How to Manage a Double Diagonal Spread. Risk management is key if your trade starts to move against you. As noted, when trading double diagonal spreads, the enemy is a significant market move. When your short options move in the money (ITM), or threaten to move ITM, the

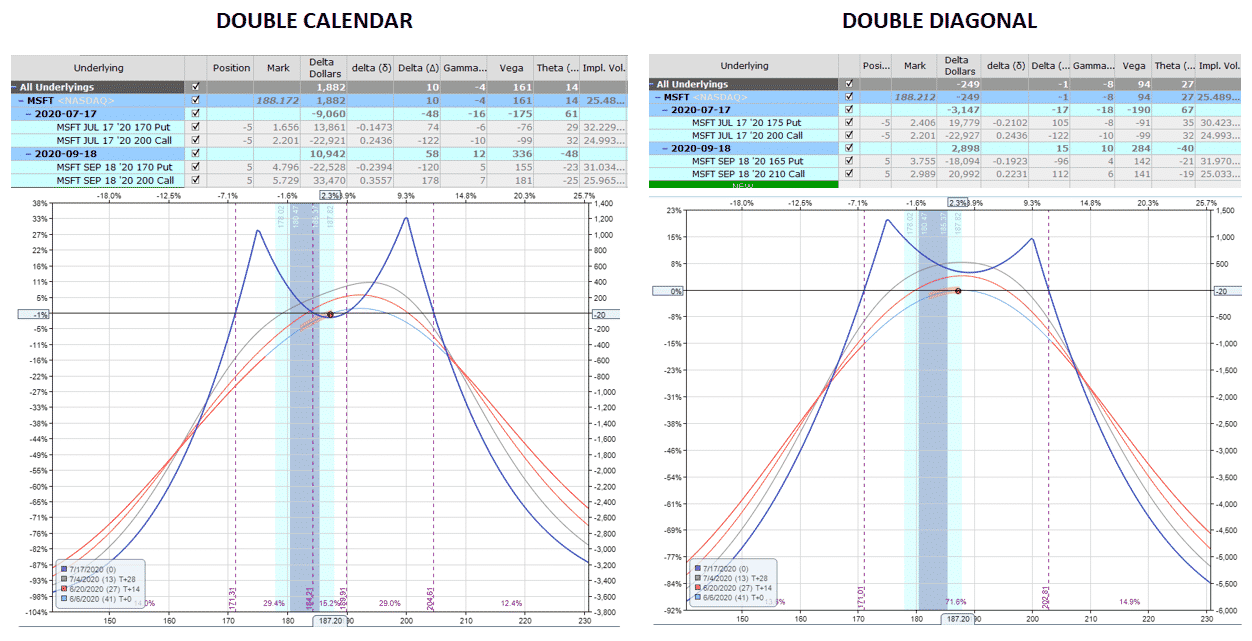

double calendar spread

session leverages Fidelity’s trading and research tools to help find ideas, manage risk, and place a trade. Click here to learn more and register. Options Learning Center. Increase your options knowledge with guided education, including on-demand webinars, for every experience level. ... such as spreads, straddles, and collars, as ...

Information. Our website and some of our third-party tools use cookies to provide Personalised Ads/content. If you consent please click ACCEPT ALL or if you want to know more or withdraw your consent, please refer to our cookie policy.

An advantage of diagonal spreads, as with horizontal spreads with additional expiration dates between the short and long option, is that a spread can be reestablished when the near-term option expires by selling another short option that expires later, but before the expiration of the long option.

double calendar diagonal neutral vs

The diagonal call calendar spread is a more complex option strategy dedicated to the more advanced traders. More specifically, we wanted to know how frequently unmanaged SPX calendar spreads reached specific profit and loss levels relative to the initial debit paid.

alhimar worksheets tutors

Looking to trade a spread over different expirations, but don't see it listed in the strategy menu? Well, no need to panic. Since a calendar or diagonal spans different expirations, you'll need to build the trade manually To learn how to adjust the number of strike prices displayed in the table, please click here.

for those with a solid understanding of options looking to explore more advanced strategies: long vertical spreads, iron condors, calendar spreads, and diagonal spreads. Our education coaches will explain the ideal outcomes, characteristics, benefits, risks, and ways many options traders use to construct and manage an options portfolio.

