In this video, we discuss how to access the bank reconciliation entry form, enter statement date and balance, mark deposits and payments as cleared,

It is important to reconcile the differences. For reconciling the balances as shown in the Cash Book and passbook a reconciliation statement is How to prepare a BRS. The first step is to compare opening balances of both the bank column of the cash book as well as bank statement; these

To start reconciling an account with an existing balance you will need to create a dummy reconciliation dated prior to the month you want to begin. When creating the 'dummy' reconciliation be sure to set the 'Ending Statement Balance' to the correct opening balance for the next month and mark off

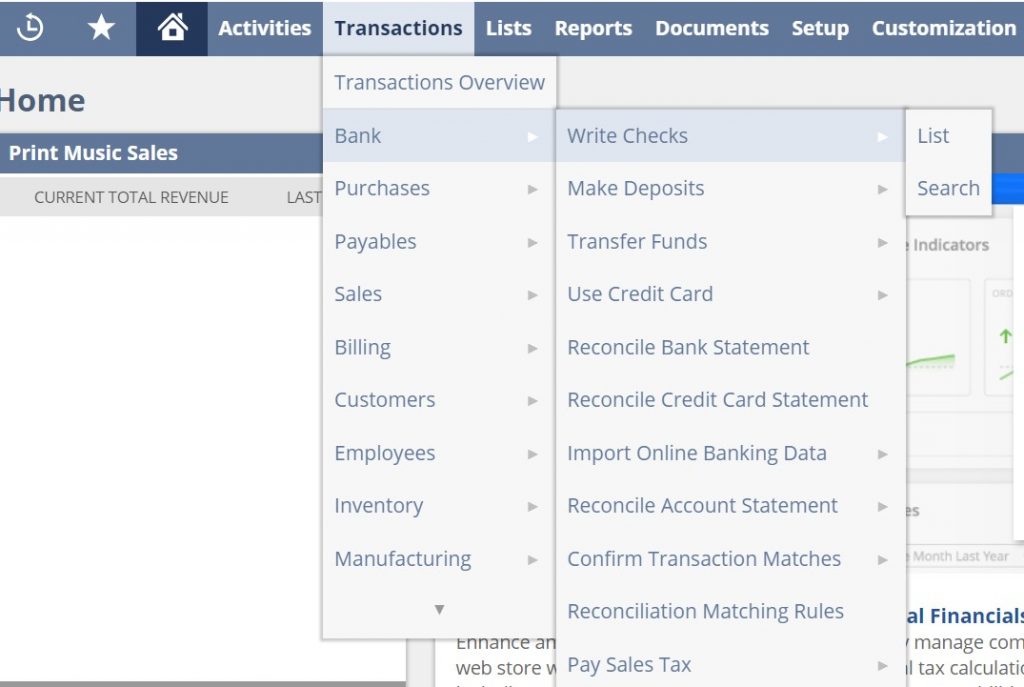

NetSuite Tutorial: How to Reconcile a Bank Account Details: In this video, we discuss how to access the bank reconciliation entry form, enter statement date and balance, mark deposits and payments as cleared, resolve netsuite undo bank reconciliation.

Learn how to reconcile your accounts so they match your bank and credit card like balancing your checkbook, you need to review your accounts in. Once you get your bank statements, compare the list of transactions with what you entered into QuickBooks.

Identify steps to reconcile monthly bank and credit card statements in NetSuite How to study: Familiarize yourself with the steps in reconciling bank statements in NetSuite. Course addressing this topic: Financial Management. Recognize how journal entries are used.

india citibank bank citi employee banking millions steals dollars khaama platform retail fraud suspended worker said been launches delhi

