A 401(k) is how many Americans save for retirement. It is funded directly through payroll If you opt to take a 401(k) loan, make sure that your company actually offers you the option, as not all do. When you take money out of your account, it won't be earning you any interest towards your retirement.

pension scheme sample

enrollment 401k irs hamiltonplastering

30, 2021 · But while many workers opt to put their savings into a traditional 401(k), there's another option you may want to consider -- a Roth 401(k). Though not every 401(k) comes with a …

How do 401(k) contributions translate into retirement income? Depending on your lifestyle and retirement goals, maxing out your 401(k) may not be enough. This is a BETA experience. You may opt-out by clicking here.

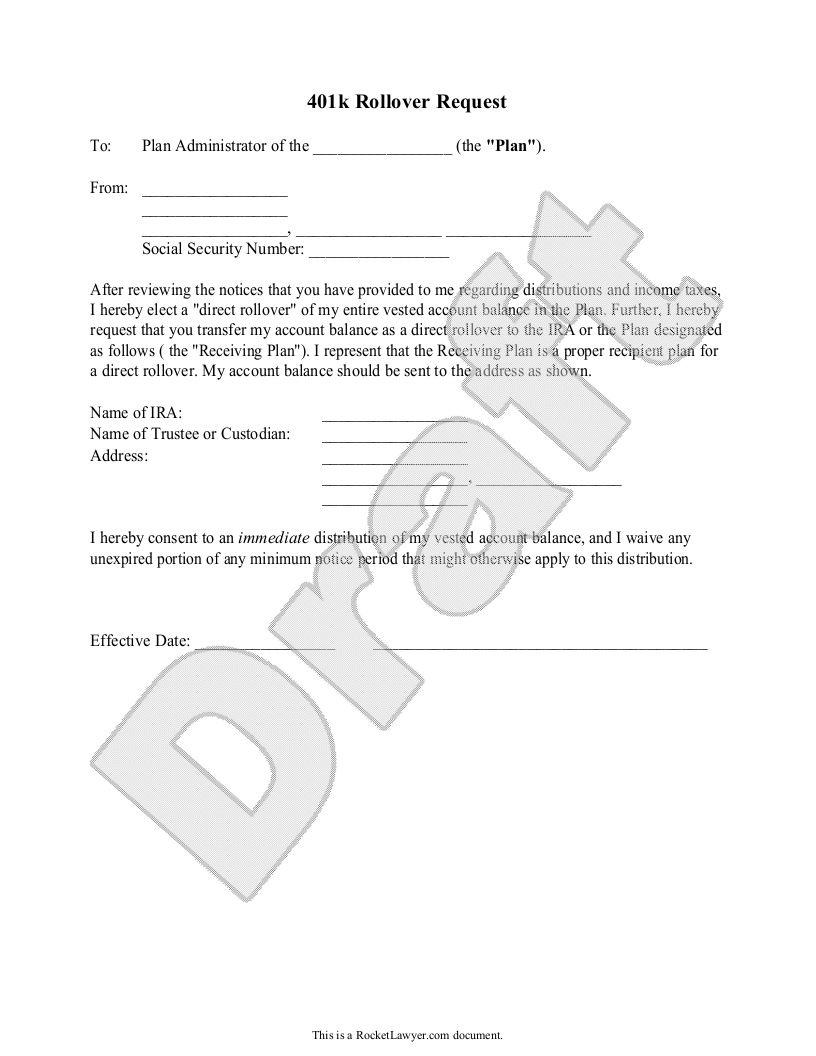

401k rollover samplewords

401k irs

A 401(k) is a defined contribution plan meaning that our retirement benefit is determined primarily by the amount that we save and how we invest those savings. It's not required but rather just a selection within the 401(k) plan document. I've found that most employers actually opt out of the "true-up"...

A 401(k) is an employer-sponsored retirement savings plan offered by many employers to their employees. Typically, employees can fund their 401(k) plans through automatic payroll withholding. Employers can opt to make matching contributions up to a certain percentage.

20, 2017 · A 401k plan is a defined contribution plan that can help you prepare for life beyond your earning years. If you don’t take your mandatory 401k distribution payments, however, you can lose some of your money. Find out when you should withdraw from your retirement savings and perhaps use your 401k to retire early.

How does 401(k) plan work for H1, L1 Visas? Eligibility to participate in 401(k) plan. Cash out: You can withdraw the money in your 401(K). However, if you are under the age of , the income tax Those employers who have opted to offer the 401(k) retirement plan must also offer to match

(k)In the United States, a 401(k) plan is an employer-sponsored defined-contribution pension account defined in subsection 401(k) of the Internal Revenue Code. Employee funding comes directly off their paycheck and may be matched by the employer. There are two types: traditional and Roth 401(k).For Roth accounts, contributions and withdrawals have no impact on income tax.

