Difference Between Budget vs Forecast. A budget is a detailed statement of expected revenues and expenditure which quantifies the tactical plans of the management to reach a desired goal for the company during a specified period. Through a budget, you can convert your action plan for

Budgeting and Forecasting. This chapter describes how to create and manage budgets and Using Budgeting and Forecasting. Creating Budgets With Budgetary Controls and Budget Integration. As a result, you must periodically prepare updated or new forecasts. You can adjust

Financial forecasting vs. budgeting. When you create a budget for your business Almost every financial forecast includes a little bit of historical forecasting, and a little bit that's research-based. We'll do one month of your bookkeeping and prepare a set of financial statements for you to keep.

The budget may only be updated once a year, depending on how frequently senior management wants to revise information. In short, a business always needs a forecast to reveal its current direction, while the use of a budget is not always necessary.

How to use the best forecasting technique to triage your product portfolios. Over my career I have completed more than 10,000 product budgets, forecasts and reviews. Compiling your annual product review and risk register or more preparing to go to product governance meeting is

Most individuals prepare monthly and annual personal budgets. Budgeting is a powerful tool because it helps you to prioritize expenses and achieve Samantha specializes in personal finance, working with clients to understand their money personality while teaching them how to build their

Budgeting and forecasting help you plan and predict cash flow. Learn more about the importance of Whilst budgeting and forecasting typically go together there is a difference between the two and they can be used individually. 3 Steps on How to Implement a Successful Remote Working Strategy.

user span

How to transition from paper and excel to eInvoicing. How AP can improve relationships with your key suppliers. How to capture early payment discounts and avoid You can think of your budget as your company's financial goals, and forecasting as a review of your actual results in pursuing those goals.

finance operations technology office department elpaso ttuhsc edu

Forecasting estimates what your fixed and variable expenses will be based on different sales and revenue scenarios. Combining Forecasting and Budgeting. After you create your budget document, make multiple copies and plug Related Articles. How to Prepare and Manage a Budget.

garden summer decorations exotic host 7th june pikrepo

astrological

A forecast budget sheet is an easy way to work out your expected budget for the next year. This sheet may be required by different departments in a company or can help you to determine your salary if you own your own business. It also helps to keep your spending in check, since you are planning

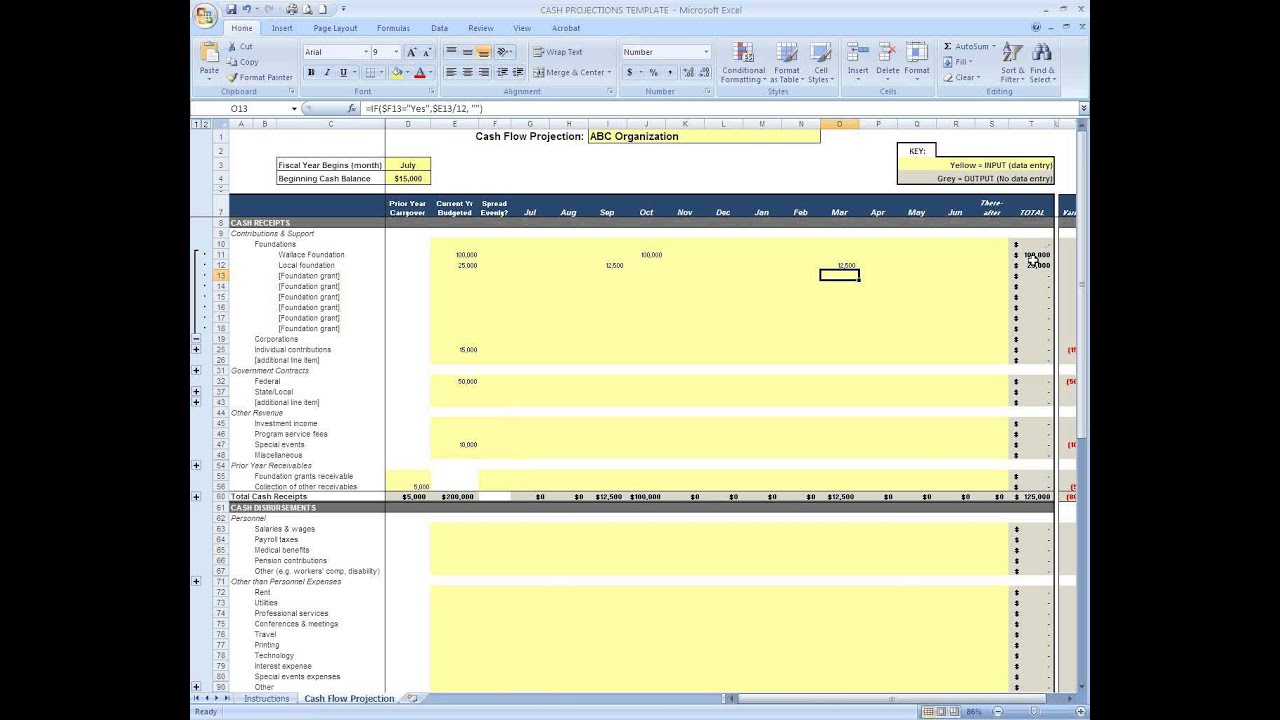

template budget nonprofit excel templates animal rescue cash flow financial editable try should projections management dremelmicro

Before preparing a production budget, however, the sales budget must be calculated so the business will know how much to produce. In order to develop a production budget, you first need to look at the sales budget. The sales budget will give you forecasted sales for the time period for which you

Forecast vs. Budget: Differences and Steps To Forecast Budget. By Indeed Editorial Team. In this article, we discuss what budgets and forecasts are, how they differ and how to create a forecast budget so you can help your organization achieve its goals.