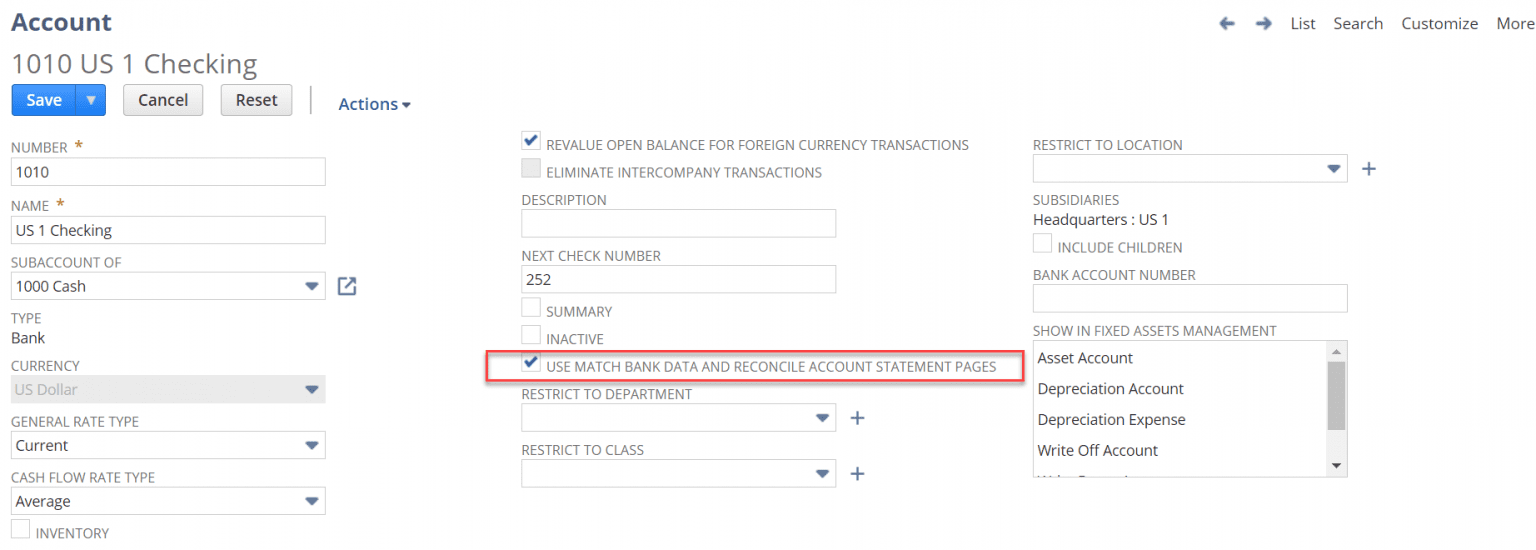

NetSuite Bank Integration: How to Prepare Bank Deposits and Do Bank Reconciliation in NetSuite. We've paired this article with a comprehensive guide There is no need for an excel or CSV file when you import account statements into NetSuite. You can match and reconcile transactions without them.

Celigo CloudExtend Excel for NetSuite is designed to solve the problem of how to create missing transactions in NetSuite when you're trying to reconcile your bank statements. Missing transactions often include miscellaneous service charges or, depending on your

