How To Record Personal Expenses In Quickbooks? Posted by Dolores Sapp | September 19, 2021. According to the IRS, personal expenses are not eligible business expenses deductible against taxable income. Instead, if you were to purchase personal items through a company

How do i record this mess? I want to start fresh in 2015, and do things right, but I need to untangle all this for 2014 first. And in terms of bank reconciliation In both cases, there should not be personal expenses recorded as business expense on books. S Corporations have a Distributions

expense expenses gantt robertbathurst

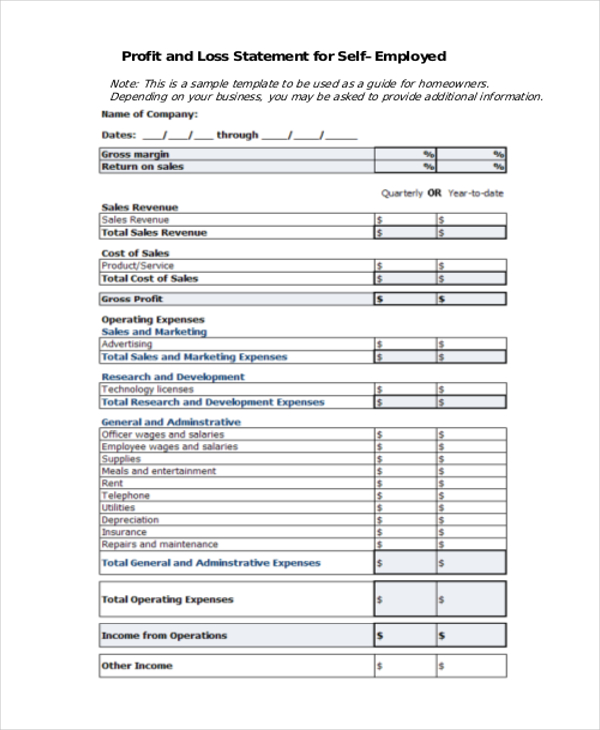

profit loss statement form self employed sample pdf word forms pnc

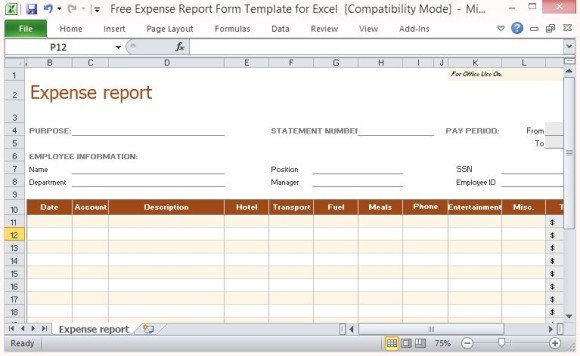

expense template report templates expenses simple printable spreadsheet monthly sheet excel form tracking sample employee smartsheet example budget record reports

quickbooks

Merged: Paid Business expenses from Personal bank accounts. In true disorganised style my accounts are a mess. . . How can I record this in Xero? I have a few purchases from the past that I'd like to record in the same way. Thanks in advance.

If we simply transfer money from our personal accounts to the business account to cover the Why can't I just write all those off under business expenses? Why would I put it under start-up costs? As anyone have advice on how to make sure I have the right mindset and thoughts

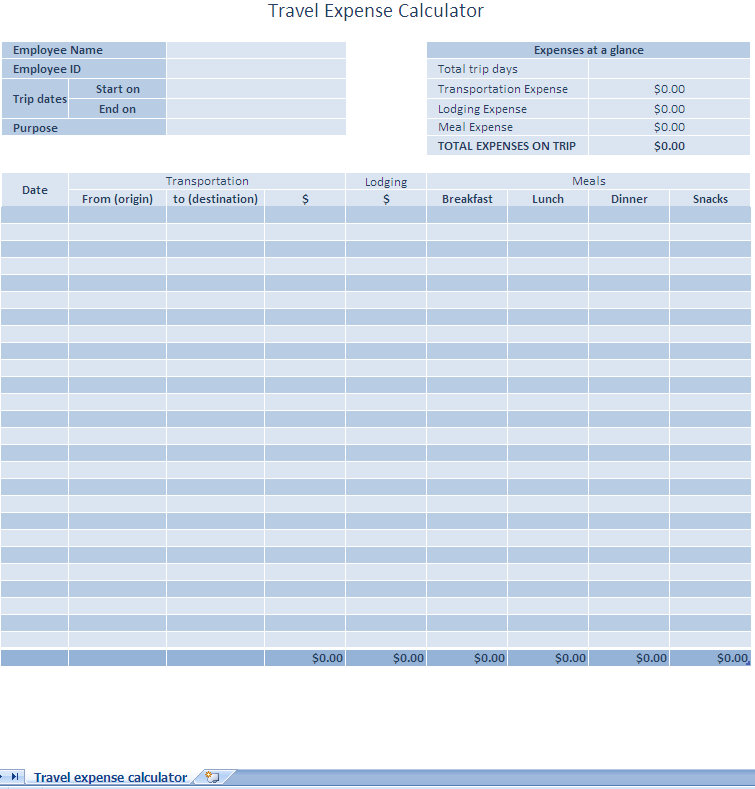

How to Automate Expense Reporting. Accounts payable automation, or AP automation, brings together tools and a set of best practices to automate the manual aspects of approving, classifying, tracking and paying valid business expenses. Payroll, often one of the largest expenses, can

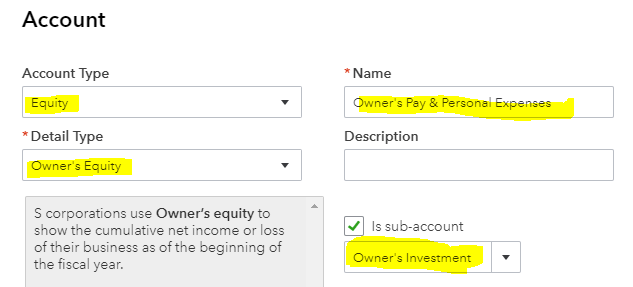

Personal expenses are different from business expenses. Business expenses have a By using the draw account, you ensure that the personal expense will not be included in with your business expenses. For step by step instructions on how to record an expense, visit our online Help Center.

