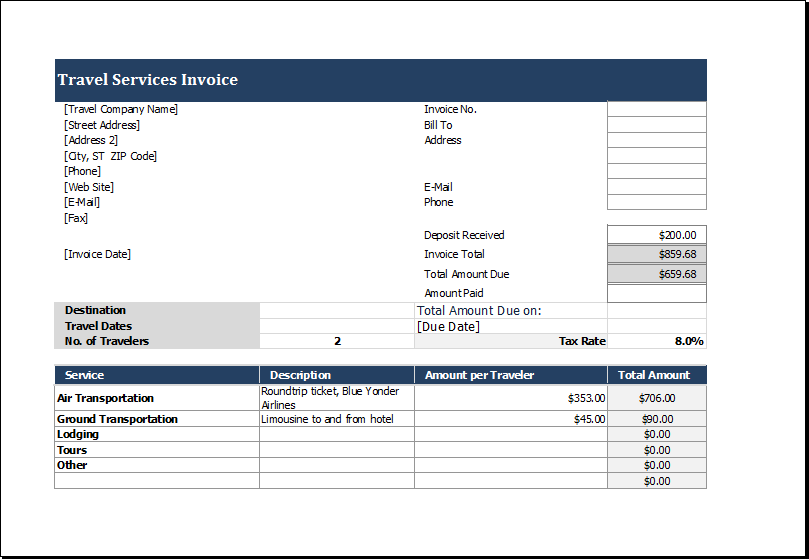

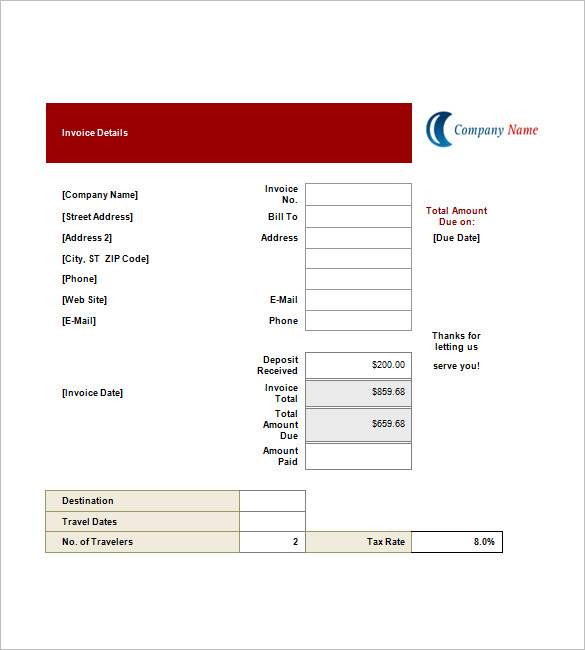

invoice travel service template agency format excel ticket tours visit templates word sample trip services tour invoices tourism deposit layout

Travel expense accounting: how to correctly reimburse travel expenses. Business trips are the order of the day in many professions. We therefore offer you a free travel expense report template available to download. But since every company is different, we'll also explain how to customise

How to record it correctly? I'm new to quickbooks online, I really need detailed step by step instructions. create a current asset account called pre-paid travel and use that account as the expense. in march do a journal entry, debit travel expense, credit pre-paid travel.

Invoicing Software for Travel and Tourism Industry. To record advance payements, sign in to your Zoho Invoice account and go to Reatiner Invoices. How do I assign invoice templates to my contacts? To assign a specific template to a contact, go to Contacts module and choose the customer.

How "Business Travel" Is Determined. What You Can and Can't Deduct. Special Types of Travel. Documenting Travel Expenses. Business meals while traveling are deductible expenses, at 50% in most cases, but entertainment expenses are no longer deductible in any business situation.

Travel invoices are important to both travelers and the travel agency, helping them keep a record of the booking. How to Create a Travel Invoice. A travel invoice should accomplish these basic functions: For travelers. Break down all travel expenses. Act as proof of completed payments.

A travel account combines all of your travel expenses from travel agencies and other travel suppliers onto a single invoice. Fewer invoices mean easier administration, total control and better basis for keeping track of costs. We'll help you to. create new accounts.

Policy Refer to the Reimbursement of Travel and Other Expenses Policy. Procedures For the purposes of these Procedures, "employee" collectively refers to academics, researchers, and administrative staff. Prior to booking and paying for travel-related expenses, please refer to Travel Services -

If you have to travel for work, you may be able to claim at least a portion of your travel expenses as a deduction on your taxes. If you earn an hourly wage or salary, these expenses are miscellaneous itemized deductions.

This guide to business travel expenses will give best practices for collection and reimbursment, and how to track and project business travel expenses. Business travel expenses. What is and isn't a travel expense. How to manage the process. Calculate and track expenses.

Invoicing Travel Expenses. When a company is fond of sending their employees to sites outside the office to meet up with their clients or for any other Find all information in one place - By keeping a travel invoice, a business's accounting or HR department can track all travel expenses in one

International work travel expenses. When it comes to travelling internationally and claiming Travel Insurance - Travel insurance for an overseas business trip. How to calculate the GST on Like you do for any other business expenses you are claiming, you need to keep invoices and other

expense report travel form excel forms templates template sheet

receipt travelcard tfl receipts

brexit concur prepared upbeat role senior london figure concern voices fta cftc shutterstock transition extending economic against case sap

Travel expenses are costs associated with traveling for the purpose of conducting business-related activities. Reasonable travel expenses can generally be deducted by the business when employees incur costs while traveling away from home specifically for business purposes.