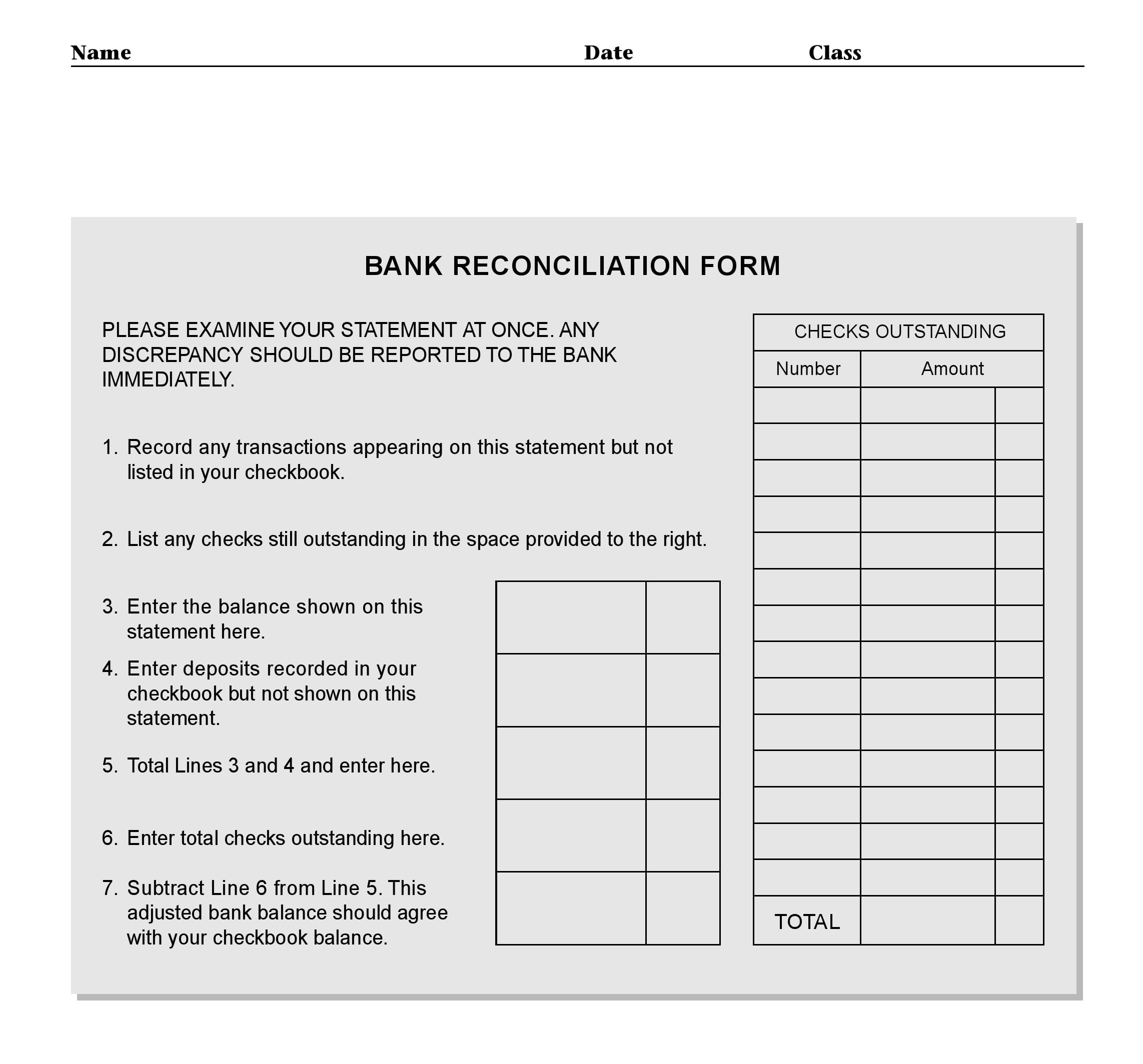

reconciliation bank statement form template deposit pdf excel spreadsheet examples account record sample check format checkbook outstanding downloadable sheet printable

What is bank reconciliation statement (BRS), why and how to prepare it? Learn shortcut key for bank reconciliation in 9 and Using auto bank reconciliation in 9. After enabling the Auto Bank Reconciliation option, now one can go ahead and reconcile the bank statement with

abacus

NetSuite will then attempt to match transactions from the import file to the transactions already entered in NetSuite using various matching rules. First, let us review how to import the online banking data that will be used to match against already existing transactions in NetSuite.

Reconciling your bank statement should be done every month when you bank statement arrives in the mail. A reconciliation reviews the income and expenses and compares what the bank has recorded compared with what you have recorded in your checkbook or accounting program.

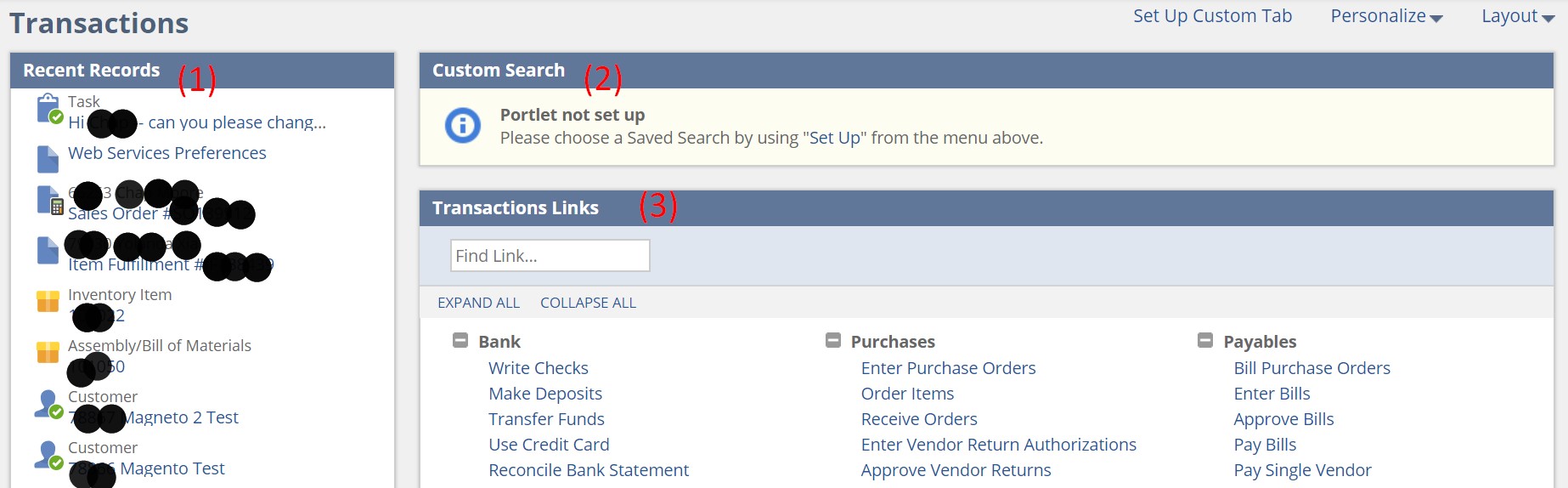

transactions netsuite oracle integration erp magento tabs groups exploring collapse expand lets note