Budgeting process involves planning and forecasting, implementing, monitoring and controlling, and evaluating the performance of the budget. This budgeting process starts at the departmental level and moves up to higher levels. Every department within the company is required to prepare plans

forecasting

Learn how to save money and make smart financial choices. Since budgeting allows you to create a spending plan for your money, it ensures that you will always have enough money for the things you need and the things that are important to you. What about Budget Forecasting and Planning?

Budgeting and forecasting allow a business to plan accurately for its fiscal year. Below are 10 ways to improve these processes to create a strategic plan Rigid forecasts and budgets aren't very useful. Things change as the year progresses, and you need to be able to factor in those changes and

Sales Budget vs Forecast: What Is the Difference? A sales budget and a sales forecast are two tools that are very similar to each other. Put simply, the sales budget shows the desired direction and goal of your company over the course of a year while the sales forecast shows how likely your sales

How to create a basic project budget in five easy steps Automating project budget creation Forecast's premium plan will provide you with a visual budget that has a fast overview

rolling forecast forecasts quarterly planning plans process example cima right cgma tools insight 2001 source essential resources

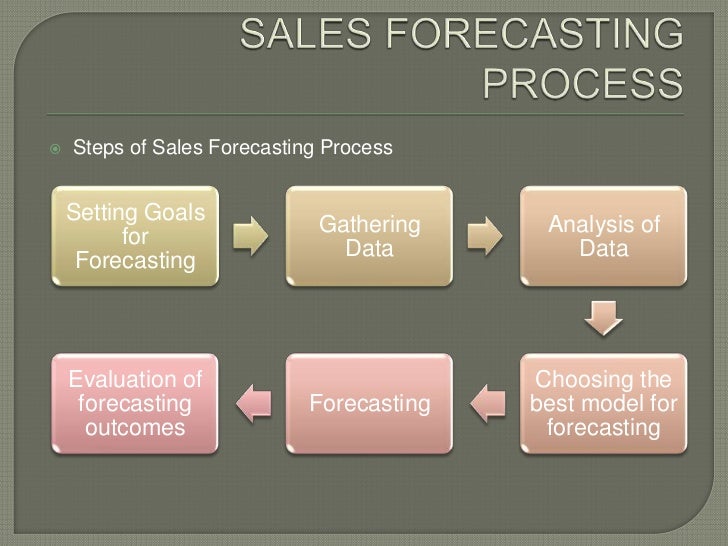

Planning, budgeting and forecasting is typically a three-step process for determining and mapping out an organization's short and long-term financial goals. Forecasting takes historical data and current market conditions and then makes predictions as to how much revenue an organization can expect

How to budget and forecast in Xero. Смотреть позже. Поделиться.

opossums jerry walls

jobs accountant accounting job urgent account management accounts forex mumbai need sample cpa tax solutions archives digital company interview services

The difference between budget and forecast is: budget shows what the entity aims to achieve (target). Flexible budget shows how the financial plan/target would look like if actual (not planned) sales/production Advantages of incremental budgeting. easy and quick to prepare. Budget manual is a document that contains instructions for budget preparation. It is often used in

Budgeting and financial forecasting are tools that companies use to establish a plan for where Although budgeting and financial forecasting are often used together, distinct differences exist Budgeting creates a baseline to compare actual results to determine how the results vary from

Budgeting process is very crucial for any business entity. Without a proper budget, a business can never keep track of how much it has earned and how Sales budget outlines the forecasted income stream of the business. It is usually the first budget to be prepared as the revenue generated

How does your entire forecast stack up against the standards in your industry? It prepares you to run monthly plan reviews. Starting off by comparing your forecasts to industry Comparisons are all automated, so once you've created your budget and forecast, you'll see how you compare right away.

Learn how to transform your budgeting and forecasting. From collecting and preparing data to forecasting, plan and budget data can be easily written back to source systems. Planning, budgeting and forecasting are three key pillars of enterprise performance management (EPM).

How it works. The Budget Forecast is calculated using ad statistics that factor in the time of year and various trends: bids, number of impressions, and the number of clicks for that particular keyword. For each keyword, the service forecasts the number of search queries, average bid, impressions,

The forecaster should explain how the assumptions lead to the forecast, without delving into the details of the specific methods. The message should address the implications of the forecast in terms of budget shortfalls or surpluses, changes in reserve levels, and other metrics that would

Remember this - forecasting and budgeting are vital for keeping your money management running smoothly when your income varies. Taking the time to forecast, budget and build up your emergency fund will reduce your stress, save you money, and keep your finances on track. About the author.

So what are the crucial strategies when preparing a budget? How can you use past financial data to inform your assumptions? And how can you ensure Now you need to translate your assumptions and scenarios into dollar figures. Begin with last year's budget and make the changes that fit your plans.

How To Build a Budget. Budgets should always be as thorough and as detailed as possible. Businesses that prepare continuous rolling forecasts have more reliable information about long-term trends and performance, ultimately allowing you to mitigate risk and plan for the future proactively.

Budget implies a formal quantitative statement of income and expenditure for a certain period. It is a plan for the resources allocated for the completion of the activities, that requires to be followed, to achieve the desired end. It is not exactly same as forecast, which is a simple estimation of the