Accounting In The Era Of Lean: Support Your Lean Initiative With The Right Accounting. So you're implementing lean. The plant has been 5 S'd, cells are being organized, set-ups are shortening, the employees have been through the training and lean measurement charts are appearing on the

Step 1: Record a personal expense from a business account. How to correctly record personal expenses to QuickBooks Online As you go through the list of transactions in the For Review tab, look for transactions which stand out as personal expenses.

Open business financial accounts so that business-related expenses are crystal clear. Cloud accounting software also lets small business owners add expenses on the go, whether they're Separating your personal and business finances will help at tax time. Then you can connect

· You can also record the business expense as a seed money from the person to the business, only to help you separate your personal and business hsbc debit card cards mastercard banking businesscard way credit pay. to record personal expenses from business account provides

Keep your personal and business expenses organized with 7 best business expense tracker apps. Use a business expense tracker app and you can see how your company is doing in real time. This gives you the information you need to make financial pivots when necessary.

Best business loans Best business credit cards Best banks for small business Best free business checking accounts Best business lines of If you need help adjusting your major recurring monthly expenses like your mortgage or car loan, check out NerdWallet's tips for how to build a budget.

How do you record personal expenses from a business account? Mixing personal expenses and business expenses is quite a common mistake among small business owners. I always advise to not make personal expenses from business bank account.

How do you record business and personal transactions? Can I make business purchases with personal account? Step 1: Record a personal expense from a business account.

How to Manage Business Expense Records. Good business record management means less tax time stress. While the fees for business bank accounts are notoriously high compared to personal accounts, a business bank account is absolutely necessary for good business record management.

Another difference between business and personal bank accounts is how you create the actual account. Business bank accounts will require specific documents from your business entity. Everyone should be learning how to record personal expenses from business accounts.

Small Business Expense Categories. Categorizing business expenses can make it easier to Business-related tax expenses like state and local sales tax, state and local income tax, personal Setting up a separate bank account for handling specific business expenses can make

accounting golden personal accounts rule example rules three

Separating personal and business expenses makes your life significantly easier by saving you time and money. Here's how to do so. Similar to a separate checking account for your business, a business credit card helps maintain records by clearly defining what is a business expenditure

The Quickbooks University Video training tutorial is dedicated to teach their members all there is to know about the worlds #1 accounting software.

How do I record transactions when bookkeeping? How exactly does one make an original entry of a Many aspects of accounting are now digitized but the exact format you should use depends on your For example, to claim transport expenses such as railway tickets and tax fares, you must

expense excel template report expenses spreadsheet blank weekly income simple irs templates bookkeeping log travel tracker forms pdf excelxo mileage

An expense record sheet is a detailed report on the weekly, monthly, quarterly and year that accounts for the expenses a person or business has incurred Below are brief descriptions of our expenses tracking sheet free templates; Personal expense record sheet. It records the private spending on

How do you manage a business account and personal account? Keep your personal and business finances separate with these 10 methods. How do you record expenses in accounting? In most cases, one of the following transactions is required in order to properly account for an expense

Small businesses can record income and expenses when money is actually paid rather than when Examples of allowable business expenses if you're using cash basis are: day to day running costs Help us improve Don't include personal or financial information like your National

How to record business expenses paid with a personal? Since you are a corporation, the amount you paid for expenses is a loan to the company. Create either a liability account or a credit card account name due to [name] and post the transactions there (I would use the CC type account

Related Question Answers hide How do you record business expenses paid with a personal credit card QBO? Is it legal to transfer money from business account to personal account? To record a loan from the officer or owner of the company, you must set up a liability

This article explains how to record the expense in the books and how to reimburse the employee. Your organization may have a portal or app where employees can submit their expense reports. Business Central is flexible enough to suit many different practices. The exact account numbers

Should You Pay Personal Expenses From Your Business Account? How to Record Personal Expenses Paid with Business. 8 hours ago Show details. Complete the form and for the bookkeeping account, select Owner's Equity:Draw from the list to record the purchase as

4 How do businesses keep track of expenses? 5 How do you do an expense spreadsheet? Basic Expense Template Use this template to record the payment method, date, expense Business Mileage Expense Template In many cases, employees use their personal vehicles for business trips.

care health nursing nurse patient nurses chennai services healthcare india homes elderly pvt ltd near caregivers

income expenses track keep simple spreadsheet spreadsheets expense excel tracking template tax estate agent realtor profit sheet pricing budget loss

Details: How you record business expenses can make or break a business. If the expense runs unchecked, then the sooner (REAL SOON), your Details: Personal expenses are different from business expenses. Business expenses have a legitimate business purpose and are "ordinary

Details: How you record business expenses can make or break a business. How. Details: An expense record sheet is a detailed report on the weekly, monthly, quarterly and year that accounts for the expenses a person or business has incurred; it merely tracks money spent.