How Can I Reduce Chargebacks? Chargeback reduction requires a comprehensive approach that begins by identifying chargebacks based on their What are Some Ways to Reduce Chargebacks? To reduce chargebacks, you need to first eliminate criminal fraud using a multilayer fraud

Chargebacks are meant to protect the consumer. But used unethically, they can be devastating to a business. Chargebacks are meant to protect consumers from unauthorized transactions . Instead of wasting time arguing with suppliers on the legitimacy of a transaction, customers can simply initiate

Here is how to reduce chargebacks and recover lost profits. Chargeback management for card-not-present (CNP) payments has always been critical. But in an era of increasing fraud and chargebacks, it is more crucial than ever for card issuers and merchants to collaborate to

How Does a Chargeback Work? A chargeback procedure involves the customer, the card-issuing bank, and the merchant. A chargeback rate below 1% used to be considered a normal or acceptable rate. However, things have changed lately. Visa has reduced the threshold to , while the

Chargebacks - Customer Wanting Refunds. Almost everyone has an idea of how a credit card SALE works. But even some experienced merchants don't And now the 17 ways to reduce chargebacks. Preventing credit card losses is not only good for you, but it is also part of your responsibility.

How Exactly Do Chargebacks Unfairly Drain Companies? It was once understandable, before the internet existed and while the US dollar was still tied to the Chargebacks will be reduced organically with enterprise-grade tokenization, advanced user permissions, and high levels of authentication.

How to Reduce Fraudulent Chargebacks. What are chargebacks and how can you protect your organisation? Table of Contents. How to Protect Your Organisation from Up to 100% Chargebacks. Achieve Further Savings by Securing Your Transactions and Unlocking a Better Rate.

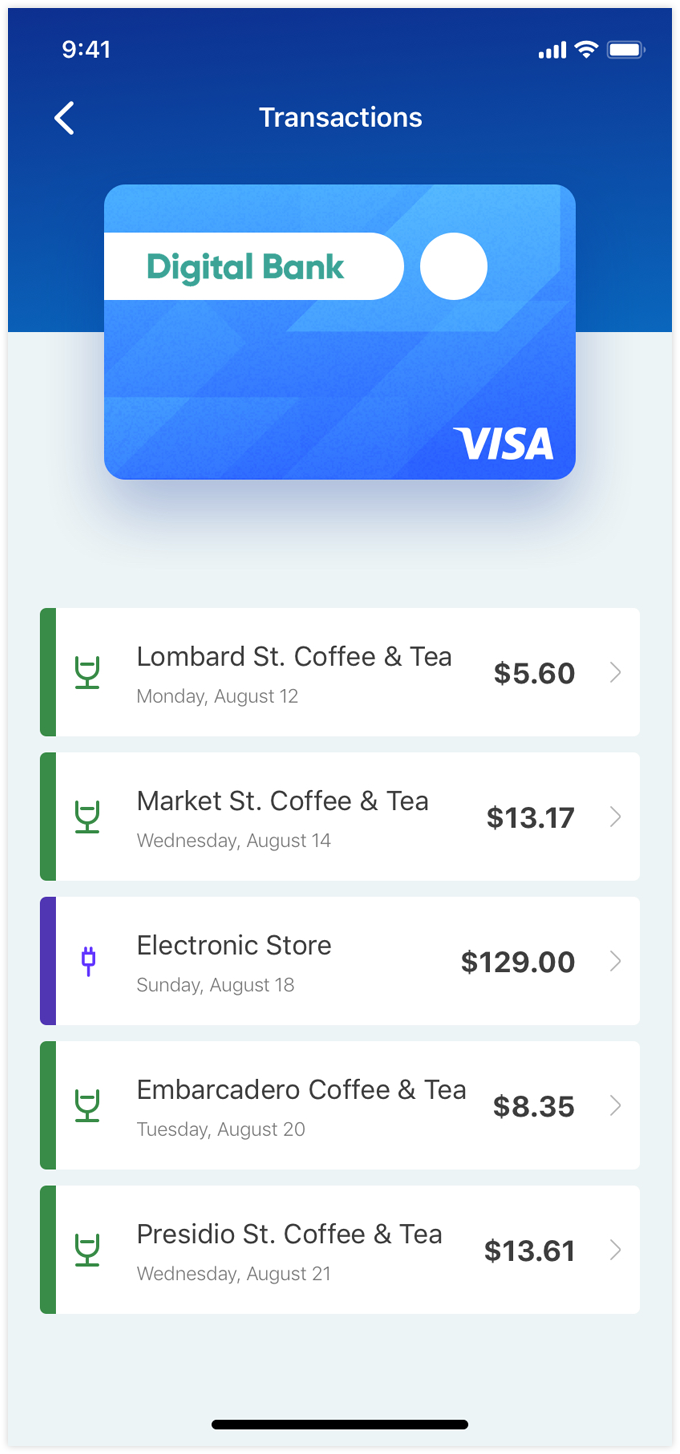

merchant mobile example banking app

To reduce chargebacks, you have to make sure fulfillment goes smoothly too. 24. Offer a variety of shipping prices and speeds. This is the story of how a merchant used Midigator's detailed analytics to block fraud, reduce chargebacks, increase profits, and improve the brand's reputation.

