sponsor: Netspend Corporation. MetaBank, is not affiliated in any way with this program and does not endorse or sponsor this program. 5 The Debit Card Overdraft Service is an optional service made available to eligible All-Access customers by MetaBank., Once you enroll and meet the eligibility requirements, you will be charged ...

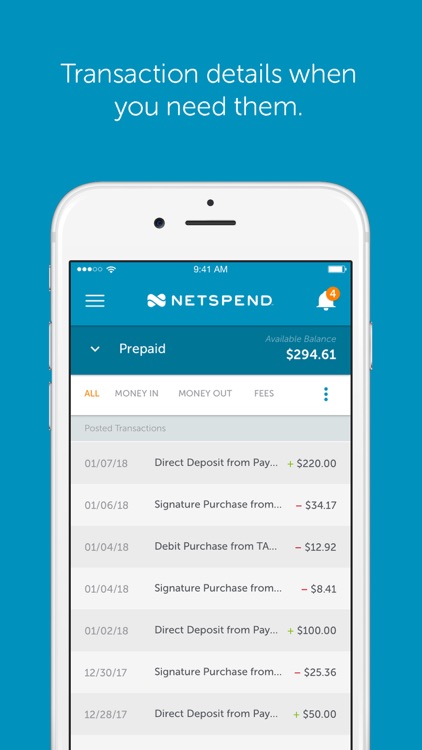

04, 2022 · Account overdraft grace periods. Spend a little more than you had in your account? No problem. You can sign up for Netspend® All-Access ® Account by MetaBank®’s optional overdraft service, giving you a 24-hour grace period for overdrafts. Payback rewards. You can also sign up for cashback rewards on your purchases.

Video result for Netspend Overdraft Sign Up Netspend: The Net of Overdraft Protection How to Register Netspend Account? 3 The Debit Card Overdraft Service is an optional service made available to eligible

prepaid netspend brinks apy overdraft checks bounced

The Netspend card offers several convenient reload options, allowing for both in-person and online account funding. The Netspend Card is a prepaid debit card from the global payment company Netspend that allows you to make transactions without a bank account.

18, 2022 · If you need to purchase a money order, you will need cash or a debit card. Once you have your Walmart money order, remember that it is as good as cash. Walmart advises you to complete all fields, such as your name and the name of the recipient, as soon as you buy it.

How Does Netspend's Overdraft Protection Service Work? Netspend offers its customers a free purchase cushion or overdraft buffer of $ means that you would not incur typical overdraft charges of $15 if you go over the amount on your debit card. While the protection gives you a

Our cardholder explains how Netspend's overdraft protection has helped them out. Get your own Netspend prepaid debit card at ... Direct Deposit GET PAID UP TO 2 DAYS FASTER[2] When you Direct Deposit to your Netspend Card, you can get your paycheck ...

How much can I overdraft on netspend? Netspend offers prepaid debit card users overdraft protection when their account balance goes under -$ Customers must enroll and have at least one direct deposit of $500 or more every 30 days.

Netspend Direct Deposit, you can get paid faster than a paper check. No late fees or interest charges because this is not a credit card. No Overdraft Fees on purchases using your card. Use the NetSpend Mobile App to manage your account on the go and get text message or email alerts (Message & data rates may apply).

How to Load Money to the Netspend Prepaid Visa Card. Direct Deposits. Mobile Check Load. With the Netspend Prepaid Visa card, you can do mostly everything that you can with a bank account, from checking account balances to transferring payments, and cashing checks to paying for everyday items.

The Netspend prepaid card offers basic debit card features, plus an option to save and earn interest. Netspend's prepaid debit cards are expensive alternatives to a checking account. They're easy to get, and there's no banking history or credit check required to open, but Netspend makes

Answer The Question. Similar Questions. What is the overdraft limit for netspen. How do I get overdraft protection with netspen. How much can I overdraft on my skylight car. Does netspend pay 2 days earl. Asked By: Wallace Barnes Date: created: Jul 14 2021.

How soon can I use my overdraft privilege? How much can you overdraft with Metabank? What is the limit on a netSpend card? How do I overdraft my Greendot card? three to 31 days. Why would netSpend send me a card? According to the representative, someone at netSpend thought that

But even when overdrafts are not allowed by the card issuer, there are situations in which overdrafts can occur. This may happen when, for example Netspend offers prepaid debit card users overdraft protection when their account balance goes under -$ ... Netspend charges $15 per

Netspend cards — like all prepaid cards — are not designed to allow cardholders to spend beyond How Much Can You Overdraft On a PayPal Card? The PayPal Prepaid Mastercard® provides a If you tend to overdraft several times each month, this service can save you money over the long run.

19, 2015 · Application for this prepaid card is simple: create an online account, fill in the necessary details and Symphony Financial Co will mail you one. 5. NetSpend Visa Prepaid Card. You can apply for a prepaid Visa debit card for international use online from NetSpend. Their card is issued by MetaBank.

