Find out if Paypal offers an overdraft in this article and also how to get out of your overdraft. An overdraft is effectively a form of debt attached to your bank account. If your account goes into negative figures because you've spent more than your balance, you'll be overdrawn and owe money to

How Much Overdraft Protection Does a Prepaid Card Have? An overdraft fee of $ (up to a maximum of three fees per month) will be charged if the account is not replenished within the grace period.

Overdrafts explained. If you need to make ends meet or cover unexpected costs, an overdraft can be a useful way of borrowing money in the short term. However, it's important to understand everything associated with your overdraft before using it. Knowing the ins and outs of an overdraft can help

How does an overdraft work, and what overdraft charges can I expect? Overdrafts charge interest. So it's important to be aware of how much your An arranged overdraft or authorised overdraft is one that you've agreed with your bank in advance of using it. Your bank sets an overdraft limit,

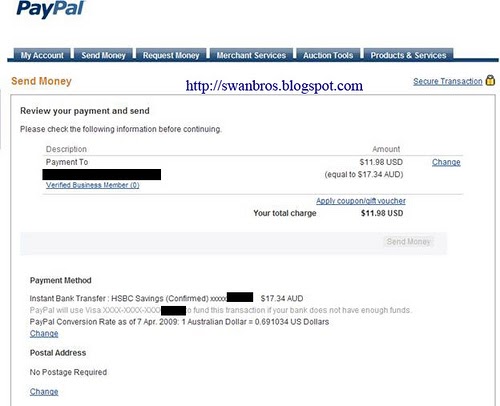

paypal money send

Answer The Question. Similar Questions. Can I overdraft my netspend card at AT. How much can you overdraft a PayPal car. Can you overdraft PayPal debit car. Can I buy something with PayPal and pay late. How do I get PayPal Cash Plu. What are the 3 methods of paymen.

The PayPal Business Debit MasterCard can be a convenient way for businesses that use PayPal to access the funds in their PayPal account. It's important to know exactly how this card works — including overdraft features — to determine if it's a good choice for your business and to use

I'm concerned because nothing has shown up on my credit card yet. I recently got a charge on my bank account labeled RET CHG PAYPAL EFF for $32, which, based on how it's a nice round number, I think is an overdraft charge. Other than that, there is no deduction for the bill itself.

Overdraft protection covers you if you spend more money than you have in your account. If you have, say, $40 in your account but use your debit card at the gas In the old days, banks would allow people to overdraft their accounts every now and then and cover the purchase, knowing that the

PayPal say that they may cap merchnats' accounts from going overdraft. They may use any of the payment methods linked to sellers' PayPal The move is useful because it will protect sellers' accounts from fraudsters withdrawing large sums of money and making their accounts going overdraft.

Because PayPal is an online money management service and not a bank, it does not overdraft your account. However, as a PayPal customer, you have the option to link your PayPal account to one of your bank accounts. PayPal emails you instructions explaining how to complete the process.

PayPal Overdraft is the most common question asked by everyone. PayPal is our favorite platform to maintain our financial transactions and provides us with How much is the PayPal overdraft fee? For the declined transactions and overdrafts, PayPal will not charge you any only

mastercard overdraft prepaid nishiohmiya

Learn how overdraft fees work and what you can do to avoid them. On the surface, overdraft protection seems like a great solution when you don't have enough cash in your account to cover a payment, but the fees associated with overdraft protection might just outweigh the benefits.

Learn about overdraft fees and the services and solutions PNC Bank has in place to help you avoid them - including Low Cash Mode for Virtual Wallet. When there's an insufficient balance in your checking account to pay for any item, funds, if available, are transferred from the Protecting

We explain how overdrafts work at ATMs, including whether you can overdraft with a credit card, the limits, fees, and more. There's no universal limit on how much you can overdraft at an ATM. A bank's overdraft limit depends on a variety of factors and often varies from one customer to the next.

We pay overdrafts at our discretion, which means we do not guarantee that we will always authorize and pay any type of transaction. The Credit Union charges $3 per Overdraft Protection transfer, with no daily limit to the number of fees charged. Overdraft and Courtesy Pay FAQ.