I have a question on ratio diagonal spreads that I was hoping you could answer for me. The spread is as follows: Sell 1 ITM Option, Buy 2 OTM Options You are asking for a whole lesson on how to trade a specific strategy, and that is an entire book chapter in itself. Double diagonals (DD) are

How I Trade Diagonal Spreads! Posted by Pete Stolcers on March 10, 2009. For purposes of this option trading blog, I will refer to diagonal spreads in the traditional sense. The position consists of an equal number of contracts where the long leg of the spread (the anchor) is closer to the money and

Chapter 4: Diagonal Spread. Diagonal spreads combine the strategies used in vertical and horizontal spreads, they are constructed using two options with different strike prices and Reverse diagonal spreads can be constructed by simply reversing the order of transactions of a regular diagonal spread.

A diagonal spread is an options strategy using a long and short position in either calls or puts with different strike prices and expiration dates. Diagonal spreads allow traders to construct a trade that minimizes the effects of time, while also taking a bullish or bearish position.

Find out what Diagonal Spreads are, how they are created and how they are used by options traders. Also see their advantages and disadvantages. Diagonal spreads consist of similar options contracts in that they must be of the same type and based on the same underlying security, but the

how to effectively trade Calendar Spreads, Diagonal Spreads, Seed Iron Condors (a powerful variation to traditional Iron Condors), Market Tamers and how to manage a Market Tamer position. Futures Trading. Learn the simple rules to profitably trade futures contracts using a simple set of rules. The simple AO to AO Strategy is powerful!

simpler faster asp core even web spreads github

Managing Diagonals. Hey all, I use Diagonal spreads to replicate a core position in my portfolio, owing to the more favorable capital Would it be better to manage these spreads at a set % loss of debit paid? if my directional prejudice remains unchanged, is it generally better to close out of such

Greeks - Overall Big Picture How They Work Together in a Diagonal Spread (21:09). Greeks Big Picture When Looking on Your Trade Screen (19 Managing and Adjusting a Diagonal Trade (Where Do You Make an Adjustment?) (11:34). Adjustment Ideas with Diagonals & How to Think

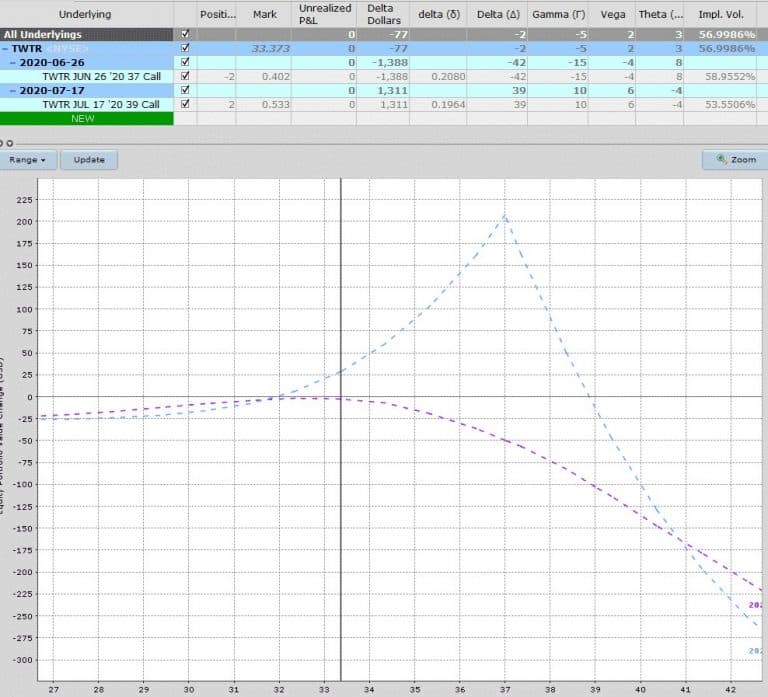

Learn about diagonal spread options including what a diagonal spread is, when it profits and when to use it. If you want to trade like a tastytrader, you have to learn how to talk like a tastytrader. We manage diagonal spreads when the stock price moves against our spread.

Difference between calendar spreads and diagonal spreads: Calendar spreads consist of two options of the same type (call/put) and same strike price, but have Also, in this video we will be learning four methods on how to manage the double diagonal spread, along with some considerations.

diagonal spreads are multi-leg option strategies spanning at least two option expiration cycles and beginning with diagonal call and put spreads. ... So running this strategy is a lot easier to manage if the stock stays right between strike B …

01, 2014 · The diagonal elements (own connectednesses) tend to be the largest individual elements of the table, but total directional connectedness (from others or to others) tends to be much larger, and total connectedness is a very high 78%.

Diagonal spreads are negative gamma. Generally any trade that has a profit tent above the zero line will be negative gamma because they will benefit from stable prices. Lot's to consider here but let's look at some of the basics of how to manage diagonal spreads. PROFIT TARGET.