By shoving an unwanted card onto us, netSpend pretty much lost any chance of having us a customer in the future. Credit and debit cards are not supposed to be given out like candy and I hope netSpend realizes that. It seems that netSpend's business is basically to get people to

Netspend, the pre-paid debit card service, lets cardholders overdraw their accounts only if they have enrolled in its overdraft protection service. Netspend offers prepaid debit card users overdraft protection when their account balance goes under -$ Customers must enroll and have at

is a service provider to Republic Bank & Trust Company. Certain products and services may be licensed under Patent Nos. 6,000,608 and 6,189,787. Fees, terms and conditions apply. Card may be used everywhere Debit Mastercard is accepted.

gobank account card cards prepaid debit checking bank credit go2bank generator number mastercard creditcards visa fake bad statement partner offer

How to Activate Netspend Card Without SSN: Activation Process Detailed. There are four ways to load your Netspend Visa Prepaid Card or Netspend Prepaid Mastercard: in-person reload at a partner Reload Location, via direct deposit, by money transfer, or through a mobile check load.

Our cardholder explains how Netspend's overdraft protection has helped them out. Get your own Netspend prepaid debit card at

netspend mastercard prepaid cards credit debit creditcards partner offer

netspend prepaid visa

How much does NetSpend® Visa® Prepaid Card cost? Netspend offers you a choice between three different fee plans. Optional Debit Card Overdraft Service. Get paid up to 2 days faster with Direct Deposit. Withdraw up to $400 in cash per day without a fee at participating ACE locations when

How does Netspend work? Netspend's prepaid cards function similarly to debit cards, but with one crucial When you receive your Netspend card (about seven to 10 business days later, unless you pay for expedited delivery), follow the activation and identity-verification instructions that come with it.

Netspend offers prepaid cards from Visa and Mastercard. These cards provide the convenience of a How does Netspend work? Once you've signed up for a Netspend prepaid card, you receive You can also enroll in a protection plan that covers overdrafts up to $10. As long as you have

29, 2021 · Netspend was founded in 1999 and is a provider of prepaid debit cards for both personal and commercial customers. According to its website, Netspend serves 68 million underbanked ...

Customers can buy a Netspend card from the company's website online or purchase one from How can I open an account online to get a Free Netspend Money card? It is relatively easy to open an Netspend overdraft protection allows prepaid cardholders to incur fees or complete transactions

How do I enroll in netspend overdraft protection service. If you have an online account with NetSpend, in addition to the debit/charge card, check out the Bill Pay feature.

How to redeem. The Netspend Prepaid Mastercard Prepaid Card can be a useful alternative to a traditional Mastercard credit card by giving you more control over your spending and Netspend Prepaid Mastercard holders can have access to their direct deposits up to two days earlier than usual.

card credit netspend money load

Contents 5 How much can you overdraft netspend? 8 Can I overdraft my NetSpend card if its already overdrafted?

netspend prepaid

29, 2021 · NetSpend: Best for Prescription Purchases. Netspend ... and send money with very few fees. There are no minimum account balances, no overdraft fees, and customers can enjoy over 20,000 nationwide fee-free ATM locations. check cashing fee; $ charge for sending money to family and friends ... If you have an ID card but no bank and do ...

a Netspend card to pay for a car rental. You can use a Netspend card at car rental agencies that accept prepaid cards. However, they usually require a deposit of 15 percent more than the cost of renting the car. The rental agency will put an extra hold on the account for that amount of money and the hold could last for a couple of weeks.

The Overdraft Protection Service Fee is $ for each transaction that overdraws your account by more than $, up to a maximum of three (3) Overdraft Protection Service Fees per calendar month. Can I use my debit card for an online payment without the card holder's name?

up to $200 overdraft protection with opt-in & eligible direct deposit. ⁴ No monthly fee with qualifying direct deposit of $500+. Otherwise, $ per month. ⁵ Earn 2% annual interest (APY) on savings on up to $1,000 balance in your savings account. ⁶ Lock protection in the app. Misplaced card? Press LOCK to prevent purchases.

How to Use Netspend Cards. Customers are allowed to use the overdraft protection service up to three times per calendar month. Customers are charged a transaction fee of $15 overdraft transaction services for customer withdrawals that exceed their card balance by more than $10.

As noted above, Netspend provides prepaid debit cards for both individual and commercial customers. Here is how it operates. Netspend enables customers a buffer of $10, which means that overdraft protection kicks in as soon as the balance goes beyond -$

Netspend FAQs make it easy to understand exactly how our prepaid debit cards & services work for you. There is no cost to order and activate a Netspend card. Once you activate the card, you may choose from our selection of fee plans.

Hey guys, quick question for anyone with a Netspend Card, is it possible to overdraft it? Seems like there's a section of this sub that has really lost the plot. If you don't have compassion for your fellow addict, how the fuck do you expect the normies to have sympathy and understanding?

How many times can I overdraft my Netspend account? If you have enrolled for overdraft protection, Netspend will allow you to overdraft your account with your all-access debit card for a maximum of 5 times per month.

Step 1. Go to Netspend Overdraft Sign Up page via official link below. Step 2. Login using your username and password. Netspend - Overview, Services Offered & How to Open an ... Remember, you can't overdraft with a NetSpend card, but here's some good tips from