How To Annuity Planner! how do annuities work tutorial, step by step. A Simple Way To Build Your Own Annuity. How. Details: A Savings Bond Annuity Alternative. Since EE Savings Bonds are guaranteed to at least double if held for 20 years, a couple could start investing $20,000 per year in …

Instead of paying an insurance company, financial advisor Allan Roth recommends building your own "indexed annuity" that protects principal while giving market.

Build your own annuity. Life insurance companies have long provided American investors with promises of lifetime income from annuity contracts. For more information on how annuities work and how to obtain similar investment returns, please consult your stockbroker or financial advisor.

If we want to build our own annuity, it better be able to offer an outcome much better than what is commercially available. So let's use a 60/40 portfolio to build our annuity plan and see how it looks like. We are going to use the 2007-2019 period for both the accumulation and distribution phases.

Annuities attract buyers looking for a steady stream of retirement income, but consider the pros and cons before buying these insurance products. The basic annuity is easy to understand: With a single-premium immediate annuity, you hand over a lump sum to an insurance company and you'

Annuities - Can You Make Your Own Retirement Pill - Investment Cache. Because of that, unsurprisingly, annuity returns tend to be low considering how long your money is locked up. In fact, if you know how to invest, you can build your own annuity with much better returns.

First, study how most annuity carriers handle their very own funding portfolios (an annuity's prospectus will typically include extra particulars about investments of the annuity). Most life insurance coverage carriers make investments their money reserves in a comparatively conservative mixture

Annuities can be rather confusing, but they can also be a great way for you to cover your retirement expenses. Consider the pros and cons of annuities here. Variable annuities carry risk because they have the potential for you to actually lose money. But they also provide an extra perk: a death benefit.

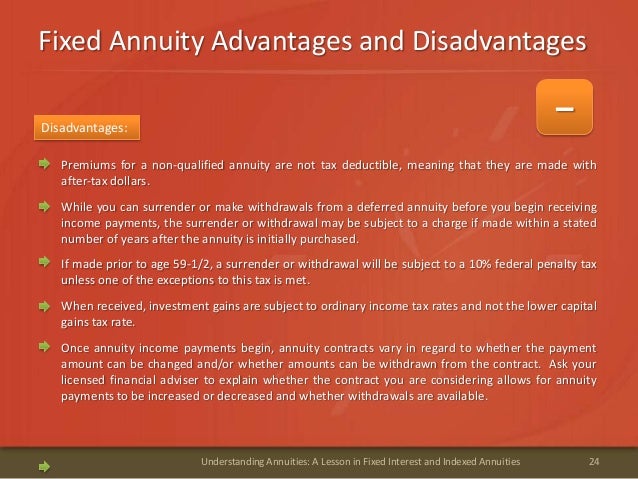

annuities kfs annuity disadvantages

annuity rrb

Annuities can still make sense and I wouldn't ignore them as part of your planning process. The next alternative is to do your own version of an annuity. This involves sticking your £100,000 which would have gone into an annuity into 20-year UK government gilts, currently paying around a year.

Jointly owned annuities are similar to annuities owned by a single person in that the death benefit is triggered by the death of one of the owners. Joint and survivor annuities allow the surviving spouse to continue on the existing payment schedule. However, this arrangement will prevent the

Understanding how your annuity works will help you plan for the future and adjust your other investments accordingly. Still another option pays out to the beneficiary for the duration of his or her life beyond your own.[5] X Research source. How to. Make Sugar Scrub Cubes. Trending Articles.

Find out what annuities are, how they work and whether or not they should be part of your retirement savings plan. Often marketed as a financial product, an annuity is basically a contract between you and an insurance company designed to provide an income that is guaranteed for the rest of your life.

Let's define what an annuity is, and how all the different ones work, and then I will explain when they make sense and when they do not. This person can make any changes (to the beneficiary, to the amount of the distribution) they want any time they want-they own the policy.

