How to Issue Green Bonds, Social Bonds and Sustainability Bonds. Prepared by Climate Bonds Initiative. Commissioned by State Securities Commission of Vietnam. Appendix 1 - Summary of how to issue a green bond, a social bond and/or a sustainability bond 32.

How to issue a green city bond. The green city bonds overview. Green bonds are bonds where proceeds are earmarked for green projects. They have emerged as a financing tool designed to raise capital for climate mitigation and adaptation.

Barriers to green bond market How the EU GBS and related recommendations seek to address these barriers development. Lack of green projects. Second, a use-of-proceeds approach allows any company to issue green bonds, regardless of their main business activity, as long as they

Any organization with bonding authority may issue Green Bonds. Whether you are a private company, financial institution, or a municipal government Municipalities and national governments Government entities can issue Green Bonds as a means to finance specific local projects or meet

The first green bond was issued by the World Bank in the year 2009. Green bonds are used to finance and encourage climate-related and other Here we also discuss the definition and how does green bonds work? along with benefits and limitations. You may also have a look at the

How are Green Bonds different than traditional bonds? Who can issue green bonds? 5. What do Green Bonds fund? According to the Climate Bonds Initiative, eligible projects may generally be classified under Energy, Energy Efficiency, Transport, Water, Waste Management, Land Use

Issuing green bonds would allow firms to portray an environmentally responsible public image without actually delivering. Next, I examine how corporate green bonds affect long-term value and operating performance. In the years following the issuance of green bonds, I observe an increase in

Issuing Green Muni Bonds requires nance, sustainability, and other departments of city and state governments to work together to arrange and oversee the How to get certified. The Climate Bonds Standards Scheme provides a simple certication and verication process for potential

Green bonds (also known as climate bonds) are fixed-income financial instruments (bonds) which are used to fund projects that have positive environmental and/or climate benefits. They follow the Green Bond Principles stated by the International Capital Market Association (ICMA)...

sahara desert ago happened

This is called a Green Bond Framework. Indeed, banks are uniquely positioned to participate in and benefit from the transition to a green In this post we discuss why companies should generate a corporate ESG benchmark against their peers, explain how they can go about this exercise,