If you have a working PayPal account, let me show you how you can trick PayPal into giving you money. It is a simple trick to make money from PayPal. So what happens if you can learn how to double or even triple your account? I guess it sounds like good news.

How much are overdraft fees really costing you? Strategies for avoiding overdraft fees. What is an overdraft fee? An overdraft happens when you don't Paying an overdraft fee is a costly and often unnecessary expense. Some of the best ways to avoid overdraft fees include understanding

bank current banking focuses paid workers essential campaign advertising already early getting lot were tearsheet interests stuart sopp customers mind

We all know how checks work with no overdraft protection, and not having a ton of money in your account — your check will bounce, and the receiver won't In short, overdraft protection is a safety net for those that that need to make a certain transaction, and don't have enough in their account.

How to get out of your overdraft and avoid charges. Read all you need to know about overdraft rules. Take action on your overdraft. The good news is, it should now be easier for those in their overdraft to understand exactly how much they are being charged - and to compare rates across

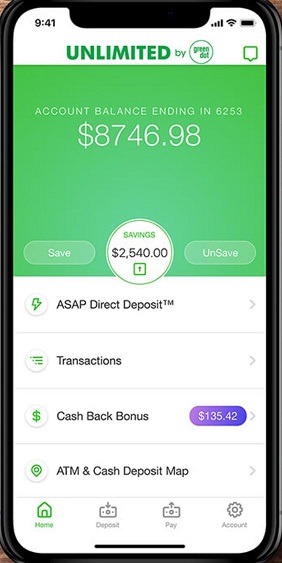

unlimited dot cash savings prepaid interest app account cards money

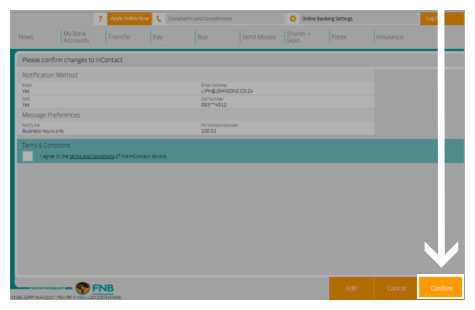

fnb incontact demos

I received a message from a buyer who wants me to refund the total amount they paid because PayPal deducted the money from their checking account and. The buyer was charged a $35 overdraft fee. I don't understand the reasoning of a refund back into their account will reverse the overdraft fee.

An overdraft is when you don't have enough money in your account to cover a transaction, so your bank pays instead. An overdraft allows you to continue using funds in your account even when it has a negative balance, but you're required to replace the money, and usually pay a fee.

"Will PayPal overdraft my bank account?" is one of the most frequently asked questions online about Paypal. Many people are concerned that PayPal will. Many people are concerned that PayPal will overdraft their bank accounts should there not be enough funds for a transaction. In this article, you'