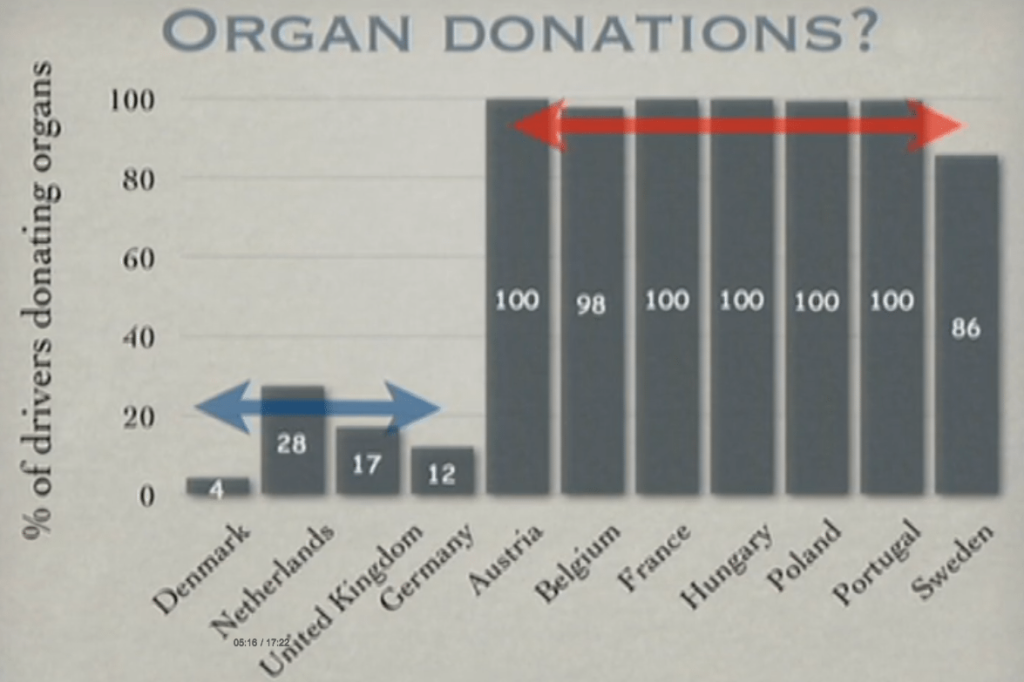

opt habits procrastination laziness organ willpower pregunta semilla ceniza

401k plans, IRAs and other tax-advantaged retirement savings accounts are common ways to save for retirement, and millions of Americans pour money into them every year. It's generally wise to avoid withdrawing money from your 401k, as there are often hefty penalties and taxes to consider for

The Average 401k Balance By Age | How Does Yours Compare? 8:23. How to Change Your Fidelity 401k Investments.

Many employers that sponsor 401(k) plans also match worker contributions to some degree. Now these matches can vary, and some are more generous than others. But if your company offers no such match whatsoever, then frankly, that takes a lot of the appeal of 401(k)s out of the equation.

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. Your 401k is now money that's there for you to start preparing for the next stage of your life as you put the finishing touches on your career and prepare to start drawing Social Security benefits.

21, 2020 · It seems my best option would be to open a 401k plan with the partnership which would be offered to the employees and my partner would likely opt out. I could then have a separate individual 401k for my 1099 hospital employed income? Does the fact that all income is going into my personal s-corp change the ability to have 2 separate accounts?

go into the details of something that is completely out of your control like inflation, salary growth, changes in federal law, or changes in employment policies. This 401k contribution calculator helps streamline the process of figuring out how much you should contribute toward your 401k to meet your future goal.

If your 401(k) plan generally provides a 6% return on the amount invested, you could be paying more in interest on the credit card than you are earning through Your family could also be looking to purchase a home, buy another vehicle or make a renovation. You might opt to put some funds in a 401(k)

05, 2021 · A 401(k) plan is a retirement savings plan offered by many American employers that has tax advantages to the saver. It is named after a …

401k pdffiller

How to Set up a 401k Plan for Small Business Employees. Employer match: Matching contributions are among the top benefits of 401(k) plans for employees. Employers can either match a percentage of employee contributions up to a set portion of total salary, or contribute up to a certain dollar

Several kinds of 401(k) plans are not subject to the annual contributions testing that traditional 401(k) plans require. There are a number of protections for participants receiving electronic disclosures, including the right to request paper copies of disclosures or to opt out of electronic delivery.

As Peggy explained, 401(k) plans and their tax advantages are intended for accumulating funds for retirement, not for use as an ATM. (In fact, if you have less than $5K inside the plan, you might actually be forced out of the plan anyway.) If, the year you leave the employer, you'll be turning 55

401k rollover ira roth retirement cheat conversion withdrawal irs sheet loan convert early opt distribution types fortune lose employer inservice

Check out the following pros to maxing out your 401(k). If these pros fit your needs, you may choose to head down Money comes out on a pre-tax basis (unless you choose to opt for a Roth 401(k) instead of a regular 401(k), which Featured Article: How can investors benefit from after-hours trading?