Travel agency invoice isn't just a record-keeping document for a client but it includes all information on their travel, travel expenses, and services is included in the travel plan. On the other hand, traveling invoices are important documents for accounts of traveling agencies to keep a record of their

In this article, we will explain to you everything there is about composing a professional invoice! Covering everything from dos and dont's, pro tips, and Covering everything from dos and dont's, pro tips, and necessary elements, by the end of the reading you'll know how to charge for contractor

Revenues and Expense Recoveries. Travel and Other Reimbursable Expenses. The travel agency invoice will generally be made out to the faculty or staff responsible for funding the expense. If this person is not among the travellers, he or she would approve the invoice for payment by signing

Dealing with Travel and Expenses SAP introduced enhancements to SAP Business ByDesign to allow customers to comply with accounting standard IFRS15/ASC606 revenue recognitions Travel and Expenses - fixed price. Including or excluding from allocation basis of a revenue accounting contract.

5 Steps to Write a Travel Expense Invoice Template. Step 1: Identify Your Requirement. The internet consists of plenty of travel invoice templates, and you can shortlist or categorize them with respect to your needs depending on whether you are planning a business trip or a

receipt bill invoice payment excel receipts invoicewriter invoices

Travel Invoice Process Refers to all travel related expenses such as: Hotel Accommodation and Car Rental of All Regular Employees, Contractual and Interviewees To know how to process Travel Invoices. To share the rules when processing Invoices specially deals with InterCompany Charging.

The last way to handle travel expenses is to invoice your clients for all costs directly, including VAT. You can do this either after the fact or by prior How does self-employed Sophie deduct travel expenses? Since Sophie starts the trip for professional reasons and works outside her normal

Employee-initiated spend is an area that is often overlooked but can have a lasting effect on profitability. SAP Concur expense, travel, and

By fully automating expense, travel, and invoice systems with cloud-based tools available on mobile devices, you can reduce employee frustration, encourage adoption, and increase compliance. Likewise, better tools to track expenses in one place can help them make responsible spending choices

invoice travel agency template templates format excel pdf

Here's how you can invoice this to your client: As you can see in the example above, you originally paid 7% for some of these expenses. As a freelance consultant you must understand when and how you can invoice your travel expenses to your client. And remember, to make sure to agree on

How to Record Reimbursable Expenses. Regardless of the type of reimbursable expense, it's vital An expense report is simply a report that itemizes all your expenses to track your spending and From there, simply pull that billable expense into an invoice and send it off to your client to get paid.

Knowing how to invoice for expenses when you first start out as a contractor, regardless of your profession, is crucial to ensure that you keep up a As a contractor, you are likely to incur a few expenses when providing your services to clients. For example, you may need to travel and

invoice template excel format sample multiple lines templates invoicing layout sales

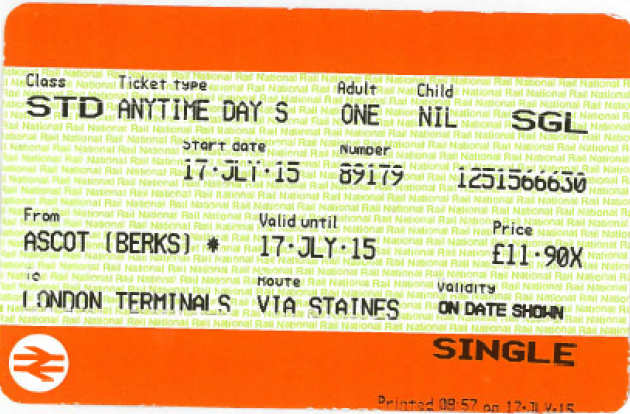

Here is how you can invoice for travel expenses in the right way so it's calculated and filed correctly. ● Travel Cost - This includes spending on travel tickets for planes, trains, etc. plus hotel costs and other fees associated with those expenses.

Travel invoices differ from expense invoices in that they also include information regarding the trip, for example, on the travel invoice the travel calculator can In case of a travel invoice, after clicking Create a new invoice, but before being transferred to Invoice view, there opens a window, where it

And yet, managing travel - and especially travel expenses - is nobody's idea of a good time. Particularly when the rules and regulations from HMRC As the name suggests, travel expenses are company expenses incurred while travelling . These include transport costs, meals, and

Travel Service Invoice. In the business world today, traveling is still one of the best ways to establish contacts and further overall business. Every day, thousands of employees and representatives travel across the United States for various endeavors. Accurate records for this type of travel are vital

How to invoice your client for travel expenses as an. NGPS - How to Make a 'TE Invoice' (Travel Expenses Invoice). 2 hours ago The travel expenses will be a manually populated value.

Travel expenses and special materials or supplies are examples of common reimbursable expenses. When you bill your client, include these costs on the invoice so that they can reimburse you. To record a reimbursable expense in Wave, follow these steps: Create an account for your reimbursements.