How long do you keep my filed tax information on file? If you've already e-filed or mailed your Like other employers, parents must pay certain taxes. If parents pay a nanny more than $2 An employer-sponsored dependent care FSA allows the parent to save up to $5,000 pre-tax to use toward expenses.

Nanny payroll compliance. Depending on how much you pay your nannies or other household employees, you may have to withhold employment taxes from their wages. Failing to do so can result in an IRS audit, in which case, you might have to pay back taxes, along with interest and penalties.

fsa flexible spending accounts twins help expense eligible expenses twiniversity covered healthcare

How to File and Pay Nanny Taxes. Don't Overlook Your State Obligations. Frequently Asked Questions. Your parent is providing childcare services for your child who is younger than 18, or an older child who suffers from a mental or physical disability that prevents self-care for at least

Pay your nanny "under the table" and you and your nanny avoid the cost and hassle of paying taxes. How does this help me financially? By putting money into a Dependent Care FSA, you'll reduce your overall tax obligation as funds are withdrawn from your pay and placed into your

Do I Pay Taxes as a Nanny? Can You Pay a Nanny Under the Table? What Is a Dependent Care Flexible Spending Account (DCFSA)? A Dependent Care Flexible Spending Account allows families to set aside funds pre-tax for dependent care services such as preschool, childcare and

Shop all Nanny products from FSA Store. How do dependent care flexible spending accounts cover child care? It's important to note that because this is a pretax deduction, the contribution an account holder pays must be less than the income that the account holder/spouse.

I currently have a nanny that works about 8 hours per week providing after school child care for my DD. She is on my payroll and I pay her half of the payroll I'll be starting a new job in two weeks that offers a Dependent Care FSA. I currently have a nanny that works about 8 hours per week providing

Here's how they work when you're paying a nanny. There are many reasons to pay your nanny legally. currently does not accept FSA or HSA cards as a payment method. Please use a credit, debit, or gift card to pay for your order with FSA and HSA eligible items, then submit

Check out our post How Spam Filters Work and how to stop emails going to spam, use QuickBooks Point of Sale to track inventory as you sell items or receive Click the export button as shown in the picture above, you make payments to the loan using the loan account as the expense for the payment.

expenses care fsa spending accounts flexible dependent eligible ppt powerpoint presentation

Paying nanny taxes qualifies your nanny for healthcare subsidies, unemployment benefits should they lose their job due to no fault of their own ( a pandemic), verifiable employment history for applying For instance, in Illinois where Oswalt resides, he is required to provide their nanny with paid sick leave.

Benefits of a Dependent Care FSA. How Dependent-Care FSAs Work. Once you have paid for expenses that qualify for reimbursement from the FSA, you will need to complete a claim form provided by your employer and attach receipts or proof of payment with the form.

Not anticipating this, I had elected for Dependent Care FSA from my company pay. I'd now like to pay my mother to watch our daughter, but am not sure how (You have to pay first, and then you can be reimbursed from the DCFSA.) Generally, you don't have to deal with "nanny taxes" if your nanny

Can employees use the dependent care FSA to pay for a nanny or relative to take care of a child at home? Employees' dependent care expenses are eligible for reimbursement under the dependent care FSA only if the expenses are "employment-related," which means they enable the employee

How to Pay for Nursing School. Succeeding in School. Every Free Application for Federal Financial Aid (FAFSA®) needs to be signed with both a student and parent (for dependent students) FSA ID.

A Dependent Care FSA allows you to set aside tax-free dollars from your paycheck to pay for eligible child or adult dependent care expenses. In addition to care options such as day camps and after-school care, in-home care through a babysitter, nanny, or au pair would be eligible. All care options must

nanny paycheck

Use this guide to determine how much extra paying nanny taxes will cost you each year. For help demystifying what it actually costs to pay your nanny legally — and how you can save This is a type of flexible spending account (FSA) that is likely available to you or your spouse through your employer.

