Understanding your workplace 401(k) is the first step toward the retirement of your dreams, so let's get started. How to Make Your 401(k) Selections The money you put into the 401(k) and its growth are always yours. But many companies require you to remain employed a certain number of years

Managing your 401(k) takes work. Your administrator handles your portfolio's actual transactions and the recordkeeping and reporting, but you decide when and how to reallocate and rebalance your assets. Beyond keeping tabs on the performance of your portfolio, you will want to know your plan'

Safe harbor 401(k) plans that do not provide any additional contributions in a year are exempted from the top-heavy rules of section 416 of the Internal Revenue Employers sponsoring safe harbor 401(k) plans must satisfy certain notice requirements. The notice requirements are satisfied if each

Read through to learn all about 401(k) plans, or use the links below to navigate throughout the post. How to rollover your 401(k) money. Final thoughts. What is a 401(k) plan? Traditional 401(k) plans provide retirement benefits to employees. Each paycheck, employees can have their employers

How to pick 401(k) investments. Taking a loan from your 401(k) is in reality, borrowing from yourself and may be an appropriate decision for some people who are unemployed with no income source, need money for medical expenses, or are purchasing their first home.

Contributing to a 401(k) plan allows you to defer paying income tax on your retirement savings. [ Read: How Much Should You Contribute to a 401(k)? ] Your 401(k) plan is required to send you an annual fee disclosure statement that lists the costs associated with each fund in the 401(k) plan.

How does a 401(k) work once you reach retirement? If you're retired and have reached the minimum age required by your plan, then you're free to withdraw from your account penalty-free. The exact process will depend on the company that manages your 401(k), but you are free to sell

An employer matching program is an employer's potential payment to an employee's 401(k) plan dependent on the extent of an employee's participation in the plan. An employee's 401(k) plan is a retirement savings plan.

For those that have no clue how to decipher your investment account statements, this video walks through a 401k statement.

Because traditional 401(k) contributions are made with pre-tax dollars, you will owe income taxes on the funds you convert to a Roth IRA, which holds By rolling over an old 401(k) into a plan with your new employer, you can keep everything in one place. Evaluate investment options carefully, though,

› Get more: 401k statement exampleShow All. Your 401k Statement - Everything You Need to Know to. How. Details: Your 401k statements should be sent out quarterly for self-directed 401(k) accounts and annually for the rest. The structure of your 401k statement will depend on

Let's walk through how to read and understand your quarterly 401(k) statement. Please note, while I'm providing an example of a 401(k) statement produced by Bankers Trust, the instructions for understanding sections of the statement are applicable to most statements produced by

The 401(k) Audit Process. 401(k) Audited Financial Statement Example. Tips For A Smooth Audit. How To Find A Good 401(k) Auditor. The 401(k) plan audit is mandated by the Employee Retirement Income Security Act (ERISA) and is intended to make sure a plan is being run correctly.

...a 401(k) is the 401(k) deductions, you may be wondering what 401(k) tax form you'll need to attach to your return and how to report any 401(k)-related One quick way to know if you have triggered any forms that you require for your return is to check the tax statement section of the online portal of

A 401(k) plan can be a great way to help save for retirement. And while it can be a relatively low-effort way to invest, there are also a lot of moving parts to consider. You may want to consider whether the plan has automatic features, your company's policies, the applicable administrative and

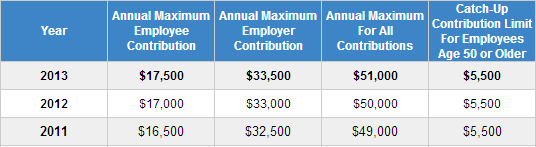

contribution max match employer limit 401k 401 limits include does chart

What is a 401k plan? Learn all of the important facts about these retirement savings accounts, including contribution limits and withdrawal rules. This guide will explain exactly what a 401k does, what you can and can't do with it, how to put money in it, and how it can set you up for a financially

A 401(k) is a retirement savings and investing plan that employers offer. A 401(k) plan gives employees a tax break on money they contribute. Contributions are automatically withdrawn from employee paychecks and invested in funds of the employee's choosing (from a list of available offerings).

4 min read. A 401(k) is a great way to save for retirement. The majority of Americans use 401(k)s as their primary retirement savings vehicle. Additionally, you can liquidate your 401(k) if you leave your company during the calendar year you turn 55. In this instance, you can withdraw your 401(k)

401k transaction

How does a 401k work? A 401k plan is a benefit commonly offered by employers to ensure employees have dedicated retirement funds. A set percentage the employee chooses is automatically taken out of each paycheck and invested in a 401k account. They are made up of investments (usually

401k roth traditional plans benefits limits contribution income

Largest text size A. No 401(k)? How to save for retirement. To find out more about IRAs, read Viewpoints on : Traditional or Roth account? A self-employed 401(k), also known as a solo 401(k), can be an option for maximizing retirement savings even if you're not making a lot

401K Rollover Options. How To Minimize 401(k) Fees With Personal Capital. Contributing to a 401(k) is extremely valuable as you plan your long-term retirement goals. Read More: Types of Retirement Accounts You Should Know. However, when it comes to your 401(k) plan, there

401k

How To Invest Your 401k. You can validate your current vesting percentage on your 401k account statement. However, if you want to obtain the vesting schedule rules, read through your plan documents for details or consult with your benefits department.

Knowing how to read and understand the information presented in a 401(k) statement may be vital to your retirement future. Why Investors Need to Open and Read Their 401(k) Statements. Many investors approach their 401(k)s with a set-it-and-forget-it strategy. This is not advisable as 401(k)...

2. How to read an investment statement. Your 401(k) statement may look overwhelming when you first glance at it, filled with all kinds of numbers and charts, but there are a few sections you'll want to keep a special eye out for to help you truly understand your statement. First, look for an

Continue reading → The post Cashing Out Your 401(k): What You Need Additionally, some 401(k) plans allow you to borrow from the plan, usually up to 50% of the vested account balance Also, you can roll over funds from your 401(k) plan into another retirement plan. How to Cash Out Your 401(k).

Free 401(k) analysis tools help you avoid common 401(k) mistakes. Get step-by-step instructions to optimize your 401(k) for lower fees and bigger The Ultimate Guide to Making Smart 401(k) Decisions + How to Get a Free 401(k) Analysis. Key Ideas. What is the 401(k) trap and why do so many

With a 401(k), your company might offer to match a percentage of some of your 401(k) contributions. This is basically free money. There are limits to how much you can save in your 401(k). In 2020, you can contribute no more than $19,500 out of pocket for the year (for employees age 49 and below).

401k

Some 401(k) plans give you access to institutional share classes, which may cost less than other alternatives, outside of a qualified retirement plan. If you leave the money within a company retirement plan and ultimately leave that company after age 55, you will have penalty-free access to those

Roth 401(k)s are ideal for high earners who aren't eligible to contribute to a Roth IRA and for people who expect to be in a higher tax bracket in retirement. If you remove money from your 401(k) before age 59½, you will have to penalties and taxes on it.

balance sheet personal 2007 latest frequently asked answers questions consumerismcommentary

A 401(k) plan: n Helps attract and keep talented employees. n Allows participants to decide how An automatic enrollment 401(k) plan allows you to automatically enroll employees and place their salary An individual benefit statement shows: n The total plan benefits earned by a participant, n