The following steps show you how to start CheckMark Payroll for Macintosh and open a sample company file called PR Sample Co, Inc. If you would rather start setting up your own company right away, go to "Creating a New Company File" on page 25.

I currently use a company to "process my payroll." I am the only employee of my US based S corp. Every month the payroll company takes $700ish I own a payroll company in the south. 1 employee generally runs about $35 a month. Could this leave me open to claims from them in the future?

How your payroll administrator manages time and attendance - whether it's a time clock, a mobile app or a pencil and paper Open a bank account specifically for paying employees and taxes. Develop a payroll schedule. Create a company payroll policy. What are the types of payroll processing?

explains how to begin your payroll processing by resetting all your information and preparing for the next payroll cycle. Rapid Pay Data Entry Window. To see information about options in the Open dialog box, see "Opening a Payroll Batch" on page 2-53.

How a Payroll System Works. Payroll systems manage everything having to do with the process of Payroll is an integral part of a company's operations. Not only is it responsible for employees' How to Make a Payroll System in Excel. Creating a manual payroll calculator can be tedious but

adaptation adaptable marketing market adapt adapting

How to process payroll with a payroll service: Just like with the DIY option above, you need to have all your employees complete a Form W-4 and find or register for Employer If you don't want to learn how to do payroll yourself for your company or use a payroll service, consider hiring an accountant.

Payroll software is a system that automates and streamlines the process of paying a company's It is also ideal for companies looking to digitize and automate how they file and process tax forms. It comes in two packages—Basic Payroll and Full-Service Payroll—which can scale to how

How to open a payroll program account. A payroll program account is required to identify your business or organization when you remit payroll deductions. number of employees. payroll service name (if any). country of the parent company or affiliate, if you have a foreign owned corporation.

A good payroll service will pay employees and file and pay payroll taxes. Editor's Note: Looking for Payroll Services for your company? If you would like information to help you choose the one that's right for you, use the questionnaire below to have our partner, BuyerZone, provide you

ppp forgiveness

Payroll is a list of employees who get paid by the company. It also refers to the total amount of money paid to the employees. Learn how to do payroll. A payroll officer needs to do careful planning. There are always ongoing tasks that need attention and a constant need to monitor changes

How to do payroll accounting: 7 steps. At first glance, payroll accounting can be scary. Debit the wages, salaries, and company payroll taxes you paid. This will increase your expenses for the period. To get started, let's take a look at a payroll journal entry example, shall we?

bank account kong hong corporate hk banks opening open lccs

How to manage global payroll for your international team. For example, if a company does not own a legal entity in a country, a global payroll provider can help that company hire international workers without needing to spend thousands of dollars over several months to open a new entity.

Fill in your company details. *Company alias: another name of your company *BizNature : business nature (eg: Food Catering, Forwarding,etc) *Industry Code - Before you process the month end, you can use open pending payroll to key-in all others add hoc info like extra allowance, overtime, claim etc.

Outsource Your Payroll. For many businesses, payroll services offer an attractive and valuable alternative to in-house processing. Chosen correctly, they provide a less expensive, simpler means of paying your employees, filing your taxes, and performing a host of other duties these companies'...

If you made it to the end of this video on how to start a payroll company, and would like to learn the skills needed for building a truly leveraged business without dealing with supplies or equipment and employees using the internet, visit my training How To Sell Payroll- As-A-Service | PayEvo Podcast.

How do I start a payroll business? How to process payroll yourselfStep 1: Have all employees complete a W-4 form. Step 2: Find or sign up for Employer Identification Numbers. 1 How do I start a payroll business? 2 Are payroll companies profitable? 3 How much does it cost to set up payroll?