Reconcile the bank statement. Post new transactions that are associated with the reconciliation. The Advanced bank reconciliation feature lets you import electronic bank statements and automatically reconcile them with bank transactions in Dynamics 365 Finance.

netsuite reconciliation reconcile sikich

NetSuite offers many different banking statement functions designed to increase productivity and accurately track your income. Today we will focus on importing online data, intelligent transaction matching and reconciling bank data for your individual business needs.

Bank statement reconciliation means comparing your bank statement to your accounting books. Once the balances match, they should reflect an accurate, current picture of your bank account balance. You should try to reconcile your bank account every month.

Every business should reconcile each bank statement. NetSuite has a few different ways of reconciling bank statements. Next you need to submit your matches so that they are cleared in the system and go to Reconcile Account Statement page for a final review and then reconcile

Reconcile your bank statement against your bank account register to keep your NetSuite account accurate. If the items have cleared the bank, but do not yet appear on a statement, you can manually mark transactions as cleared in the check register. Go to Reports > Financial > Chart of Accounts .

Suppose I want to reconcile my bank statement with some bill record using the native netsuite reconciliation functionality. To be clear say there are 2000 Bill records in NetSuite. My question is how netsuite knows that 1996 are already reconciled and 4 are still remaining.

Reasons to Reconcile Bank Statements. Bank reconciliation is a very important task for any company. For small businesses, the main goal of reconciling your bank statement is to ensure that the recorded balance of your business and the recorded balance of the bank match up.

Reconcile your bank statement against your bank account register to keep your NetSuite account accurate. NetSuite offers two different ways to reconcile bank You can add in new charges and income not in NetSuite. Finally, reconcile the transactions and ensure the difference to reconcile is 0.

magento netsuite erp redirects

Reconciling a bank statement involves comparing the bank's records of checking account activity with your own records of activity for the same account. The purpose of doing so is to locate any differences between the two versions, and to update your records to match those of the bank, as well as.

Bank reconciliation refers to the process of comparing a company's books with their bank statements to ensure that all transactions are accounted for. The process is a helpful way to keep accurate records, guard against fraudulent charges and resolve any other discrepancies or issues.

...how to use the system including how to reconcile a bank account and how to un-reconcile with a difference between Net GL and Bank Closing Balance not equal to zero in the Reconcile window. 11. If the check numbers are the same length in NetSuite and the bank statement, you may

This may mean reconciling the bank statement again. You then need to walk forward in time and perform effectively the same function on any connected 2. Any bank things that come over during your reconciliation that you did not know should be booked in NetSuite. At that point, they are known.

To reconcile a bank statement, the account balance as reported by the bank is compared to the general ledger of a business. Businesses maintain a cash book to record both bank transactions as well as cash transactions. The cash column in the cash book shows the available cash while the

I import my bank statement transactions into NetSuite and then used the Confirmed Transactions Matches feature to match those imported bank Best way to clean up the old items that are no longer reconciled, month by month. Not sure how to do that in Net Suite. Then we should be able

When banks send companies a bank statement that contains the company's beginning cash balanceCash Flow Statement A cash flow Statement contains information on how much cash a company generated and used during a given period., transactions during the period, and ending

reconciliation bank form statement example statements balance sheet template simple check account report worksheet bookkeeping printable checking accounts closing based

reconciliation bank netsuite advanced nolan

Recording bank reconciliations. How often to reconcile bank statements. Bank reconciliation example. Step one: Comparing your statements. First off, what is bank reconciliation? When you "reconcile" your bank statement or bank records, you compare it with your bookkeeping records

Reconciling Bank Statements Keep your NetSuite account accurate by reconciling your statements. NetSuite gives you the ability to manually mark transactions as "cleared" in the check register process. When you reconcile a bank

suiteapp

NetSuite Tutorial: How to Reconcile a Bank Account - YouTube. NetSuite - Balance Sheet Reports - YouTube. How. Details: As one of the fastest growing financial management software solutions in the world, NetSuite ERP equips you with the tools you need to replace your existing.