A chargeback means returning funds to a customer. It's forced by the issuing bank and causes merchants a lot of problems, wasting their time and money. So obviously nobody likes a chargeback. Most merchants will do a lot, to avoid them. Even if their policy doesn't allow refunds, they'll

First, let's talk more about how chargebacks work and are classified. Chargebacks are typically classified into two distinct types: friendly fraud and Chargebacks can add up over time — but these tips can help keep it under control. For more tips, download our Reducing Chargebacks and

How to reduce chargebacks: make sure that your contact information is visible and easy to access. Provide as many contact channels as possible Another effective way to reduce chargebacks is by becoming compliant with the official standard for credit card data protection PCI-DSS.

routing guide guides costco example

Learn what chargebacks are, how to deal with them, and ways to reduce chargebacks. A chargeback was originally designed as a form of customer protection and occurs when a cardholder disputes the charge after they notice a transaction they don't recognize.

How To Fight Chargebacks: The Chargeback Resolution Process. Preventing Chargebacks Is All About Being Proactive. Common Questions About Reducing Chargebacks. Why Small Businesses Need To Prevent Chargebacks. You already know that a chargeback is when a customer

Chargebacks: Best to Avoid. Chargebacks cost merchants in fees, lost revenue and wasted time. They can also have serious implications for processing online These chargeback reason codes provide some insight into how it can be possible to reduce the risk of credit card chargebacks overall.

laundering feedzai espionage mobster fueled

card express american centurion credit amex cards data platinum hacking advantage canada bmw britain charge requirements rezdy lounges system inside

mitigation chargeback definition chargebacks911 illegitimate include might following

The costs associated with Chargebacks often fall on merchants' shoulders. Learn some best practices you can employ to reduce the occurrence of chargebacks.

Before we learn how to reduce chargebacks, we must ask why cardholders would initiate a chargeback. Reasons for a chargeback being initiated by a cardholder are varied and numerous. Issuing banks have their own "chargeback reason codes" which are used to give structure to

Most companies know how common, and more importantly, how costly retail chargebacks can be. While it may be impossible to eliminate chargebacks completely, there are steps every company can take to drastically reduce the amount they pay out every year in chargeback fees.

Retailer chargeback fines for non-compliant shipments are a profit-draining reality for many consumer goods manufacturers. But they don't have to be. Companies with the will and the resources to prevent and refute chargebacks can avoid hundreds of thousands, even millions, in lost profit.

But how do chargebacks happen in the first place, and how can merchants avoid them? What Is a Credit Card Chargeback? Chargebacks can take anywhere from six weeks to six months to be processed, depending on how quickly the consumer notices and reports the fraudulent activity

How to Reduce Costly Chargebacks at Your Business. by Sarah Blanchard. Although not all chargebacks can be prevented, you can take various actions to reduce their number. Here are four tips on how to reduce the number of chargebacks your business handles.

A chargeback, by definition, is a demand by a credit-card provider for a retailer to make up the loss on a fraudulent or disputed transaction. It isn't possible to stop chargebacks completely if you want to know how to reduce chargebacks there are measures you can put in place.

Chargebacks are payment reversals that merchants, including property managers, have learned to dread. Yet, it wasn't always this way. What chargebacks were intended for and what they've become are two separate things, and we have tips to share for how property managers can avoid them.

chargebacks

industry financial banking disrupting services disruption paymentsnext

How to Reduce Chargebacks. Darren DeMatas on July 28, 2020. As an eCommerce marketplace seller, your goal is to sell your product to the customer and get paid for it. This sounds pretty simple, right? However, chargebacks may occasionally occur and turn a straightforward business

Although chargebacks are a part of doing business (and a good sign that your risk management strategy isn't overly strict), there are ways to reduce them. This article will explore what chargebacks are, how the process works, and ways you can prevent and respond to them.

chargeback risk disputes cardholder initiated transaction

Chargebacks aren't going away. This profit draining reality only serves to further reduce your bottom line as additional fees and fines are added to your product's Cost: How much are you being charged, what is your exposure to future fees/fines, and what's an acceptable percentage of chargebacks?

Between the influx of fraud (both counterfeit fraud and "friendly fraud" chargebacks), most merchants have a hard time finding a balance in fraud prevention that allows them to effectively combat bad actors without turning away good sales.

Whether you are taking mobile payments or accepting payments online, chargebacks are something every merchant has to be prepared for. Although it's impossible to stop customers from issuing a chargeback, below are a few easy ways you can help limit your chances.

Chargebacks include returns and disputed transactions, and result in a reduced conversion rate and Learn strategies to lower the chargeback rate and reduce its impact on your revenue. How to manage and prevent ecommerce chargebacks. Must-have features of ecommerce

Chargebacks are one of the most unglamorous sides of the payments business. They instill dread and frustration in most merchants on a monthly, weekly and even daily basis, but there are ways to reduce and sometimes even eliminate chargebacks. The chargeback system was established by the

How Do You Solve a Chargeback Problem? How Long Does a Chargeback Dispute Usually Take? Do Chargebacks Cost Money? Chargebacks are the bane of any e-commerce merchant. Due to the greater opportunity for fraud in card-not-present transactions, these merchants face