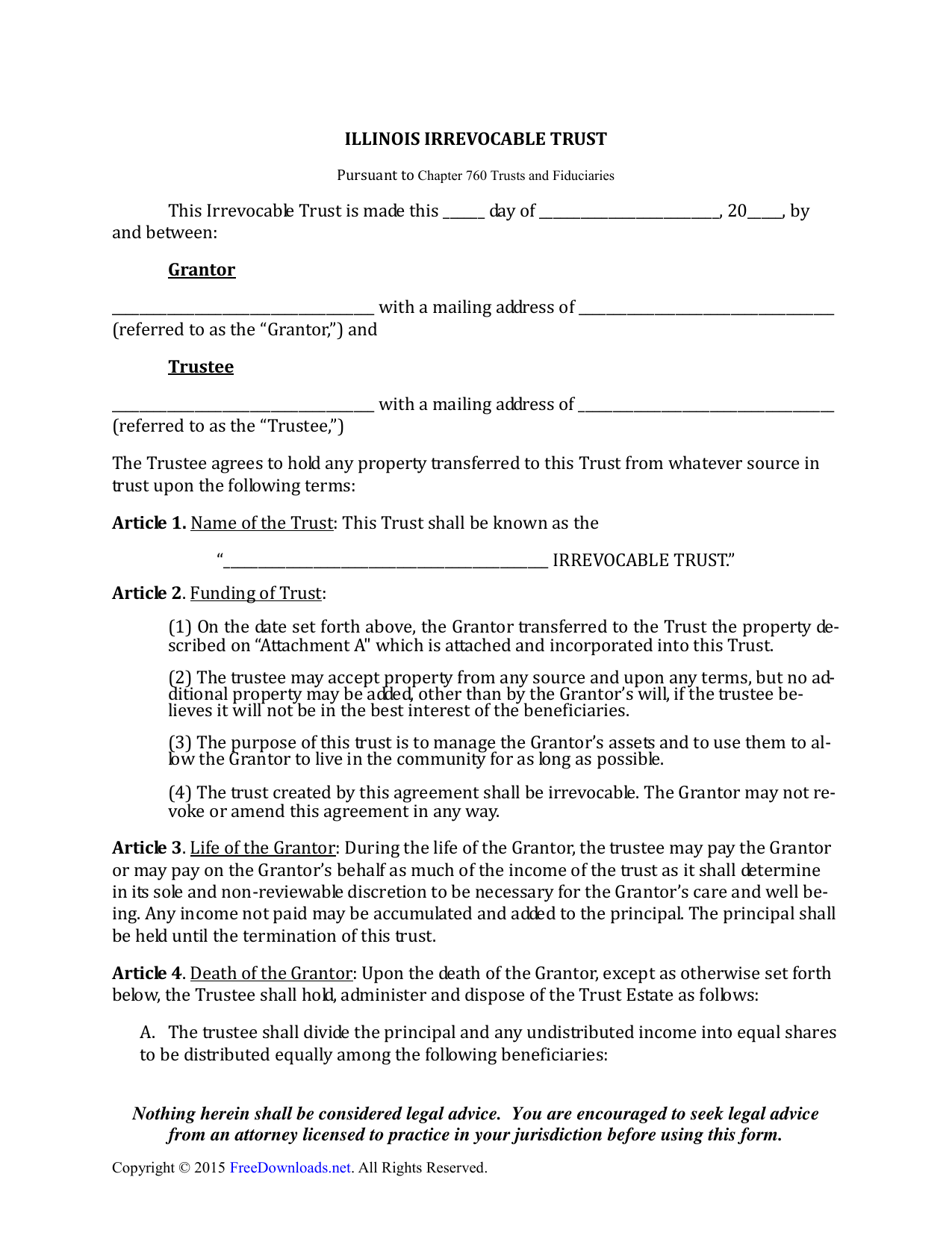

trust living irrevocable illinois form pdf trusts 1303 downloads word

A trustee can remove beneficiaries from the revocable trust if the trust expressly states that the trustee can do so. If the trustee is the person who contributed the money to the trust, then the trustee may have the power to revoke the trust, which essentially has the effect of removing the beneficiary.

My mom put 2 properties in trust in 2006. She passed Feb 2017. She only owned 1 property on her death. Originally she left a condo to my sister and If you have a copy of the trust agreement it should lay out the options of how to remove a trustee. Generally this will be laid out in the

13, 2020 · If the trust is revocable, then you, then, as a contingent beneficiary, you are not entitled to any information until the trust becomes irrevocable. Thus, you may not be entitled to a copy of the Trust until your interest vests. It all depends on what the Trust says so it is important to read the trust. If the Trust is irrevocable, then you may ...

However, a successor trustee cannot remove property from the trust unless you gave approval when you were the trustee. When a Revocable Trust Becomes Irrevocable. The trust identifies "incapacitation" as the inability to handle or financially manage assets in a reasonable capacity,

As the trust is revocable, you can take the title back if necessary. The method for taking property out is the same as putting property in. As trustee you make out a new deed giving title back to yourself as owner. How to Activate a Revocable Trust. What Is a Reconveyance in Real Estate?

Revocable - the trust can be changed or revoked at any time after it has been created (until it becomes irrevocable, which occurs when the creator Trust - an estate planning mechanism that holds assets and distributes them to specific individuals or entities in accordance with an

an amendment to your trust. Type the amendment so that it specifically states the trustee that you wish to add. Indicate whether you wish to remove an existing trustee, in addition to naming a new one. Specify that the trustee you are adding is a co-trustee, rather than a successor trustee.

Judges take Trustee removal seriously, and will only accept evidence if your team has followed proper procedures. Further, Trustees are free to use Trust funds to defend themselves. Trustee Being Under Undue Influence. Conflict of Interest. How to Remove a Trustee.

A revocable living trust offers grantors flexibility that other trusts do not. They also provide benefits like more privacy. If you want to remove a beneficiary from an irrevocable trust, that beneficiary needs to agree and sign off. The reason for this inflexibility is that as soon as the trustmaker signs

9. How is a revocable trust agreement used in conjunction with a pour-over will in your state? In particular please specify The settlor, a co-trustee, or a beneficiary may also petition the court to remove a trustee.

Settling the Revocable Trust in California. A Primer for the Non-Professional Trustee. The trustee on the other hand will want to retain a trust attorney for advice on how to administer the trust, and may want to defer distributions, initiate court proceedings and/or take other steps to protect the

What steps does a trustee need to take to evict a beneficiary from a house? Control of the family home is often a painful issue among trustees and beneficiaries. Not without first getting a probate court's intervention. While a probate court is empowered to remove one co-trustee, it is a difficult challenge.

A trust agreement, or trust instrument, is the document by which the settlor (also known as a grantor) and a trustee establish the ground rules for Beneficiary A beneficiary is a person who receives money or property from a revocable trust. Help for trustees under a revocable

If you establish a revocable living trust, don't take the process of selecting trustees lightly. The more difficult question is whether any of the beneficiaries of your trust should have the right to remove a trustee after your death and, if so, for what reason.

, the grantor is also the trustee as long as she is still alive, although this is not a requirement. There are many reasons why a grantor may need to amend a living trust. The grantor might wish to add, alter, or remove certain assets in the trust, add or remove a beneficiary, or change the distribution of the assets.

How to Remove a Trustee From a Family Trust. There are cases where a trustee is unable or unwilling to administer a trust because of illness or lack of skill. Must Both Grantors Die Before a Revocable Trust Becomes Irrevocable?→.

veksler