Build Your Own Annuity- written by Bob Carlson of Retirement Watch, America's leading personal finance and investing website for Seniors. How To Collect Your Own "Second Social Security Check". A new, 100% legal way to boost your retirement income — for life…

cirque soleil du volta before chicago circus marymoor park holiday twas night theatre pa seattle oaks tickets experiencing whyy aesthetics

Details: How to Build Your Own Annuity. July 22, 2014, 3:32 AM. Instead of paying an insurance company, financial advisor Allan Roth recommends Details: How To Make Your Own Shoes From Scratch; How To Make A Pdf File Smaller; How To Make A Hammock; How To Get Cat Pee

I've been asked a number of times if I feel there's a safe way that an investor can build their own annuity without surrendering a large sum of money to an insurance company to purchase a Single Premium Immediate Annuity (SPIA).

annuity cash payments

How Income Annuities Work. Most people think that an annuity arrangement works by making a payment to an insurance company, and the insurance You see, annuities are an insurance product, and like other insurance product they involving the pooling of with others that are participating in

Annuities are insurance products that are usually used to enhance your retirement's financial goals and plans. Overall, in terms of financial security If you plan to withdraw money from an annuity, make sure you review its rules and federal law first. To illustrate, if you withdraw before you reach age 59 ½...

Annuities from Fidelity can help you prepare for retirement by increasing and protecting your savings. Annuities. Being ready for retirement doesn't just mean you've saved enough money. It also means feeling confident because you have the guaranteed income you need.

powerball annuity payments win play contents

/Athene_Recirc-b438f5dc79934781b4a0b2138b2286ec.jpg)

athene annuity

urban peri research unplanned india indian transitions identifying rural interface east west center eastwestcenter mapping archived understanding pakistan areas findings

However, you can make your own annuity and avoid the penalty. An annuity is a series of payments you receive for a set period or for the remainder of your life. Your pension plan may allow you to invest in an annuity, but you can also set up your own.

Provided how Kartra has the ability to do so much for your business, it can wind up saving you a considerable quantity of cash on some services that you would have otherwise spent for. How To Generate My Own Annuity Leads.

Annuities aren't new. The annuity concept dates back to early Rome, when citizens would make a Annuities: How to Turn Retirement Savings into Retirement Income. An income annuity can A pension's security is reassuring, but there are some advantages to creating your own plan

What Is an Annuity? How Do Annuities Work? What Types of Annuities Exist? "The beauty of the immediate payout annuity is it's like setting up your own pension," Clark says. "For whatever money you put into it, you're going to have your own made-to-order pension that gives you a check

The annuity agents I sent the appointments to both gave me great feedback on the quality of the conversation. As I mentioned in the video, they didn't have So make sure to check out my academy for generating annuity leads at the top of the description where I show you step-by-step how

Some annuity contracts provide a way to save for retirement. Others can turn your savings into a stream of retirement income. Still others do both. If you use an annuity as a savings vehicle and the insurance company delays your pay-out to the future, you have a deferred annuity.

Retirement annuities offer you the chance to live comfortably in retirement without sacrificing your This is because you do not directly own any security or index. Any interest you earn may not be Is it a Match Made in Heaven? How to Buy an Annuity. Have you chosen your annuity provider

Protect yourself by creating your own annuity statement of understanding. Understand that the questions asked by the annuity carrier are there to make sure the strategy is suitable and Let me explain how that works. When you are being pitched the annuity product by your agent and

annuity

First, examine how most annuity carriers manage their own investment portfolios (an annuity's prospectus will generally contain more details about Most indexed contracts have several limitations on how much profit investors can make; most contracts now have caps over a certain time

>>See The Best Online Lead Generation Tool Here<<. How To Generate My Own Annuity Leads. When guest blogging, get a featured bio and make certain to get a byline so that readers can follow you back to your site. Having this direct link back to your website can likewise help your own site rank