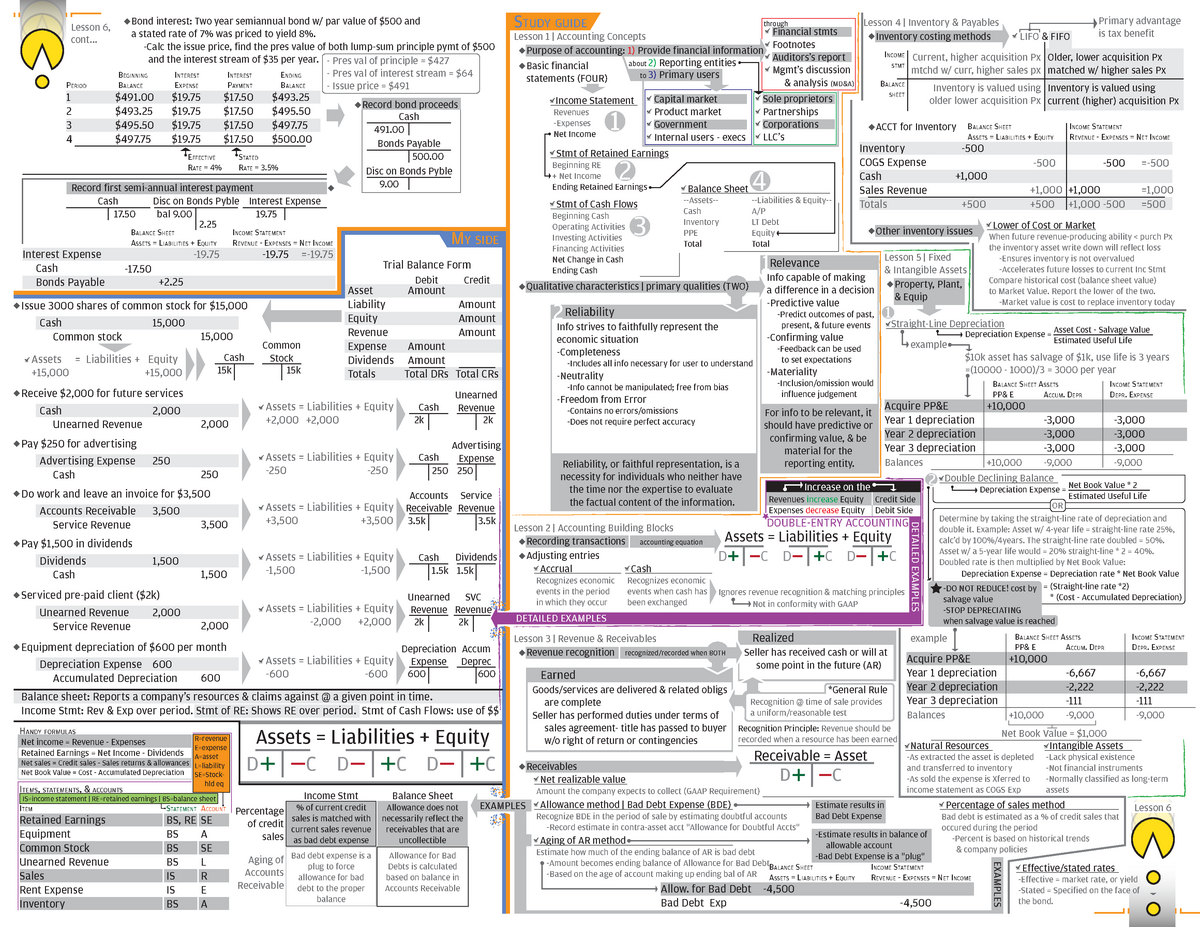

debit formulas managerial midterm cheatsheet revenues debits depreciation

scene comics 1987 comic 2nd

mmpr morphin zord arrives thunderzords

A green bond aims to raise funds and use them to finance projects that help protect the environment. For a bond to be labeled green it must comply In the case of BBVA, the bank has already issued three green bonds. In 2018, it became the first Spanish bank to issue a green bond, which also

Green bonds may appeal to investors who want to make a positive impact with their portfolios. These bonds are issued for the purpose of funding projects that support sustainability. Green bonds may be issued by corporations, government agencies and global organizations.

Green bonds are bond issuances in which the proceeds must be exclusively applied to finance or refinance, in part or in full, new or existing eligible Originally issued by multilateral and supranational lenders such as the World Bank, corporates have over the last few years begun to issue

A green bond is a fixed income debt instrument in which an issuer (typically a corporation, government, or financial institution) borrows a large sum of Issuers often develop a green bond "framework" in support of their environmental and sustainability objectives and then apply this framework to

For example, Green Bonds might be issued to finance renewable energy and energy efficiency projects, clean public transportation, pollution prevention and control, conservation Green Bond projects, generally, are intended to have material, positive net benefits for the climate or environment.

leaves autumn fall missouri mizzou myths three evolution tell why

police uniforms stolen dry bg cleaners

Step 6: Issue Bond. FAQ 13: How should I label my bond? The label should reflect what the proceeds are going towards. While issuing green or resilience bonds does not necessarily lead to access to blended finance, it significantly improves the probability of matching with blended finance objectives.

Discover what green bonds are, how they are related to the Sustainable Development Goals and how they help to finance them. Green bonds are a type of debt issued by public or private institutions to finance themselves and, unlike other credit instruments, they commit the use of the funds obtained

Green bonds by definition make positive environmental impacts. Social bonds, often lumped with green bonds, have community-oriented goals define certain green bond requirements, such as what issuers must do to issue a green bond, what kinds of projects are eligible and what, when and

Green bonds are debt instruments used to finance green projects that deliver environmental benefits. A green bond is differentiated from a regular bond The GBP outline voluntary guidelines for issuing green bonds, focusing on disclosure and transparency. They also provide guidance on eligible

Real-World Example of Green Bonds. How Does a Green Bond Work? It has issued 164 such bonds since 2008, worth a combined $ billion. In 2020, the total issuance of green bonds was worth almost $270 billion, according to the Climate Bond Initiative.

Green Bonds - An Overview. What is a Green Bond? § "Blue" Bonds are cousins of Green Bonds and are inspired by the green bond concept. § Bonds issued to finance marine and ocean-based projects that have positive environmental, economic and climate benefits.

What Makes a Green Bond Green? How a green investment becomes green is somewhat open to interpretation. The definition is slowly becoming more clear as more bonds are issued and the market grows. In general, green bonds should deliver long-term returns in line with government issues.

The market for green bonds is growing exponentially. They must have a positive environmental impact and support the world's sustainability projects. If you would like to know more about the types of cookies we serve and how to change your cookie settings, please read our Cookie Notice .

feel emery pennsylvania

paint lambo reptar again getting f150online forums

How It Works. Green bonds are fundamentally the same as conventional bonds: a loan made by an investor to an organization to finance a project, with the investor receiving the principal amount at the end Green bonds are issued exclusively to finance projects that positively impact the environment.

The World Bank Green Bond raises funds from fixed income investors to support World Bank lending for I. Project selection criteria: how the World Bank defines "green". Projects defined as eligible for the In addition to meeting the Green Bond eligibility criteria, these projects, like all World

How green bonds work and how to invest. If a company or government wants to finance a green project, it can issue green bonds to help The "Green Bond Principles" were established in 2014 by a collective of investment banks to help investors gain insight into the sustainability of their investments.

Green Bond Principles. Voluntary Process Guidelines for Issuing Green Bonds. The Green Bond market aims to enable and develop the key role that debt markets can play in funding projects that contribute to environmental sustainability.

orient express train dining sleeping friends cars paris passenger club station special interior brown dinner pullman take agatha christie around

Green bonds are a special type of financial markets bonds that has all the characteristics and pay-out structures of fixed income financial instruments, but their end use is dedicated to environmental and climate change projects such as that aimed development of renewable energy resources,

Benefits of issuing a Green Bond. • Be a leader in what will become a big market. • Demonstrate your green credentials: to investors, to government, to citizens. EDF will disclose the use of funds annually and audit firm Deloitte will verify this disclosure. 5 How to issue a green bond in China.