31, 2018 · McDonald’s 401k Plan Summary Plan Description and Prospectus Para solicitor una traducción en español de la Descripción Resumida del Plan y Prospecto, llame al 1-877-469-4015. ... opt out at any time by calling 1-800-242-6182 and …

401k

A 401(k) is an important benefit employers can offer to their employees. Follow this step-by-step In this article, we'll give you the lowdown on how to set up a 401(k) plan that takes superb care of your team. As employees usually set up automatic contributions that come out of their paycheck, it

Getting in touch with your 401(k) is critical. You need to understand where your hard-earned money is going. As silly as it sounds, you need to know where to find your 401(k) and how to log into your account. How can they do this? Well, typically they give you a chance to opt-out—otherwise,

If you're asking how to invest beyond your workplace retirement plan, then you're making huge strides in If that's the case, and you want to contribute to an IRA, you can opt for a Roth IRA instead. 2. Convert Old 401(k)s to Roth IRAs. Let's pretend that you've changed jobs at least once in your

first option is of 401k loans and the second one is 401k hardship withdrawals. Getting a 401K loan is easy and less costly irrespective of the requirement. The benefit is, that interest paid on this loan is diverted to the 401K fund. On the flip side, be ready to shell out loan fees and miss out on tax benefits.

A 401(k) plan may allow you to receive a hardship distribution because of an immediate and heavy financial need. The Bipartisan Budget Act of If you've made hardship distributions to participants in your 401(k) plan that haven't followed your plan or the hardship distribution rules, find out how

plan 401k know things retirement jgi jamie grill getty cnbc

How to cash out and the implications of doing so The procedure for cashing out is usually rather simple. All you need to do is contact your plan's You aren't limited to a small selection of 401(k) funds. If you want more control over your retirement investments, or simply don't have a new 401(k)...

Cashing out a 401(k) or making a 401(k) early withdrawal can mean paying the IRS a 10% penalty when you file Other exceptions might get you out of the 10% penalty if you're cashing out a 401(k) or making a 401(k) Certain costs to repair damage to your home. How to make a hardship withdrawal.

Because 401(k) plans have such strong tax advantages, the IRS limits how much you can contribute to them each year. Once you reach these limits on your 401(k), you've "maxed it out" for the current tax year. This is when you can begin to look elsewhere for other places to save for retirement.

11, 2018 · It’s not required but rather just a selection within the 401(k) plan document. I’ve found that most employers actually opt out of the “true-up” feature. However, if your employer has the “true-up” provision in their plan, then they must go back each year and give you your full match. So, you’ll definitely want to check on that.

opt_out. Nativo. Cashing Out a 401(k) After Leaving Your Job. Once you leave your job, whether it's your choice or otherwise, you'll eventually need to move your 401(k) How Much Do You Lose When You Cash Out Your 401(k) Early? You might think that paying the taxes on the income isn't a big deal.

In the United States, a 401(k) plan is an employer-sponsored defined-contribution pension account defined in subsection 401(k) of the Internal Revenue Code. Employee funding comes directly off their paycheck and may be matched by the employer.

Closing a 401(k) account can take a significant bite out of the balance. Jupiterimages/Comstock/Getty Images. With a previous employer, you can always close a 401(k) plan by requesting a withdrawal of the entire account balance. The plan administrator will sell all of the investments in your account

Data from Plan Sponsor Council of America shows that 58% of 401(k) transfer balances are between $1,000 and $5,000 when a career professional Or, the 401(k) account holder's company merged with another firm, was bought out, or went bankrupt. You might even automatically have been enrolled

Unfortunately, 401(k) plans come with fees but many savers don't realize this. According to TDAmeritrade's January 2018 Investor Pulse Survey, 37% of Americans don't know that they pay any 401(k) fees, 22% don't know if their plan has fees, and 14% don't know how to determine the fees.

401(k) Contribution Limits. For employees who have the ambition and financial wherewithal to make the most of their 401(k), one of the best ways to begin is If you do not like how a plan is organized or the investment options on offer, say so. Complaining about a deficient plan can be an effective means

What happens to your 401(k) after you leave a job? 8 things to consider about moving your 401(k). Your former employer may force you out of the plan by placing your funds in an IRA in your name or Keeping on top of how the plan is performing is very important as you may later decide to

A few 401(k) plans allow you to take money out of the plan while you are still employed, by using this option. If I take money out of my 401(k), how long do I have to roll it over? If you take a distribution directly and plan to roll it over into an IRA, you must deposit it within 60 days in order to avoid

Learn how to cash out a 401(k) plan when you leave your job. Find out whether you should How to Cash Out a 401(k) After Quitting Cashing Out a 401(k) in the Event of Job Termination

have carried a phobia after investing all my 401k funds in my former employer’s stock (Citigroup), only for it to all fizzle out after the company was bailed out. I currently contribute to my company’s 401k plan, I get the matching funds, and I contribute as much as 20% of my income in most years, but it’s all sitting in cash.