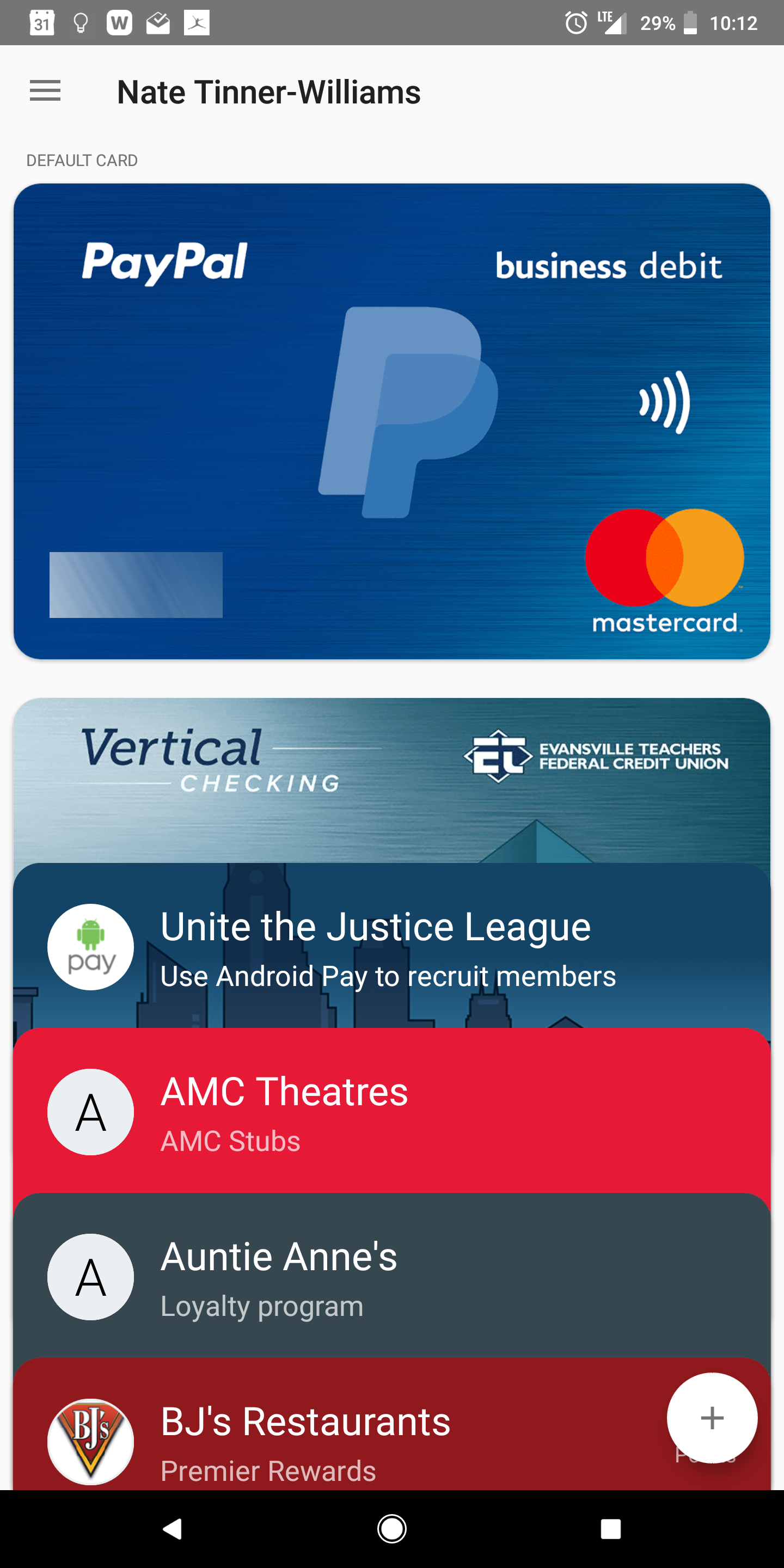

paypal pay debit android mastercard card

Table of contents 2. how does paypal work with no money? 9. can i overdraft paypal debit card?

If you read your PayPal agreement, PayPal can do whatever it wants to. Even if you link a credit card, it is mandatory you have a linked checking account. I had this problem of PayPal over drawing my bank account , so I opened a free checking account at my bank and changed accounts.

How can I overdraft my debit card? It means that you are going to use your card and purchase an item while you don't have enough funds on your checking Related Searches. paypal overdraft loophole 2021 paypal cash card atm paypal cash card atm locations paypal cash account paypal

Want to know about debit card overdraft? This article shows different ways you can overdraft a debit card. Carefully read through. If you don't sign up for Debit Card Overdraft Service and don't have enough money, your ATM withdrawals and ordinary debit card purchases will be denied.

> How to use PayPal (Archive). > Pay-pal caused me to overdraft. I added a card and they withdrew to check and see if it cleared well when the did the caused an overdraft charge when they took it they credited the back but left me with a over draft fee thanks paypal for

Now, I took the $30 fall on that and paid off the overdraft fee, and removed the bank account from the PayPal entirely. How can I make sure this never happens again? Can I get any sort of refund from PayPal because they should not be touching accounts I remove from their system.