Working with a payroll company located abroad, but making sure they have a local representative you can talk to when necessary. It may also cost more to learn how to use the software and pay for the license. Payroll companies already have specialized programs for handling payroll, so it'll be

A payroll company can make the withholding calculations and submit the net payment amounts to each worker's bank account. You supply the employee data and the company bank account you use to process payments. You may need to deduct additional employee items such as retirement

workspace productive productivity

Here we discuss How to Create a Payroll in Excel along with example and downloadable excel template. While most organisations turn their heads towards software like Tally or ADP for payroll, or they give a contract to some outsourcing companies to provide them with the payroll

office gensler gusto francisco san headquarters architecture pier 70 dezeen warehouse industrial spacestor workplace interior interiors vast buildings company becomes

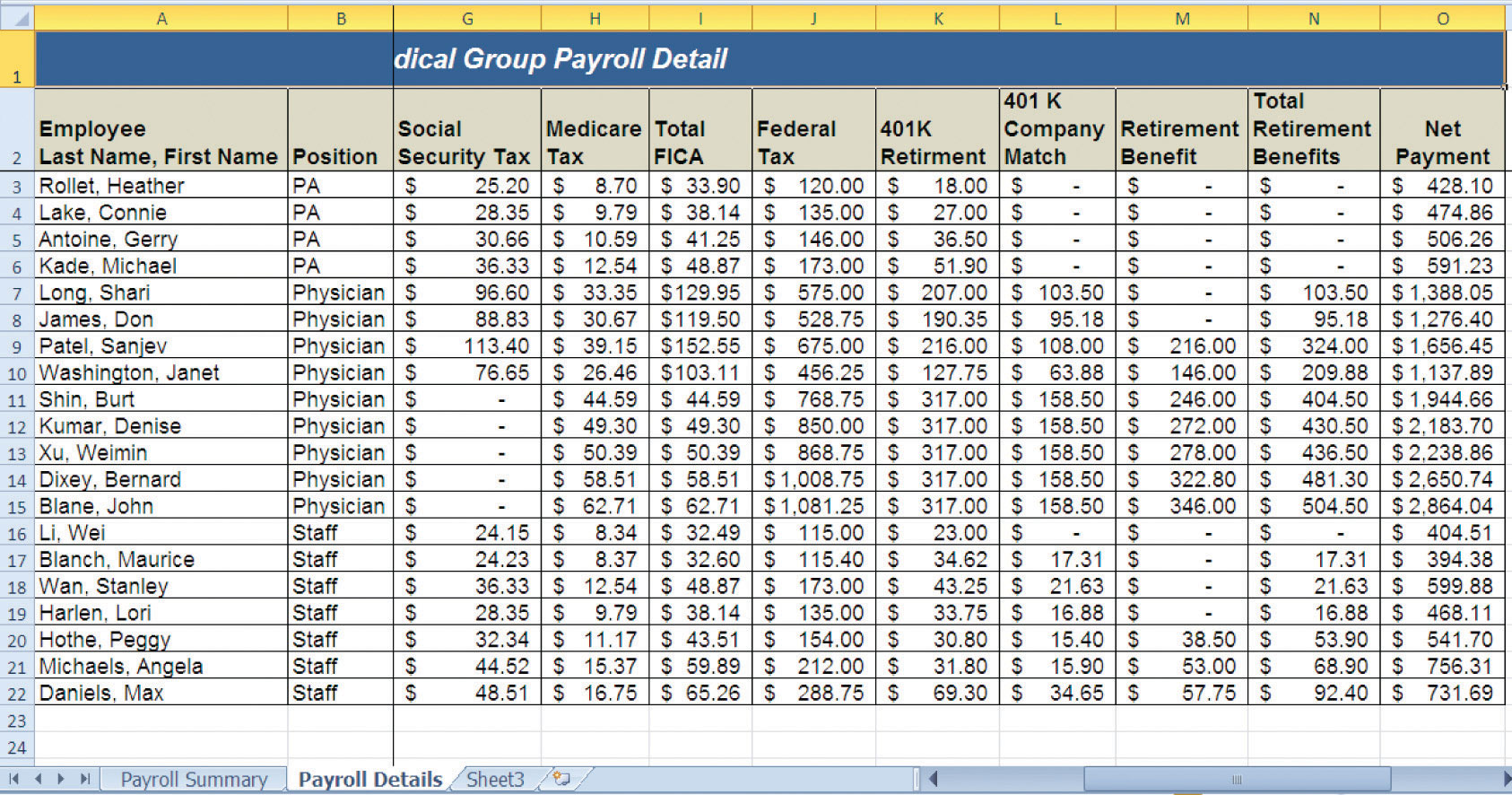

worksheet excel spreadsheet practice accounting exercises templates pdf microsoft payroll exercise cip assignments column sample chapter completed summary columns logical