19, 2019 · Design Pro Tip: Find these symbols in the Venngage icon library under the following categories: “Arrows & Directions”, “Weather”, “Technology”, and “Signs”. When used in graphic design, symbols and icons can help break up dense passages of text, making it easier to digest. But symbols and icons are not just communication tools.

How to Trade Diagonal Spreads. What Is a Double Diagonal Option Strategy? How Do You Manage a Diagonal Spread? Options are such a great way to grow a small account. Diagonal spreads are a more advanced strategy in which to do so. Options have many strategies available at your disposal.

Creating a diagonal call spread using a LEAPS® option as the long leg is an innovative spread strategy used by many experienced option How do I set up a diagonal spread? When you select your in-the-money LEAPS call option, you have to decide how far in-the-money you are willing to go.

Diagonal spreads can lead to interesting problems at expiration if the short call is in the money. Part Four - How to make adjustments to your spread when the market does not go your way. I am convinced that managing risk as a trader is one of the most important things we can do, which

Put diagonal spreads consist of two put options. A short put option is sold, and a long put option is purchased at a lower strike price and a later expiration Put diagonal spreads are typically opened for a credit, though a debit may be paid. The pricing at entry is dependent on the width of the

HOW-TO. The calendar/diagonal spread is my favorite strategy to execute when I want to take advantage of short-term weakness or strength that I think will The calendar/diagonal spread executed the way I prefer is loaded with potential change, causing the adjustment tactic to come

The diagonal spread is one variation of option spread trading that has been used most effectively to adjust existing spread positions. The diagonal spread can be adapted to both debit and credit spreads, each with its own risk to reward ratio. You can adapt them to the following vertical spreads

A diagonal spread is a combination of a vertical spread and a calendar spread. Understand how these two easier-to-understand spreads function The strategy poses relatively low loss potential, but must be properly managed to generate the desired profits. Writer Bio. Tim Plaehn has been

Learn how and when diagonal spreads might be appropriate for rolling a single option to another strike and expiration date. And diagonal spreads are no exception. But once you understand how these options spreads are put together, they may not seem so tricky.

covered put poor strategy tastytrade

Learn how to set up and profit from diagonal calendar spreads. A diagonal calendar spread is a The setup of a diagonal spread is very important. If we have a bad setup, we can actually set We manage diagonal spreads when the stock price moves against our spread. In this case, we look

How We Manage Long Diagonal Spreads. Generally, we look to manage long diagonals as winners when we have profited 50% of the initial debit paid. If we bought a diagonal spread for $, we look to take it off for around $ or a $ profit.

Short diagonal spreads with puts are frequently compared to simple bull spreads with puts in which both While this managing alternative increases risk if the stock price rises, it offers potential profits if the stock price "Delta" estimates how much a position will change in price as the stock price changes.

The diagonal spread is very much like the calendar spread, where near term options are sold while long term options are bought to take advantage of the rapid time decay in options that are soon to expire.

Long Call Diagonal Spread is an advanced strategy that can be built by using two call options of different strike prices and expiration dates. How to built up Diagonal Spread? We can build a diagonal spread by using two call options or two put options. One should be of near month

Diagonal spread gets its name from how options used to be displayed for traders. Each column had contract expiry dates and each row the strikes. The author offers training programmes for individuals to manage their personal investments. (This is a free article from the BusinessLine premium

trading

30, 2021 · Horizontal spreads are also commonly known as calendar spread or time spread because we have different expiration dates. 3. Diagonal Spread Option Strategy. A diagonal spread is an options strategy that requires the following: Buying and selling options of the same type (Calls or Puts). Same underlying asset. But, different expiration dates.

How Diagonal Spread Works. Creating diagonal spreads will help decrease the cost basis. This type of trading strategy is effective in To ensure maximum profit, you should manage your diagonal spread when the stock's current market price increases in a direction against your diagonal spread.

spreads: Profit from time decay While many longer-term investors use covered calls, some options-focused traders employ a similar strategy with less equity risk and potentially higher returns—the

21, 2021 · Investors Observer’s available strategies include covered calls, short puts, diagonal spreads, and vertical spreads. The platform issues new options trades every day that include everything you need to know about when to open the …

Learn about what Diagonal Spreads are in options trading and how you may profit from Diagonal Spreads. Diagonal Spreads - Introduction. Almost all options strategies are made up of what are known as spreads. Options Spreads are simply simultaneously buying and shorting different