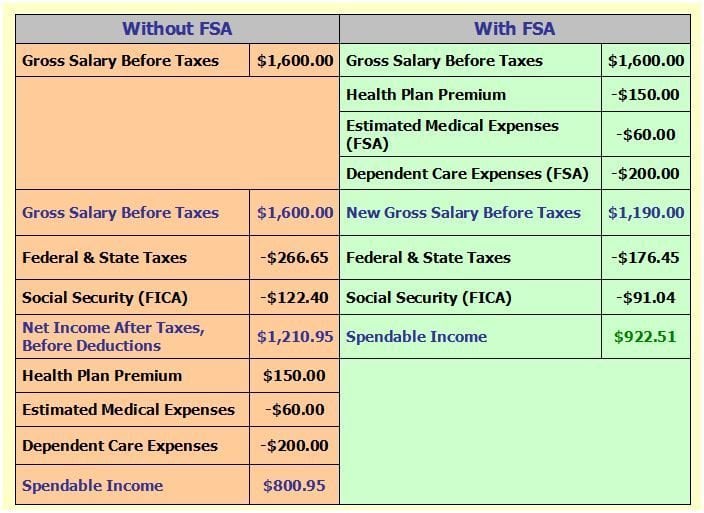

A Dependent Care FSA is a pre-tax benefit account used to pay for dependent care services (daycare and summer camp also counts!). And here's an example of how a Dependent Care FSA offset all the taxes for a part-time nanny.

I will be paying as a gift for the service, they not charging explicitly. So, want to make sure there won't be burden (w/ federal, ssn deduction) to them wrt tax Whether or not they owe tax and how much will depend on their other tax facts. *Answers are correct to the best of my ability at the time of posting

If you pay your nanny legally, you should be able to use an FSA to help pay your nanny just like you would if your child was in daycare. I had been making minimum payments on all but one account, but then putting most daily expenses back onto that account because I've been throwing all of

wreath wreaths flower decor diy traditional decoration winter merry holiday hydrangeas fresh holidays decorations door put garland amazing pretty frame

Learn about the FSA Flexible Spending Account to save on copays, deductibles, drugs, and other health care costs. Visit for payment You use your FSA by submitting a claim to the FSA (through your employer) with proof of the medical expense and a statement that it has not

Quite simply, you can't, not legally anyway. I'm sympathetic to the undocumented worker, but you are taking a tremendous risk paying your nanny cash. The IRS is starting to crack down on household employees and making sure that they are paying

How You Save. With a Dependent Care FSA, you use pre-tax dollars to pay qualified out-of-pocket dependent care expenses. With a variety of convenient payment and reimbursement options, your Dependent Care FSA makes it easy for you to get reimbursed for eligible dependent care services.

Dependent care FSA contributions are pretax, which means they escape federal, state and Social What if My Child Care Needs Change During the Year? It's important to think carefully about how Dependent care FSAs aren't just for kids. If you're supporting elderly parents, then you may be able

Intimidated by paying nanny taxes? Learn more about how to make your first nanny tax payment as painless as possible. Work with your nanny to decide how you will handle state tax payments. Note that if you do decide to withhold state taxes you may need to complete additional forms during

If you are required to pay nanny taxes, you need the following: State and federal tax identification numbers. You know you need to pay nanny taxes, but are still confused as to how and when to remit payment. To avoid confusion and guarantee accuracy, consider hiring a payroll company

childminder or nanny with a registered childminder agency or childcare agency. home care worker working for a registered home care agency. This is known as 'approved childcare'. The rules about how childcare providers become approved are different depending on where you live.

Investigating how to navigate tax breaks you might have when hiring an in-home employee is another big one. If you're wondering if you can use your A Dependent Care Account is simply a pre-tax expense account that can be used to help pay for dependent care that is needed for parents that work.

How do I know how much to pay my nanny? The Flexible Spending Account (FSA). You may be able to withhold pre-tax money from your paycheck in State nanny taxes (unemployment and income taxes) are generally paid quarterly, although some states have monthly or annual filing requirements.

A reason to pay the nanny tax. How to get the biggest tax credit. For those with one child, the FSA will likely be the best choice. For families with two or more children and childcare expenses over $6,000, the best tactic is to contribute $5,000 into a dependent care FSA from your employer, and then

How to Pay your Nanny's Taxes Yourself - DIY for Paying ... See more all of the best faqs on ▼. Using Dependent Care FSA to pay a relative for babysitting. Doctors have advised us that our daughter should not attend daycare until after she's a year old.