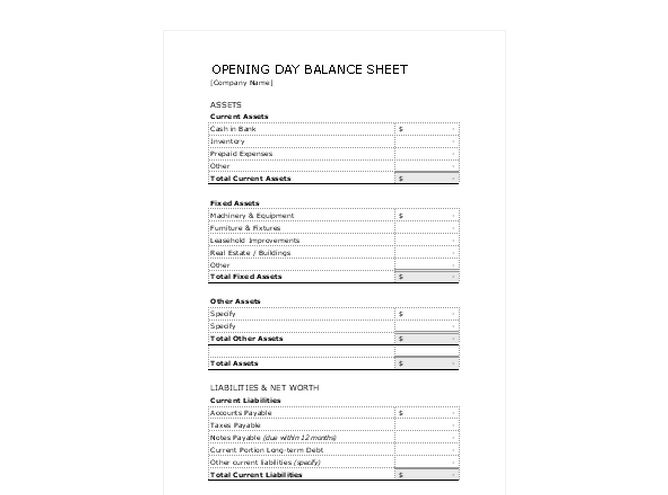

balance sheet opening template

Many businesses choose to open a bank account separate from their business account just for the purpose of payroll. If you do so, use this account only for How do I start and do payroll? To begin to process payroll, you will need to gather information about each of your employees and your company.

How Relevant streamlined payroll operations at a US-based fintech company with a custom solution How much it takes in terms of time and budget to develop a payroll automation system Priorities for a payroll management solution. Choosing how to automate payroll processing

Just open a new account at your current bank, make sure to schedule your payroll a couple days ahead of time. Make sure you have enough money for your payroll What they do is figure out how much of that pay goes to whom. I worked for a small-ish company in Canada, they farmed out payroll.

For example, you can roll back a payroll run when you want to carry out a test run without keeping any If an employee leaves the company before the end of a payroll period, you will need to calculate the For information on how to define event group qualifiers, see: Defining Event Group, Note ID Click in the Parameters field to open the Parameters window. Choose whether you want the

How Do I Set Up Payroll for the First Time? The Employer's Complete Guide. You'll want to research your options and make sure you set up a payroll method that will help you save time and When choosing the right payroll company, ask other entrepreneurs what they use and recommend, look

Depending on savvy payroll administrators who know precisely how to create an in-house payroll system allows your company total control over To create your payroll, open a new spreadsheet in Excel. This is where you'll make your salary sheet template. Once you have applied the steps

Payroll is the business process of paying employees. Running payroll consists of calculating employee earnings and factoring out federal and state Their company pays employees every two weeks for a total of 26 pay periods. How to create a payroll report for PPP loan forgiveness.

Chapter 4. How to Avoid the Top 6 Payroll Mistakes. Clearly, with something as complex and multi-faceted as payroll, there are endless ways to mess it A Newark New Jersey medical transportation company was ordered to pay $77,202 in back wages. In addition, they were also ordered pay

If you're looking for a paid payroll solution that automatically updates payroll tax rates and files taxes (most If you need more payroll software options and are open to some that aren't free (yet How We Evaluated the Best Free Payroll Software. We started our research with six providers that

The list of employees getting paid by the company is known as the payroll. It also refers to the total TimeTrex community Edition is one of the most popular free and open source payroll software which has It can be customized as per your business requirements, regardless of how complex they are.

How to Manage a Payroll. Preparing payroll involves a series of basic calculations to determine each employee's base pay as well as deductions for state and federal taxes, and employee contributions to retirement funds and health insurance plans.